Banks are at a crossroads in their banking digital transformation journey. With 67% of consumers now expecting real-time, personalized service, the pressure to modernize has never been greater. At the same time, fintechs and digital competitors are stealing market share by offering faster, cheaper, and more seamless banking services.

Did you know that banks could save up to 30% of their costs by adopting cloud computing and automation? Or that AI is expected to reduce fraud by up to 50 % by 2025? The facts are clear — digital transformation is not just an option, it’s a necessity.

So why are traditional banks hesitating while fintechs are forging ahead? And what technologies are making this happen? Let’s find out why the digital transformation of banking is not only inevitable but essential for survival.

Why do banks need digital transformation?

With customer expectations rising and competition from digital-first fintechs growing, financial institutions must embrace digital transformation. But what does this really mean for the industry?

Banking digital transformation is all about modernizing the way banks work. It’s not just adding some new tech—it’s a full shift to digital tools and smarter processes that make banking faster, easier, and more customer-friendly.

From automating routine tasks to creating apps that allow 24/7 access, this transformation focuses on making banks as efficient and responsive as possible. It lets banks provide services instantly, with more personal touches than today’s customers expect.

So, why do banks need this transformation?

Meeting customer expectations

Today, people want the same instant, around-the-clock access to their bank that they get from shopping or social media.

They want personalized, easy-to-use services. Without these, banks risk losing customers to new digital-first competitors who can deliver.

Rising competition

The financial landscape has changed—digital-first banks and fintechs are taking over by offering fast, flexible, and often cheaper options. To keep up, traditional banks need to embrace digital tools and a customer-first approach.

Keeping up with regulations

Financial rules are evolving, especially around security and data-sharing (think open banking). Going digital makes it easier for banks to meet these standards and keep customer data secure.

Boosting operational efficiency

By automating repetitive tasks and digitizing paperwork, banks save time and cut down on costs. This means quicker customer service and more time for employees to focus on meaningful work.

In short, digital transformation isn’t just about tech; it’s a way for banks to stay relevant, offer better service, and stay competitive in a fast-moving world.

Challenges and opportunities in the banking industry

The banking industry is undergoing a significant transformation, driven by technological advancements, changing customer expectations, and increasing competition from fintech startups. This transformation presents both challenges and opportunities for traditional banks.

Challenges of traditional banking

Traditional banks face several challenges, including:

- Legacy systems and infrastructure: Many banks still rely on outdated systems that are not designed to support digital transformation. These legacy systems can be costly to maintain and difficult to integrate with new technologies.

- High operational costs and inefficiencies: Traditional banking operations often involve manual processes and paperwork, leading to higher costs and inefficiencies. Digital transformation can help automate these processes, reducing costs and improving efficiency.

- Meeting changing customer expectations: Today’s customers expect seamless, personalized digital services. Traditional banks must adapt to these expectations or risk losing customers to more agile, digital-first competitors.

- Increasing competition from fintech startups: Fintech startups and digital-only banks are rapidly gaining market share by offering innovative, user-friendly services. Traditional banks must innovate to stay competitive.

- Regulatory requirements and compliance issues: The banking industry is heavily regulated, and compliance with evolving regulations can be challenging. Digital transformation can help banks meet these requirements more efficiently.

Opportunities for growth and innovation

Despite these challenges, traditional banks also have opportunities for growth and innovation, including:

- Leveraging digital technologies: By adopting digital technologies, banks can improve operational efficiency, reduce costs, and enhance customer satisfaction. Automation, AI, and machine learning can streamline processes and provide valuable insights.

- Enhancing customer satisfaction and loyalty: Personalized digital services can improve customer satisfaction and loyalty. By understanding customer needs and preferences, banks can offer tailored products and services.

- Expanding into new markets and customer segments: Digital channels enable banks to reach new markets and customer segments. Online banking and mobile apps make it easier for customers to access banking services anytime, anywhere.

