Islamic banking is often viewed with mystery and misunderstanding. For many, the concept of a financial system that operates without interest (riba) and adheres to religious principles seems overly complex. However, Islamic banking provides a rich and flexible framework beyond mere religious observance.

In this article, we will explore the core concepts of Islamic finance and debunk some of the most common myths surrounding it. Let’s delve into how Islamic banking operates and why it is gaining more attention in today’s global financial landscape.

The core concepts of Islamic banking

Global Islamic banking assets reached USD 2.37 trillion in 2023, growing 7.21% year-on-year, reflecting the sector’s strong performance and increasing global adoption.

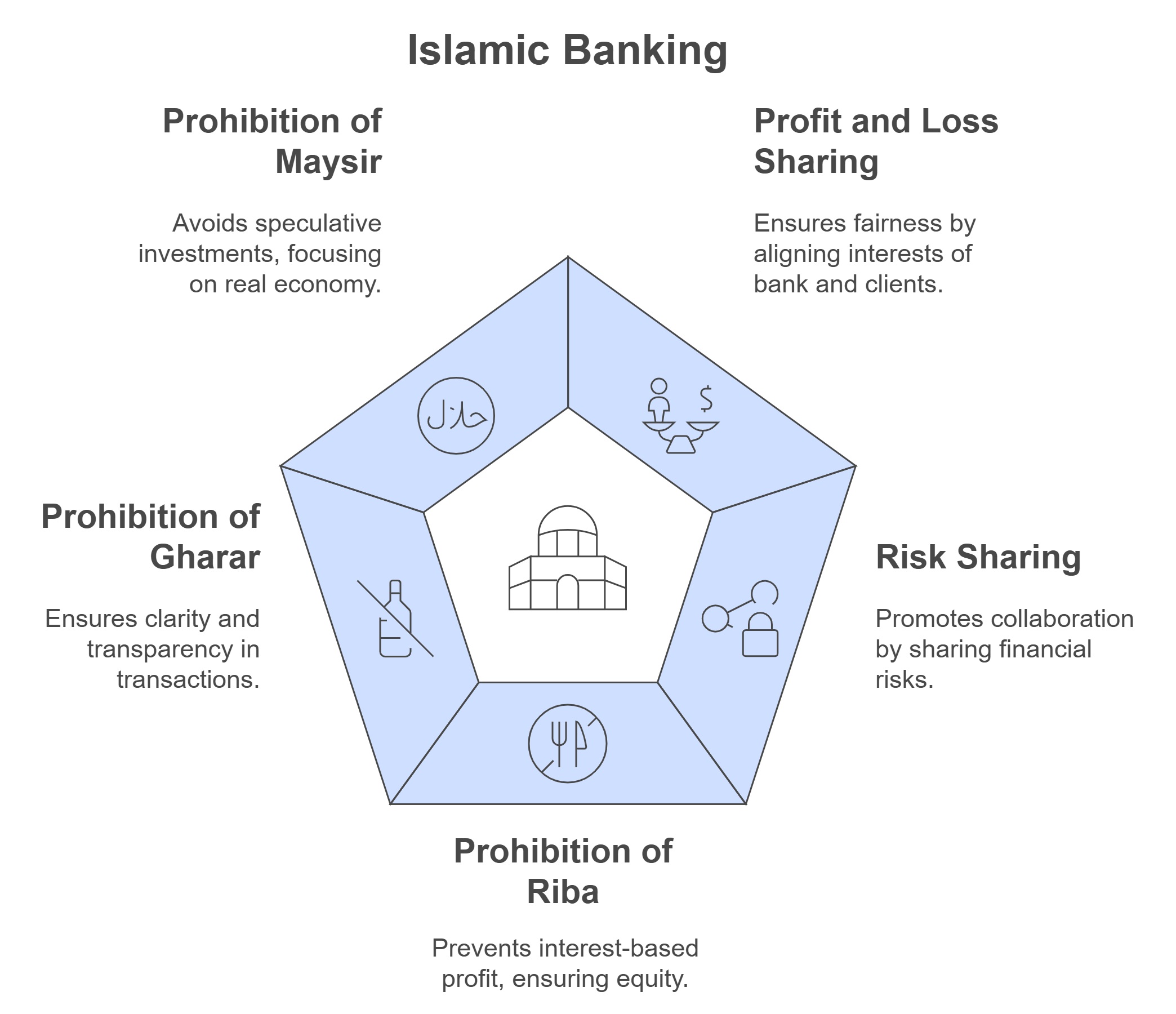

At the heart of this growth, Islamic banking operates under Sharia law, prioritising ethical, transparent, and equitable financial practices. Its core principles include:

The core principles and unique features of Islamic banking have historically formed its foundation, and some companies and financial institutions continue to adhere strictly to these rules.

