Do you know that the global card market is expected to reach $65 billion by 2025? Card issuing has become a critical component of the financial industry, enabling customers to make purchases or withdraw cash conveniently while generating revenue for issuers through interest charges and fees.

The world of money transfer has changed dramatically in recent years, and one of the main drivers of this change is the emergence of card issuing. In this article, we explore what card issuing process is, how it works, and the benefits for FinTech companies.

What is card issuing?

Card issuers, also called issuing banks, are financial institutions responsible for providing credit and debit cards to cardholders. These issuers work on behalf of major credit card companies such as American Express, Discover, Visa and Mastercard. While some credit card networks provide cards directly to cardholders, issuing banks typically act as intermediaries, managing cardholder accounts and issuing cards to the respective account holders.

Card issuance requires direct access to card schemes such as Mastercard or UnionPay. Joining a card scheme can be a time-consuming and costly process for businesses and fintechs, requiring regulatory compliance and reporting, as well as an in-depth knowledge of the relevant processes of an ever-changing payments industry. This often requires a significant investment of time, resources and expertise to successfully navigate the relevant processes and regulations. For companies looking to implement card payment programmes, this is often more than they bargained for.

How do card issuers work?

In simple terms, card issuing refers to the process by which a financial institution provides credit or debit cards to its customers.

These cards can then be used to make purchases or access funds at an ATM. While this sounds like a straightforward process, there are many complex systems and regulations involved that make it all possible.

At the heart of card issuing is the virtual cards network.

