- Onboarding and 2FA ensure secure user access

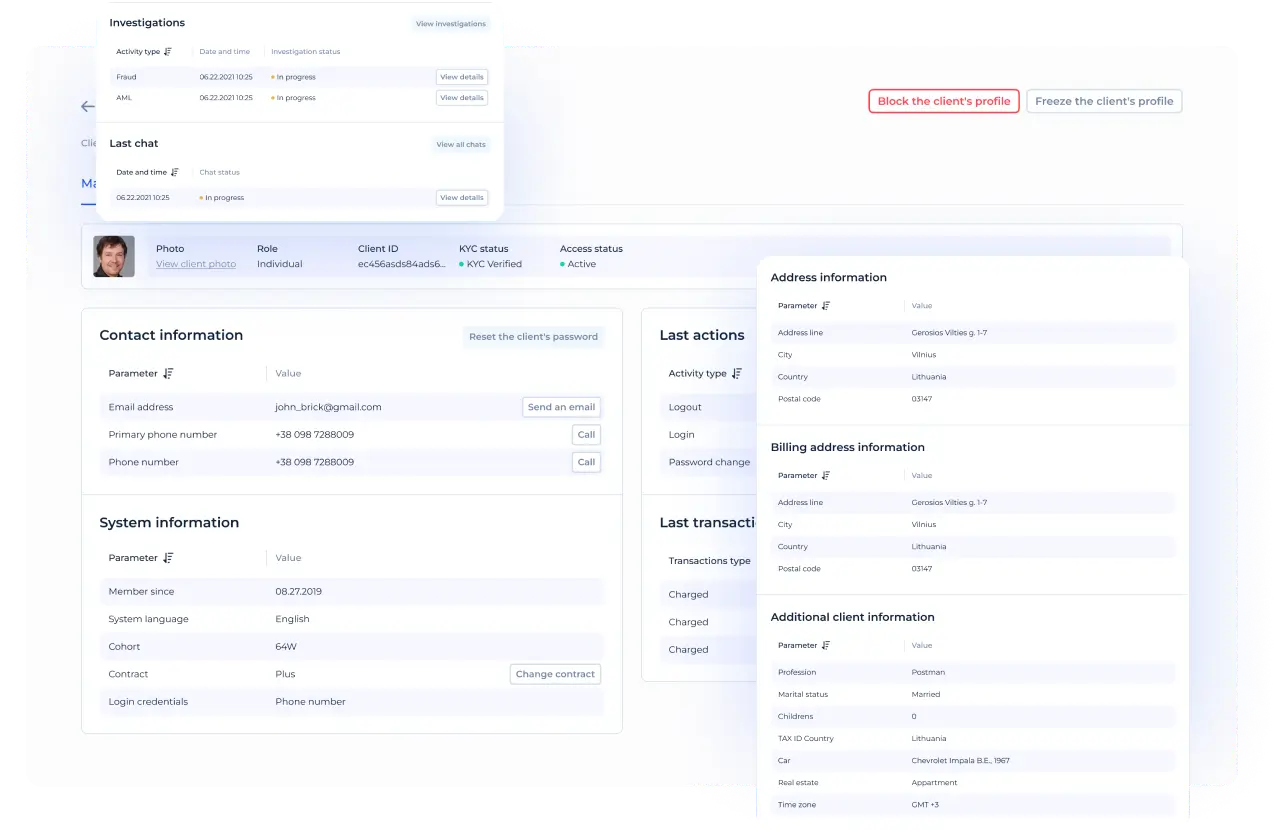

- Customizable customer profiles and settings

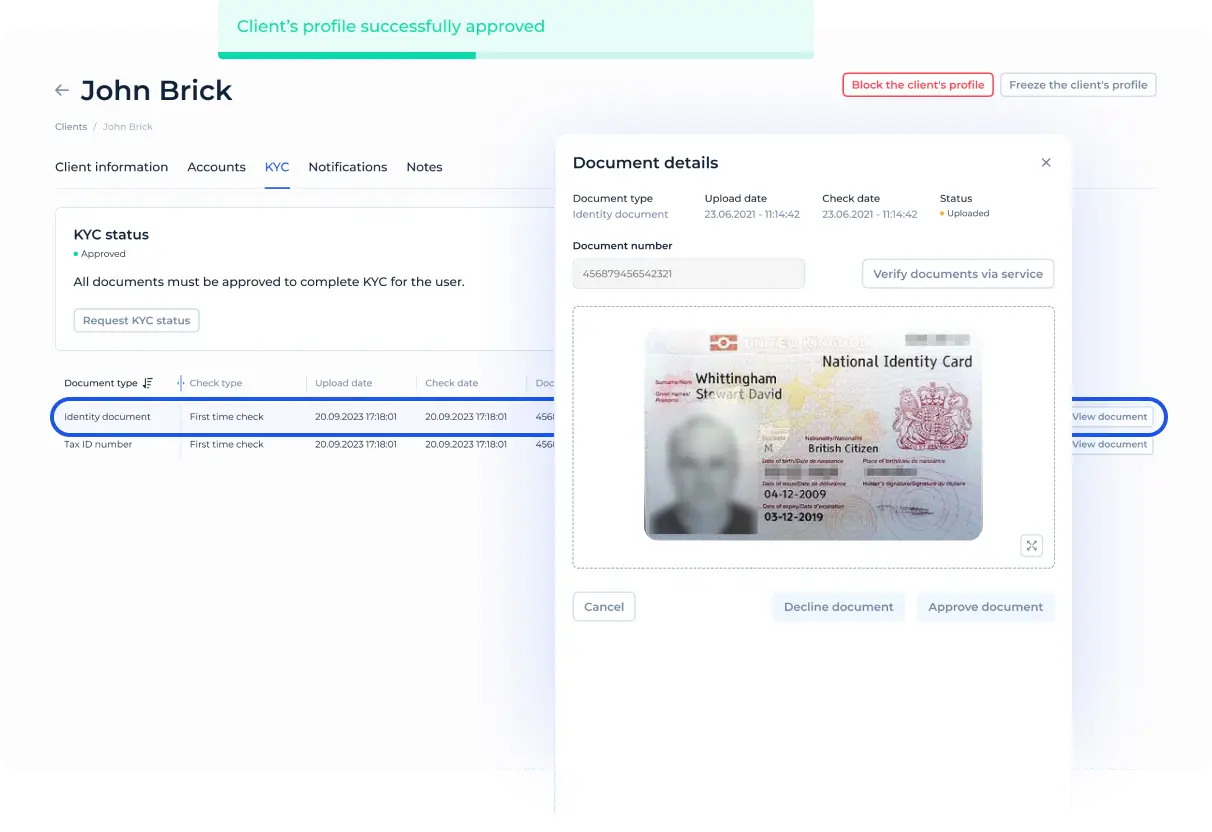

- Seamless KYC/KYB integration simplifies compliance with vendors

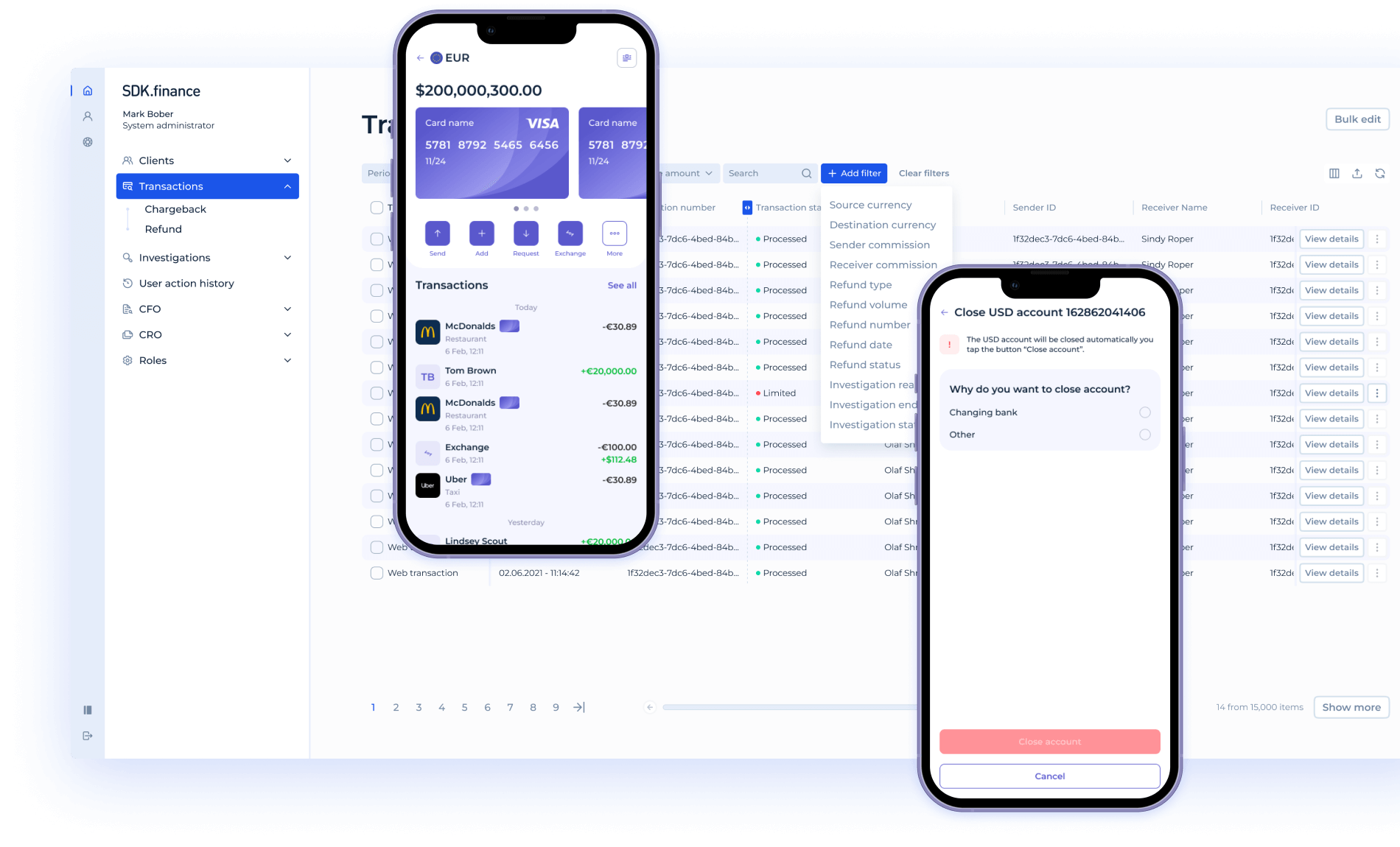

- Cards and IBANs linked to accounts

- Integrations power real-time currency exchange

- Fund transfers and payment requests

