Open banking is projected to push the global market beyond $43 billion by 2026. Yet, behind this vision lies a maze of challenges: fragmented markets, stringent regulations, and the difficulty of merging cutting-edge technology with outdated legacy systems.

Sound familiar? You’re not alone.

In this article, we’re diving deep into the tech-heavy obstacles facing open banking implementation. From cloud hosting to security concerns, we’ll break down the hurdles and explore real-world strategies that are driving success. Let’s tackle these complexities together!

The rise of open banking technology

Open banking has rapidly gained popularity in the global financial landscape, fueled by consumer demand for more control over financial data and the rise of new fintech solutions.

The open banking technology is transforming traditional banking models.

By 2027, an estimated 76% of global financial institutions are expected to fully integrate open banking APIs into their services, driven by the need for faster payments, personalized financial products, and enhanced customer experiences.

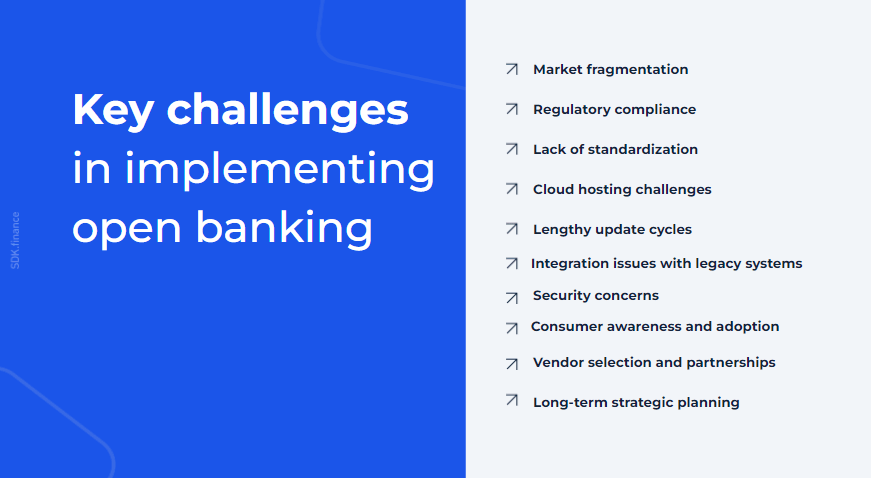

Key open banking challenges

Fragmented market

Different countries, different rules – it’s a recipe for complexity. For example, while Europe has standardized PSD2, the U.S. is a patchwork of state-level regulations, and Brazil has its own unique framework. The inconsistency means extra layers of customization and, of course, higher costs.

Challenges:

- Varying regulations, standards, and technologies across countries

- Inconsistent API specifications, authentication methods, data formats

- Increased complexity and costs for product development

Solutions:

- Advocate for and adopt global standards to simplify operations. Engage in industry collaborations to influence the development of universal protocols.

- Identify key markets that align with your business strategy. Focus resources on markets with significant ROI potential.

- Collaborate with local institutions to navigate regional complexities. Leverage partnerships to expand market reach without overextending resources.

Let’s take Wise as an example. They prioritized setting up distinct compliance processes for each key region early on. This allowed them to scale without needing constant regulatory workarounds. The lesson here? Prioritize your high-value markets and build partnerships with local institutions to navigate regulations without draining your resources. Focus matters.

Regulatory compliance

Compliance often feels like a moving target, with new data privacy laws, cybersecurity standards, and financial reporting requirements popping up constantly.

Challenge

- Compliance with diverse regulatory frameworks (such as GDPR in Europe and various local regulations) can be complex and resource-intensive for organizations. Each region may have specific requirements that must be met to avoid penalties.

Solutions:

- Leverage compliance as an innovation opportunity: view regulatory requirements as an opportunity to enhance customer trust and differentiate your offerings.

- Stay ahead of regulatory changes: Monitor regulatory developments proactively to gain a competitive edge.

Example

Take Stripe, for example. They invested in a region-specific compliance structure from the start, which has allowed them to lead in security while gaining customer trust.

Lack of standardization

Moving on to standardization or lack thereof. Banks, fintechs, and regulators each have their own approach to APIs and data formats. This fragmented approach causes compatibility issues and slows down integrations.

Challenges

- Different institutions use varied APIs and data formats

- Inconsistency leads to higher costs

- Integration of new services is slow

Solutions

- Adopt industry standards by implementing widely accepted protocols to simplify integrations

- Use API management solutions through platforms

- Drive standardization initiatives by participating in industry groups

Example:

Look at the UK’s Open Banking Implementation Entity (OBIE). By standardizing APIs, they created a smoother playing field, allowing banks like Monzo and Starling to build innovative, connected solutions more quickly.

Drive standardization from within. If the external environment won’t align, you can work internally or collaboratively to streamline APIs and data protocols.

Cloud hosting

Regulations in many countries restrict the use of cloud solutions for storing sensitive financial data, requiring data to be stored within national borders. This necessitates local hosting solutions, which can be costly and complex to manage, and may limit scalability and flexibility.

Challenges

- Data sovereignty regulations restrict the use of cloud

- Increased infrastructure costs and operational complexities

- Slowed down expansion into new markets

Solutions

- Hybrid hosting models: Combine local data centers with cloud solutions to meet regulatory requirements.

- Local partnerships: Collaborate with regional hosting providers familiar with local regulations.