- Developing new revenue streams: Digital platforms and services can create new revenue streams. For example, banks can offer value-added services like financial planning tools, investment advice, and digital wallets.

- Improving risk management and compliance: Advanced data analytics and machine learning can enhance risk management and compliance. By analyzing customer data, banks can detect fraud, assess credit risk, and ensure regulatory compliance.

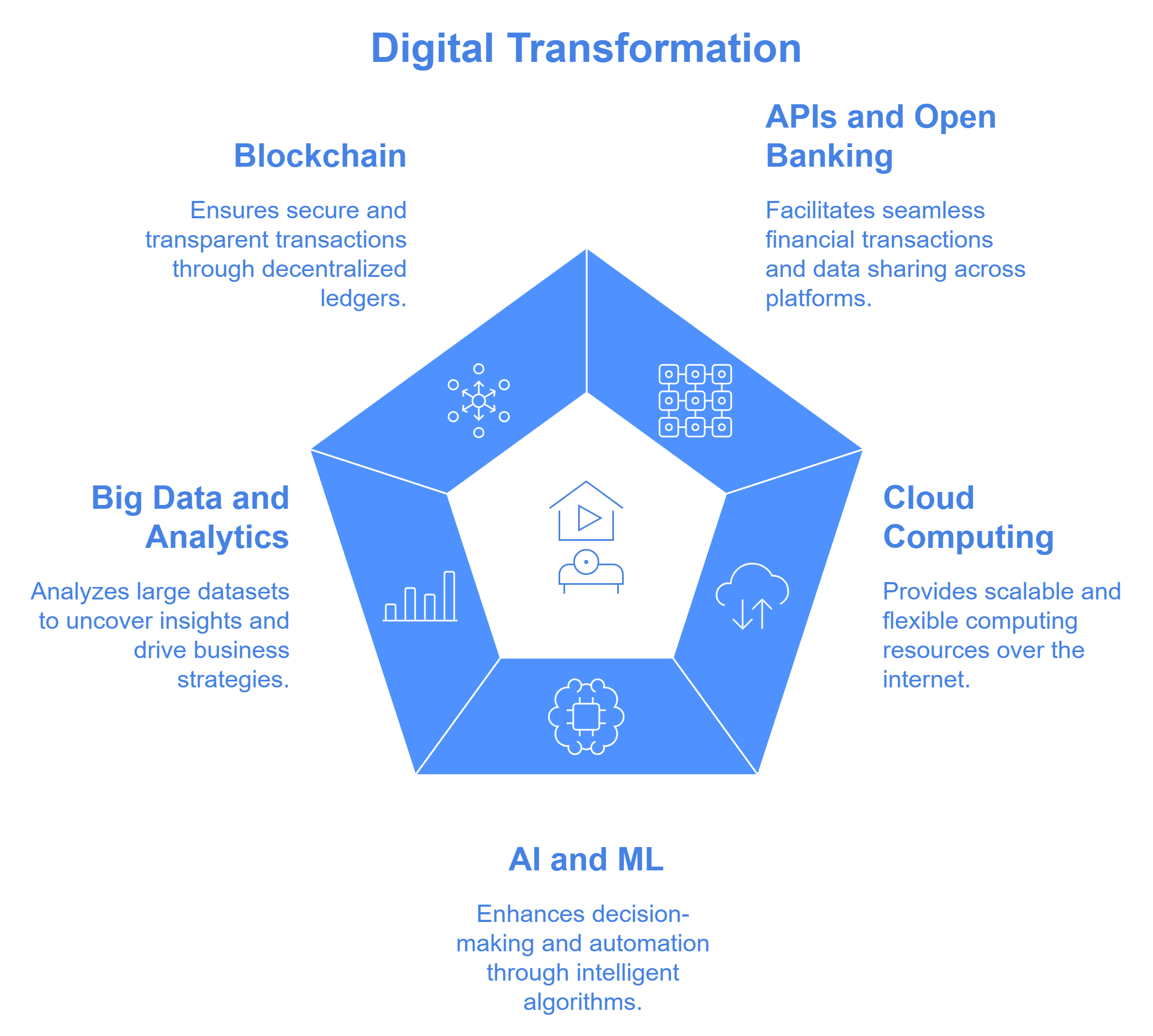

Technologies driving digital transformation

The journey of digital transformation in financial institutions is powered by a range of advanced technologies:

