An electronic money institution (EMI) is a symbol of the evolution of financial services. To operate legally, an EMI must obtain an electronic money institution license from the relevant regulatory bodies. Such institutions are best known for e-money disbursement and payment intermediation, which contribute to the total value of digital payments around $6,752,388 in 2021 and is expected to hit $10,715,390 by 2025. So, it is crucial to understand what EMI Institutions are, how they operate, and how they differ from other financial services. Electronic money, also known as e-money, is a digital equivalent of cash money stored in EMI computer systems ewallets) or banking computer systems to facilitate electronic transactions. Because of the enormous efficiency of this technology, electronic money is mostly used for electronic activities. Its value is usually determined by the same financial factors as fiat currency and can thus be converted into a tangible form. An EMI can operate only after receiving an EMI license from the relevant bodies. Unlike traditional banks, EMIs do not require a traditional bank account to facilitate transactions. It operates as a bank – but it’s important to understand – EMI is NOT a bank. Considering the limited amount of information available on the concept of EMI, most people who have conducted businesses using e-money did so without even knowing. Electronic Money Institutions (EMIs) play a crucial role in managing client funds and bank accounts. When a client deposits funds into an EMI, the institution is required to segregate these funds from its own assets. This means that the EMI must hold the client’s funds in a separate account, distinct from its own operational funds. This segregation is a critical safeguarding measure, ensuring that client funds are protected in the event of the EMI’s insolvency. EMIs are also required to maintain a separate account for each client, or a pooled account for multiple clients, with a clear and transparent record of each client’s funds. This account must be held with a credit institution, such as a bank, and must be subject to regular monitoring and reconciliation. In addition to segregating client funds, EMIs must also ensure that client accounts are properly safeguarded. This includes implementing robust security measures, such as encryption and secure authentication protocols, to protect client data and prevent unauthorized access to client accounts. The key services performed by electronic money institutions include the following: It’s also important to highlight he services that EMIs DO NOT provide: An EMI Institution license is a legal document granted by relevant regulatory bodies to an institution, authorizing the latter to operate and disburse electronic money. In establishing or setting up an electronic money institution (EMI), intending EMIs owners must obtain licensing from the FCA. When applying for an EMI license, the intended EMI must denote that the company would disburse e-money and offer allied payment services. As a result, it should include data on the company’s operations and business plan, initial capital specifications, safety measures, institutional frameworks, and internal controls, the institution’s practices and processes, business continuity measures, data protection measures, AML/CTF compliance measures, and information on shareholders and subcontracting agreements. Obtaining an EMI license requires a thorough application process, which involves submitting a comprehensive business plan, demonstrating sufficient capital and liquidity, and meeting strict regulatory requirements. The application process typically involves the following steps: Regulatory compliance: The applicant must demonstrate compliance with relevant regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements. The EMI license application process can be complex and time-consuming, requiring significant resources and expertise. It is essential for applicants to seek professional advice and guidance throughout the process. Electronic Money Institutions (EMIs) are required to maintain sufficient capital and liquidity to meet regulatory requirements. The capital requirements for EMIs vary depending on the jurisdiction and the specific activities of the institution. In the European Union (EU), EMIs are required to maintain a minimum capital requirement of €350,000. This capital must be fully paid up and unencumbered, and must be sufficient to cover the institution’s operational costs and risks. In addition to the minimum capital requirement, EMIs must also maintain a sufficient level of liquidity to meet their short-term obligations. This includes maintaining a segregated client fund account, which must be held with a credit institution and subject to regular monitoring and reconciliation. The capital and liquidity requirements for EMIs are designed to ensure that the institution is able to meet its obligations and maintain financial stability, even in times of stress or uncertainty. In 2014, the EU made over 2.1 billion e-money purchases, which grew to over 4 billion in 2018. In 2019, there were roughly 4,6 billion e-money transactions. So, what’s driving the increase? While banking institutions fuse (mix) client funds with their funds and utilize both in running their businesses (e.g., “to extend loans on their own account”), electronic money institutions must ring-fence all funds received from clients and keep them distinct from their own on “stratified accounts.” Additionally, despite an EMI possessing access to clients’ funds, it is not licensed to divert the funds into anything other than purely transactional objectives, such as e-money disbursement and repayment. With respect to deposits, electronic money institutions, unlike banks, are also not authorized to receive deposits and offer loans from funds received in exchange for e-money. And in circumstances that they do, it must be supplementary and disbursed primarily in conjunction with the fulfillment of a payment process. Before we delve into the differences between both terms, let’s understand what API, or authorized payment institution, entails. What is an authorized payment institution (API)? A Payment Institution is a class of payment gateway established under Directive 2007/64/EC, often known as the Payment Services Directive 1 (PSD1). Now, PSD2 and its national implementation by the EU Member States control the activity of payment institutions. payment transactions, such as credit transfers and direct debits via payment cards or similar devices; Now that we are familiar with both EMIs and APIs, let’s take a peek at some of the disparities between both concepts: The ability to issue e-money is the ground difference between EMIs and PIs. Only electronic money institutions are allowed to issue e-money, while PIs aren’t. At the same time, EMIs can provide all the services that PIs do (but it doesn’t mean they are automatically allowed to do so – this area is strictly regulated, so they need authorization from a national regulatory agency to provide specific kinds of payment services electronic money institutions and Payment Institutions must follow the special safeguarding measures set out in EMD2 and PSD2. Payment Institutions that provide payment initiation or account information, on the other hand, are not subject to any safeguarding obligations. Furthermore, the amount of cash an EMI institution receives for services linked to e-money disbursement and unrelated payment services cannot be held in the same safeguarded account. According to Article 4(12) of PSD2, a payment account is used to make payments in the name of one or more users of a specific payment service. Article 2(3) of Directive 2014/92/EU also states that a payment account is held in the name of one or more clients and used to perform payment transactions. In basic terms, when funds are transferred to a payment account held by a payment institution, that money must be accompanied by a specific payment transaction. Unlike an electronic money institution, a payment institution cannot store money on an account holder’s behalf. Read this article to get more information about developing a money transfer app. Authorized payment institutions have considerably curtailed start-up capital requirements than electronic money institutions since they do not store money on behalf of customers and thereby must transfer money into the account through a traceable transaction. There is a variation in the different application costs that should be paid by EMI and API aside from the start-up capital requirement and other capital requirements connected to the licensing. The European Union (EU) has established a comprehensive regulatory framework for Electronic Money Institutions (EMIs). The revised Payment Services Directive (PSD2) and the Electronic Money Directive (EMD2) provide the foundation for EMI regulation in the EU. The PSD2 sets out the requirements for payment services, including payment initiation services, account information services, and payment transactions. The EMD2 provides specific requirements for EMIs, including capital and liquidity requirements, safeguarding measures, and regulatory compliance. The EU regulatory framework aims to ensure a level playing field for EMIs, promoting competition and innovation while maintaining high standards of consumer protection and financial stability. Considering the rapid growth of digitalization and the evolution of the finance industry to meet up with this growth, it can be said for sure that electronic money institutions are here to stay. And as such, players in the industry must acclimate to recent technological tools to remain relevant. In that regard, having adaptable software payment products to tackle the growing needs of consumers is imperative. If you want to generate revenue as quickly as possible instead of spending months or years on a new project, let’s guide you through building a payment processing system based on the SDK.finance Platform. With our payment software, you can build a digital wallet, a neobank, a payment acceptance system or a money transfer service. The software is available in two variants: You can also use a dedicated team of FinTech experts with 12+ years of experience to bring your product to life with our payment Platform. Contact us to speed up the launch of your digital payment product without an exhaustive hiring process.What is EMI?

