Digital transformation is no longer optional for governments, especially when it comes to social programmes. The numbers tell a compelling story: global spending on digital transformation reached $1.85 trillion in 2023, with worldwide investment projected to reach nearly $4 trillion by 2027. Yet despite this unprecedented investment, 1.4 billion adults worldwide still lack access to formal financial services, and 75% of poor people remain unbanked.

In low-income countries, 35% of adults opened their first financial account to receive state support. Digitalising these payments could save up to 1.1% of GDP annually, funds that could help governments reach more citizens, faster.

This was exactly the challenge one Central Asian government* tackled head-on. When they decided to roll out an ambitious nationwide social assistance program, the stakes couldn’t have been higher.

*Due to NDA restrictions, we’re unable to disclose the name of the country involved. However, we believe this case study offers valuable insights for any government or institution seeking to modernise social payment infrastructure at scale.

The mission?

To create a robust, secure payment platform capable of serving millions of citizens across nine distinct beneficiary groups, all while safeguarding sensitive financial data at a national scale.

Here’s the story of how SDK.finance became the cornerstone of this transformative initiative, setting a new standard for government-issued payment solutions in the region.

The сhallenge: building a lifeline for billions

The vision was bold:

Launch a comprehensive social assistance system that would serve as a financial lifeline for those who needed it most. The program aimed to cover nine different categories of beneficiaries, including:

-

People with disabilities needing tailored support

-

Low-income families struggling with essentials

-

Pensioners relying on regular payments

-

Unemployed individuals seeking temporary assistance

-

Parents and guardians receiving child support

-

Patients requiring healthcare-related financial aid

-

Students accessing educational grants

-

Households needing housing subsidies

-

Citizens facing emergencies requiring immediate help

This was no small undertaking. To succeed, the government needed a payment system that could:

