As our world becomes increasingly globalized, the need for faster, more efficient ways to transfer money across borders has grown exponentially. In the past, sending money overseas was a slow and cumbersome process involving banks and money transfer agents. However, with the advent of digital transformation, the global digital remittance market has undergone significant changes. In this article, we will explore the evolution of the money transfer market and how digital transformation has changed the game.

Introduction to the money transfer market

The global digital remittance market is a complex and rapidly evolving industry that encompasses a wide range of financial services. It includes both domestic and international money transfers, as well as remittances, bill payments, and foreign exchange transactions. The market is driven by the growing demand for cross-border payments from businesses and individuals alike.

Traditional methods of money transfer, such as banks and money transfer companies, have been in use for many years. However, they are often slow, expensive, and inconvenient. Banks charge high fees for international transfers, and the process can take several days to complete. Digital remittance services also charge high fees and may require the recipient to visit a physical location to receive the funds.

Spurred on by innovations in FinTech and mobile banking, the global digital remittance market has gone from an expensive but necessary service with hidden fees to a mostly transparent quick, and easy one. Although many banks are still hanging onto the outdated business model, newcomers are forcing them to adapt their technology to offer competitive rates to customers worldwide.

According to Insider Intelligence, money transfer volume is expected to grow 12.58% annually to $339.87 billion in 2030, per February 2023 data from Research and Markets.

While they have been slow to respond to pressure to reduce fees, companies like TransferWise have sprung up to make money transfer as seamless and cheap as possible. Big Tech has also entered the market. Apple and Facebook, for example, already offer quick and easy payments between users within their ecosystems.

Challenges faced by traditional methods

Traditional methods of digital remittance services face numerous challenges, including high fees, slow transaction times, and limited accessibility. Banks and money transfer agents have traditionally dominated the market, but they are facing increasing competition from digital money transfer services.

One of the biggest challenges faced by traditional methods is the high cost of transferring money. Banks and digital remittance services charge high fees for international transfers, which can range from 5% to 10% of the transfer amount. This can be a significant burden for individuals and businesses that need to send money overseas on a regular basis.

Another challenge is the slow transaction times associated with traditional methods. Banks can take several days to process international transfers, and money transfer operators may require the recipient to visit a physical location to receive the funds. This can be inconvenient for both the sender and the recipient, particularly if they are in different time zones.

COVID-19

The public health crisis triggered by COVID-19 has accelerated existing consumer and business trends. The movement towards e-commerce, digital and contactless payments, and the cashless economy have all seen significant growth over 2020. Even though some of these behaviors will be reversed once the lockdown is lifted, the positive trajectory for future growth has been set.

The World Bank indicated that remittances to low and middle-income countries are projected to rise by 5.6% to $470 billion in 2021, following the fall in 2020. According to Dilip Ratha, the coordinator of the G7/G20 Global Remittances Working Group, quick actions that make it easier to send and receive remittances can provide much-needed support to migrants’ lives and their families. These include treating remittance services as essential and making them more accessible.

Impact of digital transformation on the money transfer market

Digital transformation has had a significant impact on the money transfer market, disrupting traditional methods and driving innovation. It has led to the emergence of new providers, as well as the expansion of existing ones.

One of the key impacts of digital transformation has been the increase in competition. With more providers in the market, customers have more choice and can select the provider that best meets their needs. This has led to a reduction in fees and an increase in the range of services offered.

