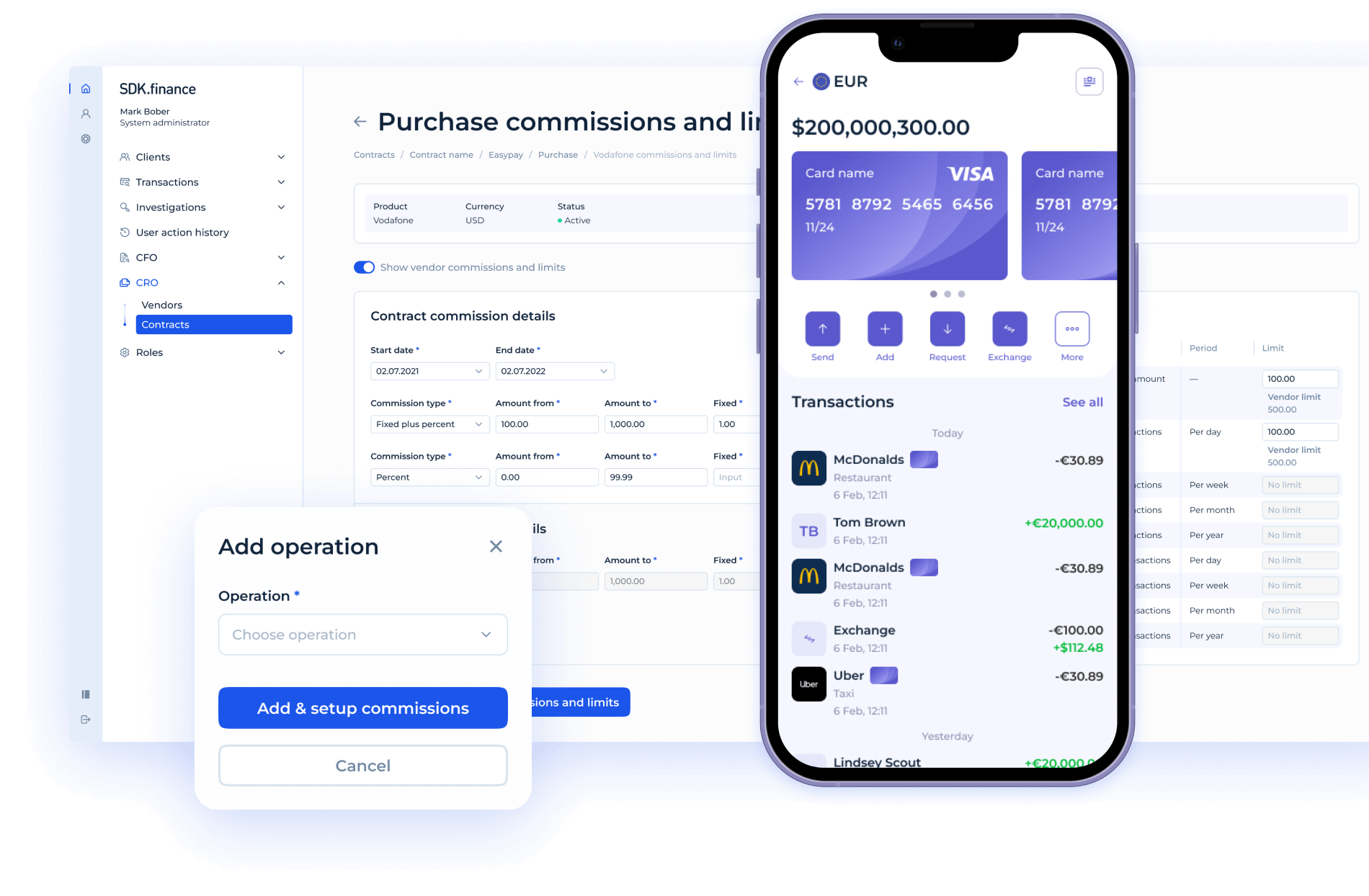

While some traditional financial institutions implement digital finance services systems, neobanks are growing exponentially and penetrating new markets in other regions. In just three years, the global customer base of neobanks has grown from 2 million to 15 million, and the number of neobanks has increased from around 70 to over 250. According to stats, the global neobank market is growing at a CAGR rate of over 47% and is expected to hit $722,60 billion by 2028. Source: Statista This growth results from the neobanks enticing business model’s massive acceptance from millennials, generation Z, Startups, and MSMEs. And that is not all. The massive patronage from the mid-eastern financial service space is adding more momentum to the growth of neobanks. While regulatory policies in other world regions have restricted neobanks to just basic financial services, policies in the Mideast allow neobanks to offer more robust financial services like traditional banks. In this article, we explore the following: the meaning of neobank, features, and the future of neobanks. Particular emphasis will be on the white label neobank and the factors that contribute to its appeal. Additionally, a list of the best neobank solutions providers is included to assist you in launching your own product. Neobanks and challenger banks operate entirely online and do not require physical banking halls. From the comfort of your own home, you can make payments, transfers, and other transactions using the services provided by these banks. Users can access neobanks online via mobile applications and web platforms. Increased internet connectivity and the emergence of a tech-savvy young population have fueled the growth of this alternative banking model. For example, in the United States, it was estimated that holders of neobank accounts increased to approximately 20.2 million between 2020 and 2021. Source: Statista Due to a variety of factors, customers throughout the world have begun to embrace neobanking in order to operate various business models. The ease of conducting business, lower transaction fees, the elimination of the need to visit a bank, and the 24-hour banking system are just a few of the key factors. Neobanks, as they are entirely online, also provide seamless loans to customers with no paperwork. Among the principal services provided by neobanks are the following: While neobanks have grown exponentially in the United States, Europe, and the Middle East, the industry is largely untapped in certain parts of the world, including Asia and Sub-Saharan Africa. Let’s look at these markets to see how they have developed thus far. Source: Fincog The Middle East’s demand for neobanking services has skyrocketed. The proliferation of fintech startups evidences this in recent years. According to a report, as of 2020, the Middle East had over 20 neobanks serving nearly 15 million customers. The widespread availability of internet access, combined with the emergence of Covid-19, has increased the need for neobank platforms. As such, residents of the Middle East are well aware of the benefits of doing business with fintech. Even established financial institutions have diversified into the fintech space. For example, Bahrain’s ABC Bank, Israel’s Leumi Bank, and Dubai’s National Bank have launched unique digital banks. Source: Fintechnews.sg Like the rest of the world, Asia sees an increase in demand for digital-only banks. Online banking has grown in popularity in this region due to lockdown restrictions and remote work. According to a 2019 report by KPMG, roughly 73% of Southeast Asians are unbanked. At the time, only 5% of Cambodia’s population had a bank account. Due to the lengthy process of obtaining credit from traditional banks, Southeast Asia has found neobanks a viable alternative. In the Philippines, approximately 46% of the population don’t have access to banking services. However, with more people owning mobile devices, the market for online banks is ripe. According to Statista, the Philippines will have approximately 77 percent internet penetration by 2025. This will accelerate the growth of neobanks in the country. Source: Statista Similarly, we are seeing some neobank industry growth in Malaysia and Indonesia. By 2025, Indonesia is expected to have approximately 9 million users of neobanks, while transaction value will reach approximately $16.5 million in 2022, representing a 57.8 percent increase. Malaysian online bank customers are expected to reach 2.35 million by 2025, with user penetration increasing to 6.8%. In India, the state of neobanking is reflected in the country’s largely untapped e-commerce market. Online-only banks are not permitted to obtain a bank license. To provide licensed services, they must form partnerships with traditional banks. The Reserve Bank of India (RBI) does not allow banks to be completely digital; it requires physical branches. This regulation has constrained fintechs in India to provide