Launch your closed-loop wallet. Boost loyalty and cut costs

Enhance customer retention with a secure, cost-effective, and customizable closed-loop wallet solution. Our white-label source code empowers you to launch quickly and adapt seamlessly to market demands, ensuring a tailored experience that meets your business needs.

Contact usSmarter payments, stronger

connections

Cut down payment fees

Avoid costly credit card fees by keeping transactions within your own closed-loop ecosystem. Closed-loop wallets help you save on processing fees, keeping more revenue in your business.

Boost customer loyalty

Add loyalty programs, rewards, and incentives directly into your payment flow. This encourages repeat business and stronger engagement, increasing customer lifetime value.

Offline functionality

Supports offline payments, ensuring continuity in low-connectivity scenarios and enhancing customer satisfaction.

Faster and secure transactions

Transactions are confined to your closed loop system, ensuring enhanced security and faster processing times.

No intermediaries

Eliminate the need for third-party vendors and payment processors, reducing costs and giving you greater control over the payment process.

Brand engagement

Reinforce brand loyalty with a seamless, branded payment experience that keeps customers engaged.

transactionsper second

transactionsper day

transactionsper month

transactionsper year

End-to-end closed-loop wallet solution

Tailored to your business

Our white-label solution adapts to your unique needs, letting you modify functionalities, add features, and shape your wallet to stay ahead in a changing market.

Ready-to-deploy

Build an e-wallet app or integrate asset accounting seamlessly into your existing system. Create a closed-loop ecosystem for exclusive in-network transactions.

Customizable asset/currency management

Manage unlimited currencies, rewards, and bonuses to align with your business model and enhance customer loyalty.

Effortless integrations

With over 470 APIs, connect smoothly with payment gateways, loyalty programs, and other third-party services.

Built to scale

Handle up to 230 million transactions daily and 2,700 per second, ensuring your wallet grows with your business.

Seamless migration

Easily integrate with diverse database formats for hassle-free data transfer and operational continuity.

