Asia-Pacific is leading the payment revolution, with non-cash transactions surging by 20% in 2024—outpacing Europe’s 16% and North America’s 6%. India’s UPI processes over 15 billion transactions each month, while China’s QR code systems are making payments more convenient. However, not all regions are keeping up with these advances.

In this article, we will highlight the regions that are leaders in real-time financial inclusion and point out the countries that are working hard to catch up.

Global adoption of instant payments

Instant payments are growing rapidly worldwide, with e-commerce growth being the biggest driver. Globally, most industry executives (77%) identify e-commerce growth as the critical driver accelerating the shift to non-cash transactions. This trend is especially strong in regions with high digital adoption, where businesses and consumers are seeking faster, smoother, and more efficient payment solutions.

The global instant payments market is projected to reach USD 287.4 billion by 2033, up from USD 23.6 billion in 2023, growing at a CAGR of 28.4% from 2024 to 2033.

Source: market.us

To better understand why instant payments are becoming so essential, it’s important to define what they are and how they work.

What are instant payments?

Instant payments are electronic money transfers that are processed and settled in real time, 24/7, allowing recipients to access their funds immediately.

Unlike traditional payment methods, which often rely on batch processing and can take days to settle, instant payments offer speed, efficiency, and convenience.

These systems are transforming global commerce by enabling faster transactions, reducing dependency on cash, and improving liquidity for both businesses and individuals. They empower small businesses, streamline cross-border trade, and enhance financial inclusion by providing quicker access to funds, even in underserved regions.