APIs and open banking

Application Programming Interfaces (APIs) enable financial institutions to connect seamlessly with third-party providers, allowing customers to access a wider range of financial services, like budget tracking apps or credit monitoring. APIs support open banking, where customers can authorize trusted third-party access to their banking information, driving flexibility and innovation in financial services.

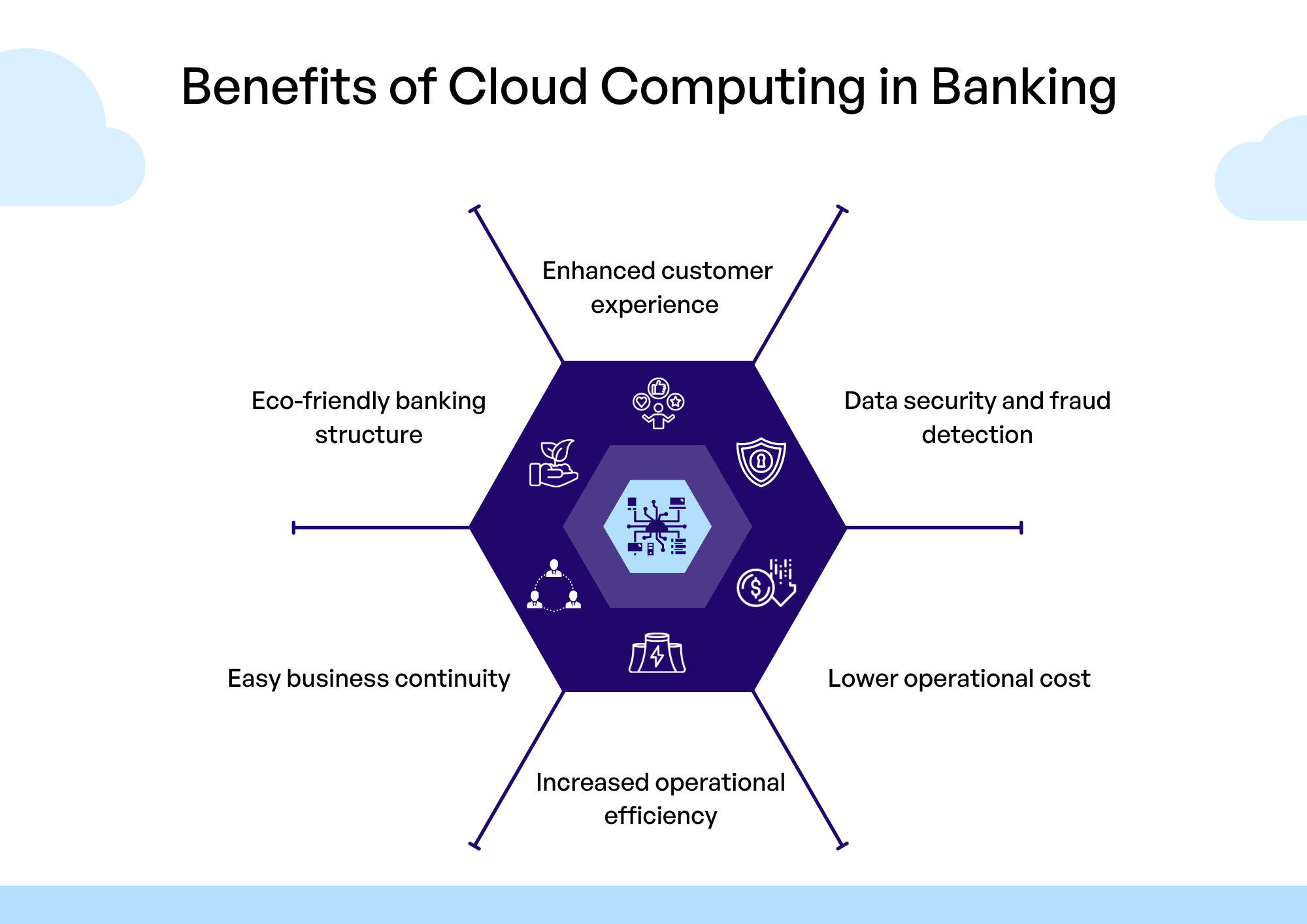

Cloud сomputing

Cloud computing offers financial institutions unmatched scalability, security, and flexibility. By moving data and applications to the cloud, banks can reduce infrastructure costs, deploy updates faster, and scale up or down to meet fluctuating customer demands.

With cloud-based solutions, financial institutions can handle surges in activity, efficiently manage data, and focus on launching new digital services without being limited by traditional data centers.

Source: Appventurez

SDK.finance uses on-premises and cloud-based infrastructure to allow banks to scale their services seamlessly. The Platform’s ability to deploy applications quickly and provide a highly flexible environment ensures that banks can respond to market changes without the constraints of legacy systems, driving greater operational efficiency and cost savings.

AI and ML

AI is revolutionizing the banking sector. AI-powered chatbots can answer customer queries 24/7, personalize financial recommendations, and automate repetitive tasks. AI can also be used for fraud detection, risk management, and algorithmic trading. Machine learning algorithms spot unusual patterns in real-time, flagging suspicious transactions as soon as they occur.

Big data and data analytics

Banks can gain valuable insights into customer behavior, spending patterns, and financial needs by analyzing vast amounts of customer data. Data analytics allows financial institutions to segment their customers based on various criteria, such as demographics, behavior, and preferences. This data can personalize financial products and services, predict market trends, and make data-driven decisions for optimized operations.

Blockchain