However, many of these concepts have been adapted, refined, or even reinterpreted to meet modern financial needs and regulatory requirements. Below we’ll debunk the most common myths about Islamic banking to explore how Islamic finance operates in the modern world.

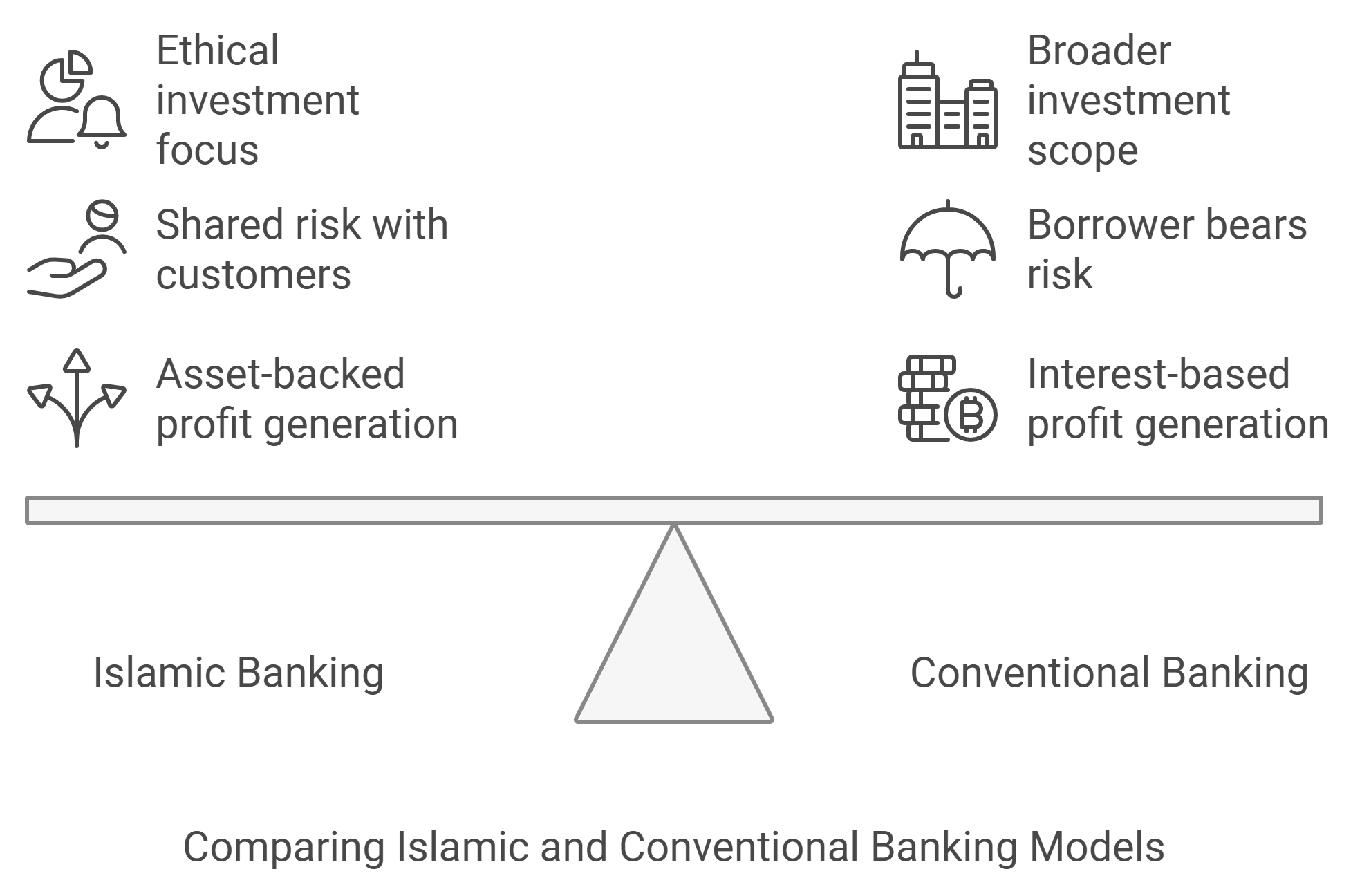

Islamic banking vs. conventional banking

Islamic and conventional banking are distinct systems with unique principles. While conventional banking dominates globally, Islamic banking provides a Shariah-compliant, ethical alternative focused on transparency, fairness, and socially responsible practices.

