The rise of FinTechs has brought about a revolution that is challenging traditional banking models and ushering in a new era of digital financial services. However, this opportunity also comes with complexity.

Success in the FinTech landscape requires more than just a breakthrough idea – it requires a strategic approach, extensive industry knowledge, and the right technological foundation.

Whether you’re looking to launch the next big digital bank or develop a niche fintech solution, this guide will show you how to turn your vision into a reality.

Understanding the FinTech industry

The FinTech industry has undergone a remarkable transformation in recent years, emerging as one of the most dynamic sectors in the global economy. The digital assets market is projected to grow by 17.38% in 2025, according to Statista.

As the FinTech industry continues to evolve, companies are realizing the importance of going digital to offer innovative solutions for both consumers and businesses. This presents a range of opportunities for entrepreneurs, including starting a FinTech bank, which can be challenging but also highly rewarding.

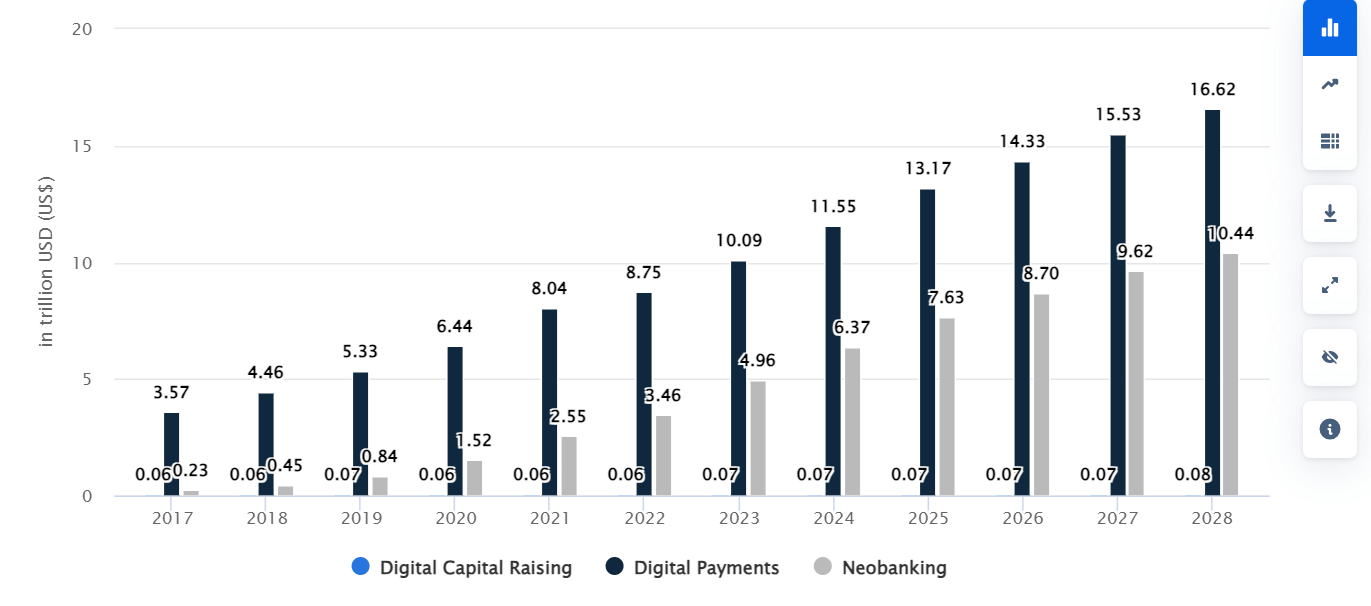

Digital payments transactions value (2017-2028)

Source: Statista

In the past 2 years, the number of new financial technology companies has tripled, providing more investment opportunities in this sector. Additionally, 75% of users now actively use FinTech products, which shows that these services are widely accepted. This is a great opportunity for entrepreneurs who want to start a financial technology company.

Market growth and trends

The FinTech industry is growing rapidly due to a few key trends that are changing the financial services sector. Digital banking is now an essential part of modern finance. It offers people great convenience and access to financial services through their smartphones and computers.

