Imagine a payment experience where transfers happen in seconds rather than days, setting new standards for customer satisfaction, loyalty, and competitive edge. Today, traditional bank transfers in the UK can take days to complete—even within the country—leaving room for disruptors like Revolut and Venmo to fill the gap.

By 2027, real-time transactions are projected to reach an astounding $511 billion annually, growing at 63% each year. For businesses, this represents a massive opportunity to improve UX, boost customer loyalty, and stand out by ensuring that payments, whether for eCommerce or gig workers, are fast, reliable, and seamless. Let’s explore seven key benefits RTPs offer that go far beyond fast transactions.

How instant payments are shifting the financial landscape?

The financial services industry is experiencing a major shift as customer expectations evolve, competition intensifies, and regulatory demands increase. Real-time payments are quickly becoming a game-changer, changing the future of banking and FinTech.

Tech giants like Google, Apple, Amazon, and neobanks like Revolut and Monzo, are shaking up the financial industry. These players can easily innovate and deliver real-time financial services without the constraints of legacy systems.

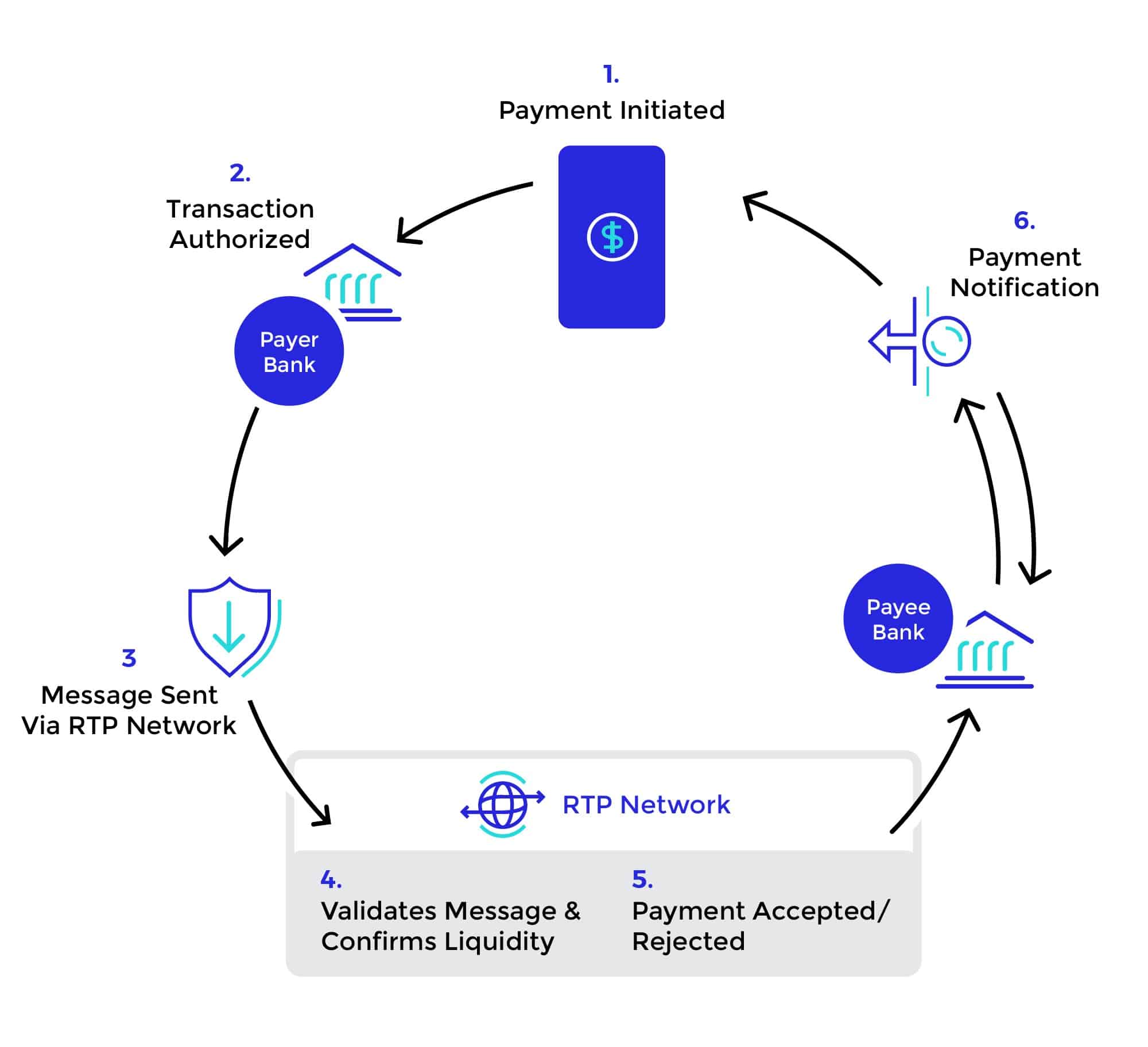

The real-time payment process itself is fairly simple:

Source: ACI Worldwide

The real-time payment (RTP) process unfolds in a series of straightforward steps that enable nearly instant transfers:

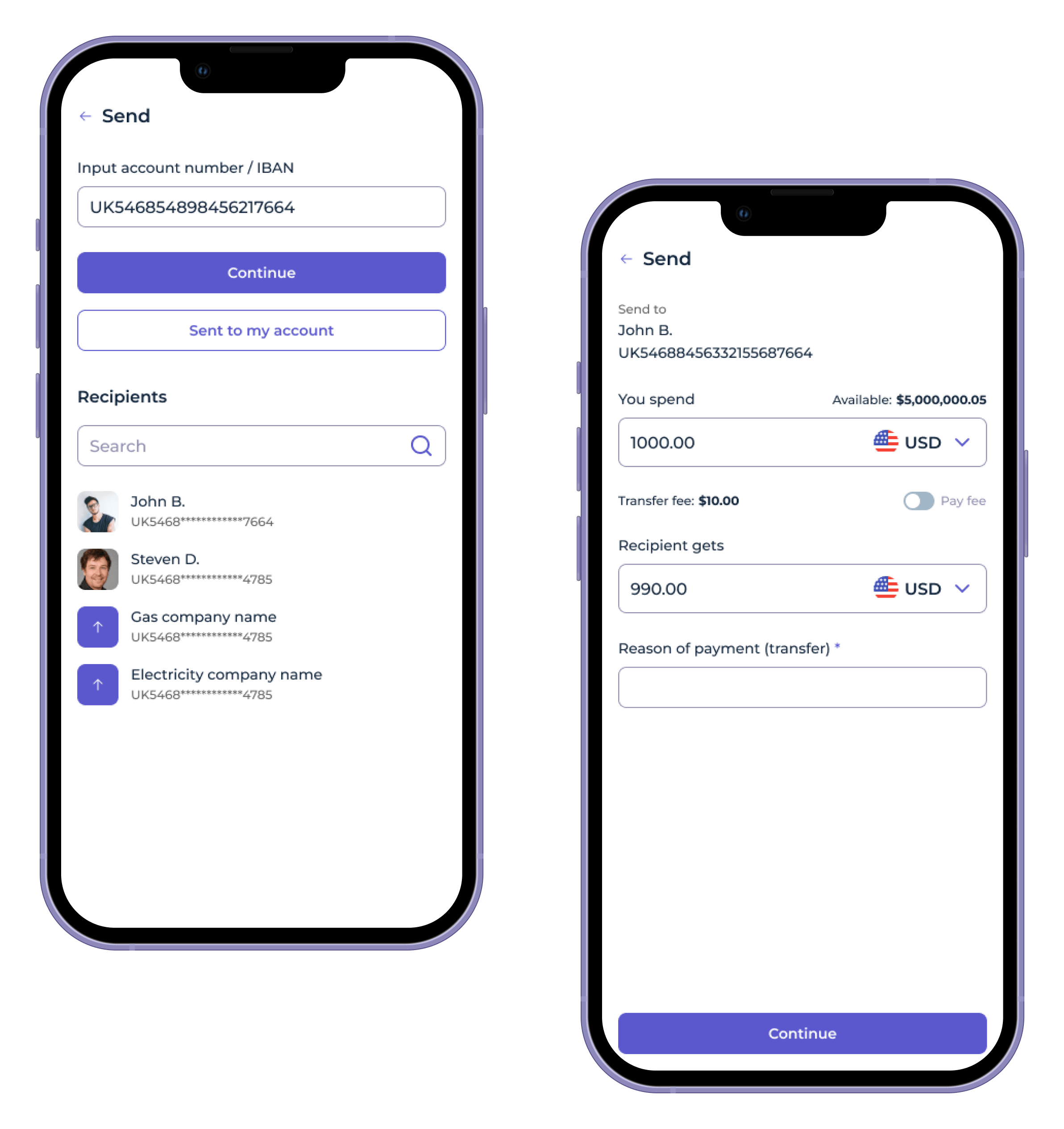

- Payment initiation: The user or business initiates the payment through their bank or payment service provider, typically via an online interface or mobile app.

- Transaction authorization: The payment request undergoes authorization, where the bank or provider verifies the user’s identity and checks account balance to ensure sufficient funds.

- Message sent via RTP network: Once authorized, a secure message containing payment details is sent through the RTP network.

- RTP network validation and liquidity check: The network validates the transaction message, confirming the details are accurate. It also checks for sufficient liquidity in the sender’s account to prevent overdrafts.

