Credit card fees still represent a major cost for retailers, reaching $224 billion in 2023.

As businesses grapple with these mounting expenses, a new player is emerging in the payment landscape: pay-by-bank.

This innovative payment method promises to cut out the middlemen and revolutionize how we transact, but it also raises a critical question: Is it a tool for efficiency, or is it paving the way for Big Tech’s takeover of traditional banking?

Let’s explore how pay-by-bank is reshaping consumer behavior, its implications for financial institutions, and the potential risks and rewards of allowing technology companies to take the reins of our financial transactions.

How pay-by-bank affects the financial industry

Pay-by-bank is shaking things up in the payment industry, ushering in a new era marked by efficiency, savings, and security.

This innovative payment method allows direct bank transfers between consumers and merchants, cutting out middlemen like Visa and Mastercard.

As a result, it’s changing how we think about transactions.

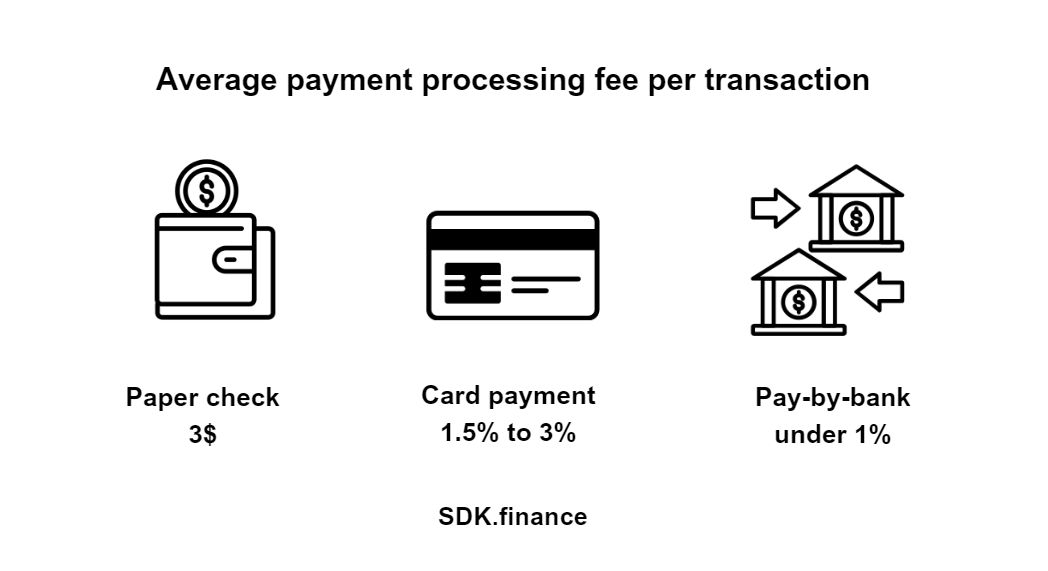

Lower commissions for transactions

One of the biggest game-changers with pay-by-bank is its potential to slash payment processing fees.

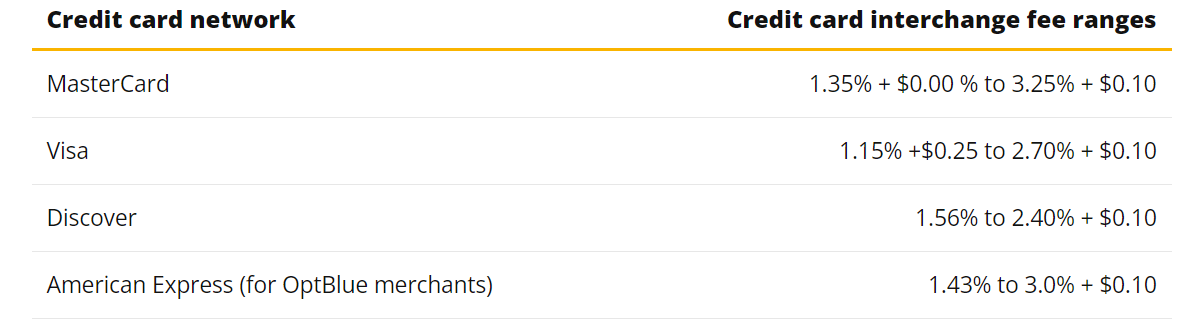

Traditional card payments often come with average transaction fees of 1.5% to 3%—and those can skyrocket for cross-border transactions.

