Outdated legacy technology could cost banks over $57 billion in 2028. Modern payment infrastructure promises faster transactions, stronger security, and room to grow. So why are so many banks and financial companies still using outdated systems?

Upgrading isn’t just a quick fix. Behind the scenes, payment systems are tangled up with old code, strict regulations, and complex connections that make change tough.

In this article, we’ll explore the hidden reasons why modernizing payment infrastructure isn’t easy and how leading companies like Starbucks, Uber, and Netflix are leveraging modern payment systems to stay ahead of the curve.

Payment infrastructure is the backbone of modern commerce

Payment infrastructure is the engine that powers modern commerce, seamlessly connecting customers, businesses, and financial institutions.

What is a payment infrastructure?

Payment infrastructure is the system that allows money to move smoothly and securely between people and businesses. It’s the backbone of modern payments, enabling everything from simple store purchases to complex online transactions.

Payment infrastructure is made up of several key elements that work together:

- Payment processors – These companies, like Visa, Mastercard, and Stripe, handle and verify transactions in real-time.

- Financial institutions – Banks and credit unions are the core players here. When you make a purchase, your bank or credit card issuer (like Chase or American Express) either issues or receives the payment.

- Security protocols – To keep payments safe, payment infrastructure includes advanced security measures like encryption and tokenization, which help protect sensitive information from fraud and cyber-attacks. For instance, companies like Apple Pay and Google Pay use tokenization to secure your card details.

Together, these elements create a reliable system that makes payments fast, secure, and easy, whether it’s a swipe at a register, a tap on a smartphone, or a click on a website.

Legacy payment systems vs. a modern payment infrastructure

Legacy payment systems and modern payment infrastructure represent two different generations of payment technology. While legacy systems have served businesses for years, they often struggle to keep up with the speed, security, and flexibility demands of today’s digital economy.

For instance, ACH (Automated Clearing House) transfers in the U.S. are a legacy system that processes payments in batches, which can lead to delays of up to several days. In ontrast, modern payment infrastructure enables real-time payments, allowing funds to be transferred instantly across accounts or even countries, as seen with Faster Payments in the UK.

Comparison of modern and traditional payment systems

| Feature | Legacy payment systems | Modern payment infrastructure |

| Transaction speed | Batch processing; transactions may take hours or days | Real-time or near-instant payments |

| Integration | Limited or complex integrations with other systems | API-driven, easy integration with various business platforms |

| Scalability | Restricted by fixed capacity; costly to scale | Highly scalable, designed for growing transaction volumes |

| Fraud | Basic security; limited fraud detection capabilities | Advanced fraud detection with AI, machine learning, and real-time monitoring |

| Customer Experience | Slower processing times, limited options | Faster processing, multiple payment methods, one-click options |

| Cost | Higher operational costs due to outdated technology | Cost-effective due to automation and streamlined processes |

| Flexibility | Rigid infrastructure, hard to update | Flexible, easily updated, and adaptable to new payment types |

Upgrading to a modern payment infrastructure can greatly enhance business performance, provide a better customer experience, and prepare companies for future payment trends.