Another trend is the rise of mobile payments, that allow easy, contactless transactions. This has become very popular, especially after the COVID-19 pandemic.

The increasing adoption of cryptocurrency is also driving the growth of the FinTech industry. As more people and businesses use digital currencies, FinTech companies are creating new platforms and services to make it easier to trade, store, and use cryptocurrencies.

This trend is not only impacting companies that are starting a FinTech company, but it’s also forcing traditional financial institutions to innovate and adapt to a rapidly changing environment.

Consumer adoption and demand

The FinTech industry is growing with 75% of people using the digital payment services, showing that consumers want new, modern solutions. This demand creates opportunities for FinTech companies to develop new products and services that offer enhanced convenience, security, and personalization.

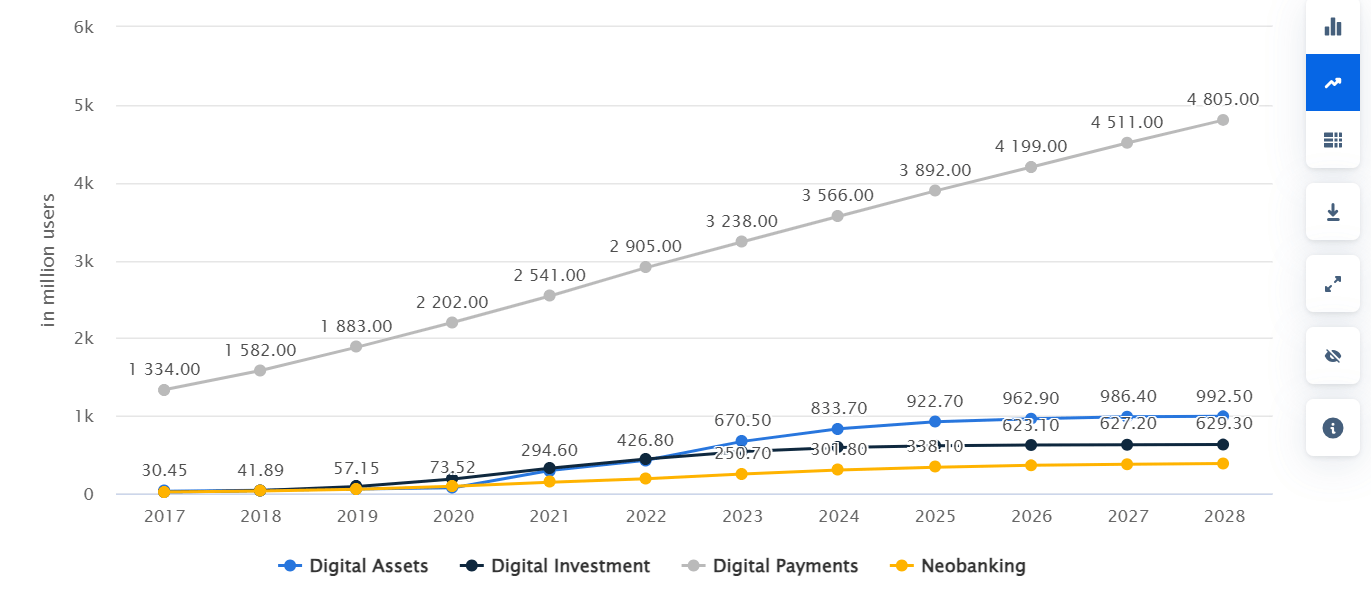

Number of digital payment users (2017-2028)

Source: Statista

Consumers are looking for easier ways to manage their finances by using a single platform that combines different financial services. FinTech companies that can provide simple and personalized experiences, along with features like tailored financial advice and automatic savings and investment tools, are well-positioned to meet this growing demand.

The FinTech industry is experiencing quick market growth due to technological advancements and changing consumer preferences. The industry is set to continue growing and providing new opportunities for innovation and expansion.

7 Steps to start a FinTech company

Starting a fintech company can be a rewarding venture, but it requires careful planning and execution. Below is a step-by-step guide to help you navigate the process of launching your own fintech startup.