In contrast, pay-by-bank transactions typically have fees under 1%.

When you stack that against the high costs of paper checks—which not only carry processing fees but also add on handling and security costs—pay-by-bank emerges as a smart choice for businesses aiming to streamline their payment processes.

With lower fees, businesses can keep more of their hard-earned money. This means they can invest in growth or even offer customers better prices. Plus, consumers win too, enjoying a more affordable shopping experience without the hidden costs tied to traditional payment methods.

In short, pay-by-bank is more than just a trend; it’s a powerful shift that’s redefining how we make payments, making transactions easier and cheaper for everyone involved.

That’s why many businesses are exploring how to use this innovative payment method to stay competitive. One prominent example is Walmart, a retail giant that consistently seeks to reduce operational costs and enhance customer experience.

How tech giants leverage pay-by-bank: Walmart’s strategy

As the retail industry changes, Walmart is making a big move by introducing pay-by-bank, a payment method that could reshape grocery shopping. Starting in 2025, customers will use this option for online purchases, cutting costs and making payments more convenient.

Jamie Henry, Walmart’s VP of Emerging Payments, explained that pay-by-bank offers instant transaction updates, allowing shoppers to manage their budgets in real-time. This eliminates the delays often seen with other payment methods. By adopting pay-by-bank, Walmart can lower costs and either pass the savings to customers or reinvest in better services.

For shoppers, pay-by-bank offers a quicker and easier checkout. Instead of manually entering bank details, they simply choose their bank from a dropdown menu for a smooth, hassle-free experience.

Looking ahead, tech giants could adopt pay-by-bank to strengthen their influence in the financial space, potentially challenging the dominance of traditional banks and payment systems.

How businesses can benefit from adopting pay-by-bank

Adopting pay-by-bank technology can significantly enhance your business operations and payment processes. Here are the key benefits that make this approach an attractive option:

Lower fees

Pay-by-bank cuts out the middleman, allowing businesses to pocket more of their revenue. This streamlined method is a boon for small and medium-sized enterprises, boosting profit margins and financial health.

For example, companies can pay 2.87% to 4.35% of each transaction for credit card processing. If your business processes $10 million via credit cards per year, you’re paying around $350,000 in credit card processing fees alone.

Sky-high approval rates

Imagine a world where nearly every transaction goes through—sounds good, right? pay-by-bank boasts impressive approval rates, achieving up to 99%. This means fewer abandoned carts and more satisfied customers sealing the deal!

For example, pay-by-bank helps reduce unintentional subscription cancellations by avoiding issues with card expirations. On average, Americans keep the same bank account for about 17 years, while credit cards typically last only 2 to 3 years.

Instant cash flow

Real-time settlement of transactions means businesses gain immediate access to funds. This rapid cash flow can significantly enhance operational efficiency and support better management of working capital.

Minimum chargebacks

Chargebacks can feel like a financial black hole. With pay-by-bank functionality, once a payment is made, it’s final, giving you peace of mind and allowing you to focus on growing your business rather than chasing down disputes.

Broader accessibility

Pay-by-bank opens up new market segments by accommodating customers who may not have access to traditional credit cards. This inclusivity can lead to increased sales and a wider customer base.

Effortless integration

Many pay-by-bank solutions can be easily integrated into existing payment systems. This simplicity allows businesses to implement the technology without extensive downtime or complicated setups.

Reduced fraud risks

Pay-by-bank is a game changer when it comes to reducing fraud. While credit card fraud is expected to hit $165 billion in losses over the next decade, pay-by-bank offers a safer alternative. Unlike credit cards, which can be easily lost, skimmed, or hacked, pay-by-bank transactions are guarded by a fortress of security measures.

Challenges with pay-by-bank: What’s holding it back?

While pay-by-bank is gaining traction, there are a few bumps in the road that businesses need to smooth out. Let’s break down the challenges and how to handle them:

Clunky user experience

Paying by bank can sometimes feel like a chore compared to the simplicity of swiping a card. Logging into your bank, confirming your details, and completing the payment can take time, potentially turning customers away.

Fix it: Businesses can create a smoother interface using open banking and APIs. Think Single Sign-On (SSO) and fewer steps—streamlining the whole process so it feels as effortless as using a card, minus the fees!

