In recent years, the pressure on banks and financial institutions to modernise their technology foundations has intensified. Legacy systems, while reliable, often lack the flexibility and scalability needed to compete in today’s digital-first environment.

To better understand what defines a strong core in 2025, we analysed the functionality offered by leading core banking providers and combined these insights with our own experience developing core banking software at SDK.finance.

The result is this guide:

A structured overview of the must-have features financial institutions should prioritise when evaluating or upgrading their core banking systems.

Core Banking System Definition

A Core Banking System is a centralized software platform that facilitates the comprehensive management of a financial institution’s most critical business processes including customer management, account handling, lending, deposits, payments, risk management, and reporting.

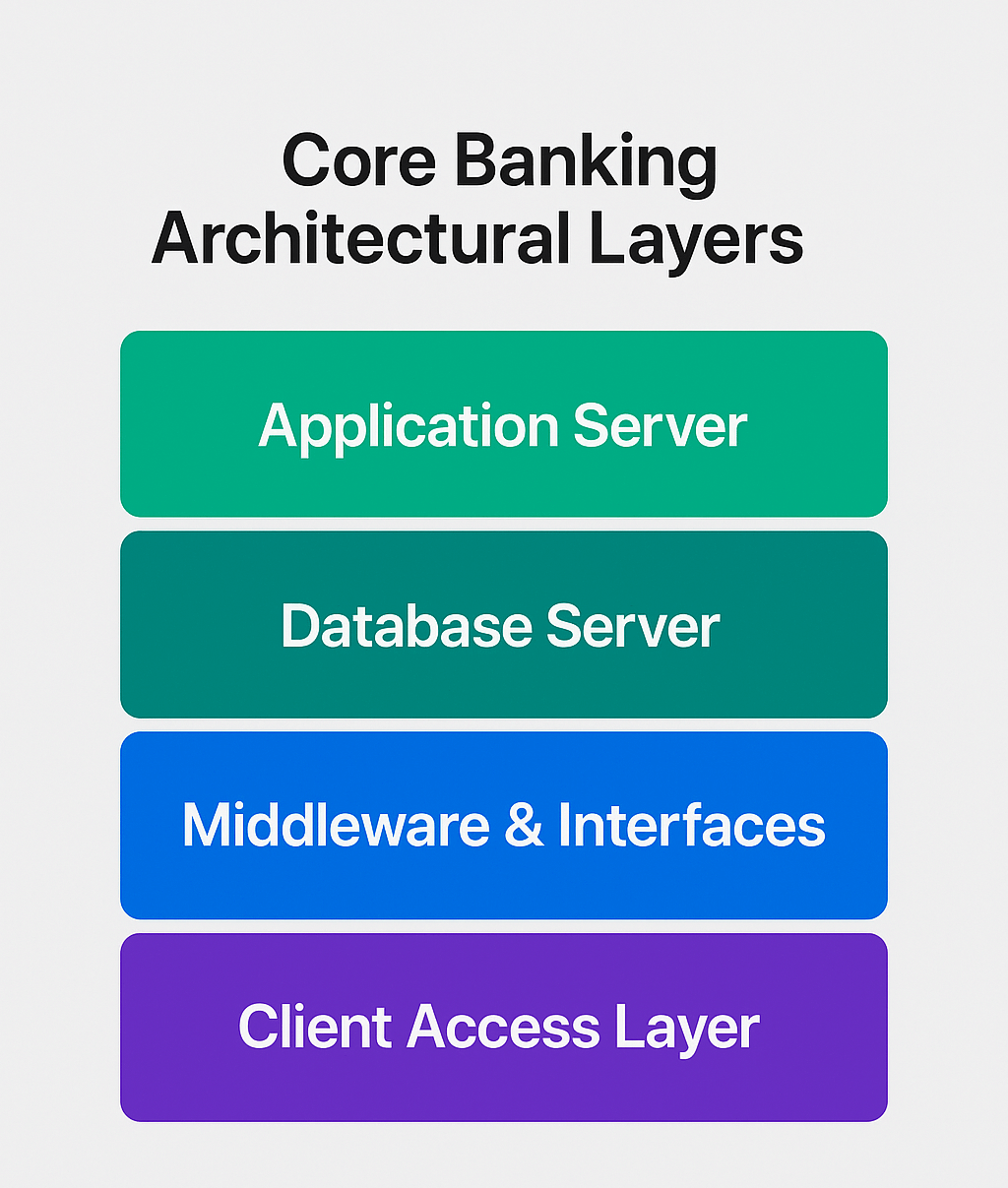

Core Banking System: Architectural Layers

| Layer | Description | Examples/Details |

|---|---|---|

| Application Server | Hosts the core business logic of the banking system. | Runs on operating systems such as UNIX, Linux, or Windows. |

| Database Server | Stores and manages transaction and record data. | Uses enterprise-grade databases like Oracle, DB2, or jBase. |

| Middleware & Interfaces | Connects the core system to external and internal networks for communication and transactions. | External: SWIFT, Reuters, card organisations, internet/mobile banking. Internal: messaging middleware for reliable communication. |

| Client Access Layers | Provides channels for users and systems to access core banking functionality. | Desktop clients, browser/web-based clients, APIs for programmatic access. |

Security is managed via a Security Management System that controls user access, authorizations, and records activities, employing encryption technologies and connection managers with SSL/TLS protocols.

Core Banking System: Functional and Business Modules

| Module Type | Module Name | Description |

|---|---|---|

| Support Modules | Customer Information File | Maintains static customer data that is shared across accounts and products. |

| General Ledger and Accounting | Automatically generates accounting entries, supports virtual accounts and structured reporting. | |

| Risk Management and Credit Scoring | Provides configurable credit scoring models, exposure monitoring, and collateral management. | |

| Workflow Management | Defines rule-based workflows to improve efficiency and compliance. | |

| Delivery Module | Manages outgoing and incoming communications including payment advices and SWIFT messages. | |

