White-label mobile banking solution to launch your app in weeks

Get a ready-to-deploy mobile banking application tailored for traditional banks, neobanks, and FinTech companies. Empower your bank or financial institution with a native Android/iOS mobile banking application that seamlessly integrates into your existing systems through robust APIs, enabling rapid deployment and unmatched scalability.

Contact us

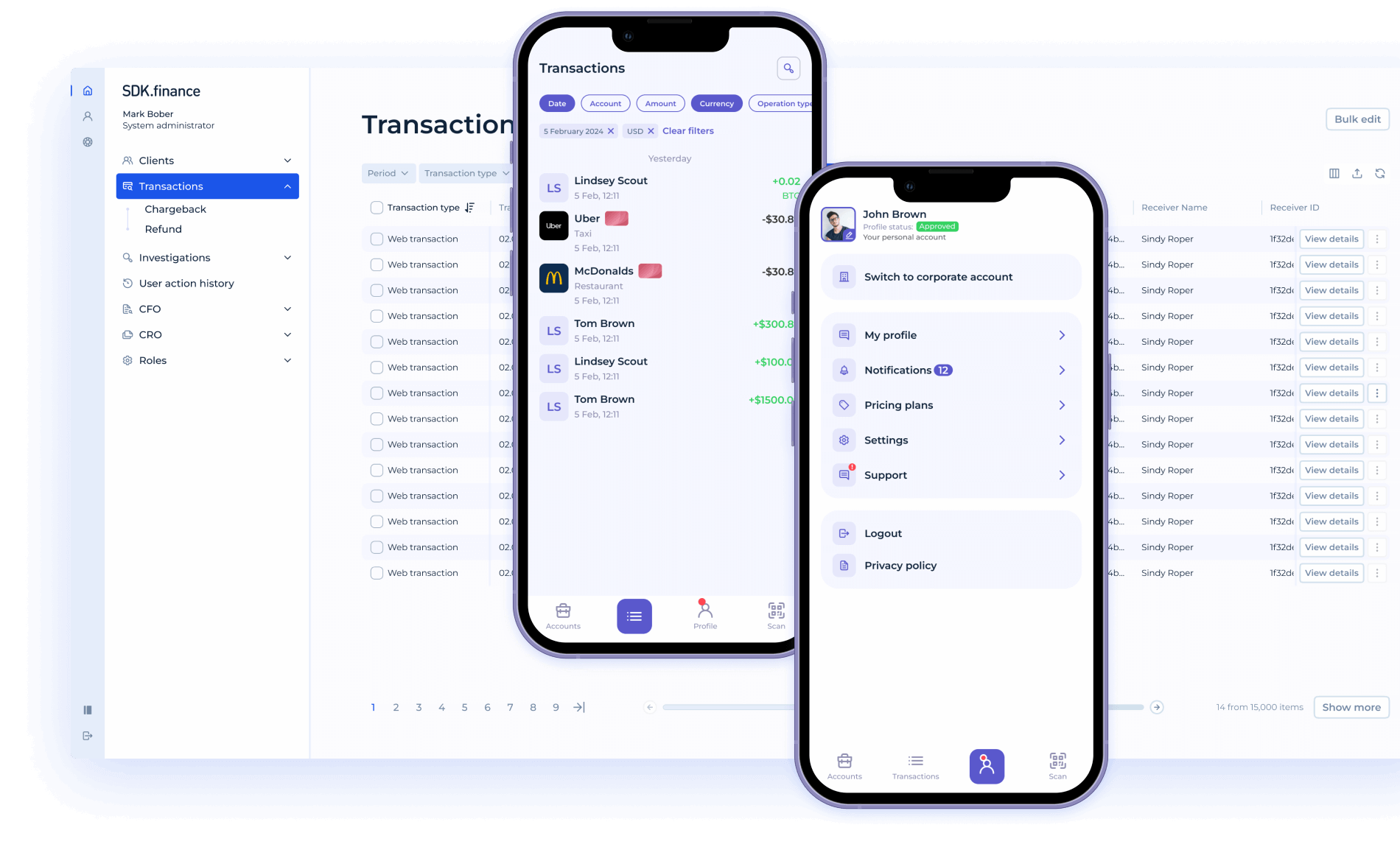

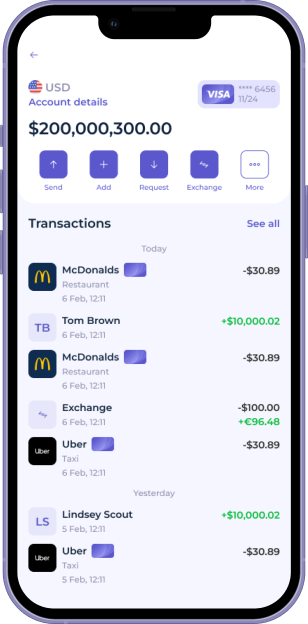

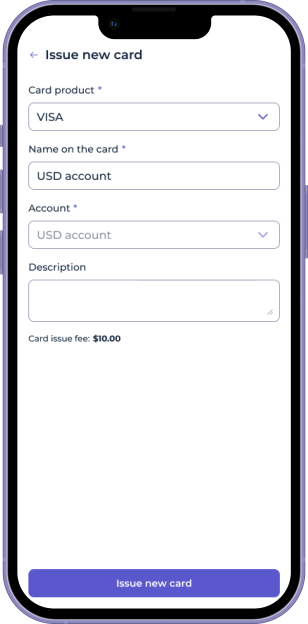

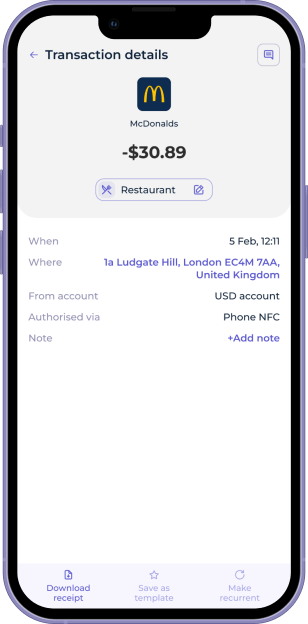

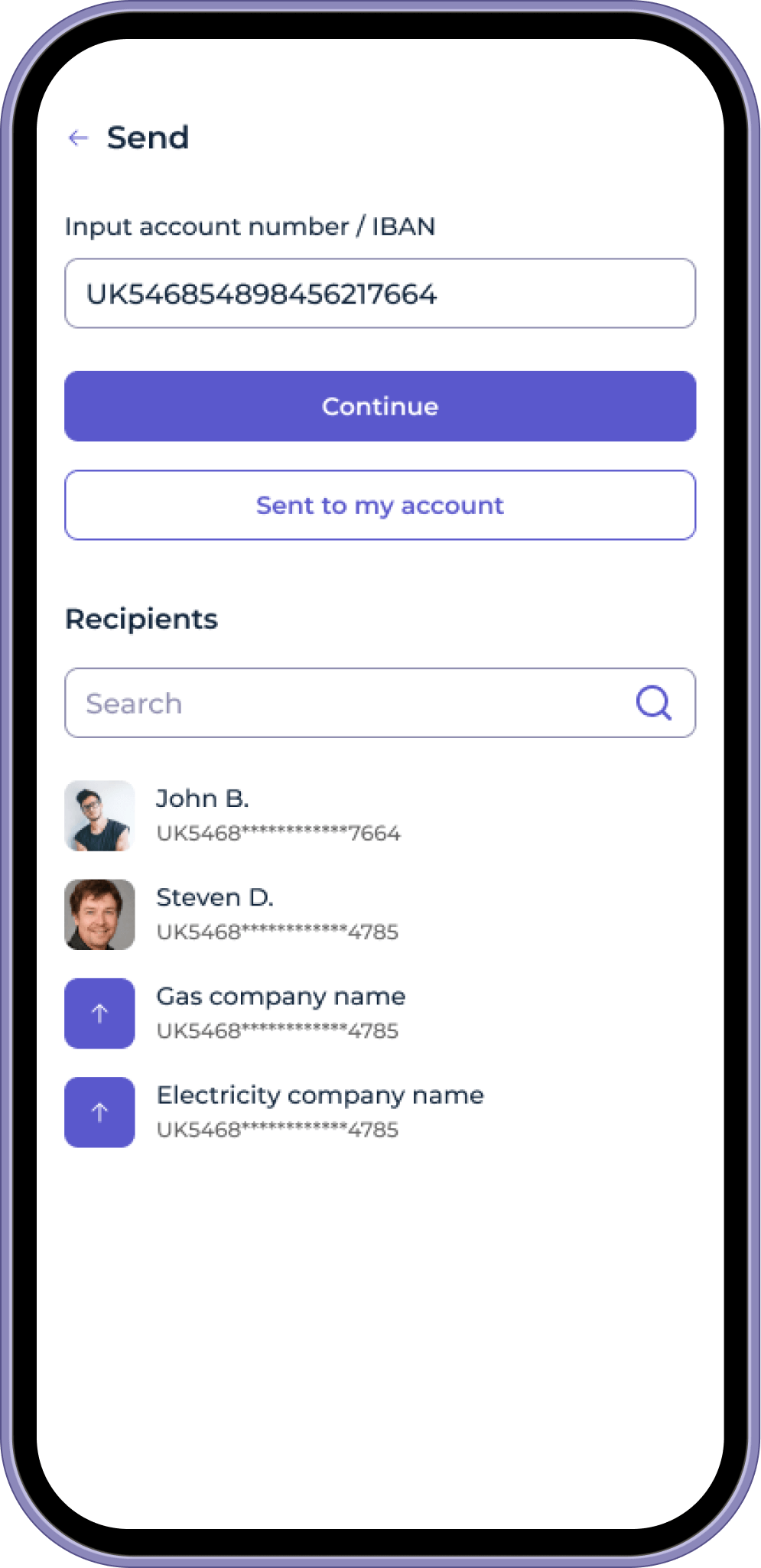

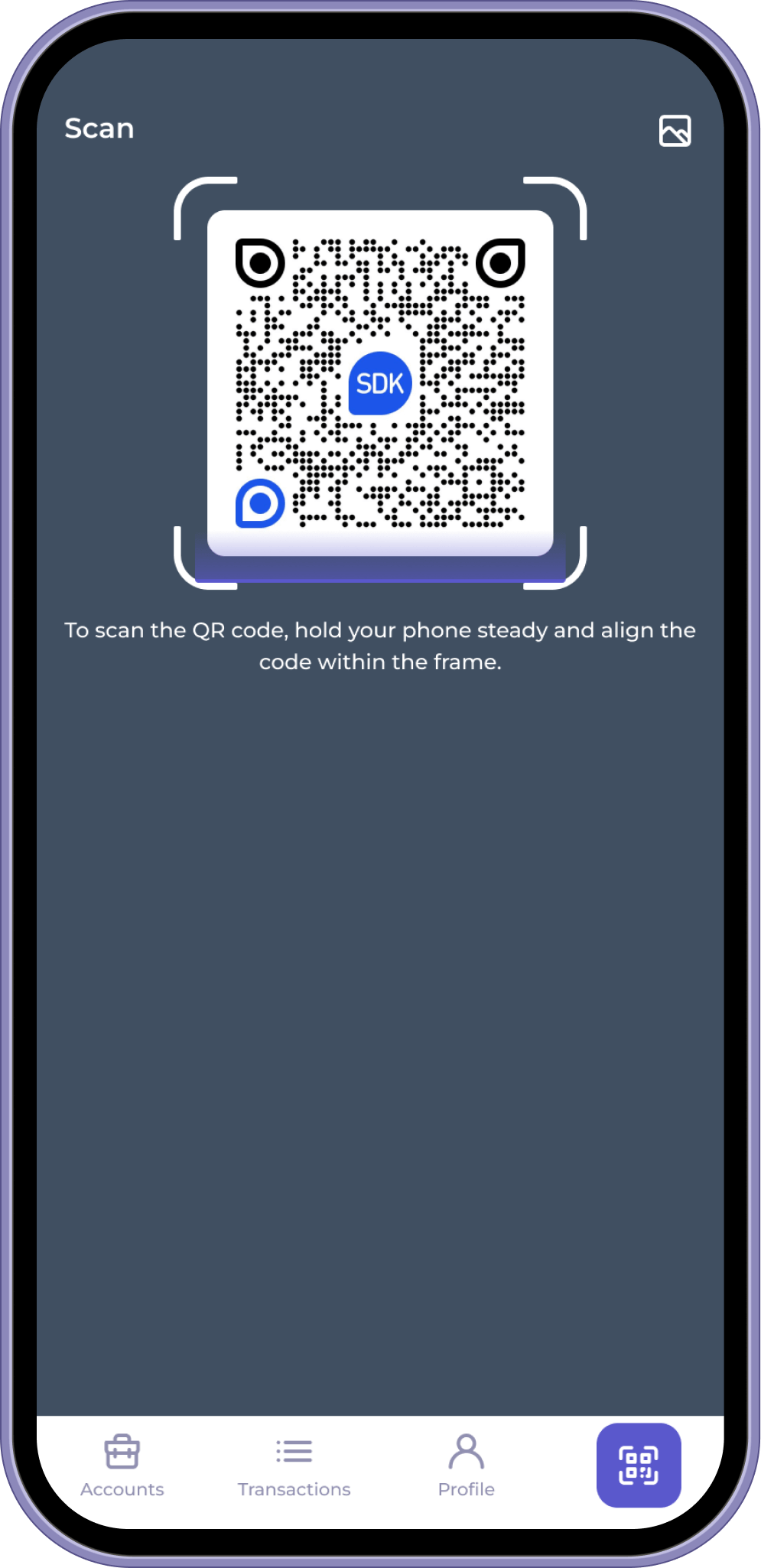

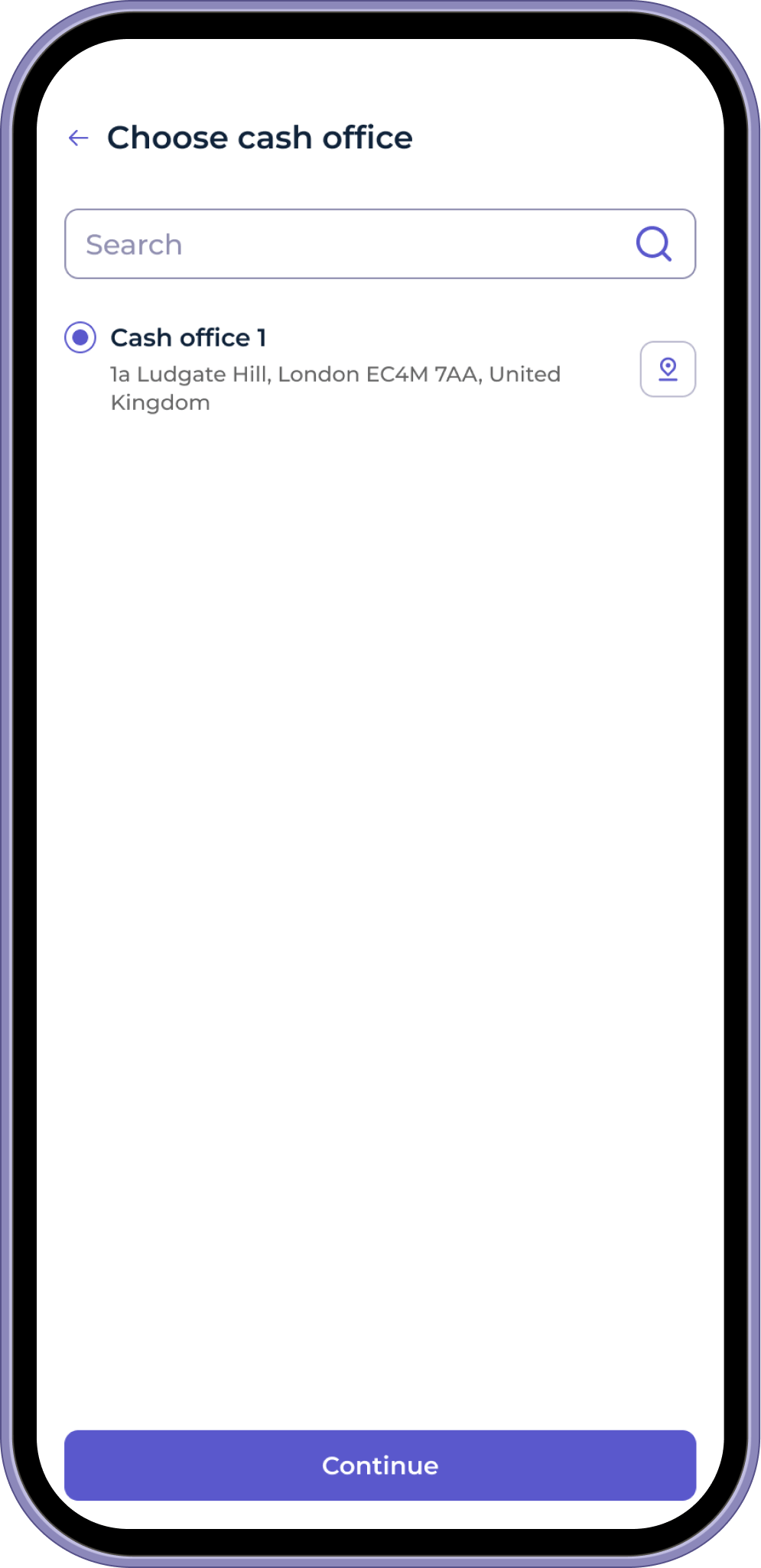

Explore the key features of our mobile banking Platform

SDK.finance mobile banking app delivers everything needed for your digital bank success and ensures a frictionless experience for your retail and business customers. It includes robust features, highlighting its comprehensive support for various user profiles.