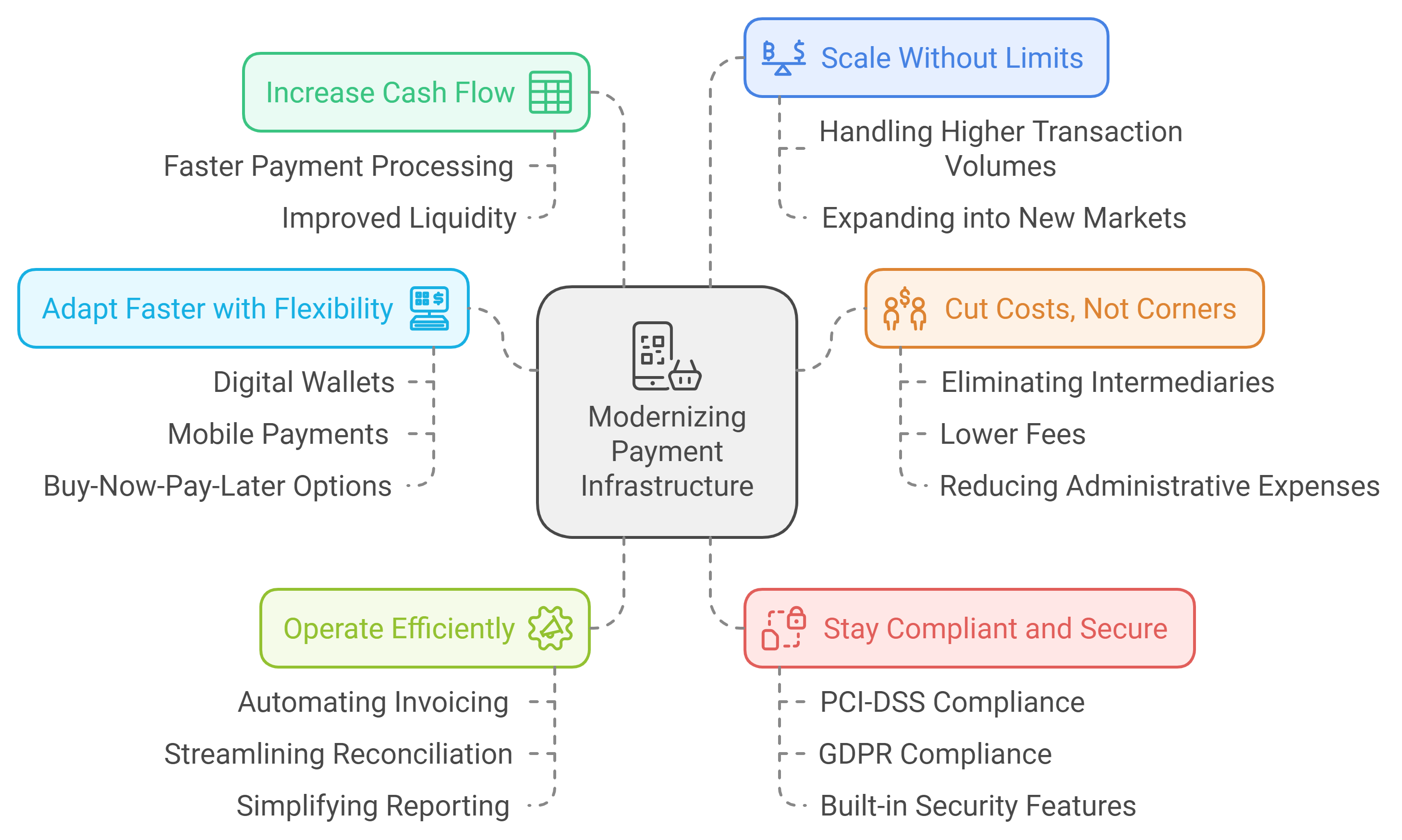

How modernising payment infrastructure can impact your business

Switching from outdated payment systems to modern infrastructure can significantly enhance a business. By adopting the latest technology, businesses can streamline payment processes, improve operations, and scale seamlessly.

Increase cash flow

Faster payment processing enables businesses to access funds quickly, improving cash flow management.

Real-time payments reduce delays between transactions and settlement, allowing businesses to improve liquidity and reinvest in operations or expand more quickly.

Scale without limits

Modern payment infrastructure is built to grow with your business. Whether you’re scaling up operations or expanding into new markets, modern systems can handle a higher transaction volume without sacrificing performance. This scalability ensures that businesses can continue to grow without facing payment bottlenecks or limitations.

Adapt faster with flexibility

Modern payment systems are designed to be flexible and adaptable, making it easier for businesses to incorporate new payment methods such as digital wallets, mobile payments, and buy-now-pay-later options.

Cut costs, not corners

Upgrading to modern payment systems can significantly lower transaction costs by eliminating intermediaries and simplifying the payment process. By reducing the reliance on multiple systems, businesses can lower fees, cut administrative expenses, and reduce the need for extensive IT support. Automation of manual processes also helps reduce overhead.

Operate efficiently

Modern payment systems automate many manual processes, reducing human error and operational bottlenecks. Tasks such as invoicing, reconciliation, and reporting are streamlined, saving businesses time and resources. By simplifying these processes, businesses can operate more efficiently and focus on core functions that drive growth.

