Crypto Banking Solutions: build your crypto banking app with SDK.finance

Empower your crypto banking business with SDK.finance’s robust Platform. From seamless crypto-to-fiat conversions to issuing branded payment cards, our enterprise-ready solution offers everything you need to stay ahead in digital finance. Our Platform is designed to be crypto-friendly, ensuring smooth integration between traditional finance and cryptocurrencies. A crypto-friendly bank can leverage these features to provide innovative services tailored for cryptocurrency users.

Contact us

Features your customers will love

User features

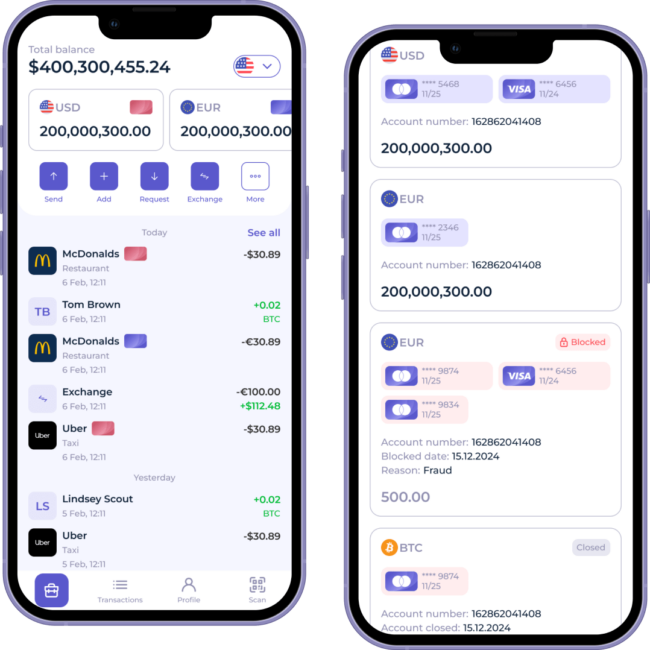

Wallets for digital and fiat currencies

Crypto debit cards

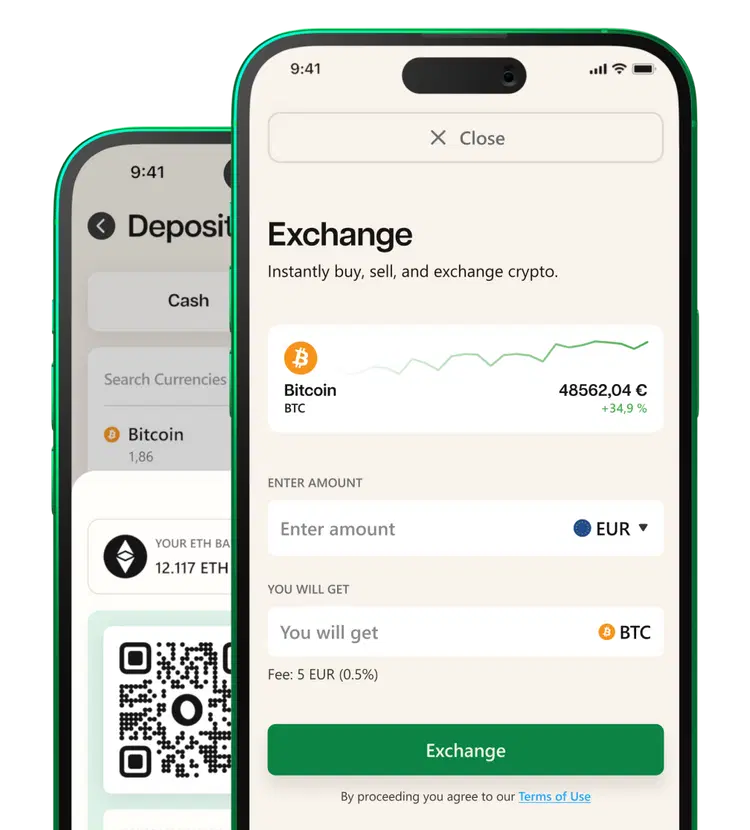

Real-time crypto-to-fiat conversion

Crypto payments and withdrawals

QR/NFC contactless payment options

Detailed transaction history for both fiat and crypto transactions

System management

Ledger for crypto, fiat, and digital assets transactions

Built-in KYC/KYB process

Customizable fee and commission structures

In-system CRM & chat with clients

Detailed transaction monitoring

Advanced reporting and analytics

Your crypto app, launched faster

Our iOS/Android mobile app enables rapid deployment of branded crypto wallets or banking apps:

- Fully customizable to align with your brand

- User-friendly design

- Pre-built features and minimal configuration

This solution is tailored for the dynamic crypto space, ensuring security and advanced features for crypto enthusiasts.

transactionsper second

transactionsper day

transactionsper month

transactionsper year

Smarter choice

for crypto banking

Source code license

Gain full control and flexibility with SDK.finance’s source code license, empowering you to tailor the platform to your unique business requirements while maintaining complete ownership of your infrastructure.

Robust digital assets & currency management

Manage fiat and digital currencies, assets, and even bonuses through a multicurrency bank account to align with your business model and requirements.

All-in-one toolkit

With pre-built backend, 470+APIs, backoffice for the team and white-label mobile app you receive everything needed for your crypto product launch.

Slash the time to market

Deploy your crypto banking solutions faster using our pre-built modules and benefiting from the API-driven architecture for streamlined integrations.

Customize your way

Tailor every aspect of the Platform to fit your business model, brand, and customer needs.

Scale effortlessly

Built for enterprises, our Platform easily accommodates growing transaction volumes and user bases.

Your strategic advantage?

White-label software

We've done the heavy lifting, you get the credit

Future ready technology

With a modern tech foundation, your app is built to last.

Streamlined integrations

Use pre-developed integrations or build yours with our 470+ APIs

Ready to discuss your crypto banking vision?

Frequently asked questions

Crypto banking refers to the integration of cryptocurrency and traditional banking services, enabling users to manage both digital and fiat currencies within a single platform. This innovative approach provides a secure, efficient, and user-friendly way to buy, sell, store, and transfer cryptocurrencies, while also offering access to traditional banking services such as loans, credit cards, and savings accounts. By bridging the gap between digital assets and traditional banking, crypto banking solutions make it easier for individuals and businesses to adopt and utilize cryptocurrencies. This seamless integration ensures that users can enjoy the benefits of both worlds, enhancing their financial flexibility and security.

Creating your own crypto bank involves:

- Exploring regulatory compliance in your operating region.

- Defining your product requirements

- Developing your branded crypto app (in-house, outsourcing or using a reliable software vendor for efficiency )

- Testing and launching your product.

Absolutely, SDK.finance offers a source code licence, allowing financial institutions full control and customisation of their crypto banking platform.

With SDK.finance, you can launch a fully branded and customized crypto banking app within weeks. The actual timeline depends on the capabilities of your development team and the level of customization and integrations required

Yes, SDK.finance uses robust APIs to ensure seamless integration with your current systems and third-party tools.

The cost varies based on factors like features, customization, and compliance requirements. Using SDK.finance’s white-label solution significantly reduces costs and accelerates development.

Developing a crypto app involves:

- Choosing a trusted software provider.

- Designing user-friendly interfaces for both mobile and web platforms.

- Integrating essential features such as multi-currency wallets and real-time crypto-to-fiat conversions.

- Implementing blockchain technology for secure transactions.

Core banking solutions form the backbone of any crypto banking platform, providing the essential infrastructure needed to manage users’ accounts, transactions, and assets. These solutions typically include:

- Account Management: Create, manage, and close user accounts with ease, ensuring a seamless user experience.

- Transaction Processing: Efficiently process transactions, including fiat-to-crypto and crypto-to-fiat conversions, to facilitate smooth financial operations.

- Asset Management: Securely manage users’ digital assets, including storage, security, and detailed reporting, to maintain trust and transparency.

- Compliance: Adhere to relevant regulations, such as AML and KYC, ensuring that the platform operates within legal frameworks and maintains high standards of integrity.

- Integration: Seamlessly integrate with other systems, such as payment gateways and blockchain networks, to enhance functionality and user experience.

By implementing robust core banking solutions, crypto banking platforms can offer a comprehensive, secure, and efficient service that meets the diverse needs of their users.