Save time and resources

with our quick-launch app

Building a mobile banking solution from scratch can take years and require extensive resources. With SDK.finance, you get speed, cost-effectiveness and unparalleled customizability.

Time to launch

Development costs

Customisability

Compliance readiness

1+ years

$$$$

High

Manual

A few weeks

$$

High

Built-in integrations

Why SDK.finance’s mobile

banking solution?

White-label and customisable

Our mobile banking platform is pre-developed but fully customisable and brandable, giving you complete control over the user experience and aesthetics of your mobile app.

Launch faster and smarter

Skip the years-long development process and deploy a tailored mobile banking solution in a matter of weeks, saving you time and resources.

Seamless integration

Our powerful APIs ensure your mobile banking app integrates smoothly with existing systems, enabling a consistent and secure user experience.

Easy backoffice management

Manage accounts, transactions, and user data with real-time analytics and reporting, ensuring operational efficiency and better decision-making.

Full source code access

Complete freedom to modify and customize at your pace, using the comprehensive Knowledge transfer and consistent software updates.

Minimized development risks

Avoid the bottlenecks of building from scratch by using the ready application with a pre-developed backend and backoffice for system management.

transactionsper second

transactionsper day

transactionsper month

transactionsper year

Your strategic advantage

470+ APIs

Integrate with third-party systems to expand your app’s capabilities.

Scalable backend

Ensure consistent performance as transaction volumes grow.

Future ready technology

Built using advanced tech stack, your app will stay current for years to come.

Ready to deliver exceptional mobile banking experience?

Frequently asked questions

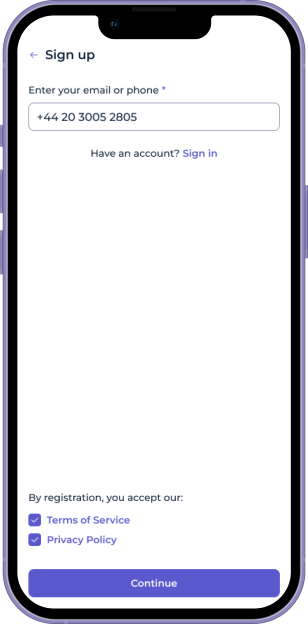

