Fast-Track Card Issuing with BIN Sponsorship

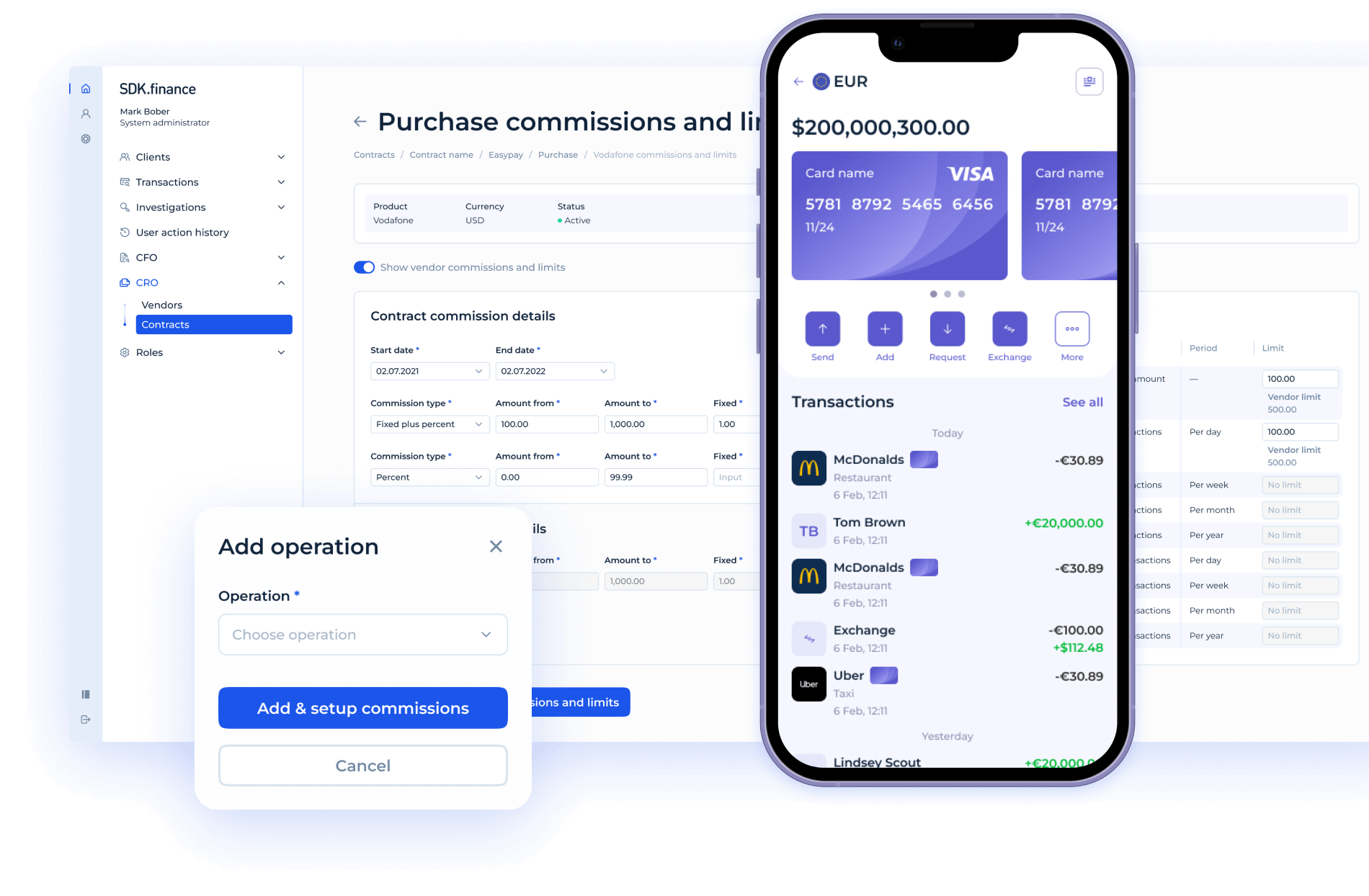

SDK.finance offers ready-to-go payment software that enables you to launch and manage virtual and physical cards instantly.

