Launching a Point of Sale business presents a compelling opportunity for entrepreneurs in today’s rapidly digitizing economy. As technology becomes increasingly integrated into retail and service environments, the global POS market is poised for significant growth.

From understanding the fundamentals of POS systems to selecting the right hardware and software, and ensuring compliance with legal standards, this guide outlines the essential steps to successfully launching a POS business.

Understanding the basics of a POS system

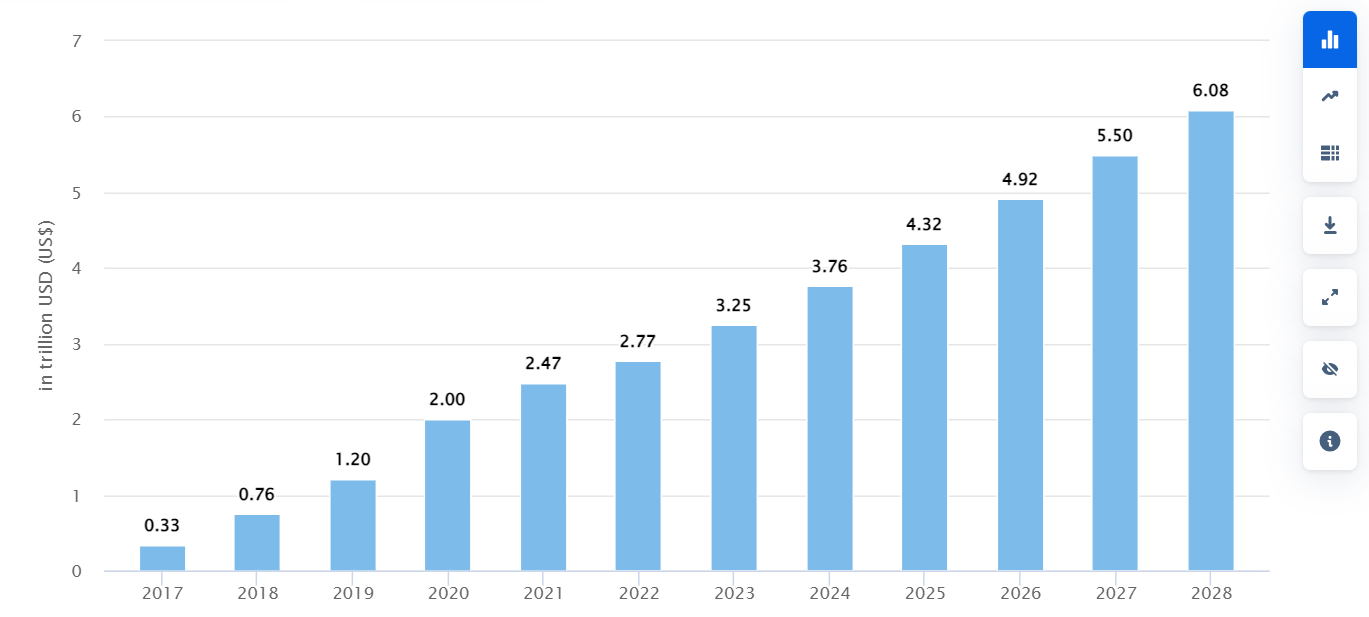

The global point of sale (POS) market is growing rapidly due to increasing reliance on technology across industries. The Mobile POS Payments market in the world is projected to grow by 12.77% (2024-2028) resulting in a market volume of US$6.08tn in 2028, the POS industry offers a lucrative opportunity for entrepreneurs.

Source: Statista

Before delving into the details of starting a POS business, it’s essential to understand the basics of a Point of Sale system.

What is a POS system?

It is a digital platform that simplifies transactions between businesses and customers. It includes hardware components such as cash registers and barcode scanners, as well as software for inventory management, sales tracking, and customer relationship management.

Key components of a POS system:

- Hardware: POS terminals, barcode scanners, receipt printers, cash drawers, and payment processors.

- Software: Sales and inventory management, customer relationship management (CRM), employee management, and reporting tools.

- Payment processing: Integration with credit and debit card networks for secure transactions.

How a POS system works:

- Customer purchase: The customer selects items, and the cashier scans them using a barcode scanner.

- Transaction processing: The POS system calculates the total, processes payment, and generates a receipt.

- Inventory management: The system updates inventory levels in real time.