- Payment acceptance or rejection: Based on the validation and liquidity check, the payment is either accepted and processed, or rejected if conditions aren’t met.

- Payment notification: Both the sender and recipient receive notifications of the payment’s status, confirming either a successful transfer or a rejection message if issues arose.

This streamlined process minimizes delays, making funds available to the recipient within seconds.

On the other hand, traditional banks are under growing pressure to modernize their payment infrastructure just to keep up. In today’s fast-moving market, instant payments have shifted from a nice-to-have to a must-have—crucial for staying competitive and retaining customers.

How do real-time payments fuel cash flow?

The real-time payment process is designed to facilitate immediate transactions, ensuring that funds are transferred instantly between parties. This efficiency helps eliminate the delays typically associated with traditional payment methods, allowing both businesses and consumers to access their funds quickly.

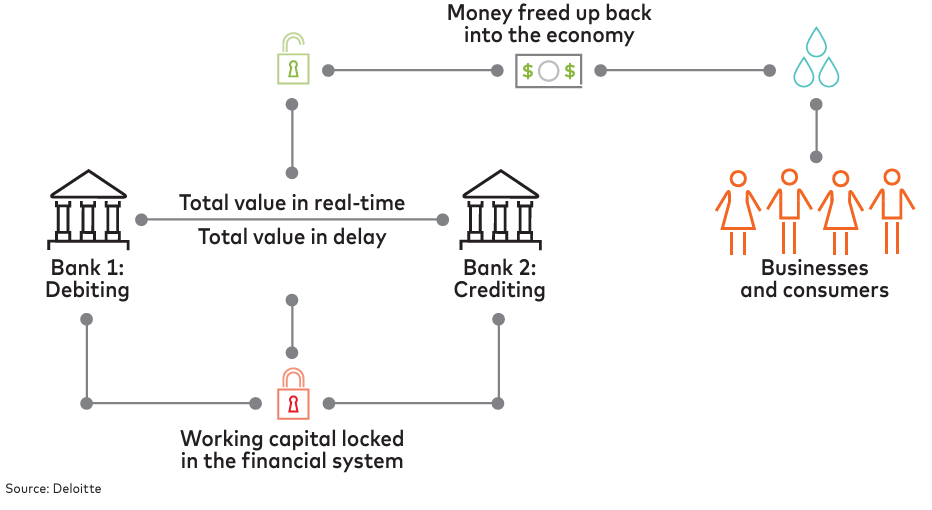

This scheme highlights the impact of real-time transactions on cash flow and economic activity, contrasting it with the effects of delayed transactions.

- Transactions between businesses and consumers: Payments occur between businesses and consumers, initiating the transfer of funds across the financial system.

- Impact of real-time transactions on cash flow: With real-time payments, funds move instantly from Bank 1 (debitor) to Bank 2 (creditor). This immediate transfer frees up working capital, enabling businesses and consumers to use their money right away, which can lead to higher spending and quicker reinvestment into the economy.

- Effect of delayed transactions: In contrast, delayed transactions lock up working capital within the financial system, as funds sit pending until the transaction is complete. This can restrict cash flow for businesses and limit consumer spending.

- Economic boost from real-time payments: Real-time transactions keep more money actively circulating, enhancing economic growth. By freeing up cash flow quickly, businesses can reinvest in inventory, operations, or new projects, while consumers are able to spend or save without delay.

The push for real-time payments isn’t just about staying competitive—it’s about unlocking a range of strategic benefits that go far beyond speed. As tech giants and neobanks set the pace, traditional banks must adapt or risk falling behind. But the shift to real-time payments offers more than just survival; it opens the door to new opportunities for growth, efficiency, and customer satisfaction.

Here are seven key benefits of integrating real-time payments:

6 Key benefits of real-time payments for business

-

New products and revenue streams

With the growing demand for instant payments, financial institutions have the opportunity to introduce premium services. For example, businesses can offer tiered pricing models for same-day or instant settlements, appealing to customers willing to pay for speed.

According to ACI Worldwide, 2023 saw a 30% increase in the adoption of real-time payments globally, with financial institutions in countries like Brazil, India, and the UK capitalizing on premium real-time services to drive additional revenue.

Real-time payments allow for the creation of entirely new products that cater to modern customer needs.

For example, fintech platforms like Square and Stripe offer instant payroll services, allowing gig economy workers to access their earnings immediately instead of waiting for traditional pay cycles.

By enabling these instant payments, companies can attract freelancers and contractors who prioritize financial flexibility.

Another example is PayPal, which introduced its instant transfer service in 2019, offering immediate access to funds for a fee, and has since expanded its user base by leveraging the demand for real-time transactions.