-

Handle sensitive financial flows securely

-

Serve millions of citizens simultaneously

-

Integrate seamlessly with existing databases and banking systems

-

Process transactions in real time

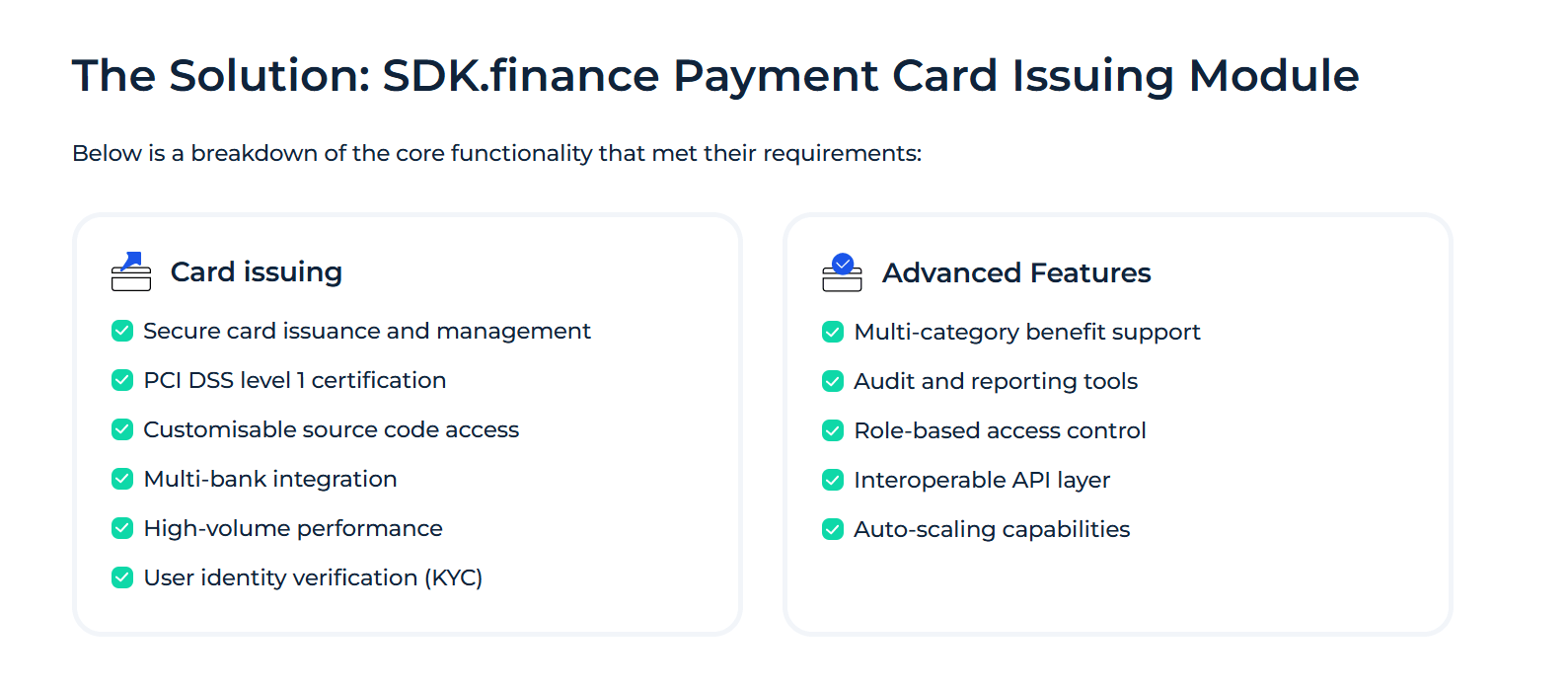

And, crucially, the solution had to meet the most stringent global security standards, PCI DSS Level 1 compliance, to ensure every transaction was fully protected.

Why SDK.finance? Three game-changing advantages

After months of careful evaluation, the government chose SDK.finance. Three factors tipped the scales in their favour:

1. Uncompromising security: PCI DSS level 1 certification

At the core of any national payment system lies security, and SDK.finance delivered on this front with flying colours. Our PCI DSS Level 1 Service Provider certification – the gold standard in payment data protection – gave government officials confidence that the platform could handle the immense responsibility of safeguarding millions of citizens’ financial information.

This isn’t just a badge. Maintaining PCI DSS Level 1 requires rigorous audits, constant monitoring, and adherence to the tightest protocols in the industry. For a government dealing with sensitive social program funds, anything less was simply not an option.

2. Source code license: control and independence redefined

What really set SDK.finance apart was its source code license. Few providers in the market offer this level of access and flexibility. For the government, this meant:

-

Full control: Their technical teams could adapt, customize, and evolve the platform as national priorities changed.

-

No vendor Lock-in: Unlike SaaS models, which tie organizations to ongoing contracts and external dependencies, the source code license ensured independence.

-

Future-proofing: With direct access to the codebase, the system could be maintained and updated internally, helping them stay compliant with local and international regulations.

-

Long-term savings: While the upfront cost was higher, eliminating recurring licensing fees and scaling costs promised significant savings down the line.

In a world where digital sovereignty is becoming a top priority, this level of autonomy was a strategic win.

