As cryptocurrencies gain a stable foothold in mainstream finance, the ability to move money seamlessly between digital and traditional systems has become essential. Behind this connection lies a complex infrastructure known as crypto-to-fiat payment rails – the technological and operational bridge that enables the exchange of cryptocurrencies for fiat currencies and vice versa.

For FinTech companies, electronic money institutions (EMIs), and payment service providers (PSPs), these rails are the backbone of any product that involves digital assets. Yet, building and maintaining such a system internally can be a lengthy and expensive process.

This article explores how crypto-to-fiat payment rails work, the challenges of developing them from scratch, and how the white-label crypto-to-fiat solution by SDK.finance offers a faster and enterprise-grade alternative.

Offer crypto and fiat spending side by side

Learn moreWhat are crypto-to-fiat payment rails?

Payment rails are the underlying systems that move money between parties – from traditional ones such as SEPA, SWIFT, ACH, and card networks to blockchain-based systems processing digital assets.

Crypto-to-fiat payment rails are a hybrid layer connecting these two worlds. They allow cryptocurrencies like Bitcoin, Ether, or stablecoins (USDT, USDC, etc.) to be converted into traditional currencies such as USD, EUR, or GBP, and transferred to standard bank accounts or cards.

In practical terms, they enable scenarios like:

- A customer pays for a purchase in crypto, but the merchant receives euros.

- A user sells stablecoins and withdraws funds to a bank account.

- A fintech platform offers both crypto balances and fiat accounts under one dashboard.

These rails underpin on-ramp (fiat-to-crypto) and off-ramp (crypto-to-fiat) services, essential for reducing the gap between decentralised assets and regulated financial systems.

How crypto-to-fiat payment rails work

A crypto-to-fiat transaction involves multiple steps, actors, and systems working together to make the process near-instant for the user. Let’s break down the core stages.

1. Transaction initiation

The user starts a transaction – for example, selling 0.1 BTC for euros. The platform calculates the exchange rate in real time, typically using aggregated market data from liquidity providers or exchanges.

Many platforms offer a locked rate window (30-60 seconds) to protect users against crypto volatility while the transaction is processed.

2. Crypto transfer and verification

The user sends the crypto to a specific wallet address managed by the provider. Once the transaction receives the required number of confirmations on the blockchain, the system moves to the conversion stage. For fiat-to-crypto flows, this is the moment when the fiat payment (via card or bank transfer) is verified.

3. Conversion and liquidity management

The provider converts the crypto to fiat or vice versa using one of two approaches:

- Internal liquidity pools, where the provider holds reserves in both crypto and fiat to execute trades instantly.

- External exchange integrations, where each conversion triggers an API call to an exchange or OTC desk to complete the trade at the best available rate.

Efficient liquidity management is vital – it ensures there’s always enough crypto and fiat available to complete conversions without delays or slippage.

4. Compliance and AML monitoring

Because crypto-to-fiat transactions connect regulated and pseudonymous systems, providers must comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- Users undergo identity verification through ID and address checks.

- Transactions are monitored for suspicious patterns.

- Large or high-risk transactions may be automatically flagged for manual review.

This compliance framework builds trust with banks and regulators – essential for sustaining crypto-fiat operations.

5. Fiat settlement

Finally, the converted fiat is sent through traditional payment rails such as SEPA, Faster Payments, SWIFT, or card networks (e.g., Visa Direct, Mastercard Send).

Depending on the integration, payouts can reach a user’s account within minutes. In reverse, on-ramps accept payments from cards or accounts to purchase crypto, completing the cycle.

In essence, crypto-to-fiat payment rails blend blockchain speed with banking compliance, ensuring users can move between the two financial systems with minimal friction.

Challenges of building crypto-to-fiat infrastructure in-house

Many FinTech companies initially consider developing their own crypto-fiat system to retain full control. However, what seems straightforward at first often becomes a multi-year engineering and compliance challenge.