Stay compliant and secure

As payment regulations continue to evolve (such as PCI-DSS and GDPR), modern payment infrastructure helps businesses stay compliant by incorporating the latest standards. Built-in security features and automated audit reporting ensure businesses can manage risk, avoid penalties, and protect customer data.

Upgrading your payment infrastructure to a modern system can deliver significant advantages, from cost reduction and enhanced security to improved customer satisfaction and operational efficiency. However, the path to modernization is not without its challenges. Let’s explore the key challenges of modernizing payment systems.

The challenges and solutions of modernising enterprise payment infrastructure

Updating enterprise payment infrastructure can be complex and resource-intensive. While consumer-facing innovation captures the spotlight, large-scale enterprises face a different kind of challenge: maintaining resilient, high-volume payment infrastructure behind the scenes. Unlike startups that can build with a clean slate, established companies must balance modernisation with stability across their existing systems.

Below, we explore the key challenges businesses face during this process and offer solutions to build a more efficient, secure, and scalable financial system.

Challenge: Legacy systems and technical debt

Legacy systems were not built to accommodate the scale and complexity of today’s payment needs. As a result, these outdated technologies often involve “technical debt,” where older code becomes harder to maintain and more costly to upgrade.

Solution: The solution is to start with a phased approach to modernization. Businesses can migrate to modular, API-driven platforms that allow for gradual system upgrades without disrupting day-to-day operations. For example, SDK.finance’s modular structure provides the flexibility to update individual components (such as payments, fraud detection, or customer onboarding) without disrupting the entire system.

Challenge: Integration complexities

Older payment systems cannot often integrate seamlessly with new technologies, tools, or services. This creates silos where systems don’t communicate with one another effectively, leading to inefficiencies, errors, and higher operational costs.

Solution: New payment platforms are designed to integrate smoothly with other systems. For example, companies like Uber use flexible APIs that allow their payment infrastructure to easily integrate with new technologies, making their system more efficient and cost-effective.

Challenge: High operational costs

Maintaining and supporting legacy systems can be expensive. This includes not just the costs of maintaining old hardware and software but also the personnel needed to manage them. Additionally, legacy systems often have higher transaction fees, slower processing times, and more manual interventions, all of which increase costs.

Solution: By adopting modern payment infrastructure, businesses can automate manual processes, reduce operational overhead, and lower transaction fees. Companies like Netflix have reduced operational costs by automating billing and transactions, making their payment processes more efficient.

Challenge: System scalability

As businesses grow and expand, their payment infrastructure must be able to handle increasing transaction volumes without compromising performance. Legacy systems often lack the scalability needed to accommodate growth, leading to system slowdowns, bottlenecks, and downtime.

Solution: Modern payment platforms are designed to be scalable, allowing businesses to grow without facing the limitations of legacy systems. The SDK.finance modular Platform makes it easy to scale up as needed, handling high transaction volumes with ease and ensuring businesses can adapt to future payment trends and technologies.

Now, let’s explore how companies like Starbucks, Uber, and Netflix are leveraging modern payment infrastructure.

How Starbucks, Uber, and Netflix are winning with modern payment infrastructure

Using a modern payment system has helped many companies improve their operations, make customers happier, and grow their business. Here are some examples of businesses that have benefited from this change:

Scan and sip with Starbucks’ mobile payments

Starbucks introduced a mobile payment system integrated with its loyalty program, making it incredibly easy for customers to pay through the app and earn rewards. The system’s flexibility allows for seamless, real-time payments across thousands of stores, boosting customer engagement and loyalty.

Today, nearly 30% of Starbucks’ transactions in the U.S. come from mobile payments, showing how a modern payment infrastructure can transform customer interaction and retention.