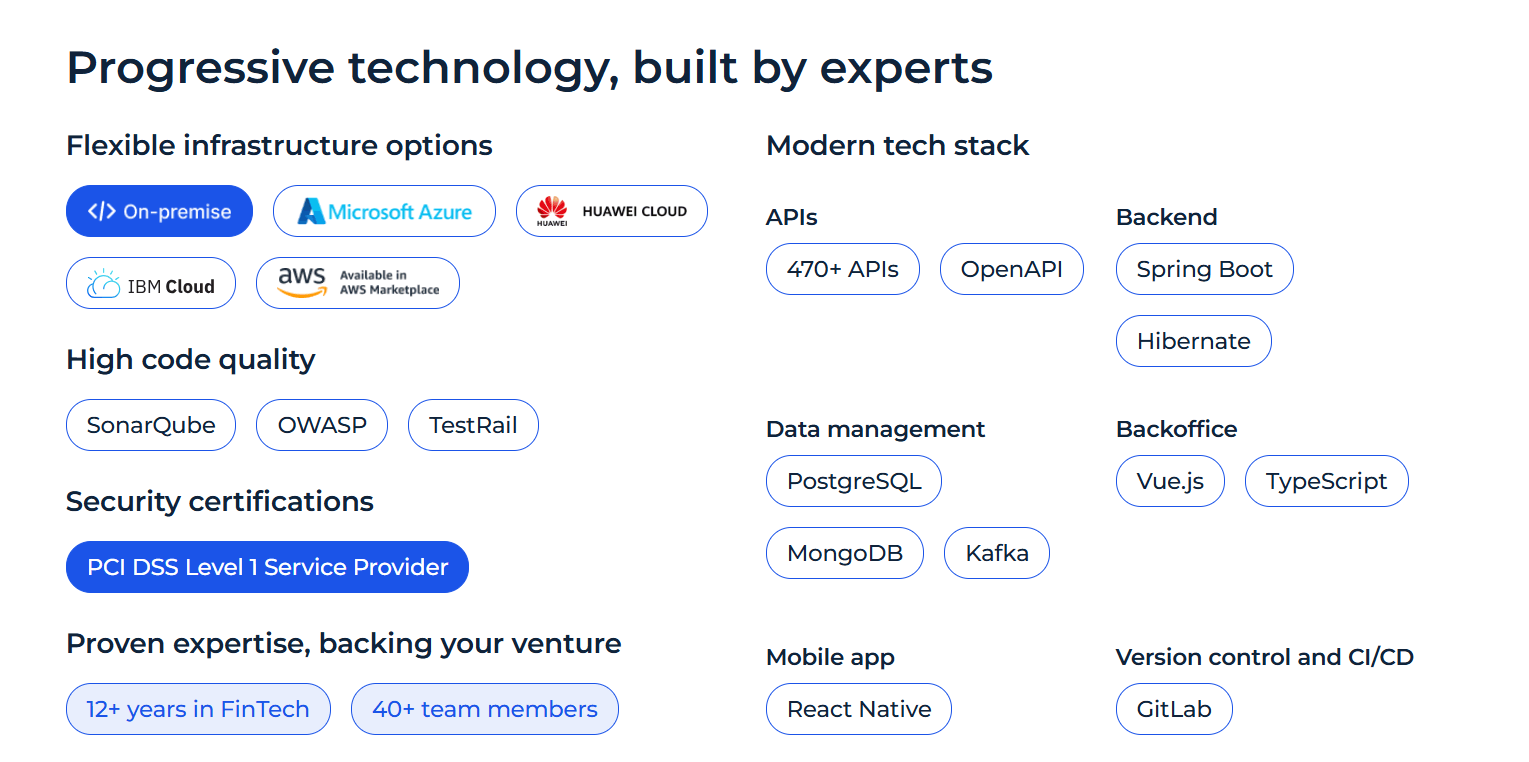

3. Proven scalability and technical excellence

The government needed a platform that could perform under immense pressure, and SDK.finance’s track record showed it could. With a modular architecture, API-first design, and capacity for over 2,700 transactions per second, the platform was engineered for high-demand environments.

The solution: a national payment ecosystem in action

Leveraging SDK.finance’s source code license, the government’s technical team built a comprehensive solution tailored to their specific national requirements. This approach delivered unprecedented speed-to-market advantages, the entire system was developed and launched in just 6 months, a timeline that would have been impossible with traditional vendor-dependent models.

The source code access enabled the government developers to customize core functionalities, integrate seamlessly with existing national infrastructure, and implement country-specific compliance requirements without waiting for external vendor modifications. This self-reliant development approach not only accelerated deployment but also ensured the system met exact governmental specifications from day one.