The table below highlights their key differences in profit generation, risk management, and operations.

| Aspect | Islamic banking | Conventional banking |

| Profit generation | Profit is earned through profit-sharing models and asset-backed financing, avoiding interest (riba). | Relies primarily on interest-based lending and other service fees. |

| Risk sharing | Risks and profits are shared between banks and customers. | Banks transfer most of the risk to customers. |

| Investments | Investments are guided by ethical principles, avoiding sectors like gambling. | No specific ethical constraints. |

| Interest | Prohibited entirely; profits must come from tangible assets and risk-sharing activities. | Interest is a fundamental component, charged on loans and deposits. |

| Regulations | Governed by Shariah law, ensuring compliance through Shariah boards. | Regulated by central banks and conventional financial authorities. |

Despite its ethical foundation, Islamic banking faces common misconceptions. Let’s address these myths to clarify their principles.

7 common myths about Islamic banking

Myth 1. No profit, no problem

A common myth is that Islamic banking cannot generate profit because it prohibits interest (riba). However, Islamic banks use various Sharia-compliant methods to generate income, adhering to ethical and religious principles. These methods focus on tangible assets and equitable partnerships, allowing banks to thrive without relying on interest-based practices.

For example, in Mudharaba (profit-sharing partnerships), Islamic banks provide capital to businesses, and profits are shared according to pre-agreed ratios. This model ensures that banks earn income based on the success of the venture rather than fixed interest payments.

Similarly, in Ijarah (leasing agreements), banks lease assets such as vehicles or machinery to clients for a fixed period, earning regular rental payments. At the end of the lease term, ownership may transfer to the client, ensuring a fair and transparent transaction.

Another popular method is Murabaha (cost-plus financing), where banks purchase goods or property on behalf of clients and sell them at a disclosed profit margin. This approach replaces the interest charged in conventional loans with a fair markup.

Myth 2. Islamic banking will break the bank

Another misconception about Islamic finance is that it is more expensive than conventional finance. This perception arose in the industry’s early days, characterised by limited competition and higher operational costs.

However, Islamic banks are competitive today, offering rates and fees comparable—and sometimes more favourable—than conventional banks.

For example, Islamic home financing, such as Murabaha or Ijarah-based structures, often matches the pricing of conventional mortgages, offering transparent and competitive profit rates without the hidden costs sometimes associated with interest-based loans.

Myth 3. It’s all Greek to me

Islamic banking is often seen as too complex or difficult to navigate due to the unfamiliarity of terms and practices. While some of the terminology may initially seem daunting, the core principles of Islamic finance—equity, fairness, and transparency—are universal and easy to understand.

Islamic banks today are highly customer-centric and offer clear, transparent services, which can be just as easy to understand as conventional banking. The product structures, such as Murabaha (cost-plus financing) and Ijarah (leasing), are often simpler than interest-based loans, with clearly defined terms and no hidden fees.

Moreover, Islamic banks have made substantial progress in educating both customers and staff, with many offering resources to explain their services in an accessible way.

Myth 4. The Sharia compliance myth

One of the biggest misconceptions is that Islamic banking is overly strict or rigid due to its adherence to Sharia law. While Islamic banks operate under Sharia guidelines, these rules are designed to promote fairness and justice, rather than impose unnecessary restrictions.

Sharia compliance doesn’t limit a bank’s ability to conduct business—it simply ensures that transactions are conducted ethically. For instance, banks avoid investments in industries that conflict with Islamic values, such as alcohol, gambling, or pornography. Instead, they invest in sectors that promote social welfare, such as education, healthcare, and renewable energy.

In fact, Islamic banking is incredibly flexible and adaptable to meet modern-day needs, with structures designed to accommodate a variety of financial goals without compromising ethical principles.