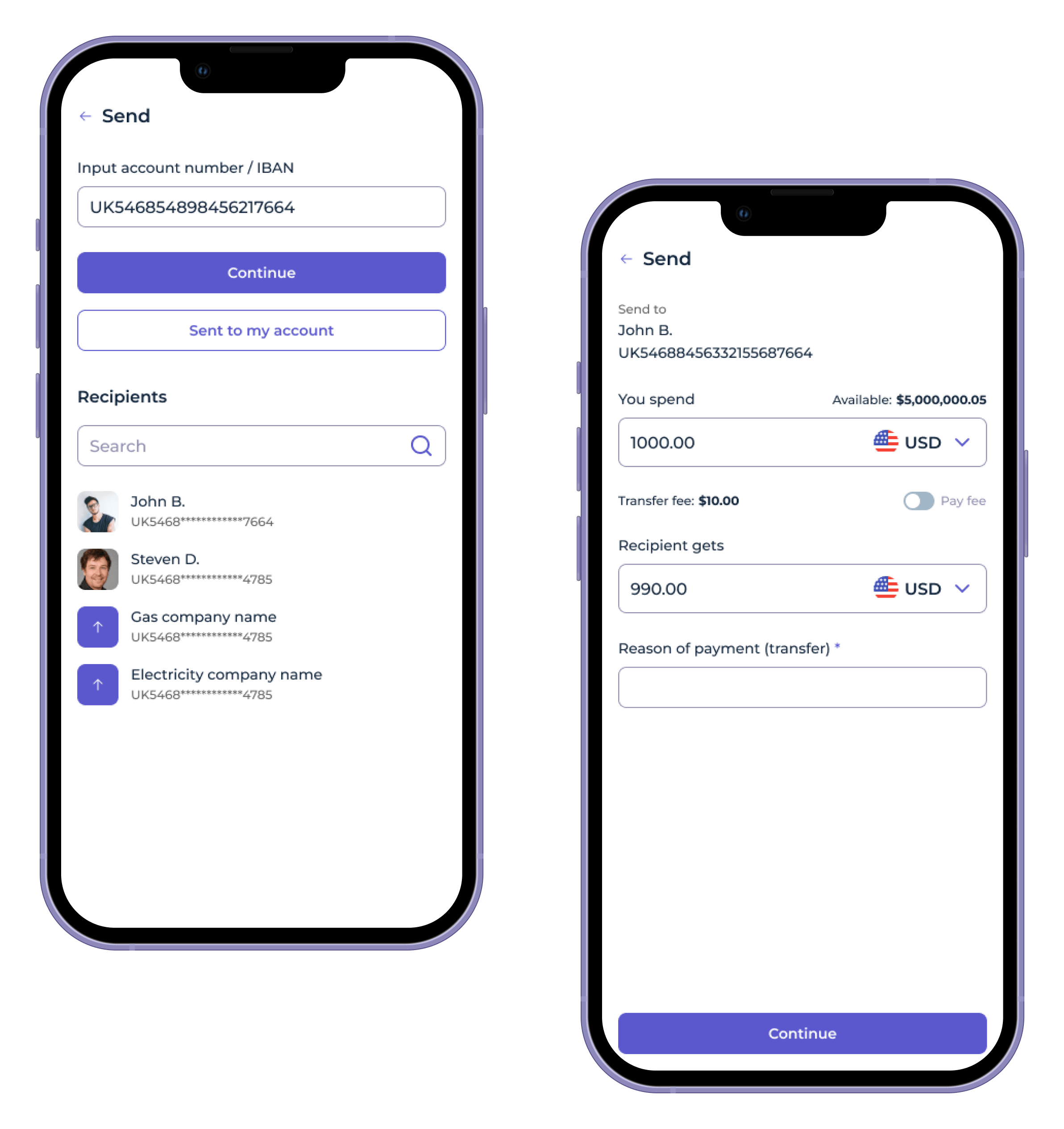

Another impact has been the rise of mobile payments. Many digital remittance services now offer mobile apps, which allow customers to send and receive money on their smartphones. This has made the process more convenient and accessible, particularly for individuals in developing countries who may not have access to traditional banking services.

Future of the money transfer market

The future of the money transfer market looks set to be dominated by digital transformation. The market is expected to continue to grow rapidly, driven by the increasing demand for cross-border payments.

One of the key trends in the market is the rise of blockchain-based transfers. Blockchain is a distributed ledger technology that allows for secure and transparent transactions without the need for intermediaries. This has the potential to revolutionize the money transfer market, reducing costs and increasing speed and security.

Another trend is the increasing use of mobile payments. As smartphone adoption continues to grow around the world, more people are turning to mobile payments as a convenient and accessible way to send and receive money.

Comparison of popular digital money transfer services

The digital money transfer market is highly competitive, with numerous players vying for market share. Some of the key players in the market include: PayPal, TransferWise, Western Union, MoneyGram, Xoom, Remitly and WorldRemit.

To help you choose the right digital money transfer service for your needs, we’ve compared some of the most popular providers below:

| Provider | Fees | Transaction Time | Countries Supported |

|---|---|---|---|

| PayPal | 2.9% + $0.30 per transaction | Instant | 200+ |

| TransferWise | 0.7% – 2.2% per transaction | 1 – 3 days | 70+ |

| Western Union | Varies | Minutes – 3 days | 200+ |

| MoneyGram | Varies | Minutes – 3 days | 200+ |

| Xoom | Varies | Minutes – 3 days | 130+ |

| Remitly | Varies | Minutes – 3 days | 50+ |

| WorldRemit | Varies | Minutes – 3 days | 150+ |

Each of these providers offers a range of services, including domestic and international transfers, mobile payments, and bill payments. They also vary in terms of fees and transaction times, so it’s important to compare providers to find the one that best meets your needs.

How do money transfer services make money?

Money transfer services can charge a fixed amount or a percentage fee that depends on the amount of money a customer wants to transfer. Unlike hidden fees charged by banks and shady services, modern software lets consumers see the full cost before making a payment. The positive trend towards transparency is an opportunity to build trust and retain customers.

The second way to generate revenue is through the spread of foreign exchange transfers. The difference between the interbank rate and that offered to a customer is what a money transfer service can earn per transaction. Providing FX as a service used to involve considerable IT infrastructure and overhead costs passed onto the consumer in the form of poor currency exchange rates.

Current money transfer software solutions drastically lower the costs of running these systems. As a result, money transfer providers can offer their customers to exchange money close to the interbank rate for further transfers.

How to start a money transfer business?

It is essential to decide on the business model, pricing, customer acquisition, and growth strategies before registering and getting a license. After completing the legal hurdles, the next step is to choose the right software partner that will enable the operation of a money transfer business. Besides front and back-office functionality, good software providers offer a great user experience on different platforms.

Developing software from scratch is a long and challenging process that requires a dedicated team and a lot of resources. Partnering with a provider to customize existing software can significantly speed up time to market, offer better security, and make the whole process a lot easier.

Conclusion

The money transfer market has undergone significant changes in recent years, driven by digital transformation. Traditional methods of money transfer are facing increasing competition from digital money transfer services, which offer faster, cheaper, and more convenient options for sending money overseas.

As the market continues to evolve, we can expect to see further innovation and disruption. Blockchain-based transfers and mobile payments are likely to become increasingly popular, and we may see the emergence of new providers and services.

If you’re looking to send money overseas, it’s important to compare providers and choose the one that best meets your needs. Look for a provider that offers low fees, fast transaction times, and robust security measures to protect your data and transactions.