- Data analysis: POS data can be used for sales analysis, customer behavior insights, and business performance evaluation.

A solid understanding of POS systems will enable you to effectively communicate with potential clients, select the right hardware and software, and provide optimal solutions to meet their business needs.

Choosing the right POS system: Hardware and software

Choosing the right POS system is crucial for a business’s efficiency and success. It involves a thorough assessment of hardware, software, and payment processing options.

Step 1. Examine payment processing options

Before delving into hardware and software, it is important to understand payment processing, as it is the foundation of any POS system. Key factors to consider include:

- Payment methods: Determine the payment methods preferred by your customers (credit cards, debit cards, mobile payments, cash, etc.).

- Processing fees: Compare fees charged by different processors, including transaction fees, monthly fees, and chargeback fees.

- Security: Ensure that the processor adheres to PCI DSS compliance to protect sensitive customer data.

- Integration: Verify compatibility with your chosen software for POS implementation.

Step 2. Choose software features according to business needs

POS software acts as the brain behind the system. Depending on the target market, businesses may focus on different POS solutions, such as a restaurant POS built for food service workflows or systems tailored to retail, services, or omnichannel operations. Essential features to consider include:

- Inventory management: Keep track of stock levels, reorder points, and product information.

- Sales tracking: Analyze sales data, generate reports, and identify trends.

- Customer relationship management: Build customer profiles, manage loyalty programs, and personalize interactions.

- Employee management: Handle scheduling, time tracking, and payroll integration.

- Reporting: Generate comprehensive reports on sales, inventory, employees, and customers.

- Scalability: Ensure the software can accommodate business growth.

- Cloud-based vs. on-premise: Decide whether a cloud-based or on-premise solution best suits your needs.

Step 3. Select compatible hardware for optimal performance

Selecting the right hardware ensures smooth operations. Key components to consider include:

- POS terminal: Choose a terminal that suits your business size and needs (e.g., touchscreen, all-in-one, mobile).

- Barcode scanner: Select a scanner compatible with your products and business environment (e.g., handheld, desktop, wireless).

- Cash drawer: Ensure the cash drawer is compatible with the POS terminal and offers sufficient capacity.

- Receipt printer: Choose a reliable printer that produces clear and legible receipts.

- Payment terminal: Select a terminal that supports your chosen payment processors and offers secure transactions.

Securing a strategic location and setup considerations

The physical location of your POS business is a crucial factor in its success. Careful planning and consideration are vital to maximize your chances of attracting customers and generating revenue.

Conducting a location survey for maximum visibility

A well-chosen location is crucial for the success of your POS business. Carefully assess potential sites based on factors such as:

- Target market demographics: Understanding your ideal customer helps identify optimal locations.

- Foot traffic: High foot traffic areas generally attract more customers.

- Visibility: Ensure your business is easily seen by potential customers.

- Competition: Analyze the competitive landscape to identify opportunities.

- Accessibility: Consider factors like parking, public transportation, and proximity to amenities.

- Lease terms: Evaluate rental costs, lease duration, and renewal options.

Options for physical setup: Kiosks, shops, mobile units

The physical setup of your POS business depends on various factors including budget, product offerings, and target market. Consider these options:

- Kiosks: Compact and cost-effective, ideal for high-traffic areas with limited space.

- Shops: Offer more flexibility in product display and customer experience.

- Mobile units: Provide mobility and the ability to reach a wider customer base.

Legalities and compliance for POS implementation

Operating a POS business requires adherence to various legal and compliance standards. Understanding these regulations is crucial for avoiding penalties and maintaining a reputable business.

Business registration and licenses required

The specific licenses and permits needed for your POS business will vary depending on your location, business structure, and the nature of your services. However, some common requirements include:

- General business license: A permit to operate a business within a specific jurisdiction.

- Sales tax permit: For collecting and remitting sales tax on transactions.

- Occupational licenses: Depending on your specific services, you might require additional licenses

- Payment processor license: If you process payments in-house, you might need specific licenses or permits.

It’s essential to research the specific requirements in your area and consult with legal and tax professionals to ensure full compliance.

For instance, if your POS business is structured as an LLC, you must ensure proper registration, annual filings, timely updates with your registered agent, and consider the best state to form an LLC for favorable tax treatment and long-term compliance.