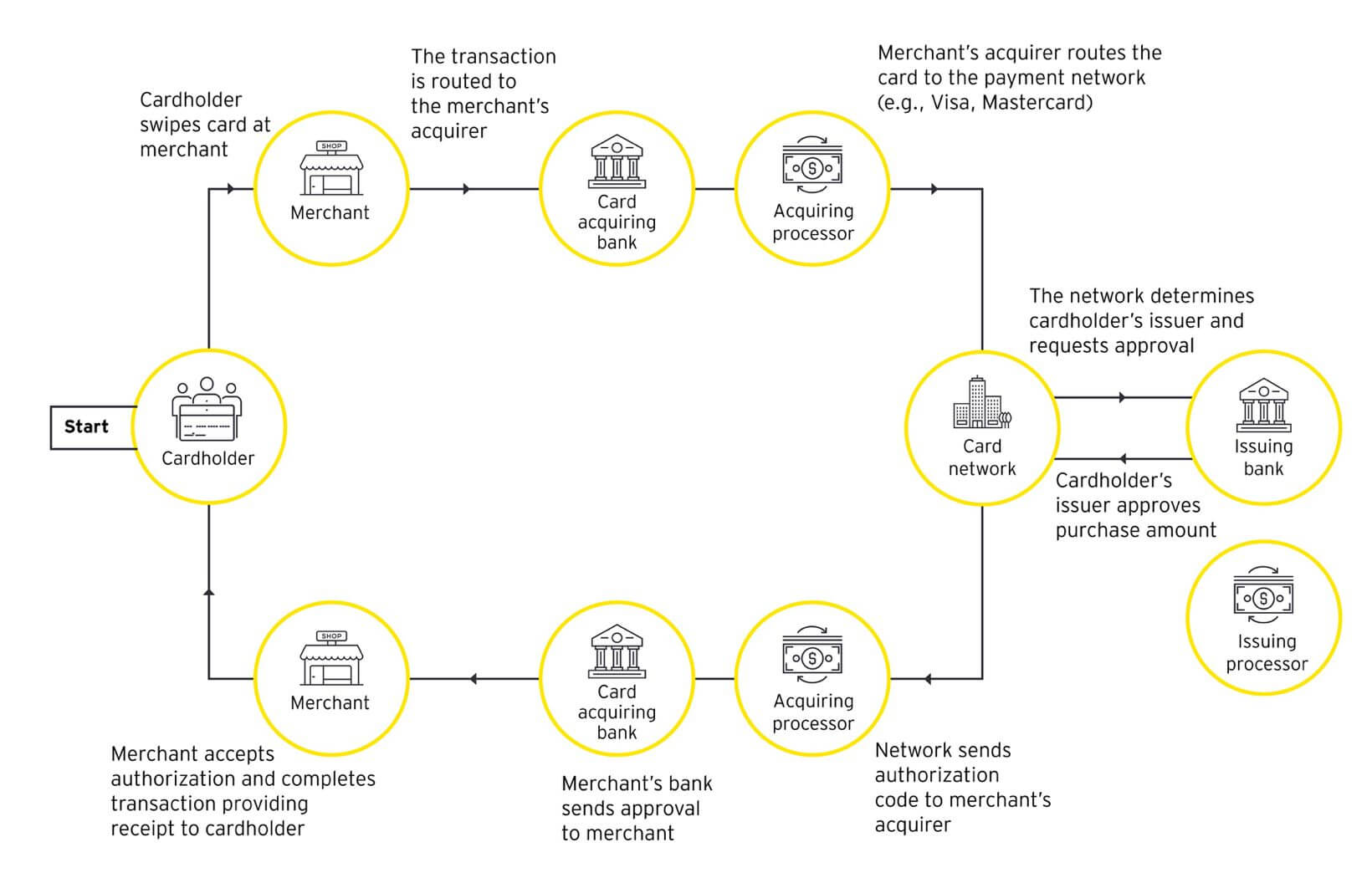

A card network is a system that allows different banks and financial institutions to communicate with each other when facilitate transactions.

When a customer makes a purchase with their credit or debit card, the transaction data is sent to the card network, which then routes the request to the appropriate bank or financial institution. This process takes only a few seconds, so the transaction can be processed quickly and securely.

Card transaction life cycle

Source: EY

The card issuer’s role is to provide the customer with the physical card, along with the associated account information and access to the card network.

When a customer applies for a credit or debit card, the card issuer typically conducts a credit check to determine the customer’s creditworthiness. If the application is approved, the issuer sends the customer a physical card along with instructions on how to activate the card. Once activated, the customer can use the card for purchases or to withdraw cash at an ATM.

The card issuer not only provides the physical card, but also manages the customer’s account and deals with any problems that may arise, such as fraud or disputed transactions. He is responsible for ensuring that the card is secure and that the customer’s personal and financial information is protected. Explore the key steps on how to launch a card programme and explore a solution to accelerate this process.

Card issuers vs. card schemes

Card issuers and card schemes (often referred to as card networks) are both important players in the credit and debit card industry, but they have different roles.

While credit card issuers are responsible for establishing and maintaining the accounts associated with the cards, card schemes are payment networks that connect card issuers and merchants and ensure the processing of transactions between different banks and merchants and the secure and efficient transfer of funds. Examples of card schemes include Visa, Mastercard, and American Express.

Card schemes (or card networks) specify a set of rules and policies that govern the use of their networks, including standards for card security, data processing, and dispute resolution.

Credit card issuers also charge fees and interest on outstanding balances and may earn revenue from the sale of transaction data to third parties.

The difference between card issuers and card networks

| Feature | Card issuers | Card networks |

| Definition | Financial institutions that issue credit/debit cards to consumers | Networks that process card transactions between merchants, card issuers and banks |

| Examples | Chase, Citi, Amex | Visa, Mastercard, American Express |

| Primary function | Determine creditworthiness of consumers and issue cards | Facilitate and process transactions between merchants and card issuers |

| Revenue steam | Interest charges, fees on late payments and balance transfers | Transaction fees charges to merchants and card issuers |

| Card features | Vary by issuer, including rewards programs, interest rates and credit limits | Uniform across all issuers within a network |

| Acceptance | Cards accepted only by merchants who have agreements with the issuer | Cards accepted wherever the network is accepted |

To clarify the difference between card issuers and card schemes, watch the video below.

What is a card scheme?

In summary, card issuers issue credit and debit cards to customers and manage the associated accounts, while card schemes provide the networks and infrastructure needed to process transactions between cardholders and merchants.