- Payment options include links and QR codes

- Cash operations are supported via cash points

- Offline payments allow transactions through POS systems or QR codes

- Online payments are simplified with easy-to-integrate solutions like Corefy

- User-friendly checkout experiences boost customer satisfaction

- Effective dispute resolution supports refunds and chargebacks

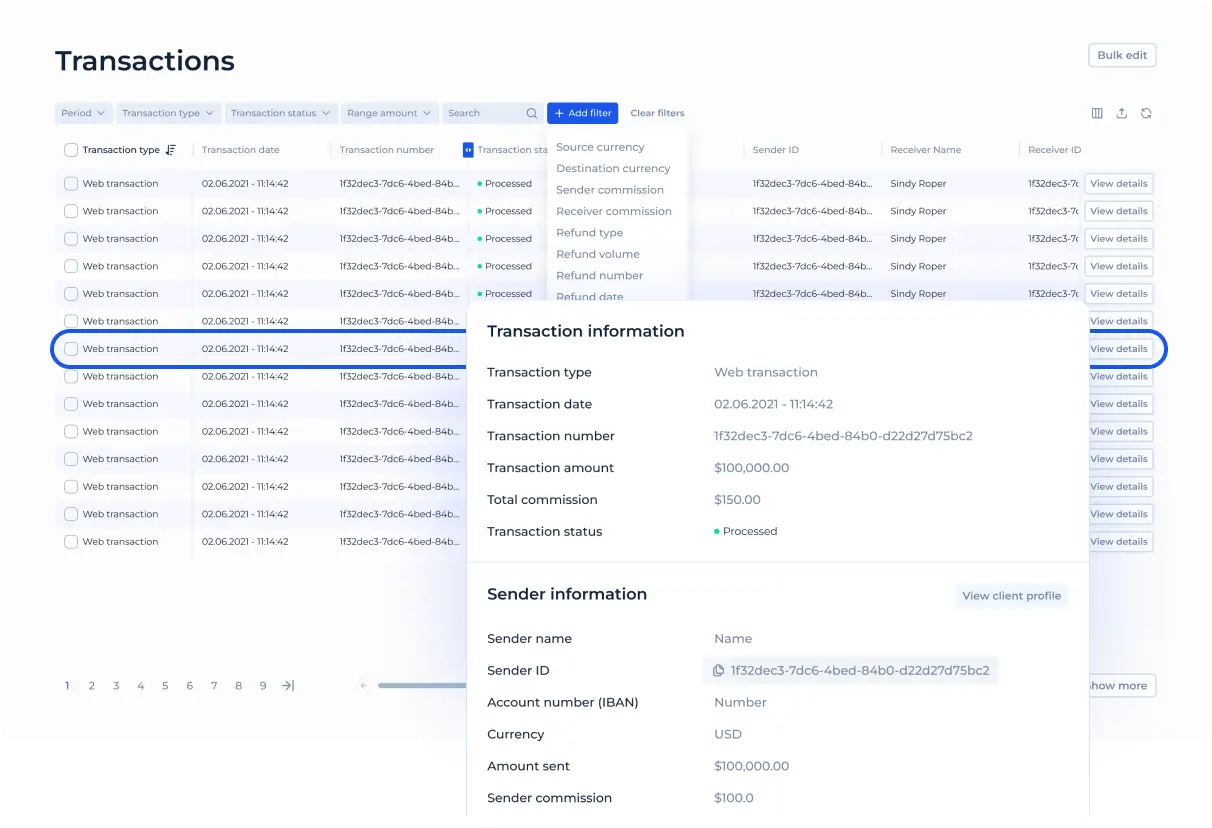

- Detailed financial reporting provides comprehensive insights

- Comprehensive currency and asset creation

- Flexible fee and limit configurations allow adjustments

- Built-in CRM and client chat enhance customer support

- Advanced transaction monitoring ensures compliance

- Integrated AML and anti-fraud tools provide security

- Action history logs support audits with features like reconciliation tracking

- Role-based access management ensures secure interactions