Security, privacy, and compliance measures

Protecting sensitive customer data is paramount in the POS industry. Implementing robust security measures is essential to safeguard your business and customers’ information. Key considerations include:

- PCI DSS compliance: Adhering to Payment Card Industry Data Security Standards to protect cardholder data.

- Data encryption: Encrypting sensitive information both at rest and in transit.

- Access controls: Limiting access to sensitive data to authorized personnel.

- Regular security audits: Conducting routine assessments to identify vulnerabilities.

- Data breach response plan: Having a plan in place to address potential data breaches.

- Privacy policies: Clearly communicate your data handling practices to customers.

By prioritizing security and compliance, you can build trust with customers and protect your business from potential liabilities.

Power your POS business with a robust backend system

A critical component of any successful POS business is a powerful backend system that manages transactions, accounts for them, and handles fees and limits.

Transaction management

The backend system should efficiently process and manage all transactions, ensuring:

- Real-time processing of payments

- Accurate recording of transaction details

- Secure handling of sensitive financial data

- Support for multiple payment methods and currencies

Accounting and reconciliation

An effective backend should automate accounting processes:

- Track all financial movements across accounts

- Provide detailed transaction histories

- Generate financial reports for analysis and auditing

- Facilitate easy reconciliation of accounts

Fee management

The system should be capable of handling various fee structures:

- Calculate and apply transaction fees automatically

- Support different fee models (flat fees, percentage-based, tiered)

- Allow for customizable fee structures for different merchant categories

Limit management

Implementing and enforcing transaction limits is crucial for risk management:

- Set daily, weekly, or monthly transaction limits

- Implement limits based on transaction type or merchant category

- Provide flexibility to adjust limits for individual accounts or merchant types

Compliance and reporting

The backend system should ensure regulatory compliance:

- Generate required reports for financial authorities

- Implement anti-money laundering (AML) and know-your-customer (KYC) checks

- Provide audit trails for all transactions and system activities

Integration capabilities

A versatile backend should offer seamless integration:

- Connect with various POS hardware and software solutions

- Integrate with external financial systems and banks

- Offer APIs for custom integrations and third-party services

Scalability and performance

As your POS business grows, the backend must be able to scale:

- Handle increasing transaction volumes without performance degradation

- Support expansion to new geographical regions or markets

- Provide high availability and disaster recovery options

SDK.finance solution to launch a POS business faster

Building a POS system business from scratch requires expertise in hardware integration, software development, payment processing, and security. SDK.finance provides a scalable FinTech Platform specifically designed to streamline the POS development process.

Our Platform provides out-of-the-box features for starting online and offline payment processing services:

- Online POS

- Payment initiation and acceptance

- Instant/Regular payouts

- Receipts generation

- Merchant’s digital wallet

- Refunds initiation

- Roles & permissions management

This allows you to focus on developing the unique features and functionalities that differentiate your POS system, accelerating your time to market and reducing development costs.

Take Geidea, a leading payment service provider (PSP) in the Kingdom of Saudi Arabia and UAE, for example. They successfully transformed their core transaction accounting system through SDK.finance’s on-premise ledger layer software. Here you can find more information on how SDK.finance helped Geidea’s accounting system to launch a revitalized scalable future-proof solution.

The future perspective: Scaling your POS business

To achieve sustained growth, your POS business must evolve. This involves leveraging technology and exploring strategic expansion opportunities.

Use cutting-edge technology for growth

Emerging technologies can revolutionize your business operations. Artificial Intelligence (AI) can predict sales, optimize inventory, and enhance customer service through chatbots.

Blockchain ensures secure transactions and transparent supply chains. By integrating these innovations, you can streamline processes, reduce costs, and improve customer satisfaction.

Expand your market reach

Consider franchising as a growth strategy to expand your brand and generate additional revenue streams. Alternatively, diversify your offerings by introducing complementary products or services, or targeting new market segments. Online sales can also significantly increase your customer base.

By strategically combining technological advancements and expansion strategies, you can position your POS implementation for long-term success and increased market share.

Wrapping up

Launching a successful POS business requires strategic planning, technical expertise, and a commitment to excellent customer service. Embracing emerging technologies such as AI and blockchain can enhance business operations and provide a competitive edge.

With the ready-made solution for building POS business by SDK.finance, you can speed up their market entry, reduce development costs, and set the stage for long-term growth and success in the dynamic FinTech industry.