What does it truly cost to build a bank? Whether you’re a startup looking to disrupt the financial sector or an established institution aiming to expand your digital offerings, understanding the costs involved in building a bank from the ground up is crucial.

Bank startup entrepreneurs, who are individuals or groups attempting to establish new banking institutions, are particularly interested in these costs. They often face profitability challenges, regulatory hurdles, and have motivations such as serving underserved communities or leveraging specific lending expertise.

From software development to regulatory compliance, we’ll break down the factors that determine the price tag of launching your digital bank.

Types of banks: traditional, and digital

The banking industry is diverse, with various types of banks operating under different business models.

Traditional banks, often referred to as brick-and-mortar banks, have physical branches where customers can access a wide range of financial services. These banks are known for their personal touch and face-to-face interactions, which many customers still value.

Digital banks, also known as FinTech banks, represent the latest evolution in the banking industry. These banks leverage cutting-edge technology to offer innovative financial services and products. Unlike traditional and online banks, digital banks often operate without physical branches, relying entirely on digital channels to interact with customers. This allows them to provide a seamless, user-friendly experience with features like instant account opening, real-time transaction notifications, and advanced personal finance tools. Digital banks are at the forefront of the banking industry’s transformation, offering a glimpse into the future of financial services.

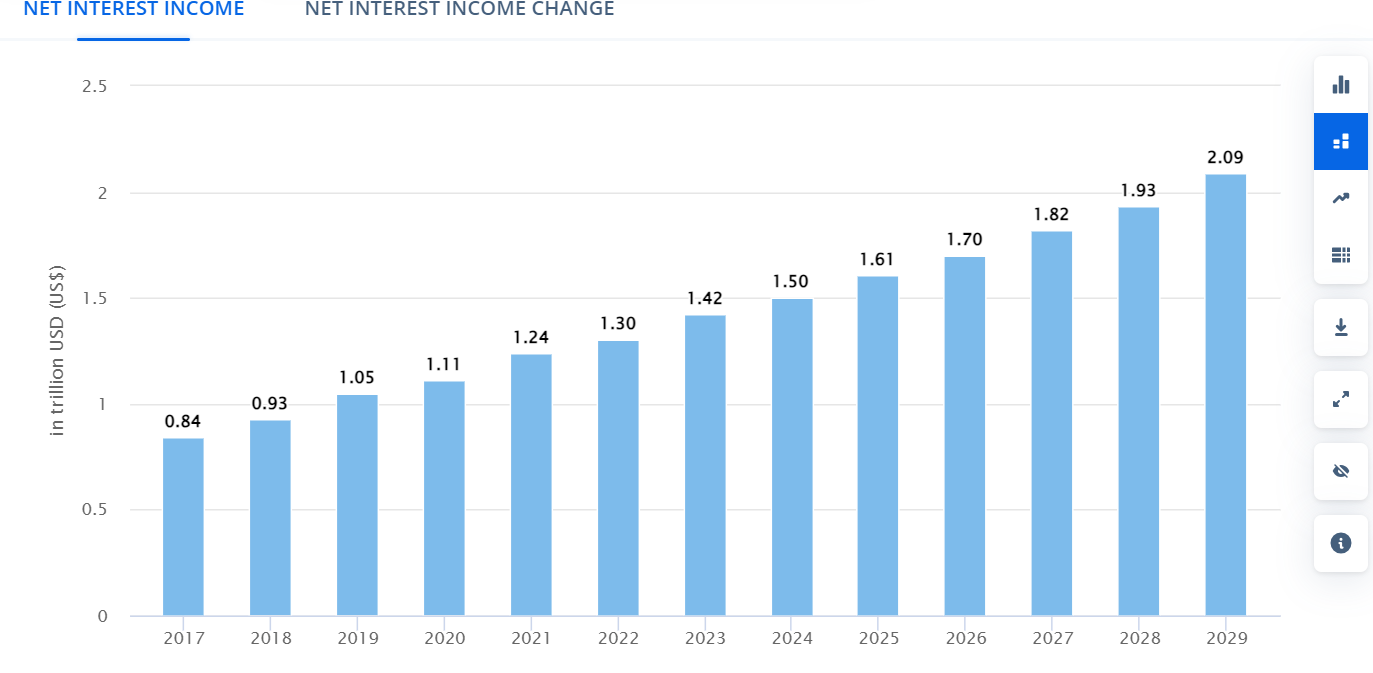

Digital banks market share

Digital banks in the worldwide banking market are rapidly gaining popularity and are projected to get net interest income worldwide is set to reach US$1.61tn by 2025. They gained significant popularity due to several key advantages they offer over traditional brick-and-mortar banks: fast payment services, 24/7 accessibility, lower fees (especially for wire transfers, ATM withdrawals, and account maintenance), and their cutting-edge features like budgeting tools, investment advice, and financial education resources.

All these functionalities are beneficial for both customers and businesses streamline payment processing services and drive financial efficiency. These innovative functionalities have contributed to the rapid growth and popularity of digital banks worldwide, with key players such as Cash App, Revolut, Venmo, Monzo, and Chime leading the charge.

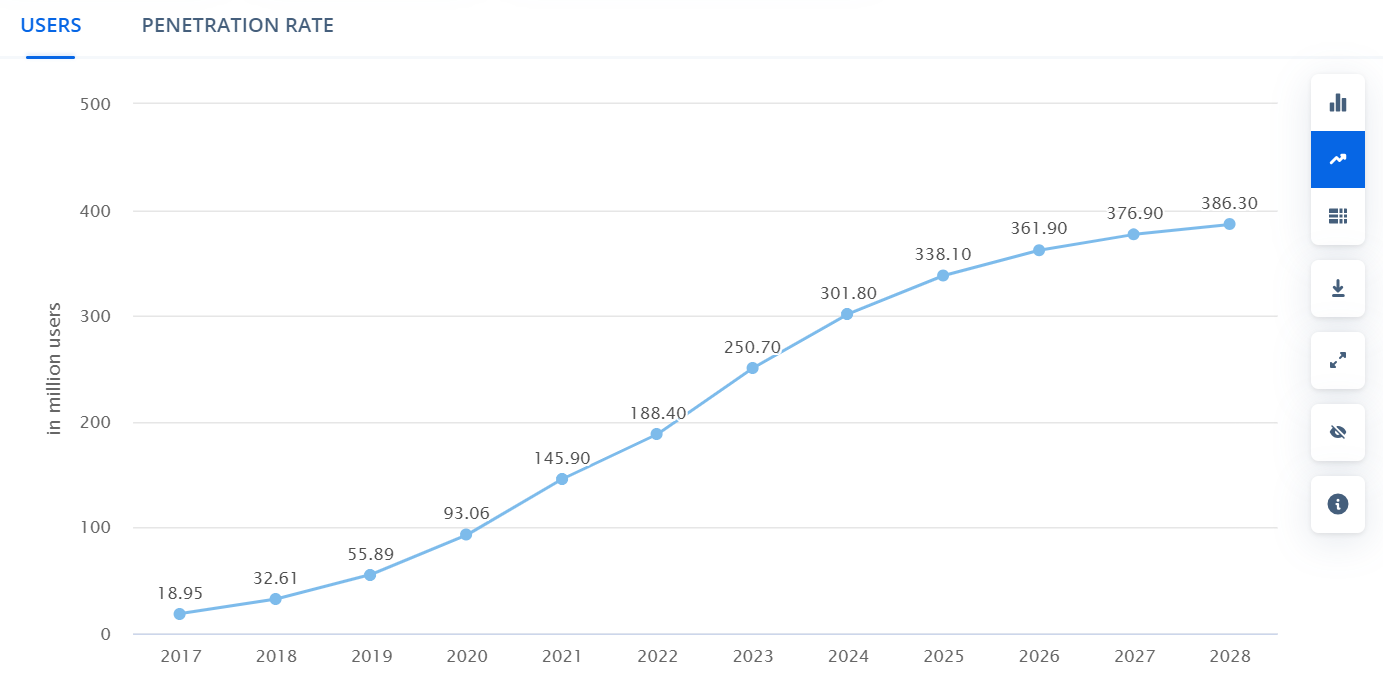

Despite their profitability, the complex nature of a bank’s operations requires significant capitalization and navigating through extensive regulations, making it a daunting endeavor for entrepreneurs. According to Statista, the number of digital banking users is projected to reach 386 million by 2028, marking an impressive increase of over 1100%.