If you already have a BIN sponsor, our platform allows you to integrate seamlessly and start issuing payment cards quickly, scaling globally with built-in transaction processing capabilities.

Schedule a callBoost your revenue by issuing payment cards

Flexible card issuing options

Through BIN sponsorship, SDK.finance allows you to create virtual or physical cards directly from your web or mobile application, tailored to your preferred card products and plans.

Customized design

Customize physical card designs to align with your branding and preferences, enhancing brand recognition and customer loyalty.

Robust card management

Manage card statuses - activate, deactivate, or reissue - as needed. Address lost, stolen, or damaged cards efficiently, ensuring uninterrupted service for your customers.

Digital wallets management

Enable linking cards to an internal digital wallet within the system to let customers easily fund and withdraw money from their e-wallets.

Spending control

Help customers manage expenses by setting limits on transaction amounts, frequency, and payments for selected merchants or categories.

Different card funding types

Offer a variety of card funding options, including just-in-time funding for more convenience.

Top use cases for issuing payment cards

Neobanks

Enhance digital banking experiences with refined payment card programs, increasing customer engagement and loyalty

Digital wallets

Enable customers to create, access, and conduct real-time payments using cards issued by your institution.

Payment apps

Develop applications that allow customers to go cashless, making payments in different currencies via virtual or physical debit cards linked to their accounts.

Ready-to-use integrations

The SDK.finance payment solution comes with pre-integrated providers for key functionalities such as payment acceptance, card issuance, and KYC/KYB compliance. This streamlined integration process ensures a hassle-free setup of your financial transactions. You can find more information about integrations here.

Benefits of issuing cards with SDK.finance

Increase the revenue streams

Becoming a card issuer, you can earn interchange fees on transactions made by cardholders, creating additional revenue streams for your business.

Enhance user experience

Offer users convenient and flexible payment options, which will improve customer satisfaction and increase loyalty to your brand.

Expand your market

Tap into a wider audience, attracting consumers that prefer traditional payment methods such as debit cards.

Talk to our experts about your card issuance needs and get a pro consultation on implementation

SDK.finance Software for BIN sponsorship ready solutions FAQs

BIN sponsorship allows a company to issue branded payment cards without becoming a licensed card issuer. A licensed financial institution “sponsors” the business by letting it operate under its BIN (Bank Identification Number).

Here’s how it typically works:

-

The sponsor registers the BIN with the card scheme (Visa, Mastercard, etc.).

-

You contract with the sponsor to use their BIN for your card programme.

-

SDK.finance provides the software layer to manage accounts, transactions, and card operations.

-

You integrate your product via APIs or a white-label app and go to market faster without becoming a licensed issuer yourself.

This setup is ideal for fintechs or businesses looking to launch a card product without the heavy burden of regulatory licensing.

Well-known BIN sponsors include:

-

Railsr (formerly Railsbank) – Offers issuing and banking-as-a-service infrastructure.

-

Marqeta – Enables modern card issuing with API-based solutions, often acting as a BIN sponsor in partnerships.

-

Bankable – Provides BIN sponsorship and programme management for prepaid and debit cards.

Each sponsor may focus on specific regions, card schemes, or compliance frameworks, so choosing the right one depends on your business model and target market.

In simple terms, the BIN sponsor enables you to legally issue cards, while the processor makes sure those cards actually work. Both are essential for a functioning card programme, but they cover different sides of the operation—regulatory versus technical.

BIN sponsorship requires your business to be a legally registered entity with a clear product plan and projected card volumes. You’ll need to demonstrate strong compliance practices, including KYC, AML, and data protection measures. Most sponsors also look for a reliable risk management setup and financial stability. A technical integration with a certified processor is usually part of the process as well.

No, BIN sponsorship eliminates the need to obtain your own issuing licence. The sponsoring bank or EMI handles regulatory compliance on your behalf.

No, SDK.finance is not a BIN sponsor. SDK.finance provides the software Platform that connects your product to card issuing partners. You get all the infrastructure needed to build, customise, and manage your card programme efficiently.

Yes. You can bring your preferred partner, or we can connect you with one of our pre-integrated BIN sponsors, depending on your region and needs.

You can fully customise the user interface, card design, transaction limits, fees, and business logic through our APIs and white-label setup.