white-label services while relying on large banks. Fintechs have become distribution channels for traditional banks due to this synergy. Most physical banks are now establishing digital subsidiaries to compete with foreign virtual banks. Despite this setback, the innovation introduced by challenger banks is driving change in India, and the demand is growing. This is demonstrated by over $230 million raised by India’s neobank startups in 2020. By 2040, India’s smartphone penetration rate will reach 96%. Increased penetration is expected to accelerate the growth of India’s neobank industry. While 80 percent of Indians have bank accounts, virtual banks offer a path to greater financial inclusion for the country’s nearly 2 billion people. Source: Whitesight.net Economic disparity, illiteracy, and a lack of infrastructure in Africa have resulted in a large proportion of the population being unable to access banking services. According to the World Bank, about 95 million people in Sub-Saharan Africa are unbanked. Increased internet access and the availability of more affordable smartphones have contributed to the growth of digital banking. According to FDI Intelligence, Sub-Saharan Africa has 456 million unique smartphone users. According to the same report, by 2025, an additional 167 million users will be added. Owners of small and medium-sized businesses benefit from the neobanks’ ease of processing and receiving payments from customers. It has helped them expand their businesses online and reach out to remote customers. The challenger banks’ digital lending service has also aided their expansion in Africa. Unlike the process with the traditional banks, individuals can easily borrow money without providing collateral to secure the loans which require property documentation to grant loans. Unsurprisingly, app-based banks have also grown in popularity in Africa. Fintechs appear to be sprouting up daily in Africa’s major tech hubs – Lagos, Nairobi, Cape Town, and Johannesburg. That said, Africa still has a sizable untapped market. Countries with a high population density, such as the Democratic Republic of Congo, Nigeria, Ethiopia, Tanzania, and Kenya, are expected to account for more than half of Africa’s smartphone subscribers by 2025 – thus making an audience for the neobank services. The debate over whether branch banking or its branchless counterpart will thrive in the future continues. Both models have advantages and disadvantages, and they will play a significant role in determining which one will win the race. Neobanks outperform traditional banks by providing users with unprecedented convenience and features. The ability to perform payments anytime, from any location, and in various currencies is a compelling reason to embrace mobile banking. Traditional banking is the preferred option for the older generation because of its security. Remote authentication methods, such as two-factor authentication (2FA), biometrics, and digital fingerprints, which are security features of digital banks, have been hacked and penetrated by fraudsters. Customers are concerned about the security of their funds due to this chink in the armor of the neobanks. It can be expected that the conventional banks will become more active players in the Fintech space soon. Their involvement will be facilitated by the lower operating costs and the ability to reach remote populations. Already, white labeling has gained popularity as it enables offline banks to expand their operations through the platform. The neobank market was valued at USD 47. 39 billion in 2021. Between 2022 and 2030, the global neobank industry is forecast to expand at a Compound Annual Growth Rate (CAGR) of approximately 53.4 percent. White label neobank refers to an end-to-end banking model employed by fintechs that uses data provided by traditional financial institutions. It is a collaboration in which traditional banks grant third-party companies such as fintechs access to their application programming interfaces (APIs). These fintechs leverage this access to develop innovative financial products on top of the infrastructure already in place. Building banking software from scratch is costly and time-consuming. White labeling saves developers time by providing them with a digital platform to develop their software. Banking-as-a-Service (BaaS) is another term for this. White label neobank platforms enable businesses without banking licenses to create unique financial products by leveraging the licenses of traditional banks. This is referred to as a neobank with a front-end focus, while stand-alone neobanks operating under their banking license are called full-stack neobanks. These neobank vendors create payment platforms that are fully customizable to the neobank’s requirements. Businesses can use this software for marketing their products under their unique brands. Apart from banks, accounting, payroll, logistics, healthcare, and food delivery are some of the other industries that leverage white-label