How instant payments work

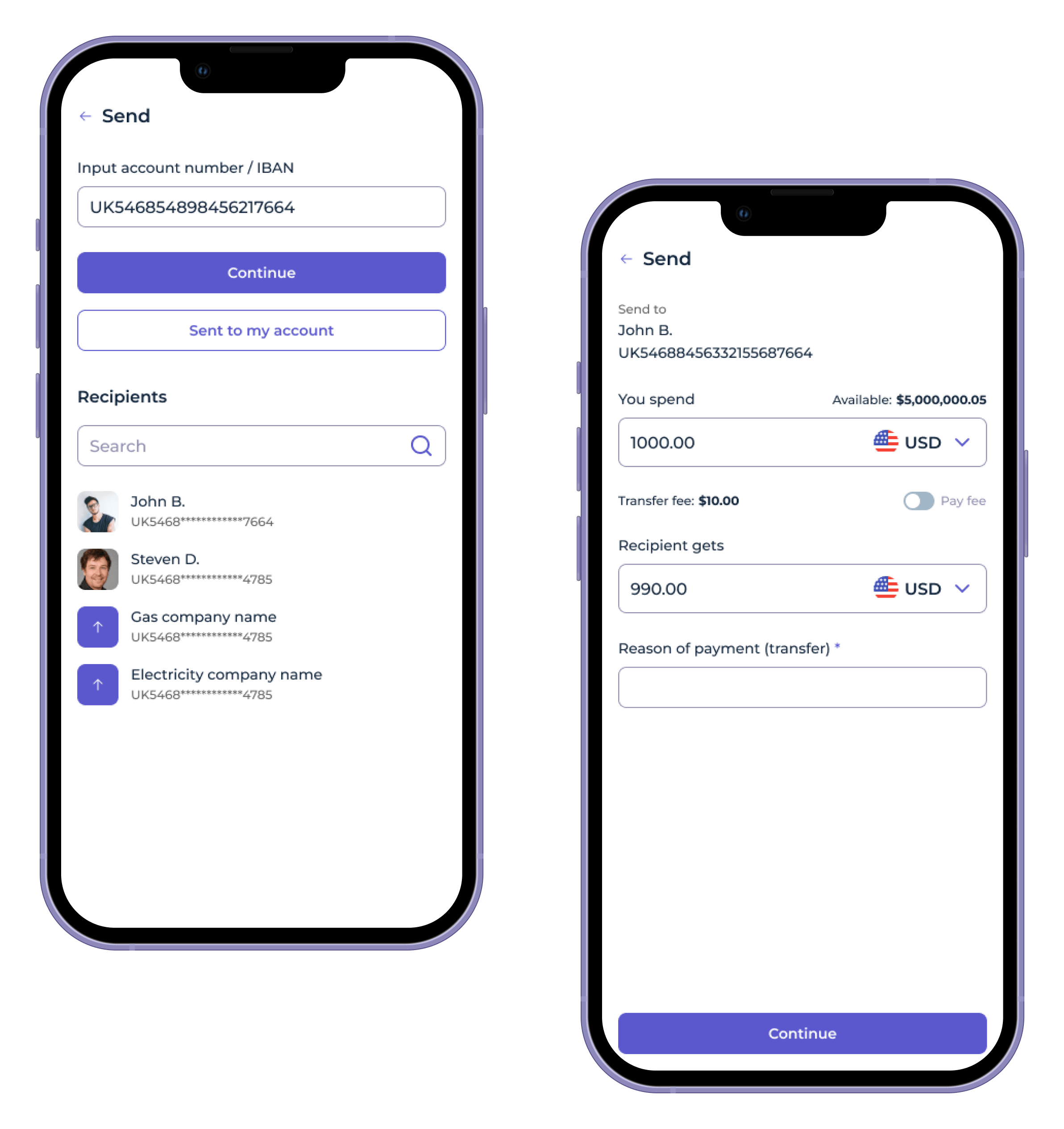

- Initiations

The payer uses a digital platform (like a mobile banking app or digital wallet) to enter the recipient’s details, such as their phone number, email, or bank account. - Authorizations

The payer’s bank checks if everything is in order—ensuring the details are correct, there’s enough money in the account, and the payer’s identity is secure. - Settlement

The payment request goes through a central system that connects the payer’s bank with the recipient’s bank. The transaction is cleared and settled instantly, so there are no delays. - Instant notification

Both the payer and the recipient are notified that the payment was successful—usually within seconds via a text message, email, or app notification. - Completion

The recipient gets the funds right away. They can spend, transfer, or withdraw the money immediately—no waiting required!

Instant payments across different regions

Instant payment systems enable near real-time fund transfers, offering significant benefits for individuals and businesses. Their adoption and implementation vary across regions, shaped by technological advancements, regulatory landscapes, and consumer preferences. Here’s an overview of how instant payment options and payments globally:

Europe

SEPA Instant Credit Transfer (SCT Inst) operates across 36 European countries and allows payments to bank accounts be processed within seconds, with limits that vary by country. The UK’s Faster Payments Service (FPS) offers immediate payments 24/7 and supports high transaction limits, making it widely adopted by banks and FinTechs.

In the Nordics, the P27 initiative focuses on the payment process and harmonising instant payments across the region by integrating domestic and cross-border payment systems.

Asia-Pacific

India’s Unified Payments Interface (UPI) has transformed the country’s economy by making instant, zero-cost bank-to-bank transfers the norm. Supported by the Indian government and the National Payments Corporation of India (NPCI), UPI processed over 15 billion transactions each month in 2024. Its connection with apps like Google Pay, PhonePe, and Paytm has made digital payments common.

China’s instant payment revolution is led not by banks but by mobile-first platforms like Alipay and WeChat Pay. These platforms dominate China with over 2 billion users combined. The platforms integrate messaging, shopping, and payments into a single app, redefining convenience. From splitting a restaurant bill to buying subway tickets, everything runs on a simple QR code system.

Source: epay

With 4.9 million users, over 80% of Singapore residents and businesses use PayNow. Through partnerships with platforms like UPI, Singapore is pioneering real-time international payments, a first for many APAC countries.

PayNow doesn’t just serve customers and consumers; it’s a go-to for businesses, making invoicing and payment collection faster than ever.

The PayNow transaction workflow

Source: Decentro

North America

United States

The U.S. has been steadily developing its instant payment infrastructure, supported by private and public initiatives.

Launched in 2017, the Real-Time Payments (RTP) network is available 24/7, providing instant bank-to-bank transfers for businesses and consumers. Its adoption is growing among banks, with use cases like payroll disbursement and bill payments becoming increasingly common. For instance, a utility company can send a bill, receive a payment, and confirm the transaction—all in seconds—enhancing cash flow and user convenience.

Zelle is a leading payment platform in the United States that allows users to send money instantly. It connects directly with U.S. banks, so people can make peer-to-peer transfers without using extra apps. By the first half of 2024, Zelle had 143 million users who completed over 1.7 billion transactions, showing its popularity and influence in the U.S. payment system.