Blockchain is transforming transaction security with its decentralized, tamper-proof ledger. It makes transactions transparent and fast, reducing the need for middlemen in cross-border payments. By providing a secure and transparent way to record data, blockchain opens up new possibilities for secure identity management and trade finance while protecting against fraud.

Internet of Things (IoT)

IoT is transforming banking by connecting devices to create a seamless, data-rich environment for personalized services, enhanced security, and smarter operations. With IoT, banks can leverage customer data to gain real-time insights, streamline operations, and offer unique services.

The role of customer data in digital transformation

Customer data plays a critical role in digital transformation in the banking industry. By collecting and analyzing customer data, banks can:

- Gain a deeper understanding of customer behavior and preferences

- Develop personalized digital services and offers

- Improve customer satisfaction and loyalty

- Enhance risk management and compliance

- Develop new revenue streams

Collecting and analyzing customer data

Banks can collect customer data through various channels, including:

- Online banking and mobile banking apps. These platforms provide a wealth of data on customer transactions, preferences, and behavior.

- Social media and digital marketing campaigns. Social media interactions and digital marketing campaigns offer insights into customer interests and engagement.

- Customer feedback and surveys. Direct feedback from customers helps banks understand their needs and expectations.

- Transactional data and account information. Analyzing transactional data provides insights into spending patterns, financial health, and potential needs for financial products.

By analyzing this data, banks can gain insights into customer behavior and preferences, and develop targeted marketing campaigns and personalized services that meet customer needs. However, banks must also ensure that they protect customer data and comply with regulatory requirements, such as GDPR and CCPA.

By leveraging customer data and digital technologies, banks can develop a successful digital transformation strategy that improves operational efficiency, enhances customer satisfaction, and drives growth and innovation.