Core components you’d need to build

- Ledger and accounting engine

A robust real-time ledger is required to track balances, conversions, and transactions across multiple currencies and assets. It must support double-entry accounting, reconciliation, and auditability to satisfy both financial and regulatory standards. - Banking network integrations

Establishing direct connections with banks and payment processors is one of the most time-consuming parts. Many institutions remain cautious toward crypto, so finding banking partners that allow crypto-related operations is a major bottleneck. - Liquidity management system

You’ll need integrations with multiple exchanges and liquidity providers to execute buy/sell orders, manage spreads, and optimise costs. This includes automation for rate quoting, slippage handling, and rebalancing reserves. - KYC and AML frameworks

Identity verification, sanctions screening, and transaction monitoring are mandatory. Building a compliant and user-friendly verification flow requires integrating multiple third-party tools and developing your own review processes. - APIs and backoffice tools

The platform must expose secure APIs for integration with frontends and partners, alongside a full backoffice for compliance, support, and finance teams to manage customers and transactions. - Licensing and regulatory compliance

Depending on your markets, you may need MSB, EMI, or Crypto Asset Service Provider (CASP) licences. Achieving and maintaining these licences requires capital, experienced compliance personnel, and continuous audits.

Time and cost implications

Developing such a system internally can take 12-24 months and cost millions in software development, licensing, and compliance management. Even after launch, ongoing maintenance, security audits, and regulator reporting remain major cost drivers.

That’s why many fintechs turn to white-label crypto-to-fiat software providers – ready platforms that already handle the complex technical and compliance layers, allowing them to focus on branding, customer experience, and growth.

Offer crypto and fiat spending side by side

Learn moreSDK.finance white-label crypto-to-fiat solution: enterprise-grade alternative

SDK.finance offers a white-label, API-first crypto-to-fiat software platform built for FinTechs, EMIs, and financial institutions aiming to integrate digital assets into their products without building the entire infrastructure from scratch.

With PCI DSS Level 1 and ISO 27001:2022 certifications, it meets enterprise security and compliance requirements out of the box.

Core features:

- Ledger-based architecture

The SDK.finance platform operates on a multi-asset ledger that supports both fiat and cryptocurrencies, enabling accurate accounting, reconciliation, and audit trails for each conversion. - Real-time processing power

The system handles 2,700+ transactions per second (34 million+ per day), ensuring scalability for high-volume businesses such as exchanges and wallets. - 470+ RESTful API endpoints

These APIs give developers full flexibility to connect with exchanges, KYC providers, payment processors, and third-party services. - Modular core with 60+ functional modules

Each component – from wallets and transfers to AML monitoring and card issuing – can be enabled independently, allowing tailored implementations for specific business models. - Deployment options

Choose between on-premise with full source code ownership or cloud-based SaaS (Software as a Service). Enterprises often prefer the source code licence for maximum control and compliance with internal policies. - Pre-integrated partners

SDK.finance comes pre-connected with providers for KYC, payments, and crypto gateways, drastically reducing setup time.

Compliance-ready foundation

Compliance and auditability are built into the SDK.finance system from day one.

Each transaction is automatically logged, categorised, and available for AML checks and reporting. The platform also supports role-based access controls for compliance officers, auditors, and finance managers.

Secure and customisable mobile experience

The SDK.finance white-label mobile app for iOS and Android allows end-users to manage their crypto and fiat funds, perform conversions, and send payments – all under your brand.

Its fully customisable design lets fintechs and EMIs tailor UI elements, add new services, and localise the app for different markets.