| Limit and Collateral Modules | Manage credit limits and collateral valuation aligned with credit risk policies. | |

| Business Modules | Corporate Banking | Supports trade finance: letters of credit, loans, syndicated loans, guarantees, leasing, and cash management. |

| Retail Banking | Includes teller functions, account management, mortgages, loans, cheques, standing orders, and direct debits. | |

| Treasury | Manages FX, money markets, swaps, futures, options, derivatives, and positions. | |

| Private Banking | Covers asset management, securities trading, fiduciary deposits, and portfolio management. | |

| General | Nostro account reconciliation, funds transfer, past due monitoring, tax engine, document, and image management. |

1. Cloud-native and modular architecture

Modern banking requires agility. Cloud-native and modular cores allow banks to scale quickly and adapt to change without the downtime or costs of legacy monolithic systems.

Business benefits:

-

Agility. Launch and update services faster, responding to customer demand in weeks, not months.

-

Resilience. If one module fails, the entire system doesn’t go down.

-

Cost efficiency. Cloud deployments optimise resource usage and reduce hardware overhead.

Banks without modular and cloud-ready cores risk slower innovation cycles and higher operational costs.

2. API-first connectivity

Banking is no longer isolated — it is part of a wider ecosystem of payment processors, fintech partners, and regulatory interfaces. An API-first core enables banks to integrate seamlessly with these networks.

Business benefits:

-

Regulatory readiness. Meet open banking requirements with secure data exchange.

-

Faster innovation. Plug in external services like identity verification or payments without months of development.

-

Ecosystem expansion. Offer banking-as-a-service or embedded finance by exposing APIs to partners.

Without robust APIs, financial institutions face integration bottlenecks that slow down product launches and limit growth opportunities.

3. Real-time transaction processing

Today’s customers expect instant payments and transfers. Real-time processing ensures that transactions are settled and visible immediately, not hours later.

Business benefits:

-

Customer trust. Clients value instant confirmation of activity in their accounts.

-

Fraud reduction. Suspicious behaviour can be detected and blocked in real time.

-

Operational insight. Liquidity and risk are tracked with up-to-date data.

Institutions running on batch-based systems risk falling behind in customer satisfaction and regulatory expectations as real-time payments become the norm.