The number of digital banking users 2017-2028

Source: Statista

This rapid growth in online bank users is directly driving a substantial increase in income for the digital banking sector. With a projected surge in users, the net interest income for digital banks is expected to reach $1.93 trillion by 2028.

This expansion makes the digital banking sphere a highly lucrative field, offering significant opportunities for businesses to capitalize on the growing demand for convenient, technology-driven financial services.

Digital banks net interest income

Source: Statista

However, behind every successful digital bank is a carefully constructed foundation. To understand what it takes to build and sustain a competitive product in this growing market, we start by exploring the essential functionality of a digital bank.

The functionality of a digital bank

Digital banks offer a wide range of functionalities that cater to the needs of both individuals and businesses. Here are some key features commonly found in digital banking platforms:

Core banking features

- Onboarding and account management: Customers can easily open various types of accounts, including savings, checking, and current accounts, and manage them online or through mobile apps.

- Payments and transfers: Digital banks provide convenient options for making payments, transferring funds, and setting up recurring payments.

- Bill payments: Customers can pay bills directly from their accounts, often with automated bill payment options.

- ATM and debit card services: Digital banks typically offer ATM and debit card services, allowing customers to access their funds and make purchases.

Additional features

- Mobile banking: Digital banks provide user-friendly mobile apps that allow customers to access their accounts, make payments, and manage finances on the go.

- Personal finance tools: Many digital banks offer tools like budgeting calculators, spending trackers, and financial goal setting to help customers manage their finances effectively.

- Loans and credit cards: Digital banks may offer various types of loans, including personal loans, home loans, and credit cards.

- Customer support: Digital banks often provide 24/7 customer support through online chat, email, or phone.

Business banking features

- Corporate accounts: Digital banks offer specialized accounts for businesses, including corporate checking and savings accounts.

- Payroll services: Businesses can use digital banks to manage payroll, including direct deposit and tax reporting.

- Merchant services: Digital banks may provide merchant services, allowing businesses to accept payments through credit cards and debit cards.

- Business loans: Digital banks can offer various types of business loans, including lines of credit and term loans.

Digital banks offer a wide range of functionalities that cater to both individuals and businesses, making banking more accessible, convenient, and efficient. From core features like onboarding, payments, and account management to advanced tools for personal finance, loans, and business banking, these platforms are designed to meet diverse financial needs.

For banks seeking to expand their offerings, digital banking platforms provide a robust loan management system, enabling them to efficiently manage business accounts, loans, and credit services while maintaining regulatory compliance.

However, building a digital bank with such comprehensive functionality is a complex and resource-intensive process. Now that we understand the key features that digital banks provide, the next question arises: how much does it cost to build such a platform? Let’s dive into the various factors that affect the cost and development process of a digital bank.

How much does it cost to build a bank?

Starting a bank is a complex and highly regulated endeavor with significant upfront costs. Obtaining a banking license is a crucial and often expensive step in this process, requiring sufficient capital and strict regulatory compliance. While the exact cost can vary widely based on numerous factors, including location, size, and services offered, the following are some key areas to consider:

Regulatory compliance

Regulatory compliance is a key factor in starting a bank, especially with the strict legal requirements in places like Europe and the United States. The regulatory process involves obtaining necessary charters, securing insurance, and complying with the oversight of government regulators. The costs involved can differ greatly depending on the bank’s size, the services it provides, and where it operates.

| Europe | USA | |

|

Capital requirement (depends on the bank type) EMI License Legal and advisory fees |

from €350,000 to €5,000,000

from €1,000–€5,000 From €50,000 (249,000 for specialized bank) |

for MSBs – 0, for small companies – from $25,000

MSL (in USA) $500 to $2,000 Legal and advisory fees can vary depending on the state |

Here, we’ve highlighted key regulations like licensing fees, and legal consultations. However, banks also need to comply with other important regulations, such as data protection laws, AML rules, and KYC standards, that also affect the overall cost of building a bank.

Prototyping and UI/UX design

After obtaining the necessary licenses and finalizing all legal agreements, you can commence prototyping and developing the product design.