SDK.finance mobile banking solution is a FinTech software Platform that enables financial institutions to offer banking services, such as account management, transactions, and payments, through its white-label Android/iOS mobile application.

To stay ahead, financial institutions must invest in digital transformation, adopting cutting-edge technologies such as artificial intelligence, blockchain, and cloud computing.

A mobile banking platform is a comprehensive system that supports the development and management of mobile banking applications. It integrates backend systems, APIs, and front-end interfaces to provide seamless banking services to customers.

Establishing a primary banking relationship is essential for financial institutions aiming to build long-term customer loyalty. Digital banking solutions play a pivotal role in this process by offering convenient, secure, and personalized services that cater to the evolving needs of customers.

Through mobile banking apps and online platforms, financial institutions and banks can provide a comprehensive range of services that enhance customer satisfaction and drive business growth. By leveraging these digital banking solutions, financial institutions can strengthen their relationships with customers, ensuring they remain the primary choice for all their banking needs.

Yes, SDK.finance offers a source code licence, allowing financial institutions full control and customisation of their mobile banking platform.

With SDK.finance, you can launch a fully branded and customised mobile banking app in just a few weeks thanks to the pre-developed functionality, but the actual timing will depend on your development team plus the level of customization and integrations required.

Absolutely. The Platform is designed for easy scaling up or down based on transaction volume. More information.

Yes, SDK.finance uses robust APIs to ensure seamless integration with your current systems and third-party tools.