4. Advanced customer information management

Customer data is often spread across multiple systems. A centralised Customer Information File (CIF) brings everything together, creating a single view of the customer.

Business benefits:

-

Personalisation. With full visibility of customer relationships, banks can recommend relevant products.

-

Efficiency. Staff spend less time reconciling data and more time serving clients.

-

Compliance. Unified records simplify KYC and AML checks.

A fragmented approach to customer data not only hampers service quality but also increases compliance risks.

5. Robust general ledger and multi-asset accounting

The general ledger underpins the financial stability of any bank. In 2025, this means supporting more than deposits and loans — including digital currencies, tokens, and loyalty points.

Business benefits:

-

Accuracy. Automated postings minimise reconciliation errors.

-

Innovation. Multi-asset support enables new offerings like crypto-linked accounts or digital wallets.

-

Transparency. Real-time reporting ensures audit and regulatory readiness.

A core without multi-asset capabilities forces institutions to bolt on separate systems, adding cost and complexity.

6. Risk management and compliance automation

With regulatory requirements tightening globally, automation of compliance and risk monitoring is essential. Manual checks are no longer sufficient for managing growing transaction volumes.

Business benefits:

-

Stronger credit decisions. Automated scoring and exposure monitoring reduce default risks.

-

Cost savings. Automated AML and transaction monitoring cut the cost of compliance.

-

Audit readiness. Built-in reporting and trails simplify supervision and inspections.

Banks that don’t embed compliance into their core face higher operational costs and greater exposure to fines.

7. Workflow and automation

Routine operations such as start-of-day and end-of-day tasks, reconciliations, and interest accruals consume significant resources in manual systems. Workflow automation takes this burden off staff.

Business benefits:

-

Efficiency. Staff can focus on higher-value tasks instead of repetitive processing.

-

Scalability. Growth in transaction volumes doesn’t require proportional increases in headcount.

-

Accuracy. Automated rules reduce human error in critical processes.

Without automated workflows, banks risk inefficiency and rising costs as they scale.