Prototypes provide a live preview of your app’s design and features, allowing stakeholders to see how it will work and feel before it’s built. This early feedback helps fine-tune the design to match your vision.

You can start with basic previews for $10,000, or go for interactive experiences starting at $15,000. Both options give you a clear look at your app’s interface and functionality before development begins.

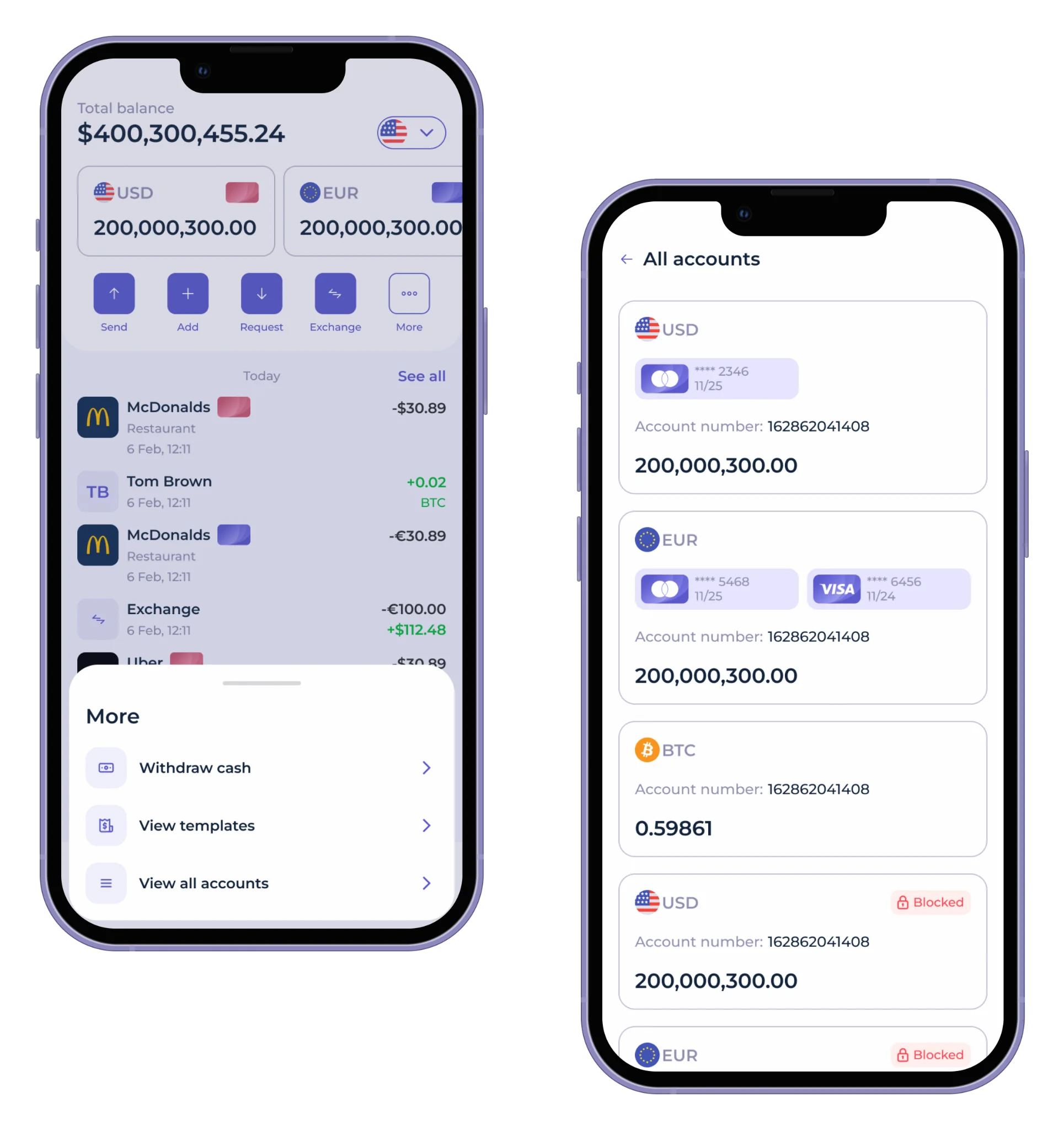

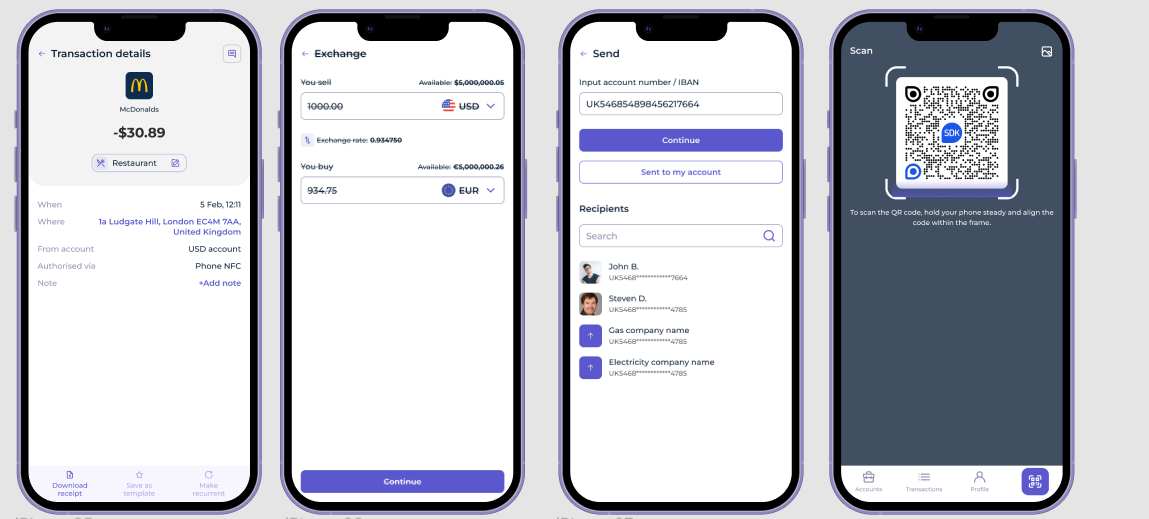

SDK.finance provides a mobile app UI/UX design kit to accelerate your digital bank launch. It is a prototype template crafted for digital banking, ewallet, and payment apps and compatible with iOS and Android.

Watch our video showcases the user-friendly mobile app UI of SDK.finance Platform, designed to empower you to create secure and feature-rich bank in record time:

The cost of UI/UX design for a banking app depends on a few main factors, like the platforms you’re designing for, where the design team is located, and the level of customization, such as animations and transitions.

The cost of mobile app UI design typically varies based on the following stages:

| Stage | Cost |

| Overall app design | $40,000 |

| Discovery | $10,000 |

| UX + UI + prototyping | $15,000 |

| User testing | $6,000 |

Source: topflight

After completing the prototyping and UI/UX design phase, the next step is to set up the technology infrastructure, which consists of several key components and significantly impacts the cost of bank development.