platforms to scale their operations. Top banks are moving into the BaaS sphere to ward off competing fintechs and other digital banks. Opening their APIs provides another revenue stream for these banks. Potential revenue from this source could reach about $2 billion in the UK by 2024. An example of a white label neobank vendor is SDK. finance offering a neobank platform. While the terms neobank and digital bank are frequently used interchangeably, they are not synonymous. Let’s clear up what are the key differences between these notions before we move on any further. Using a ready-made neobanking platform has numerous advantages. We’ll discuss what these entail in this section. Time spent planning and building a digital retail bank becomes less by patronizing white label solutions vendors. These platforms offer you a ready-made product that can help you launch your service in record time. Utilizing the white label neobank system provider’s platform saves you research and development costs. The process is fast-tracked, and the money can be spent elsewhere. Neobank solutions allow you to focus on the important aspects of your business. Your product or service with your branding becomes easily available to the public. Once onboarding and training are complete, you can launch your product. Using a neobanking platform helps expand your offerings quicker. The time spent developing a unique product is reduced. White labeling drives innovation in the digital payments space, and so you are always at the forefront of debuting exciting products. You are likely to run into some technical difficulties when starting a neobank. To ensure a stable and secure platform to build your product atop, here are some of the top neobank software options: Image source: SDK.finance interfaces of Neobank solution SDK.finance is the first on the neobank solutions list as this happens to be our blog:-), plus, as a neobank vendor, we aim to assist customers in rapidly launching your neobanking product by developing white-label solutions, such as digital retail banking software. SDK.finance is driven by a mission to provide digital financial services to every citizen across the globe. We utilize API-driven developments to design efficient and seamless banking and payment solutions for neobanks and other financial service providers. Watch our demo video of the SDK.finance Platform to explore how manage currencies and digital assets, configure exchange rates, monitor system accounts within one system. The SDK.finance Platform is a FinTech multitool helping businesses of all sizes launch their financial and payment products in record time: RadarPayments is one of the best neobank solutions with a fully customizable Saas platform. They specialize in building competitive financial products for neobanks, digital banks, payment service providers, and acquirers. RadarPayments, via one of its flagship solutions, Tippay, which was released in 2021, offers banks a solution that allows for greater tipping convenience. The tool helps banks to reach out to prospective clients while also earning extra revenue by charging a small fee for each tip submitted. RadarPayments also provides multiple payment options that are secured, customer-focused, and compliant to your specifications but at a cost-friendly rate. Mambu is a cloud-based neobank solutions system that enables banks and financial institutions to conduct and manage financial transactions. Businesses may design, configure, and deploy banking and lending services using the integrated composable banking system by interacting with numerous external resources through APIs. According to Businesswire, Mambu, and a global provider of cloud payments and financial messaging solutions, Volante Technologies, announced a game-changing alliance to help banks and lenders in swiftly modernizing their banking and payment infrastructures. The strategic partnership will allow joint clients to accelerate the launch of new payment products and services without the need to remove and replace existing systems. Optherium is a top neobank software that is backed by its own blockchain. The SAAS platform provides an ecosystem of products and services built on the technology of a decentralized private blockchain network. Customer-facing solutions from this white label neobank include digital banking, datavault, and regulatory technology (regtech). Optherium products also enable banks and corporations to operate under their own or third-party API and bank licenses. So, neobanking has established a foothold. The neobanks’ future remains bright in a world that craves greater convenience and digital innovations. Having your own branded digital transactions software has become possible and cost-effective thanks to neobank platform vendors like SDK.finance. Research and development can now be contracted to established and reputable neobank system providers. Additionally, the opportunities for neobanks to have a globally diverse customer base are limitless.