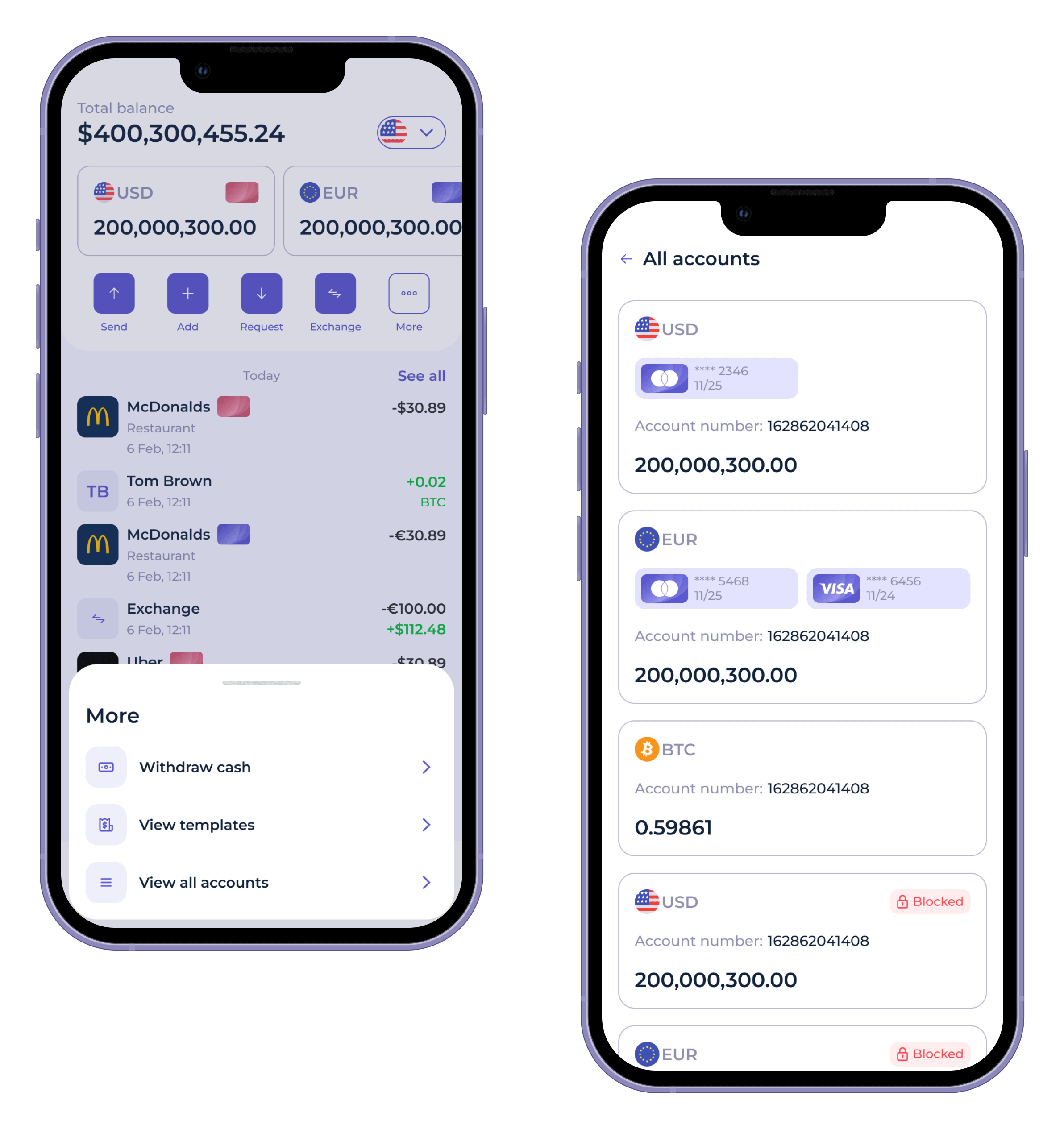

8. Multi-currency and multi-asset support

As global trade and digital assets expand, banks must handle multiple currencies and asset types within a single system. Customers increasingly expect this flexibility.

Business benefits:

-

Global reach. Serve international clients with integrated FX and cross-border support.

-

New revenue. Offer services around digital assets and multi-currency wallets.

-

Convenience. Automatic exchange rate management simplifies operations for both banks and clients.

Failing to support multi-currency and multi-asset transactions limits competitiveness in fast-growing markets.

9. Crypto and digital asset support

Digital assets are no longer a niche. By 2025, banks and fintechs face growing demand from both retail and corporate clients to hold, exchange, and spend cryptocurrencies alongside fiat. A modern core must be able to integrate crypto support without relying on external bolt-ons that fragment operations.

Business benefits:

-

New revenue streams. Services such as crypto-to-fiat conversion, custody, and crypto debit cards generate fees and attract new clients.

-

Client retention. Younger, digitally native customers increasingly expect to manage both fiat and crypto within a single wallet.

-

Innovation. The ability to integrate with crypto payment gateways and exchanges positions banks to participate in Web3 and tokenised asset markets.

-

Compliance. Built-in accounting, reconciliation, and AML checks for crypto transactions reduce regulatory risks.

Without crypto-ready cores, banks risk losing clients to fintechs and exchanges that offer integrated digital asset services. The ability to handle both traditional and digital assets within a single ledger is fast becoming a differentiator for financial institutions.

10. Security and role-based access control

Security breaches damage both finances and reputation. Role-based access control, combined with strong encryption and compliance with international standards, is essential.

Business benefits:

-

Fraud prevention. Restricting access by role reduces internal threats.

-

Operational clarity. Role-based privileges streamline responsibilities.

-

Regulatory compliance. Meeting standards like PCI DSS and ISO 27001 builds trust with regulators and clients.

Banks lacking advanced security and access controls expose themselves to operational and reputational risks.

11. Embedded analytics and reporting

Data is a bank’s most valuable resource. Embedded analytics ensure executives, risk managers, and product teams can access insights in real time.

Business benefits:

-

Decision-making. Real-time dashboards provide immediate visibility of performance.

-

Compliance. Automated reporting reduces regulatory overhead.