No take-backs

Unlike credit cards, where you can dispute a transaction with a chargeback, many pay-by-bank transfers are final. This lack of reversibility puts the pressure on the customer to get it right the first time.

Fix it: Offering dispute resolution mechanisms or easy refund options can ease customer concerns. Clear, transparent policies that make customers feel supported will go a long way in building trust.

Security risks

While pay-by-bank is generally secure, it’s not immune to risks like phishing or identity theft. Customers could be tricked into handing over their bank credentials to the wrong hands.

Fix it: Beef up security with multi-factor authentication (MFA), biometric logins, and strong encryption. Educating customers on phishing risks and conducting regular security checks ensures everyone stays one step ahead of the scammers.

Cross-border payment challenges

International payments can be tricky. Different banking systems, regulations, and potential fees can throw a wrench in the pay-by-bank process when dealing across borders.

Fix it: Partner with global payment gateways that specialize in cross-border transactions. With the right infrastructure, you can ensure that payments flow smoothly, no matter where they’re coming from.

Regulatory red tape

Pay-by-bank is subject to regulations like AML (Anti-Money Laundering) and KYC (Know Your Customer), which can add extra steps and headaches for businesses.

Fix it: Stay compliant by keeping up with regulations and automating these processes as much as possible. Invest in compliance tools and legal advice to ensure you’re always ahead of the game.

What regulations are shaping pay-by-bank?

When it comes to pay-by-bank, businesses must navigate a complex web of regulations designed to protect consumers, prevent fraud, and ensure compliance with financial systems.

AML and KYC

One of the core regulatory requirements for pay-by-bank services is the need to comply with AML and KYC rules. These regulations are meant to prevent money laundering, terrorism financing, and other financial crimes. Businesses offering pay-by-bank need to verify the identity of their users and monitor transactions for suspicious activity.

Open banking regulations

Open banking has been a game-changer for pay-by-bank services, especially in regions like Europe with regulations like PSD2 (Payment Services Directive 2). PSD2 requires banks to open their payment services and customer data to authorized third-party providers, making it easier for pay-by-bank solutions to flourish.

- In the EU, PSD2 ensures secure access to financial data, enabling pay-by-bank to integrate with different banks seamlessly.

- In North America, open banking is less standardized, but there are ongoing initiatives to develop frameworks that encourage innovation while protecting consumers.

Data privacy and security

pay-by-bank services handle sensitive financial information, so they must adhere to strict data privacy regulations. In the EU, the General Data Protection Regulation (GDPR) is the benchmark for protecting customer data, while in the US, the California Consumer Privacy Act (CCPA) is a leading regulation.

- GDPR ensures that customer data is handled securely and gives consumers the right to access, correct, or delete their data.

- CCPA gives California residents similar rights, with an emphasis on transparency about how businesses collect and use personal information.

Consumer protection and refund policies

One of the challenges with pay-by-bank is its irreversibility. In contrast to credit card payments, which offer chargeback options, pay-by-bank transfers are often final once they are processed. This can lead to consumer protection concerns if disputes arise. That’s why, some jurisdictions may enforce specific refund policies for digital payments to ensure consumer rights are respected.

Conclusion

Pay-by-bank is a revolutionary payment method that allows direct bank transfers between consumers and merchants, removing the need for costly intermediaries like Visa and Mastercard. This innovative approach not only has the potential to significantly reduce processing fees but also enhances the efficiency and security of transactions.

While the benefits are clear, the emergence of pay-by-bank prompts us to consider its implications for the future of banking and the growing influence of big tech. For businesses willing to embrace this new method, there are significant advantages to be gained. Early adopters can secure a competitive edge in a changing financial landscape.

SDK.finance provides a powerful FinTech solution, equipping companies embracing FinTech innovation with the features and infrastructure to stay ahead in a shifting payment landscape. Its all-in-one Platform and a team of expert FinTech developers equip customers with out-of-the-box functionality for a swift start to their digital wallet, neobank, payment processing, or fiat-to-crypto systems.

The SDK.finance software powers financial solutions globally, including countries like Saudi Arabia, UAE, Spain, Switzerland, Luxembourg, the UK, the USA, Canada, and many more. For more information, please visit the SDK.finance website.