Uber: Ride, Tap, Pay

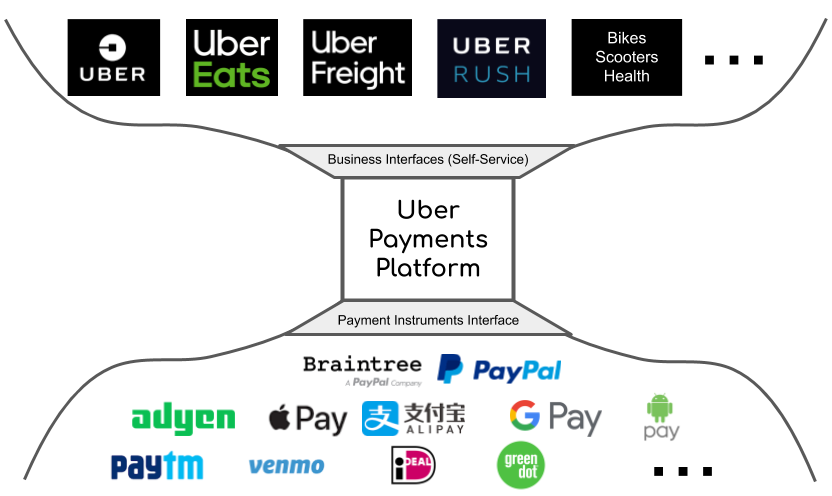

Uber’s success relies on its advanced payment system, which allows quick, cashless transactions in different areas. By using an API-driven and flexible payment method, Uber makes it easy for users to pay in their local currency.

This includes options like credit cards and digital wallets such as PayPal and Apple Pay. This setup minimizes hassle, boosts efficiency, and helps Uber grow globally without facing payment challenges.

Source: underhood

Shopify powers small businesses with scalable payments

Shopify Payments is an easy-to-use payment platform for merchants. It supports various payment methods, such as credit cards, digital wallets, and other options.

The platform has helpful features like fraud detection and compliance support, allowing small businesses to manage risks effectively. Shopify Payments is designed to help businesses of all sizes, from small shops to large e-commerce brands, stay competitive and scale as they grow.

Source: Shopify

Netflix’s recurring payments power

Netflix uses an efficient automated payment system to manage its subscriptions. This system supports various currencies and payment methods worldwide, allowing for smooth monthly billing.

This helps reduce customer cancellations and improves satisfaction. Additionally, Netflix’s modern infrastructure is flexible and adaptable, making it easier to enter new markets and offer local payment options.

Pay-by-bank payments with Walmart

Walmart is strategically advancing with pay-by-bank payments, which it plans to roll out in 2025 for online purchases. This move aligns with the company’s focus on streamlining the payment process and reducing transaction costs.

This technology allows instant transaction updates, empowering customers to track and manage their spending in real-time—a crucial feature in today’s budget-conscious market.

Building for the future

Modernising enterprise infrastructure isn’t just about replacing old systems. It’s about building a payment foundation that can adapt. Leading companies like Uber and Starbucks didn’t just create convenient consumer apps. They invested in scalable transaction engines, internal wallets, and merchant settlement tools to support their growth and product ambitions.

For enterprises evaluating their own path, the focus should shift from surface-level features to infrastructure depth: ledger integrity, automation of financial operations, configurable business logic, and data transparency.

By treating payment infrastructure as a strategic asset rather than a back-office utility, enterprises can future-proof their operations and accelerate innovation at the edge.