-

Customer insights. Analysing transaction behaviour supports targeted product design.

Institutions without advanced analytics capabilities risk slower decisions and weaker competitiveness in a data-driven market.

12. Integration-ready ecosystem

Modern cores must fit into a broader financial ecosystem. Pre-built integrations with payment networks, card issuers, and compliance providers are essential for speed and efficiency.

Business benefits:

-

Faster deployment. Reduces time spent building and testing integrations.

-

Flexibility. Enables new business models such as embedded finance and super apps.

-

Lower costs. Standardised connections reduce custom development expenses.

Banks relying only on custom integrations face longer project timelines and higher costs.

Vendor lock-in in core banking: how to avoid it

One of the less-discussed challenges in selecting core banking software is vendor lock-in. Many providers supply their platforms strictly as SaaS subscriptions, leaving banks dependent on the vendor for updates, feature requests, and integration flexibility. While this model simplifies initial deployment, it can become restrictive in the long run.

Why it matters:

-

Limited control. Banks cannot modify the core codebase to suit unique needs.

-

Rising costs. Subscription fees can increase over time.

-

Dependency risks. The vendor’s roadmap dictates future functionality.

An alternative path is the source code licence model. With full access to the software, banks own the codebase outright. This option allows:

-

Unlimited customisation without vendor approval.

-

Independence from long-term pricing or roadmap constraints.

-

Easier compliance with local regulations requiring on-premise or sovereign cloud deployments.

This is an area where SDK.finance distinguishes itself. In addition to a SaaS subscription, it offers a perpetual source code licence. Institutions using this model gain full ownership of the codebase while still benefiting from updates and warranty. For banks wary of being locked into a single vendor’s ecosystem, this option provides a strategic balance: flexibility with the assurance of ongoing support.

SaaS-only vs Source Code Licence Models in Core Banking

| Aspect | SaaS-only model | Source code licence model (e.g., SDK.finance) |

|---|---|---|

| Control | Limited – vendor controls roadmap, updates, and integrations | Full ownership – bank controls roadmap, features, integrations |

| Customisation | Restricted to vendor-approved changes | Unlimited customisation, no vendor approval required |

| Cost structure | Recurring subscription fees, risk of increases over time | One-time licence fee + optional support, predictable long-term costs |

| Compliance | Dependent on vendor’s hosting and jurisdiction | Can be deployed on-premise, private, or sovereign cloud |

| Vendor dependency | High – reliance on vendor for upgrades and fixes | Low – bank has independence, vendor provides updates/warranty |

| Time-to-market | Fast initial deployment, slower for non-standard features | Slightly longer initial setup, but faster for unique features |

Why it matters: Most providers rely heavily on SaaS models, which limit flexibility and increase dependency over time. SDK.finance is one of the few offering both approaches. Institutions that need speed and simplicity can use the PaaS model, while those seeking long-term control and independence can choose the source code license option.