Technology infrastructure

The choice of infrastructure directly affects both initial development costs and ongoing operational expenses, influencing the overall budget for building and maintaining a banking app. Additionally, maintaining technology infrastructure can constitute a significant portion of a digital bank’s operating expenses. Below we highlight the key components and their approximate cost for starting a digital bank business.

Cloud vs. on-premises hosting

- Cloud hosting: Cloud solutions (e.g., AWS, Azure) offer scalability and flexibility. Costs can vary based on storage, compute power, and data transfer. For instance, using AWS might cost $300- $600) per month, depending on the app’s scale.

- On-premises hosting: Requires significant upfront investment in hardware and ongoing costs for maintenance, which could range from $50,000 to $200,000 initially.

Backend infrastructure

- Database management systems (DBMS): Costs vary based on the type of DBMS (SQL vs. NoSQL) and licensing. For example, a SQL server license might cost $7,000–$15,000 per year, while open-source options like PostgreSQL are free but require more management.

- Server load balancers: Essential for distributing traffic. Managed services can cost around $1000–$3000 per month.

Integration with financial systems

- Payment gateways: Integrating with payment processors (e.g., Stripe, PayPal) can cost between $0.30–$0.50 per transaction, plus a percentage fee (1.5%–2.9% of the transaction amount).