EMI is an advanced and digitally-enabled system of offering financial services across the globe. Being a financial service institution, an EMI differs from banks both in regulation and operations. In essence, an EMI is a legal entity or body that has obtained an operating license to disburse electronic money. The license allows EMI to provide the services that traditional PSPs offer, plus issue electronic money.

What is electronic money?

How does an electronic money institution work?

How EMIs work with client funds and bank accounts?

What services do EMIs provide?

EMI license explained

Although a separate approval to provide payment services is not required, the EMIs must notify FCA of the payment services they intend to provide. The “small EMI UK” option is also available in the UK, where the firm’s activities are limited to the UK and also limited by the monthly payments volume and average outstanding electronic money.

EMI license requirements and application process

Capital Requirements for EMIs

What are the advantages of EMIs for customers?

The EMI’s customers will value the convenience of electronic banking. They don’t need to go to a physical bank to transact; we can do most things from home, saving more time.

Customers may decide when to access specific financial information and when to make transfers or other operations.

Since EMIs don’t use their customers’ money to lend it, unlike banks, the customers’ funds are safe, encrypted and secured on their accounts.

Since the transactions are processed easier and faster by EMIs, it results in their being cheaper, which translates to the customers as well.

Electronic money institution vs. bank: which is better?

Electronic money institutions vs. authorised payment institutions

PIs are entities created with the primary goal of providing payment services but may also engage in other economic activities (hybrid payment institutions). They are institutions classified as self-sustained financial service providers who play an essential and critical role in the financial system.

Below are some of the key services APIs offer:

EMI vs API: Differences between electronic money institutions and payment institutions