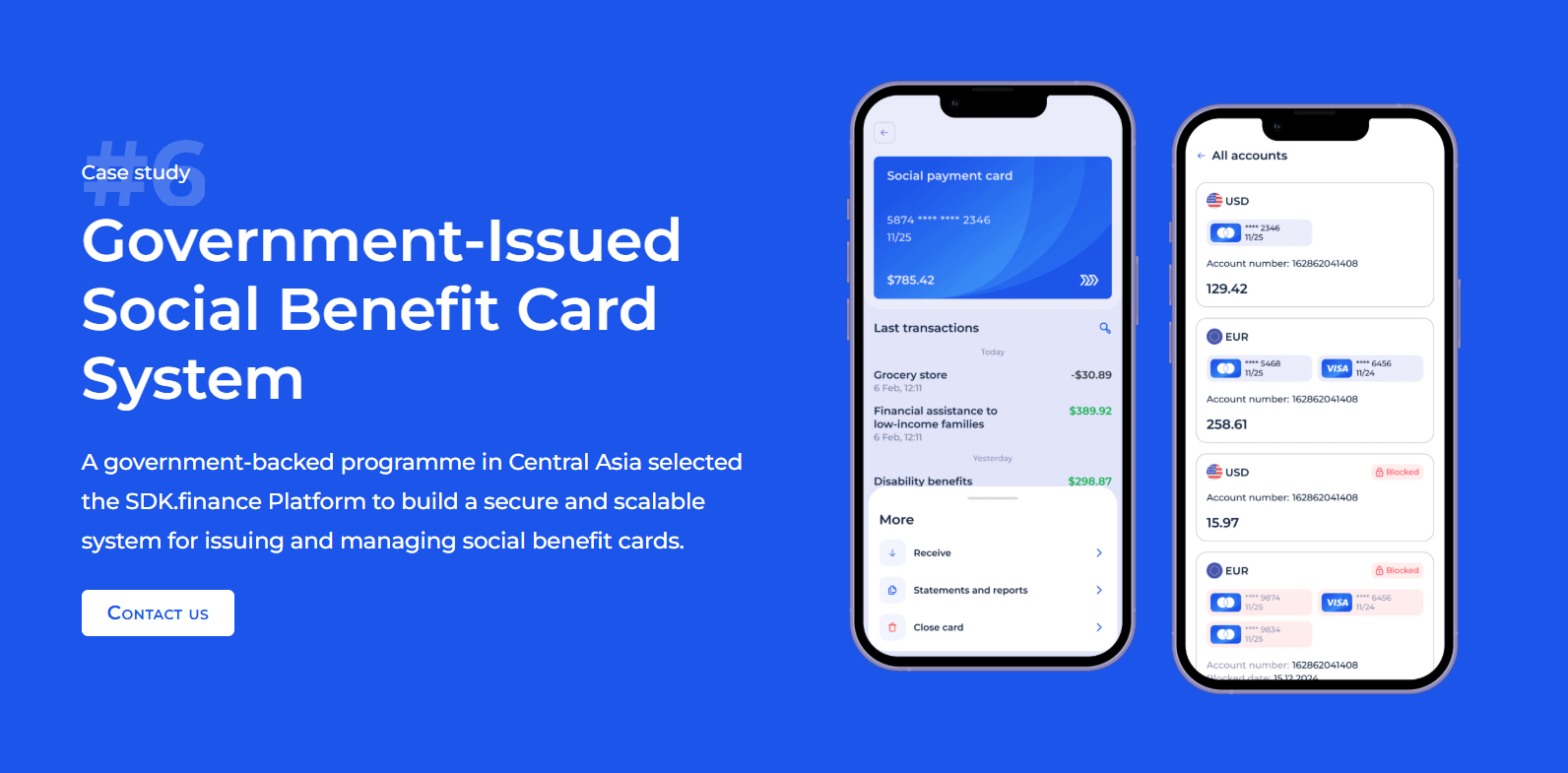

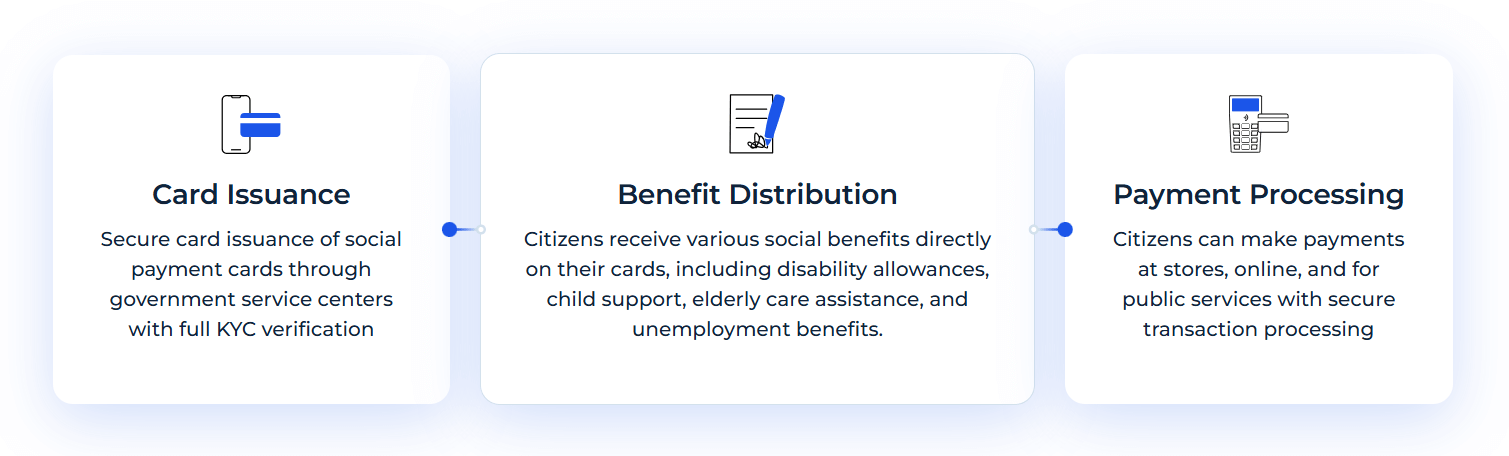

How Social Payment Cards Work?

Secure card issuance

Citizens received their social benefit cards at government service centres, with built-in KYC (Know Your Customer) checks ensuring each card was securely issued and activated.

Multi-benefit distribution

The platform handled all nine social benefit categories with ease. Whether it was a pension payment, child support allowance, or emergency relief, funds were distributed seamlessly through a unified system.

Universal payment capabilities

Cardholders could use their benefits for in-store purchases, online transactions, and even public service payments. Thanks to tight integration with the national payment infrastructure, acceptance was widespread across merchants.

Advanced features for government oversight

-

Multi-bank integration for flexible fund settlement

-

Detailed audit trails for transparent tracking of public funds

-

Role-based access controls to protect sensitive data

-

An API layer for smooth integration with existing systems

-

Auto-scaling capabilities to manage surges in demand

Real-time transaction processing meant beneficiaries didn’t have to wait for access to critical funds, an essential feature in times of crisis.

The impact: a new era of social service delivery

The results were transformative:

For citizens

-

Immediate access to social funds via secure, government-issued cards

-

Ability to spend benefits easily, both in stores and online

-

Transparency through mobile apps and statements

-

Faster, less bureaucratic access to support programs

-

Greater financial inclusion for underserved groups

For the government

-

Lower administrative costs through automation

-

Full visibility into fund distribution with robust reporting tools

-

Real-time monitoring for improved program oversight

-

Scalable infrastructure ready to support future initiatives

-

Elevated public trust in government services

Setting a regional benchmark

By partnering with SDK.finance, this Central Asian government didn’t just modernize its social assistance program, it set a new standard for digital service delivery in the region. The initiative now serves as a model for other nations seeking to combine security, scalability, and sovereignty in their payment infrastructure.

Ready to transform your financial services?

The success of this program shows what’s possible when governments choose the right partner. SDK.finance brings together:

- enterprise-grade security

- total control through source code licensing

- the technical chops to handle national-scale deployments.

Whether you’re planning a benefit program, revamping your country’s financial infrastructure, or launching new citizen services, SDK.finance provides the foundation for secure, scalable, and future-proof solutions.

Want to explore how SDK.finance can help your organization? Get in touch with our experts today.

This case study is based on the real-world implementation of SDK.finance’s platform for a nationwide social benefit card program. It highlights how advanced technology and strategic vision can work hand in hand to deliver life-changing results.