- Core banking systems: Custom integrations can be expensive, potentially costing $100,000–$500,000, depending on complexity.

Development team

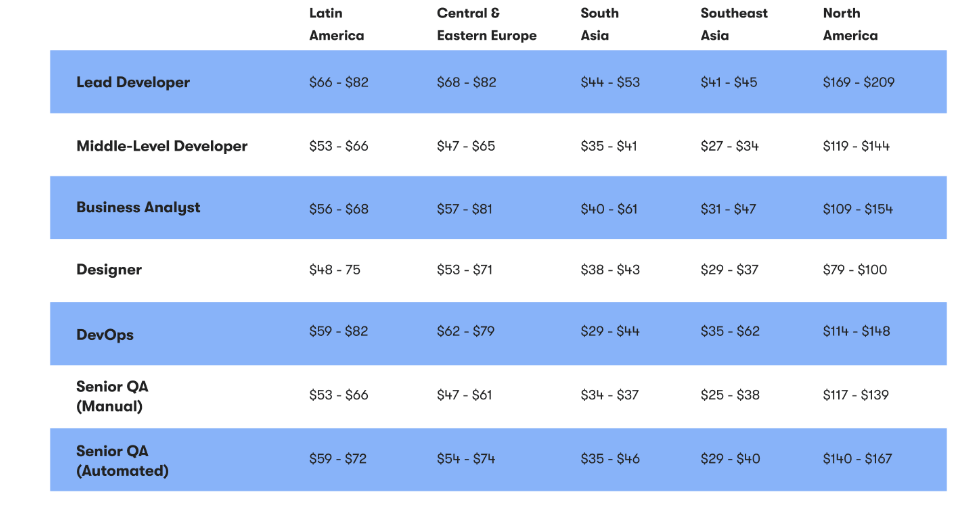

The development team significantly impacts the overall cost of building a banking app. First of all, your development team’s size and expertise significantly impact the cost of building a banking app. Furthermore, the location of your development team also significantly influences costs. The rates for custom software development vary widely depending on the country and region:

Custom software development rates by role and country per hour

It’s important to note that individual salaries can vary based on factors such as experience, skills, company size, and location within a region. Generally, North America offers the highest pay, followed by Western Europe and Latin America. In contrast, Central & Eastern Europe and South Asia typically have lower rates.

Development time for banking app features

| Feature | Approximate development hours |

| Onboarding | 80 – 120 hours |

| Transaction management | 100 – 160 hours |

| Payment processing | 120 – 200 hours |

| Fund transfers | 100 – 160 hours |

| User profile management | 40 – 80 hours |

| Alerts and notifications | 60 – 80 hours |

| Analytics and reporting | 80 – 120 hours |

However, rather than starting development from scratch, you can utilize ready-made solutions to significantly speed up the process and optimize resource allocation.

SDK.finance offers a pre-developed Platform specifically designed for building digital banks. By leveraging our ready-made solution, you can accelerate up to 70% of the development process. SDK.finance comprehensive suite of features and ready-to-use components allows you to bypass many of the initial hurdles and focus on tailoring your app to your unique business needs.

Product launch and maintenance

Following a successful bank development, there are ongoing costs associated with product launch and maintenance. Below are approximate costs for these activities, based on market prices.

Product launch costs

To create awareness and drive user adoption, invest in marketing strategies such as digital advertising, public relations, and promotions. This can range from $5,000 and more, depending on the scale and channels used.

Ongoing maintenance costs

Regular updates, bug fixes, and feature enhancements can add $5,000 per month, depending on the frequency and complexity of updates.

Maintaining a support team to handle user inquiries, issues, and feedback. This could cost from $3,000 per month, depending on the size of the support team and the volume of requests.