2. Improved risk management and fraud prevention

One of the most notable features is real-time fraud detection capabilities, which utilize machine learning algorithms to monitor transactions as they occur. This immediate analysis allows businesses to identify suspicious activities quickly and intervene before losses occur.

Additionally, real-time payments streamline Know Your Customer (KYC) processes, enabling financial institutions to verify identities and transaction histories instantly. This enhanced due diligence reduces the likelihood of fraudulent activities slipping through the cracks, ensuring compliance with regulatory standards.

3. Competitive advantage in customer acquisition and retention

Businesses that offer real-time payment options can capture demand for instant services, attracting new customers who value convenience and speed.

The improved customer experience leads to higher retention rates: companies that enhance their CX can see a 42% increase in customer retention rates compared to market averages.

For instance, e-commerce platforms that enable instant payment processing not only facilitate faster checkouts but also enhance overall customer satisfaction.

4. Cross-border transactions

Real-time payments simplify cross-border transactions, making it easier for businesses to send and receive payments internationally. Unlike traditional payment methods that often involve lengthy processing times and high fees, real-time payments enable instantaneous transactions across borders, improving the customer experience.

Wise has effectively utilized real-time payments to enhance its services and customer experiences. Wise, originally known for its low-cost international transfers, leverages a network of local bank accounts, enabling quicker and more cost-effective transactions without incurring traditional intermediary fees.

Source: Exiap

5. Strong position in the payment ecosystem

Real-time payments significantly strengthen a business’s position in the payment ecosystem by reducing reliance on third-party processors.

Real-time payments also open up partnership opportunities for traditional banks with fintechs, allowing for the development of innovative financial products. Thereby, businesses that implement real-time payment solutions may become preferred payment rails for others, driving more transactions through their systems.

6. Open banking support

Real-time payments are key to open banking, enabling easy integration with APIs that allow financial institutions and third-party developers to create innovative services. This collaboration leads to enhanced user experiences, such as personalized financial management tools that utilize real-time payment data.

Revolut is an example of a company that leverages open banking APIs to provide real-time transaction insights and budgeting features.

By connecting to users’ bank accounts, Revolut empowers customers to manage their finances more effectively and make informed spending decisions.

Challenges and considerations for implementation

Integration with legacy systems

Integrating real-time payments into older infrastructure can be complicated and expensive. Many financial institutions have outdated core systems that are not designed to handle the fast processing speeds needed for real-time payments.

Solution: Instead of replacing legacy systems all at once, gradually modernize components by adopting a microservices architecture.

Collaborating with fintech service providers or vendors that specialize in real-time payment solutions can expedite integration.

Ensuring 24/7 availability and operational resilience

Real-time payments operate continuously, meaning systems need to be available 24/7 without interruption.

Achieving this requires robust IT infrastructure, load balancing, and redundancy measures to ensure operational resilience against potential downtimes.

Solution: Cloud-based Infrastructure with cloud platforms, like AWS, offer automatic failover systems, backups, and geographical redundancy to ensure uninterrupted service.

Regulatory compliance and reporting requirements

Financial institutions must comply with multiple regulatory frameworks depending on their jurisdiction, including anti-money laundering (AML) laws, know-your-customer (KYC) requirements, and data protection standards.

Solution: Leverage AI-driven compliance tools to automate the tracking of transactions for AML, KYC, and other regulatory checks. This reduces manual effort and increases accuracy in reporting.

Future-proofing your business with real-time payments

Ready for the future: CBDCs and more

The future of payments is exciting—and unpredictable. With Central Bank Digital Currencies (CBDCs) on the horizon and other new technologies emerging, RTP gives you a solid foundation to integrate these innovations seamlessly.

Think of it like laying the tracks for high-speed trains: once you’re set up, you can welcome new digital assets like CBDCs without major overhauls.

Being ready today means you’ll stay ahead tomorrow when these innovations hit the mainstream.

Scaling up for tomorrow’s growth

As real-time payments become the new normal, transaction volumes will surge. The key to staying ahead is scalability—your payment system needs to grow with your business, capable of processing more transactions without delays.

SDK.finance’s Payment Platform provides a scalable foundation for building your own real-time payment products. With high-performance architecture, it’s designed to support seamless handling of millions—or even billions—of transactions, adapting to your business’s growth across markets. This flexibility empowers you to offer RTP capabilities tailored to your unique needs, without being limited to a fixed, one-size-fits-all solution.

Real-time payments are no longer just a competitive edge—they’re the new standard. For financial institutions and FinTechs, adopting RTPs opens up a world of opportunities, from creating new revenue streams and boosting customer satisfaction to enhancing operational efficiency and fraud prevention.

The ability to scale as your business grows and stay ahead of upcoming innovations, like CBDCs, ensures you’re future-proofing your operations for long-term success.