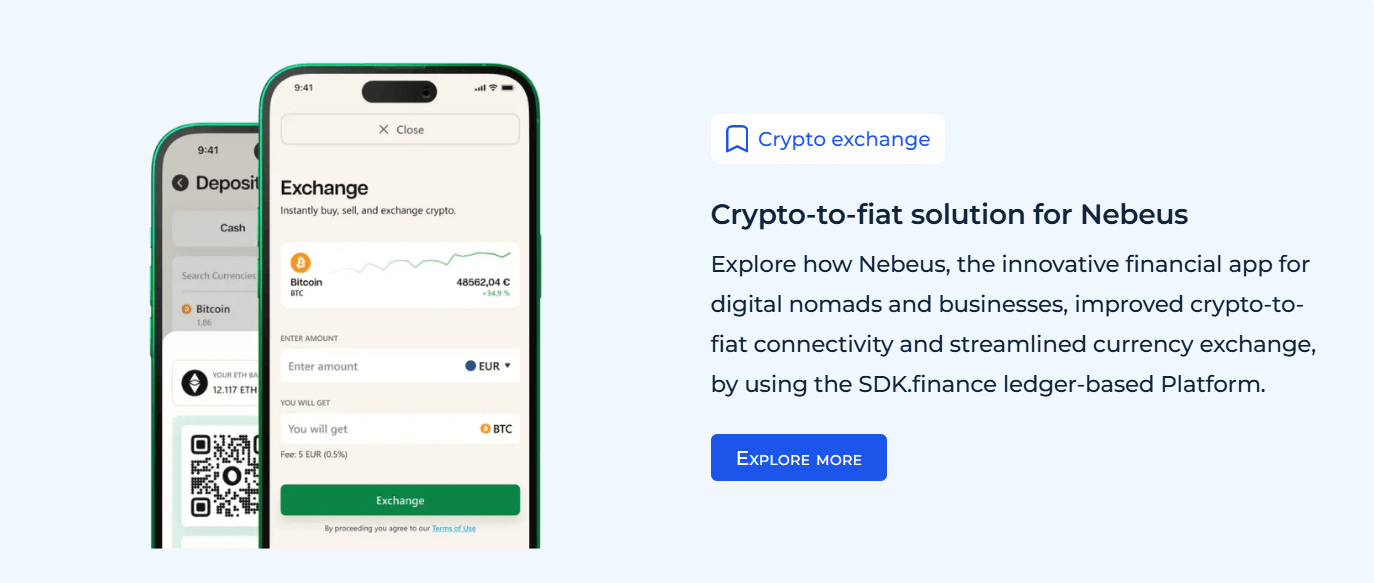

Real-world example: Nebeus case

A practical example of SDK.finance’s crypto-fiat capabilities is Nebeus, a European crypto-fiat financial app.

By adopting the SDK.finance ledger and transaction engine, Nebeus built a hybrid platform where users can:

- Store and manage both crypto and fiat balances.

- Instantly exchange between them at market rates.

- Transfer funds or make payments using multiple currencies.

The implementation allowed Nebeus to accelerate its time-to-market and achieve enterprise-level reliability without building its own core from scratch. The SDK.finance foundation handled the complex accounting and compliance logic, allowing Nebeus to focus on product innovation and user experience.

Who benefits from white-label crypto-to-fiat software

SDK.finance’s crypto-to-fiat solution is ideal for:

- FinTech startups that want to enter the crypto-fiat space quickly without the cost of building infrastructure.

- Electronic Money Institutions (EMIs) and Payment Service Providers (PSPs) expanding their service portfolios.

- Banks and neobanks aiming to offer crypto trading or conversion alongside standard accounts.

- Enterprises in non-financial sectors – such as telecom, travel, or retail – integrating embedded finance and crypto payments into their ecosystems.

Whether you’re adding crypto payment acceptance, launching a new wallet, or building a neobank with digital asset support, the SDK.finance platform provides the flexibility and control needed at enterprise scale.

Conclusion

Crypto-to-fiat payment rails are no longer optional for fintechs and EMIs – they’re a competitive necessity. The ability to bridge digital and traditional currencies opens the door to new products, broader user bases, and faster growth.

However, building such infrastructure in-house involves regulatory, operational, and technological hurdles that few organisations can tackle efficiently.

By leveraging the white-label crypto-to-fiat platform by SDK.finance, businesses gain access to an enterprise-grade system that combines reliability, flexibility, and speed to market. It’s a proven foundation for any company looking to connect the worlds of crypto and fiat securely and compliantly.

Learn more about SDK.finance crypto-to-fiat software here.

Offer crypto and fiat spending side by side

Learn more