Myth 5. Only for the devout

Another myth is that Islamic banking is only for those who practice Islam. While Islamic banks are based on Sharia principles, they are open to all customers, regardless of their religious background.

The key feature of Islamic banking is its ethical approach, which can appeal to anyone who values transparency, fairness, and social responsibility in financial transactions.

Many non-Muslim customers find that the ethical foundations of Islamic banking align with their personal values, and they appreciate the focus on risk-sharing and avoidance of excessive speculation or interest-based practices.

Myth 6. Strictly religious and not business-oriented

Finally, there’s a misconception that Islamic banking is more focused on religious values than business success. In reality, Islamic banks are highly business-oriented institutions, with a strong focus on innovation, financial growth, and customer satisfaction.

Islamic banks offer a wide range of services, from personal and corporate banking to investment banking, asset management, and trade finance. The difference lies in their ethical framework, which ensures that business practices are conducted in a socially responsible and sustainable manner. With their risk-sharing approach and emphasis on ethical investments, Islamic banks are well-positioned to meet the needs of modern businesses and entrepreneurs.

Myth 7. Shariah compliance is a barrier to innovation

A common misconception is that Shariah compliance stifles innovation, with critics claiming Islamic finance is too rigid for modern financial needs.

In reality, Islamic finance has embraced technological advancements, integrating mobile banking, FinTech solutions, and digital wallets. Shariah-compliant platforms, such as peer-to-peer lending and Islamic robo-advisors, are now widely available, offering innovative financial services while adhering to Islamic principles of fairness and transparency.

Additionally, technologies like blockchain and digital payment systems are transforming Islamic finance. Digital wallets and apps allow users to manage finances while avoiding interest (riba) and speculation (maysir). Products like Sukuk (Islamic bonds) also provide Shariah-compliant investment opportunities, proving that Shariah compliance can drive modern financial innovation rather than hinder it.

Islamic banking, rooted in ethical and socially responsible finance, has emerged as a key segment of the global financial landscape. Yet, the transition to digital banking presents both challenges and opportunities

Challenges in Shariah-compliant digital banking

Compliance with Shariah principles

Challenge

Aligning digital banking products with Shariah principles presents a unique challenge. The core principles of Islamic finance—such as the prohibition of riba (interest), gharar (uncertainty), and maysir (gambling)—must be integrated into digital banking solutions. Traditional banking products and services, which often rely on interest-based mechanisms, must be reimagined to fit these guidelines.

Solution

To overcome this challenge, digital banks must collaborate closely with Shariah scholars and advisory boards to ensure their products and services comply with Islamic law. This can involve using Shariah-compliant alternatives to interest-based products, such as Murabaha (cost-plus financing), Ijarah (leasing), and Mudarabah (profit-sharing partnerships).

Tech gap

Challenge

A significant challenge in Shariah-compliant digital banking is the absence of dedicated tech infrastructure tailored specifically for Shariah-compliant solutions. Traditional banking systems and technologies were not designed with Islamic finance principles in mind, and adapting these systems to work within a Shariah-compliant framework can be complex and costly.

Solution

To bridge the tech gap, digital banks should invest in bespoke software and platforms that are specifically designed to handle Shariah-compliant transactions. This could involve collaborating with FinTech companies that specialize in Islamic finance technology or developing in-house solutions.

Standardisation issues

Challenge

One of the key hurdles in Shariah-compliant digital banking is the lack of standardization in interpreting Shariah principles. Islamic finance is not monolithic, and interpretations of what is Shariah-compliant can vary significantly across jurisdictions. This creates confusion, especially when launching digital banking products in global markets.

Solution

Establishing common guidelines for Islamic FinTech companies can help ensure consistency and reduce confusion. Digital banks can collaborate with respected Shariah advisory boards to align their interpretations of Shariah law across different regions, making compliance easier and more uniform.

Additionally, industry groups like the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) can promote best practices for everyone in the market to follow.

Wrapping up

Islamic banking provides a transparent and ethical alternative to conventional finance, grounded in Sharia law and principles of fairness and social responsibility. As the sector continues to grow and adapt to modern needs, SDK.finance plays a vital role in facilitating this transformation.

Our scalable FinTech solution with source code stands out for its flexibility and customizability, enabling customers to develop banking products that meet their unique requirements, streamline payment operations and deliver innovative financial features.