SDK.finance solution to upgrade the payment infrastructure

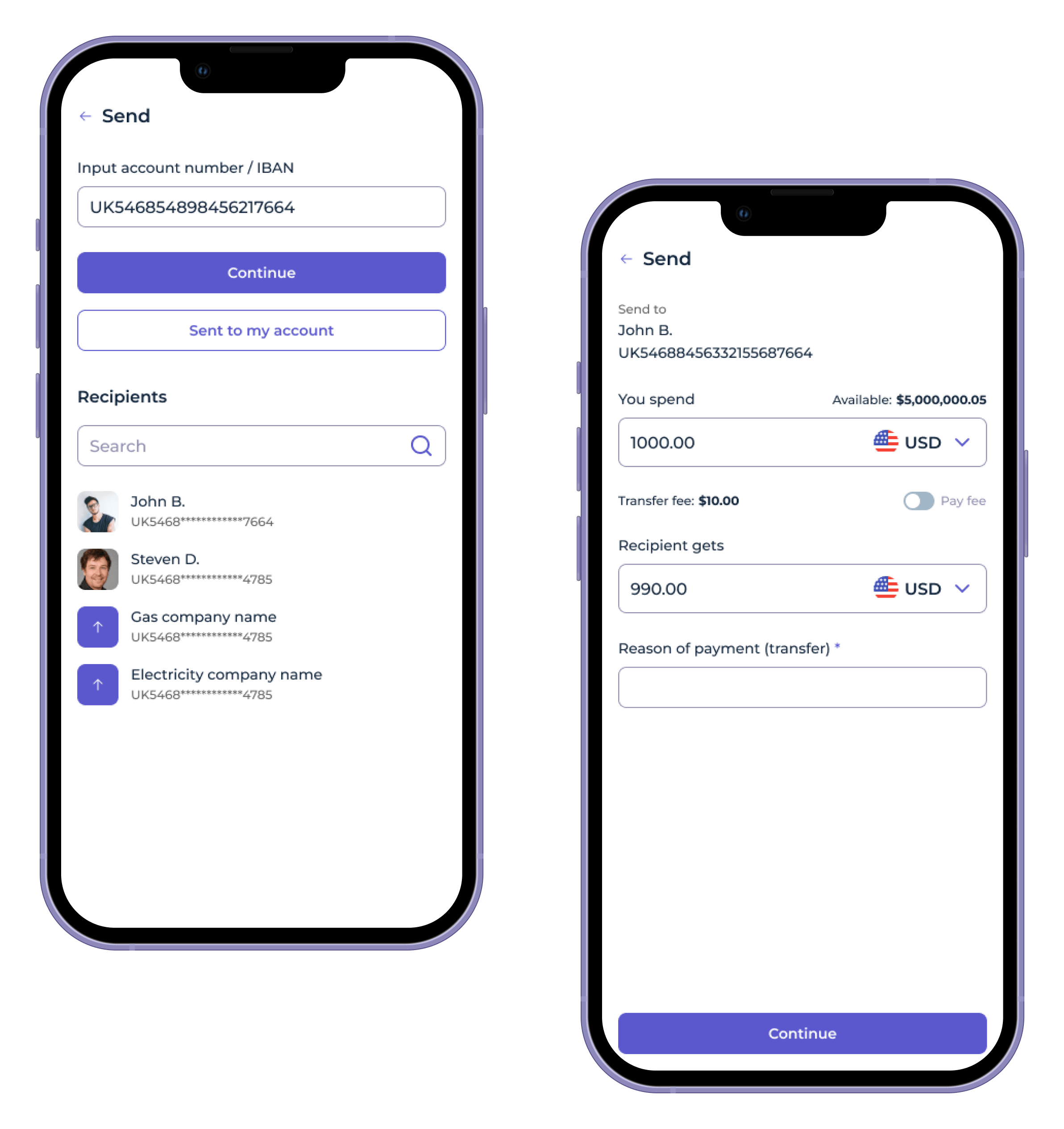

SDK.finance enables businesses to upgrade their payment infrastructure with a scalable FinTech Platform. Here’s how SDK.finance supports a modernized approach to payments:

Fast transactions, better cash flow

SDK.finance’s real-time processing capabilities reduce transaction delays, allowing businesses to access funds quickly, which enhances cash flow management and supports growth.

Effortless scaling

The Platform’s modular design is built for scalability, ensuring businesses can expand or handle high transaction volumes without sacrificing performance.

Lower costs with streamlined processes

By automating tasks like invoicing and reconciliation, SDK.finance reduces operational costs, enabling businesses to focus on strategic initiatives without excessive overhead.

Enhanced security

With compliance tools for standards like PCI-DSS and GDPR, SDK.finance provides advanced security features, minimizing compliance risks and protecting customer data.

Companies looking to improve their operations should focus on modernizing their payment infrastructure to achieve benefits such as faster transactions, lower costs and greater customer satisfaction.

Using SDK.finance’s API-driven Platform allows businesses to move away from outdated systems and adopt a robust, flexible and secure payment ecosystem. This transition not only secures operations for the future, but also enables businesses to innovate and grow in a rapidly changing market.