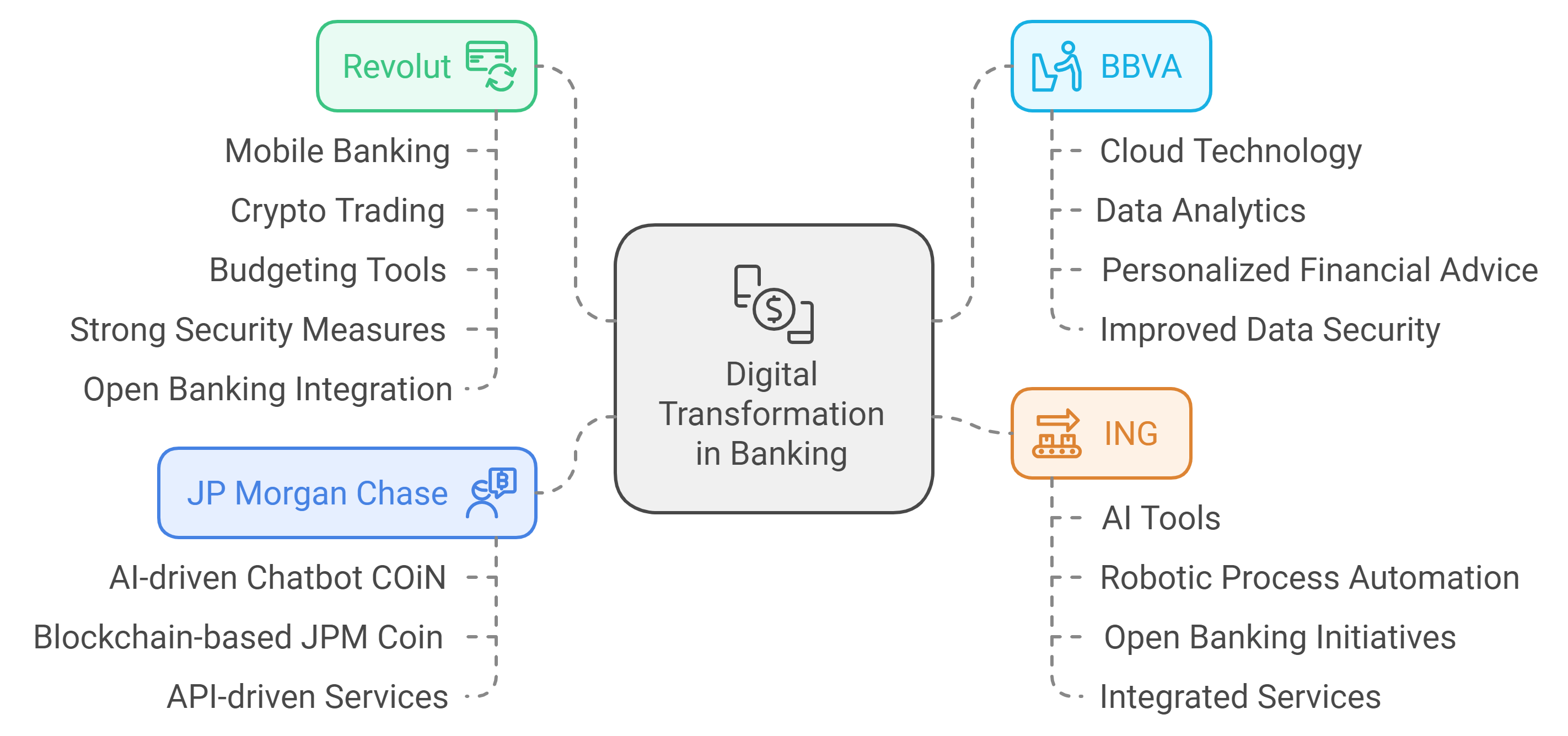

Real-world cases of digital transformation in action

While banking digital transformation sounds promising in theory—real examples show its impact. Here’s how top banks and FinTech are using innovation to elevate customer experiences and set new industry standards:

JP Morgan Chase

JP Morgan is leading the way in digital transformation with substantial investments in AI, blockchain, and API-driven services.