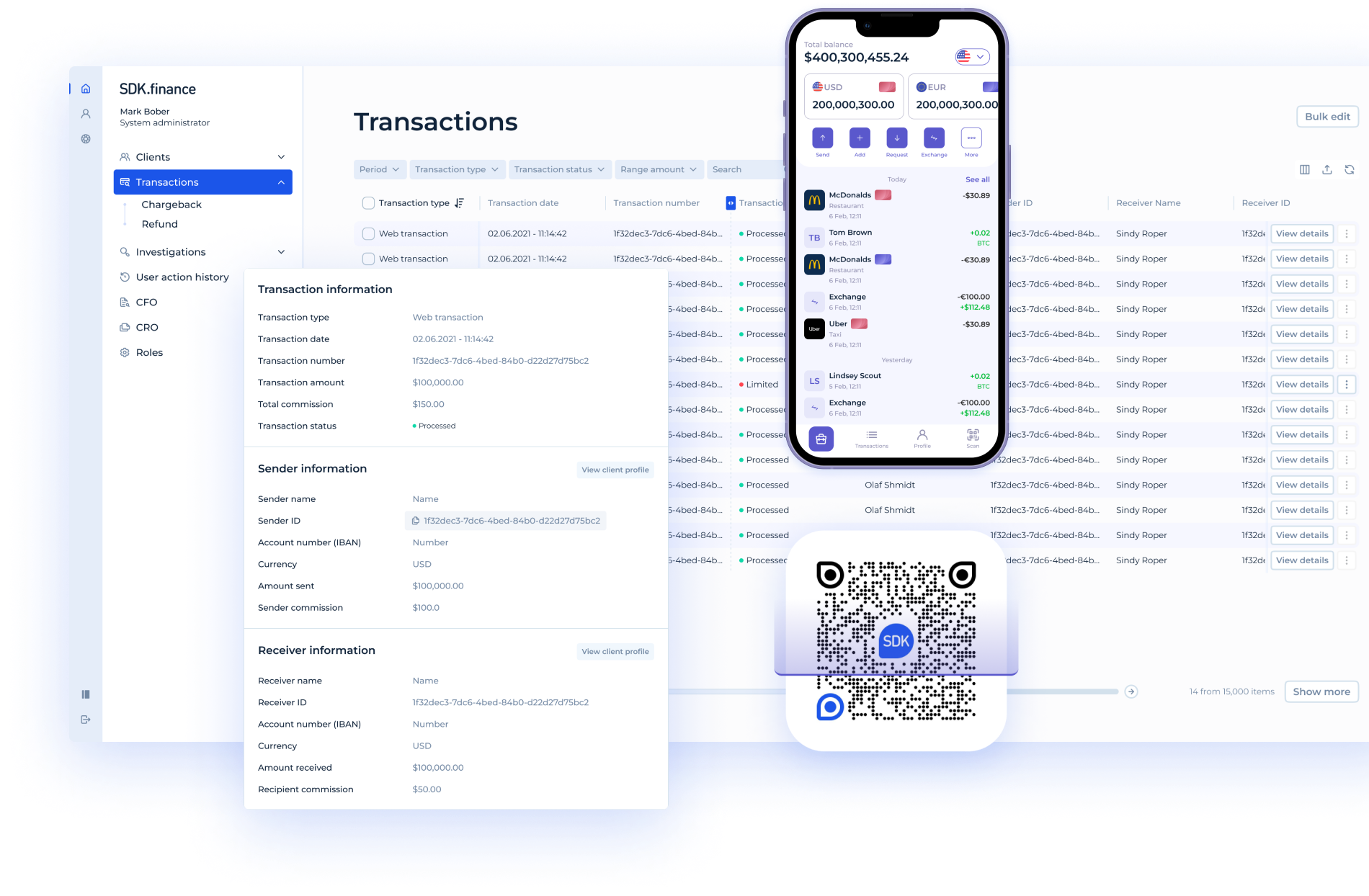

Out-of-the-box functionality to accelerate your time-to-launch

All you need for an A-Z closed-loop wallet launch within weeks.

User features

Onboarding & 2FA (two-factor authentication)

Customer profile & settings

KYC/KYB

Accounts in any currencies, crypto, points

Smart cards

Send, request, or exchange assets

Payment links & QR code payments

System management

Currency & assets creation engine

Flexible fees & limits engine

Cashbacks and rewards engine

In-system CRM & chat with clients

Detailed transaction monitoring

Flexible reporting

User action history

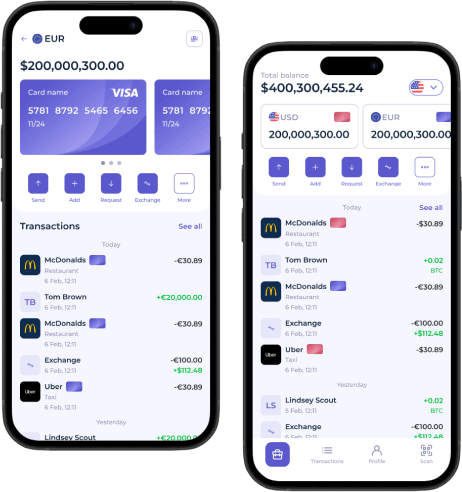

iOS/Android mobile app for first-rate customers’ experience

Launch your closed loop wallet or e-wallet quickly with our iOS/Android mobile app. Fully flexible, it allows you to modify, brand, and customize it to fit your business vision, ensuring an exceptional customer experience.

Your strategic advantage?

Full control

Own your wallet’s design and functionality

Always current

Get updates and support to keep growing

Future-ready

Stay ahead with tech that evolves with you

Ready to boost customer loyalty and retention?

Discover how SDK.finance’s closed-loop wallet solution can cut costs, build loyalty, and transform your payment infrastructure.

Related products

Mobile wallet

AvailableBuild and manage ewallet products to enable customers to securely transact, pay their bills and track expenses.

View product pageMoney transfer service

AvailableOffer your customers a fast, secure, and convenient way to send and receive money across borders and currencies.

View product pageFAQs

A closed wallet is a digital payment system that is restricted to specific merchants or brands. It enables customers to store funds and complete transactions within a controlled network, enhancing brand loyalty and customer retention.

A great example of a closed-loop digital wallet is the Starbucks mobile app, which allows customers to make payments and earn rewards exclusively at Starbucks locations.

Open-loop wallets can be used across different merchants and systems, while closed loop wallets are designed to be used within a specific ecosystem, such as a retail store or brand. Closed-loop wallets provide greater control and reduced processing fees, unlike open loop systems.

No, PayPal is an open-loop payment system, which means it can be used across different merchants and platforms rather than being restricted to a specific ecosystem.

Closed-loop wallets enhance customer loyalty by integrating loyalty rewards directly into the payment process, offering incentives and exclusive discounts that encourage repeat business. This personalized approach keeps customers coming back and boosts their lifetime value.