EMI Regulation in the European Union

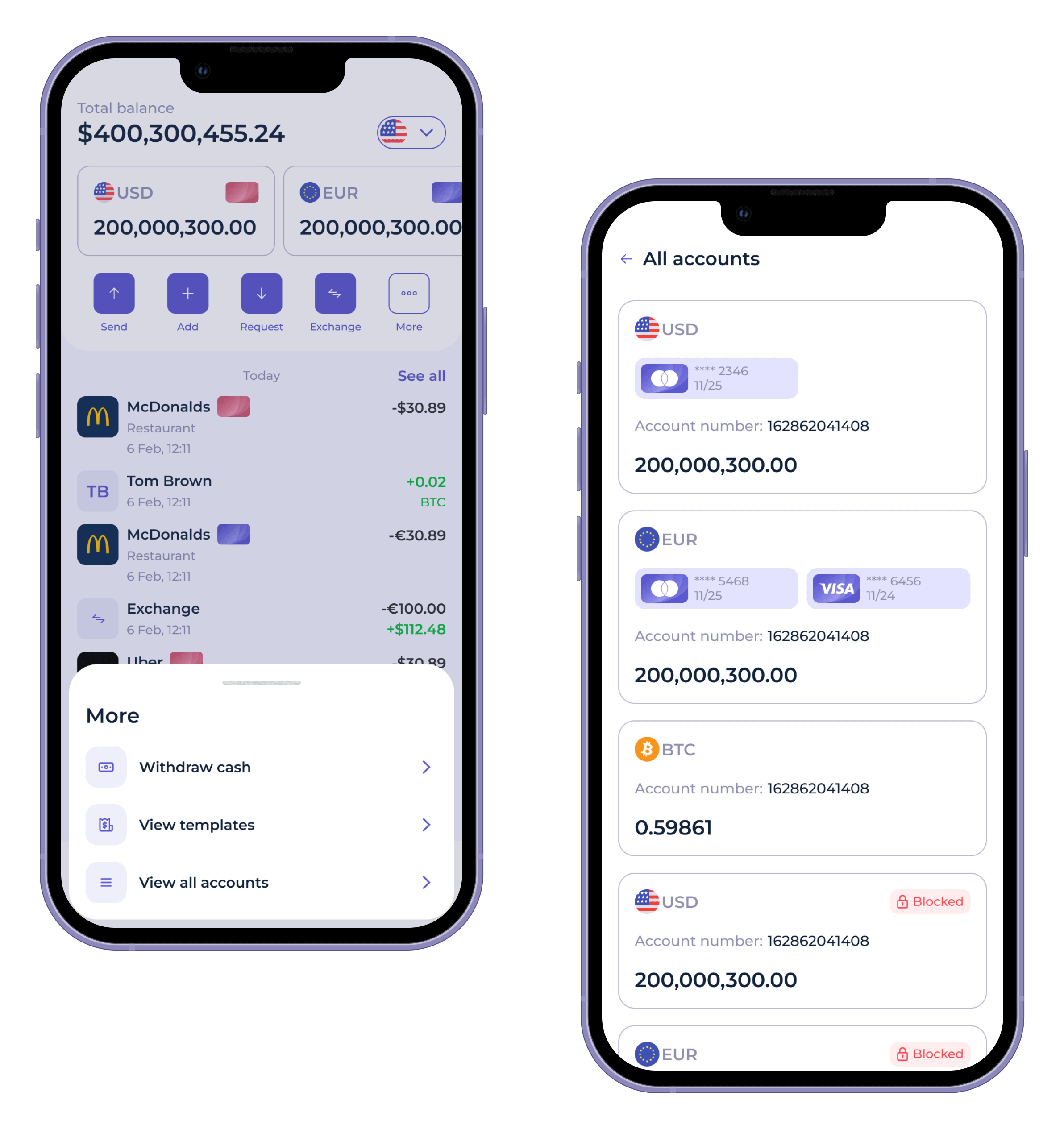

Ewallet software for EMI license holders

Electronic Money Institution (EMI) – License, Definition, Software

FAQ

What is EMI?

EMI is an advanced and digitally-enabled system of offering financial services across the globe.

Being a financial service institution, an EMI differs from banks both in regulation and operations. In essence, an EMI is a legal entity or body that has obtained an operating license to disburse electronic money. The license allows EMI to provide the services that traditional PSPs offer, plus issue electronic money.

What is electronic money?

Electronic money, also known as e-money, is a digital equivalent of cash money stored in EMI computer systems (ewallets) or banking computer systems to facilitate electronic transactions.

Its value is usually determined by the same financial factors as fiat currency and can thus be converted into a tangible form.

What services do EMIs provide?

The key services performed by electonic money institutions include the following:

- E-money issuing and distribution (customers keep their funds converted to e-money in the e-wallet (their online account) and perform payments with those funds)

- Foreign exchange services

- Direct debit or credit transfers

- Money remittance

- Payment account cash withdrawals and depositing

- Providing account information

What are the advantages of EMIs for customers?

- Easy accessibility

The EMI’s customers will value the convenience of electronic banking. They don't need to go to a physical bank to transact; we can do most things from home, saving more time.

- Payment services round the clock

Customers may decide when to access specific financial information and when to make transfers or other operations.

- No credit risk

Since EMIs don’t use their customers’ money to lend it, unlike banks, the customers’ funds are safe, encrypted and secured on their accounts.

- Lower fees

Since the transactions are processed easier and faster by EMIs, it results in their being cheaper, which translates to the customers as well.

What is an EMI license?

An EMI (Electronic Money Institution) licence allows a company to issue electronic money and provide payment services such as money transfers, digital wallets, and card issuing without being a full-fledged bank.

How to get EMI license?

To get an EMI licence, you need to apply through your national financial regulator (e.g. FCA in the UK). The process involves submitting detailed documents including a business plan, compliance policies, risk management procedures, and proof of capital. You’ll also need to demonstrate a secure IT system and appoint qualified management. Approval typically takes several months.

Navigate through article