- Invest in compliance-certified infrastructure: Use infrastructure that meets international security and compliance standards.

Hybrid cloud models and working with regional cloud providers are excellent workarounds. This way, sensitive data is stored locally for compliance, while the rest of your operations benefit from global cloud advantages.

Example

For SDK.finance clients, we recommend hybrid cloud setups where sensitive data is hosted locally, while less sensitive operations can scale globally. This model not only keeps them compliant but also future-proofed for expansion.

Everything you need to launch crypto wallets, payments, and custody

Learn moreLengthy update cycles

Legacy systems don’t just slow you down – they actively hinder innovation. New features take forever to roll out, especially when they need to meet regulatory standards.

Challenges

- Legacy systems/processes delay new feature implementation

- Prolonged time-to-market

- Higher operational cost

Solutions

- Agile methodologies: Adopt agile frameworks to enhance responsiveness.

- Modular product development: Develop products in smaller, independent modules.

- Technology modernization: Upgrade legacy systems to more flexible and scalable platforms.

Example:

At SDK.finance, we’ve moved from traditional waterfall approaches to agile frameworks for our product updates. This shift enables us to respond quickly to changes, whether they’re regulatory or customer-driven. It’s a marathon, but one that’s essential for staying ahead of the competition.

Integration issues with legacy systems

Legacy systems are a common sight in banking, and they’re not built to integrate with modern technologies. This limits what institutions can offer in terms of new, dynamic services.

Challenges

- Legacy systems may not support modern integrations

- Limited ability to adopt new technologies and services

Solutions

- Gradual system updates to minimize disruption

- Use middleware to bridge old and new systems

- Invest in long-term infrastructure improvements

Security

Security in open banking is mission-critical. With more open data-sharing and API exposure, we’re inviting more potential threats. Cybersecurity isn’t just a line item – it’s the backbone of customer trust.

Challenges

- Risk of exposing sensitive data via open banking

- Cybersecurity threats are increasingly sophisticated

Solutions

- Use AI and machine learning to detect and prevent threats

- Implement comprehensive security policies and protocols.

- Train employees on security best practices.

Example

Plaid uses best-in-class encryption protocols, secure cloud infrastructure, multi-factor authentication, and around-the-clock monitoring to protect users’ data plus regularly audits its APIs and security controls. This proactive approach is how we need to think about security in open banking. No matter the tech, human oversight and training complete the security circle.

Consumer awareness and adoption

Consumer awareness is often overlooked but is crucial for open banking to thrive. The reality? Many people just aren’t familiar with open banking benefits, and concerns about privacy can slow adoption. The solution here isn’t just technology – it’s education and trust-building.

Challenges

- Many customers are unaware of open banking benefits

- Concerns over data privacy hinder adoption.

Solutions

- Clear messaging that shows benefits and security measures

- Simplified onboarding and intuitive UI

- Transparency about data usage

Example

Monzo in the UK is great at this. They’ve invested heavily in clear, transparent messaging that reassures customers and makes the benefits of open banking obvious. In simple terms, they show customers ‘What’s in it for me?’ rather than just ‘Here’s another financial app.’ The result? Higher adoption and loyalty.”

Vendor selection and partnerships

Choosing the right vendor isn’t just about tech compatibility – it’s also about shared goals and adaptability. A misaligned vendor relationship can hold you back or worse, make scaling a nightmare.

Challenges

- Choosing vendors that match strategic goals and can adapt

- Risk of vendor lock-in or misalignment

Solutions

- Evaluate vendors’ capabilities, track record, and cultural fit

- Build long-term partnerships based on shared goals

- Establish clear KPIs to monitor vendor performance

N26 in Germany aligned with partners who shared their digital-first philosophy, which helped streamline their product rollouts. To build strong vendor relationships, set clear KPIs and choose partners who not only support your tech needs but also understand your vision. Think of vendors as partners in growth, not just service providers.

Long-term strategic planning

With rapid changes in tech and regulation, balancing short-term goals with a clear long-term vision is crucial. The challenge here is to avoid getting swept up in short-term wins while still keeping the big picture in mind.

Challenges

- Rapid tech advancements require continuous adaptation

- Balancing short-term demands with long-term vision

Solutions

- Cultivate visionary leadership that anticipates trends

- Invest in R&D to explore new technologies

- Adopt flexible business models that allow for quick pivots.

Leading FinTechs like Revolut invest in research and development to keep up with evolving tech and customer demands. They’re able to pivot as needed without losing sight of their ultimate goals. For us, it’s about building flexible models that allow for quick adjustments but are also built for longevity.

SDK.finance FimTech Platform solution for open banking

Now that we’ve explored the key challenges in open banking, let’s dive into how SDK.finance addresses these complexities. Our FinTech Platform acts as a powerful core engine for a wide range of financial products, including digital banks, e-wallets, crypto spending apps, and payment processing solutions.

With a dedicated team of over 50 experts in financial technology, we’ve successfully contributed to numerous projects around the globe. Our API-first architecture stands out in the industry, enabling our clients to create secure and scalable financial products that integrate seamlessly, no matter the market or regulatory landscape.

This architecture not only minimizes compatibility issues but also ensures smoother integrations—essential in today’s fragmented and fast-paced markets. Furthermore, SDK.finance provides clients with complete control over their databases, guaranteeing data sovereignty—a critical requirement for institutions operating in regulated environments.