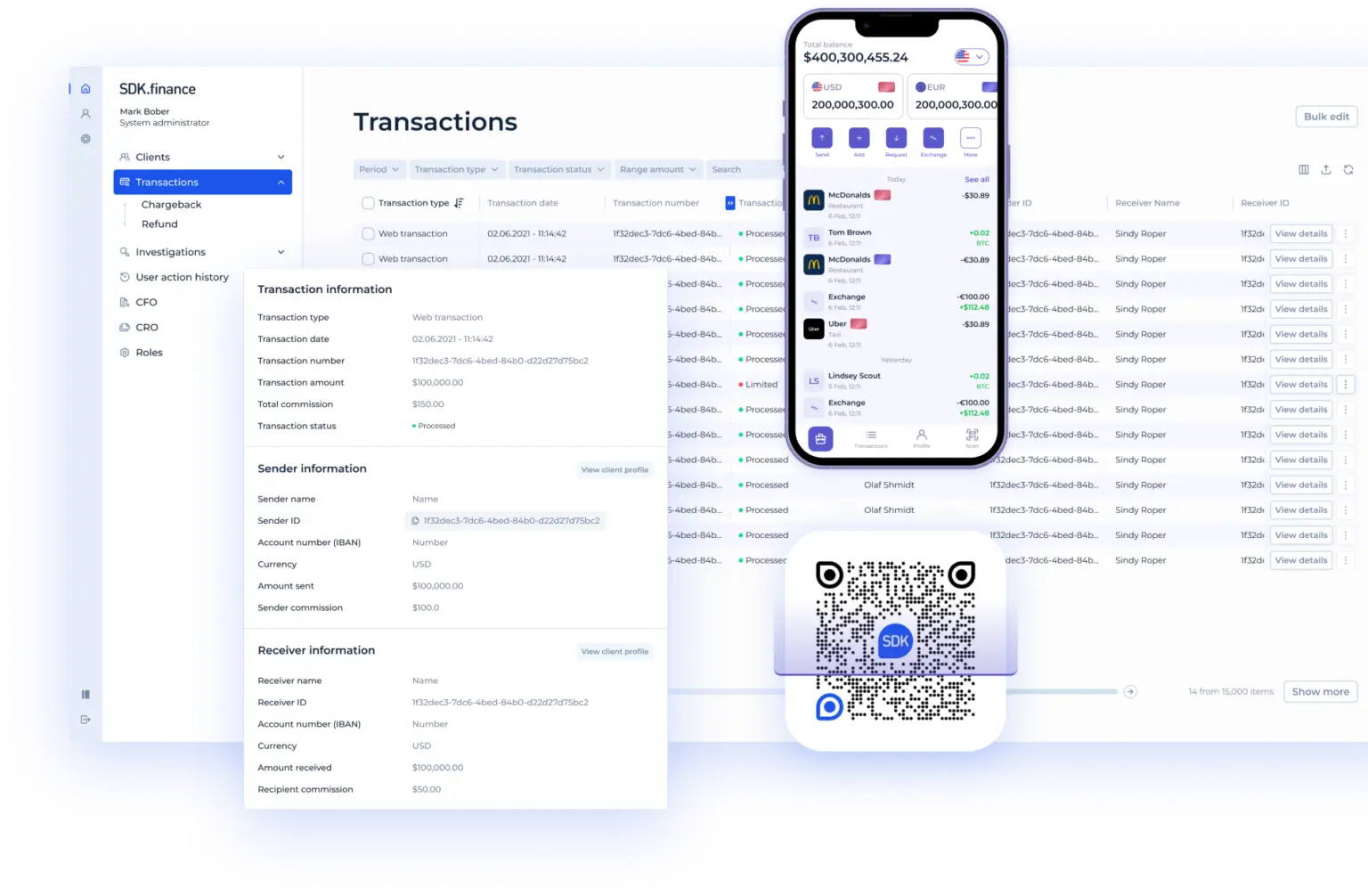

SDK.finance as a modern challenger

The analysis of leading providers shows a clear convergence on certain must-have features: cloud-native modular architecture, API-first design, real-time processing, robust ledgers, compliance automation, advanced analytics, and integration-ready ecosystems.

These capabilities define the baseline for any institution seeking to remain competitive in 2025 and beyond. The challenge for banks is not whether to modernise, but how quickly they can do it without losing ground to more agile players.

SDK.finance is a modern challenger alternative. Built with a modular, API-first architecture and a ledger capable of managing multiple asset types, SDK.finance combines the flexibility of newer entrants with the reliability expected from established providers.

With over 470 APIs, 60+ modules, PCI DSS and ISO 27001 certification, and dual delivery models (source code license or SaaS), SDK.finance provides institutions with both control and speed-to-market.

Crucially, SDK.finance is among the few providers that addresses one of the industry’s most pressing concerns: vendor lock-in. By offering a perpetual source code licence, it enables banks to fully own and customise their core without being tied to a vendor’s pricing, roadmap, or infrastructure choices. For institutions that value independence and long-term agility, this represents a meaningful alternative to the SaaS-only models dominating the market.

For banks, neobanks, and payment providers seeking to modernise their core without inheriting the cost and inertia of legacy systems, SDK.finance offers a credible path forward: a platform designed for the demands of 2025, with the adaptability to evolve further.