What’s the difference between card issuers and digital card issuers?

It is a critical process in the financial industry, enabling customers to conveniently make purchases or withdraw cash while generating revenue for the issuer through interest charges and fees. The card issuer is responsible for creating and maintaining the account associated with the card, which includes monitoring the account balance, processing transactions, and sending statements to the customer.

In recent years, digital card issuing has emerged as a popular alternative to traditional card issuing. Digital card issuers are financial technology companies that offer virtual credit or debit cards that can be used for online purchases or mobile payments. Digital card issuers typically offer a faster and more convenient application process than traditional issuers, as well as more advanced security features and lower fees.

Types of cards used in the banking system

There are several types of cards that are used in the banking system: credit cards, debit cards, prepaid cards, and forex cards. Each type of card has its own unique features and benefits, making it suitable for different financial needs and situations.

Debit cards

These cards allow users to withdraw cash or make purchases using the funds available in their bank accounts. Debit cards are linked to the cardholder’s checking or savings account, and the money is deducted immediately from the account when a transaction is made.

Explore the power of card-issuing in the sharing economy with our article.

Credit cards

Credit cards are used to borrow money from the issuing bank up to a certain credit limit. The card issuer sets a credit limit for the cardholder, which represents the maximum amount of credit that can be borrowed at any given time. The cardholder can use the card to make purchases up to the credit limit and must make payments to the issuer to repay the borrowed amount, plus any applicable interest and fees.

Forex cards

Forex cards are used to hold foreign currency during international travels. These cards are usually issued by banks or authorized currency exchange companies. Forex cards have two main variants: single currency and multi-currency cards to withdraw money abroad.

Prepaid cards

These cards are similar to debit cards, but the cardholder must load funds onto the card before using it. They are not linked to a bank account and can be used like a credit or debit card. The most common example of it is prepaid gift cards.

| Debit cards | These cards are used to make payments from a linked account. |

| Credit cards | Credit cards are utilized to borrow money and make payments. |

| Forex cards | They can hold foreign currency during international travels. |

| Prepaid cards | Prepaid cards are used to load the money in advance to make transactions. |

Each type of card serves a specific purpose and provides different benefits to the cardholder.

The role of a card issuer: where do card issuers fit into the payment lifecycle?

Card issuers play a crucial role in the payment lifecycle, as they are responsible for issuing credit and debit cards to customers and managing the associated accounts. Here are some of the key functions of card issuers in the payment lifecycle:

- Card application and approval: card issuers evaluate customers’ creditworthiness, income, and other factors to determine whether to approve their application for a credit or debit card.

- Card activation: once a customer is approved for a card, the card issuer sends the physical card to the customer. The customer must then activate the card before use.

- Card usage: customers can use their cards to make purchases or withdraw cash from ATMs. The card issuer is responsible for processing these transactions and deducting the appropriate amounts from the customer’s account.

- Account management: card issuers monitor customer accounts for fraudulent activity, set credit limits, and calculate interest and fees on outstanding balances.

- Payment processing: when a customer makes a purchase, the payment is processed through a card payment network, which connects the card issuer, the merchant, and the customer’s bank. The card issuer approves or declines the transaction based on the available funds and other factors.

Card issuers are essential players in the payment lifecycle, as they issue credit and debit cards, manage customer accounts, and process payments. Their role is critical in ensuring that transactions are processed securely and efficiently.

Please note: SDK.finance is not a card issuer. It is a technological solution that enables you to issue and manage payment cards if you already have a card issuer’s license. For example, our demo video showcases how debit card issuing works using the SDK.finance platform.

Wrapping up

With the rise of digital transactions, the role of card issuing in the payments industry is becoming increasingly important. Credit and debit cards have revolutionized the way customers make purchases or access cash, while also generating revenue for issuers through fees and interest charges.

However, launching a card payment program can be challenging due to the complex card issuing process that requires compliance with regulations and access to card schemes. This is where digital card issuers come in, simplifying the process and providing a cost-effective solution for developing payment software in FinTech.