Neobank industry growth: how far we’ve come

Neobanks in the Middle East

Neobanking industry in Asia

Neobanks in Sub-Saharan Africa

What’s the future of neobanks?

What is white label neobank?

Neobank vs. digital bank: how they differ

Neobank

Digital bank

Operates independently

Online arms of traditional banks

Typically has no banking license

Operates with the banking license of its parent bank

Not subject to regulation

Regulated as a bank

Aims to expand its user base

Targets to the balance sheet expansion

Benefits of using white-label neobank platforms

Faster launch

Lower costs

Focus on core business

Expanded offerings

Best neobank solutions to launch your business

SDK.finance

What we offer:

RadarPayments

What they offer

Mambu

What they offer

Optherium

What they offer

Comparison of top neobank software solutions

Software solution

SDK.finance

RadarPayments

Mambu

Optherium

Founded

2013

2020

2011

2018

Headquarter

Vilnius, Lithuania

Baar, Switzerland

Amsterdam, Netherlands

New York, USA

Solutions

Neobanking, money transfer platform, e-wallet, payment acceptance

Integrated payment solutions, swift instant payment support, contactless payment solutions, fraud management

Online banking, private banking, core banking, multi-user accounts, CRM

Digital asset management, e-wallet/mobile app, OPEX, an internal liquidity reserve token

Key features

Multi-currency support, payment processing and card management spendings visualization, currency exchange, bank payments

Loan origination and servicing, credit scoring and risk management, retail and corporate banking

Recurring payment functionality, subscription billing management, payment gateway integration

Secure digital wallet, cross-border payment capabilities, decentralized identity management

Integration options

RESTful API, API-first approach

API-driven architecture

API integration with payment systems

Integration with blockchain networks, API integration with financial networks

Wrapping up

Neobanking: Stats, Future & Top Software Solutions in 2025

FAQ

What is a white label neobank?

White label neobank refers to an end-to-end banking model employed by fintechs that uses data provided by traditional financial institutions. It is a collaboration in which traditional banks grant third-party companies such as fintechs access to their application programming interfaces (APIs).

What are the benefits of using white-label neobank platforms?

1. Faster launch

you get a ready-made product that can help you launch your service in record time.

2. Reduced costs

a neobank system provider's platform saves you research and development costs.

3. Focus on business

you can focus on the important aspects of your business rather than plunge into development specifics

4. Expanded offerings

Since the time spent developing a unique product is reduced, white labeling drives innovation in the digital payments space, providing more space for creating outstanding features

What are the best neobank solutions on the market?

Here are some of the top neobank software options:

- SDK.finance

- Mambu

- RadarPayments

- Optherium

Each neobank has its own unique features and offerings, so it's important to research and compare them to find the one that best fits your needs.

What is a difference between a neobank and a digital bank?

While the terms neobank and digital bank are frequently used interchangeably, they are not synonymous. Neobanks are a type of digital bank that operate exclusively online, offer a limited range of banking services, and are often associated with cutting-edge technology.

Digital banks may offer a wider range of financial products and services, and may or may not have a physical branch presence.

What are some of the top software solutions for neobanks?

There are several software solutions that you can use to build your own neobank: SDK.finance, Mambu and Temenos. These platforms offer features such as account management, payment processing, and system management. Neobanks may also develop their own software solutions to differentiate themselves from competitors.

Navigate through article