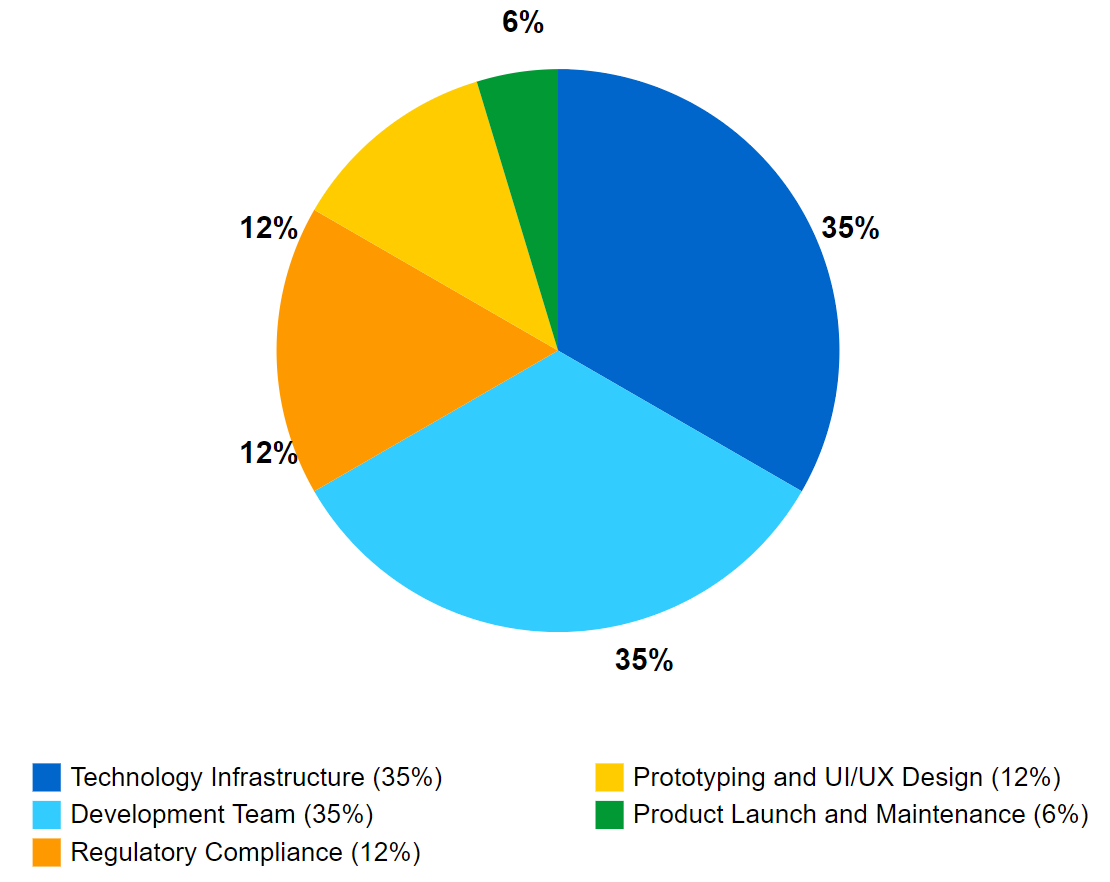

Percentage breakdown of costs for bank development

The cost of starting a bank is substantial and can vary widely depending on numerous factors. It’s essential to conduct thorough research, consult with experts, and develop a detailed business plan to accurately estimate the costs involved and make informed decisions.

The ready-made FinTech Platform to build a bank by SDK.finance

SDK.finance offers a powerful PayTech Platform for building a digital bank, whether you’re developing a neobanking solution or a consumer banking product. The software speeds up 70% of the development process, accelerating time-to-market with out-of-the-box integrations and ready-made functionality.

Our pre-developed solution is designed to help you launch quickly and affordably, providing a robust feature set right out of the box.

The key SDK.finance neobank software features:

- Accounts in any currency

- Popular payments

- P2P money transfers

- Currency exchange

- Visa/MasterCard issuing

Designed to expedite development time, our Platform eliminates the need for assembling a team and delving deeply into FinTech specifications. With over 15 years of experience, our professional team has crafted a comprehensive solution that streamlines your build, ensuring you can focus on launching your neobank swiftly and efficiently.

Wrapping up

Building a digital bank is a complex process that requires significant resources. By carefully evaluating the scope of your project, and leveraging pre-developed solutions like SDK.finance, you can better manage your budget and streamline the development process.

With thorough planning and strategic decision-making, you can navigate the challenges of building a banking app and position your digital bank for success in the growing financial sector.