One notable example is its AI-driven chatbot, COiN (Contract Intelligence), which uses machine learning to analyze and process legal documents, reducing hours of manual work.

To support smooth interactions and seamless user experience, it’s necessary to incorporate chatbot functionality testing. This helps be sure that chatbots are functioning correctly, providing accurate responses, and maintaining the flow of communication across different platforms.

Blockchain technology plays a key role in JP Morgan’s digital strategy. In 2020, the bank launched JPM Coin, a blockchain-based digital currency designed to facilitate instant payments between institutional clients. JPM Coin aims to provide faster, cheaper, and more secure cross-border transactions.

Revolut

With 35 million customers, Revolut drives digital transformation, by combining innovative technology with user-centric services.

From mobile banking to crypto trading and budgeting tools, Revolut’s digital-first approach prioritizes customer experience, speed, and innovation.

Revolut’s innovations extend beyond convenience, with strong security measures like disposable virtual cards and two-factor authentication.

The integration of open banking allows customers to view and manage multiple accounts within the Revolut app, enhancing control over their finances.

BBVA

Spanish bank BBVA has embraced cloud technology and data analytics to create more personalized customer experiences.

Through its use of cloud-based solutions, BBVA has reduced operational costs, improved data security, and sped up the rollout of new features.

The bank also uses data analytics to offer tailored financial advice and product recommendations to customers, driving customer satisfaction and loyalty. BBVA’s commitment to digital transformation has helped it achieve significant growth in its digital banking operations.

ING

ING has integrated AI, Robotic Process Automation (RPA), and open banking to streamline operations and enhance customer offerings.

ING’s use of RPA in back-office processes has increased efficiency, while its AI tools provide personalized financial insights to customers.

The bank’s open banking initiatives allow it to offer integrated services through third-party apps, providing customers with greater flexibility and convenience. ING’s innovative approach has helped it stay competitive in the fast-evolving digital banking landscape.

Leading banks and FinTechs redefining the industry

Digital transformation is already reshaping the banking industry, as seen with leaders like JP Morgan, Revolut, BBVA, and ING. By adopting technologies like AI, blockchain, and cloud computing, these companies are enhancing customer experiences and streamlining operations. The pressure is now on traditional banks to innovate or risk falling behind.