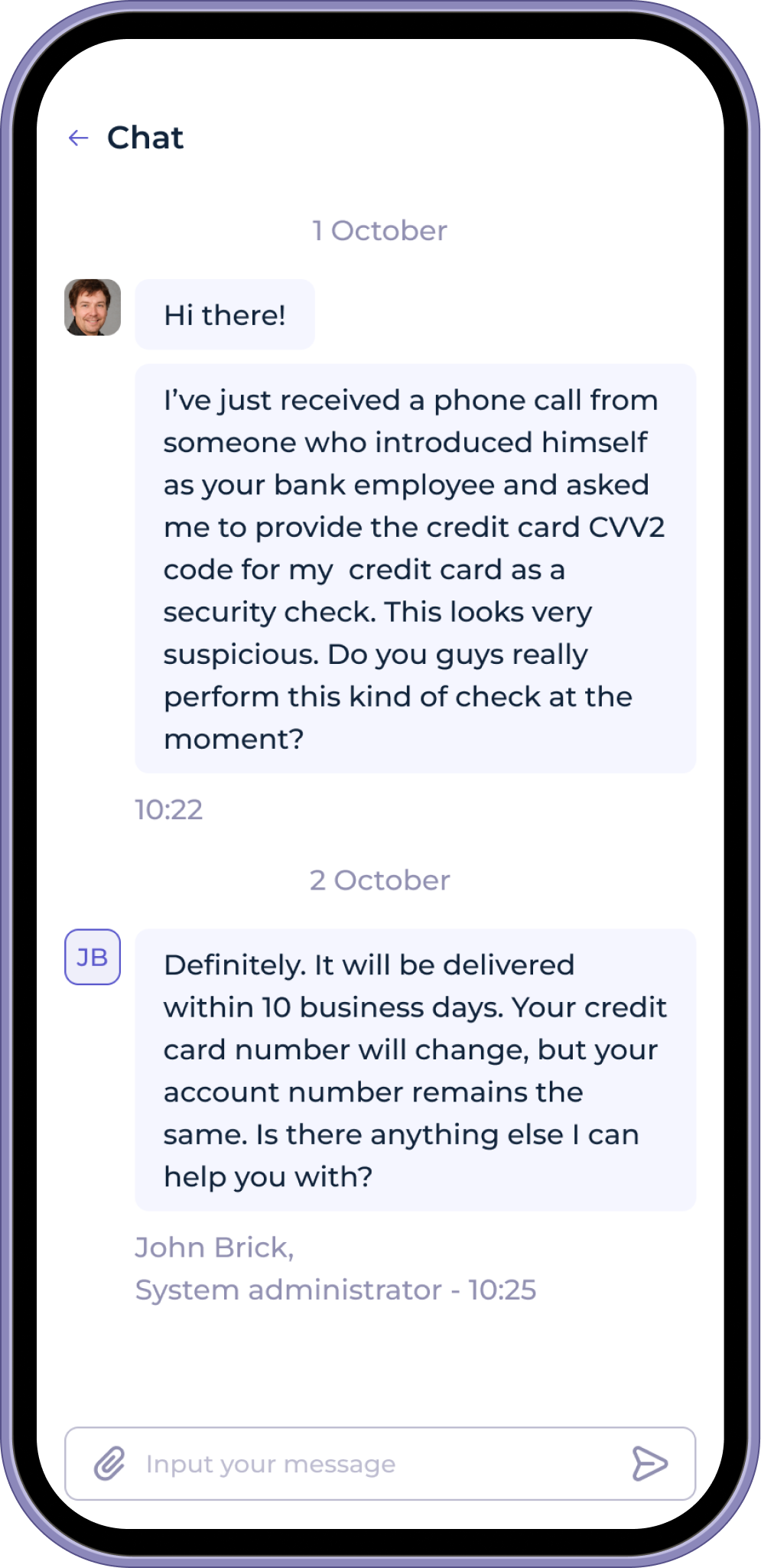

One of the standout features of modern digital banking solutions is their ability to be customized and configured to meet the unique needs of financial institutions and their customers. SDK.finance mobile banking app solution can be tailored to offer personalized promotions and services to both retail and business customers, enhancing the overall digital banking experience.

Financial institutions can configure their digital mobile wallet apps to ensure secure and efficient payment processing, integrate with other financial services like loan and credit card applications, and provide a seamless user experience. This level of customization ensures that each customer receives a banking solution that is perfectly aligned with their needs, driving higher customer satisfaction and loyalty.