Source: Zelle

However, Zelle faces some challenges that differ from India’s Unified Payments Interface (UPI). While Zelle is linked to established banks, it is mainly for bank account holders, which limits its accessibility. In comparison, UPI has an open system that supports integration across banks, wallets, and fintech apps. This makes UPI more accessible to a wider range of people, including those without bank accounts.

Canada

Canada’s payment system has some unique attributes compared to the U.S, for example, Canada’s most widely used instant payment platform, Interac e-Transfer, allows seamless P2P, business-to-business (B2B), and business-to-consumer (B2C) credit transfers together. While limited in scale compared to Europe’s systems, Interac remains critical for day-to-day transactions.

Middle East

The Middle East is becoming a promising area for instant payment solutions. The region benefits from strong government support, widespread smartphone use, and key digital transformation programs like Saudi Arabia’s Vision 2030.

In Saudi Arabia, the SAMA introduced the “Sarie” instant payment system, enabling 24/7 real-time transactions for both individuals and businesses. The system supports seamless account-to-account transfers and is integrated with key banking institutions to promote financial inclusion and reduce dependency on cash.

In the UAE, the Instant Payment Interface (IPI) enhances digital payment efficiency by providing a robust framework for secure and immediate fund transfers. Similarly, Bahrain’s Fawri+ platform delivers swift payment processing, bolstering the region’s competitive edge in financial innovation.

Cultural preferences for mobile banking play a pivotal role in shaping consumer behaviour across the GCC. Platforms such as STC Pay in Saudi Arabia and Dubai Pay in the UAE align with these trends, offering user-friendly solutions that integrate seamlessly into everyday life.

Challenges of instant payment adoption in the Arabic region and North America

Arabic region

A major problem is the lack of infrastructure. While urban centers have robust digital payments ecosystems, rural areas often struggle with unreliable internet access and inadequate financial infrastructure, which limits the adoption of digital payments solutions.

In addition, regulatory differences between countries pose significant barriers to cross-border payment innovation, making seamless regional integration difficult.

Despite the increasing use of smartphones, the cultural preference for cash continues to prevail in many regions. This requires targeted efforts to promote a switch to digital payment solutions.

North America

The payments ecosystem is fragmented and the different platforms lack interoperability. The lack of a unified framework, as exists in other regions, is hindering progress towards seamless real-time payments.

In addition, the complex regulatory landscape, characterized by overlapping federal and state regulations, poses a challenge to scaling innovative solutions. Traditional payment methods such as credit and debit cards are still widely used, further delaying the transition to real-time platforms.

SDK.finance FinTech solution

SDK.finance can significantly accelerate the adoption of instant payment solutions across the Middle East. Our FinTech Platform is designed to support the development and scaling of real-time payment systems while enabling seamless cross-border transactions.

With 470+ API endpoints, our Platform ensures swift integration with local banking systems allowing financial institutions and third-party service providers, minimizing technical hurdles.

QR code payments and recurring transfers, enhance convenience for both consumers and businesses, driving higher adoption rates. To ensure secure and compliant operations, SDK.finance provides built-in tools for AML and anti-fraud monitoring, helping financial institutions and fintechs adhere to regional and global regulatory standards.

By delivering scalable, secure, and feature-rich solutions, SDK.finance is uniquely positioned to help financial institutions and fintechs across the Middle East lead the instant payment revolution.

Who gets left behind?

While APAC’s leadership in instant payments is widely celebrated, the region’s progress is not universal. Countries like Vietnam and Indonesia, despite their growing digital payment ecosystems, still face challenges in extending these services to rural and remote areas.

Limited access to reliable internet, smartphones, or even basic digital literacy remains a major barrier. In these underserved regions, rural farmers and small business owners often continue to rely on cash for transactions, as affordable, user-friendly digital payment platforms are scarce or not fully accessible.

Globally, while countries in Africa and Latin America are making strides with innovations like M-Pesa in Kenya or Pix in Brazil, systemic barriers—such as infrastructure gaps, lower investment in fintech ecosystems, and regulatory hurdles—prevent these solutions from scaling as rapidly as in more developed regions. The result is a divide where large portions of populations are still excluded from the benefits of instant payments, further perpetuating the financial gap.

SDK.finance can help bridge this divide by offering the PayTech Platform that allow FinTechs and banks in developing regions to deploy digital payment systems. This helps ensure that underserved regions gain access to instant payments and are not left behind in the digital financial revolution.