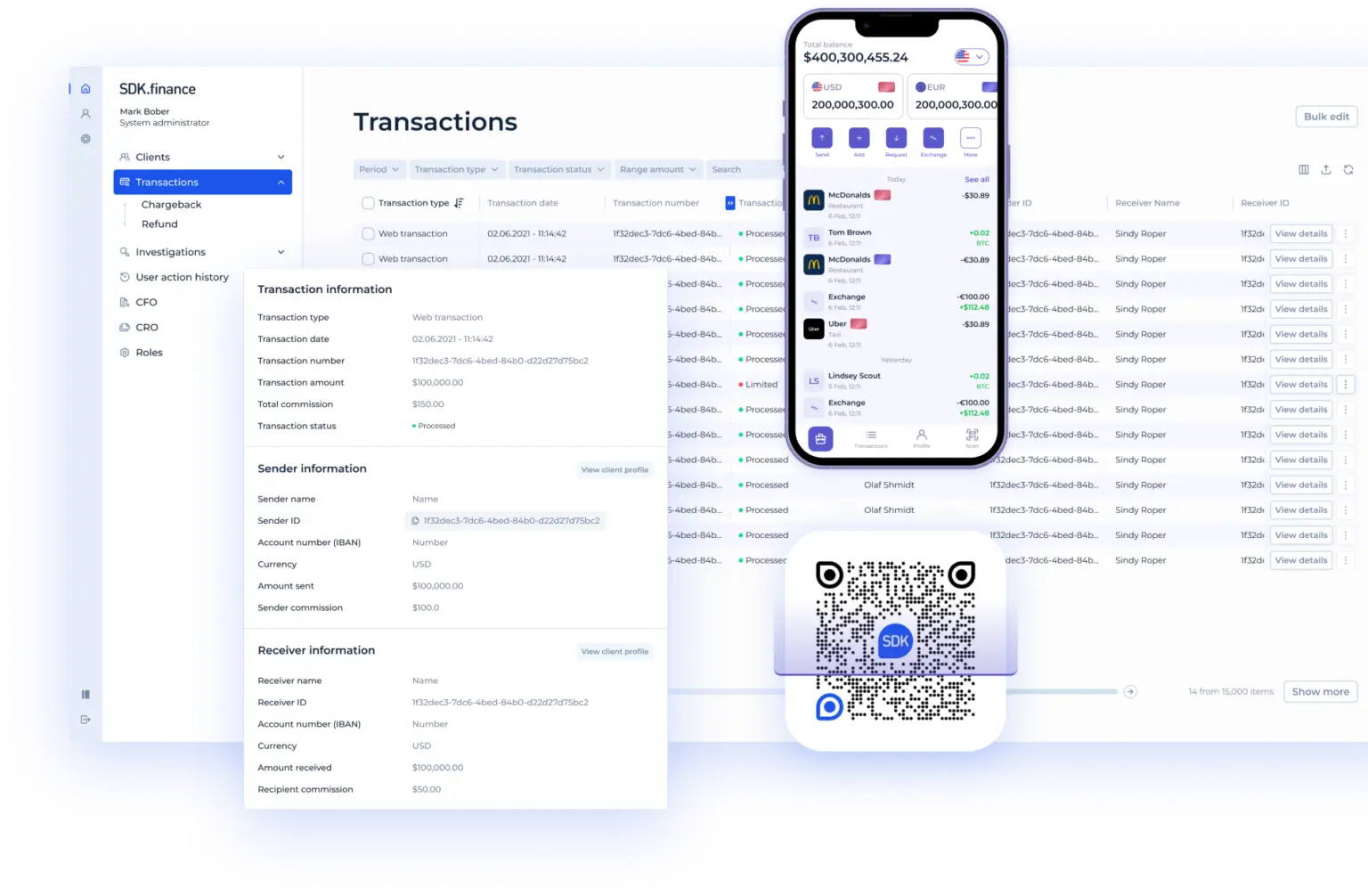

How SDK.finance can help with digital transformation in banking

Digital transformation is reshaping the financial services sector, and banks are under pressure to modernize their infrastructure to stay competitive. SDK.finance provides a comprehensive solution that accelerates digital transformation with a powerful, flexible, and scalable Platform.

Features of SDK.finance FinTech Platform:

Flexible, API-first Platform

At the core of SDK.finance’s offering is its API-first approach, providing over 470+ REST API endpoints that allow for seamless integration and customization. Banks can leverage these APIs to easily adopt new technologies without overhauling their entire infrastructure.

Scalable and modular architecture

SDK.finance’s modular core architecture allows banks to scale their operations with ease. The platform is designed to support a range of banking services, including digital wallets, payment processing, peer-to-peer (P2P) payments, and more.

Fast and low-risk implementation

Digital transformation often brings with it the challenge that implementation takes a long time and incurs high costs. SDK.finance removes these hurdles by providing out-of-the-box functionality with the flexibility of a source code license.

Secure and compliant

Security and compliance are top priorities for any financial institution. SDK.finance provides a robust, security-by-design platform, with built-in capabilities for KYC and AML compliance.

SDK.finance Platform is the ready-made solution for payment companies looking to drive digital transformation. By providing a flexible, scalable, and secure Platform with a source code license, SDK.finance enables banks to innovate faster, reduce time to market, and future-proof their operations.

Whether you’re looking to launch a digital wallet, neobank, or streamline payments, SDK.finance offers the tools you need to succeed in today’s fast-paced financial environment.