1. Conduct market research

Before starting a FinTech venture, such as launching a FinTech company or a FinTech startup, it’s important to conduct market research. This involves analyzing current market trends, identifying customer pain points, and looking at the competitive landscape. This research helps refine your product idea, identify potential challenges, and validate the demand for your fintech solution.

2. Prioritize features & develop an MVP

Once your market research is complete, the next step is to prioritize the features that will define your fintech product and start developing a Minimum Viable Product (MVP). The MVP is a streamlined version of your product that includes only the most essential functionalities needed to solve the core problem you identified in your research. Using product management tools can help organize feature prioritization, track development progress, and ensure that your team stays aligned while building the MVP efficiently.

3. Ensure compliance with regulatory requirements

Fintech companies face strict regulations, so it’s crucial to ensure your business follows all applicable laws. This includes getting the right licenses, meeting Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, and complying with data protection rules like GDPR. It’s wise to consult legal experts to help navigate these complex regulations.

4. Choose the right tech stack

Selecting the appropriate technology stack is critical for the success of your fintech product. Your tech stack should include programming languages, frameworks, and tools that support the scalability, security, and performance needed for financial applications. Consider using technologies like:

- Backend: Python, Java, or Node.js for robust server-side development.

- Frontend: React.js, Angular, or Vue.js for a responsive user interface.

- Database: SQL databases like PostgreSQL for structured data and NoSQL databases like MongoDB for flexibility.

- Cloud services: AWS, Google Cloud, or Microsoft Azure for scalable infrastructure.

- Security: Implement industry-standard encryption, secure authentication mechanisms (OAuth 2.0, JWT), and compliance with data protection regulations (GDPR, PCI DSS).

Choosing the right tech stack is key to building a strong, reliable product that can meet the demands of the fintech industry and deliver a smooth user experience.

5. Build a team

Your team is one of the most critical factors in your startup’s success. Assemble a team of professionals with expertise in finance, technology, legal, and customer service. A strong team will help you navigate challenges, innovate, and deliver a high-quality product. Consider hiring experienced professionals who have a track record in the fintech industry, as well as passionate individuals who are eager to learn and grow with the company.

6. Develop your FinTech product

After assembling your team, you have two main options for developing your fintech product:

- In-house development: Building from scratch with your internal team gives you full control but is time-consuming and expensive. It’s a long-term investment that needs a lot of resources, but it allows for maximum flexibility and innovation.

- Using ready-made software: You can choose ready-made software solutions for a faster and more cost-effective launch. This option enables you to focus on customization and branding instead of building the core technology from scratch. It significantly reduces time to market and initial development costs, making it an attractive option for startups aiming to launch quickly.

7. Launch and scale your business

Once your product is developed and tested, it’s time to introduce it to the market. Start by softly launching to gather feedback from early users. Then, refine your product based on this feedback before a full-scale launch.

During this stage, startups often prepare various outreach materials, ranging from pitch decks and onboarding flows to practical networking assets, such as learning how to create a digital business card, crafting consistent email signatures, and updating branded templates for early customer communication. Begin with a soft launch to gather feedback from early users, then refine your product before moving to a full-scale release.

Focus on strategies for gaining and keeping customers, such as targeted marketing campaigns, partnerships, and continuous product improvements. As your company grows, keep evaluating and refining your business model, look into new revenue streams, and expand into new markets.

By following these steps, you’ll be well on your way to launching a successful fintech company. Whether you choose to build your product in-house or use a ready-made solution like SDK.finance, the key to success lies in thorough planning, strategic execution, and continuous innovation.

Overcoming challenges in the FinTech industry

Launching a FinTech startup is exciting, but navigating the complexities of the industry presents unique challenges. Two crucial hurdles to address are building a skilled team and navigating the ever-evolving regulatory landscape.

Navigating regulatory compliance

Navigating regulatory compliance is crucial for any FinTech company, regardless of whether you choose to start a FinTech bank or a smaller startup. Understanding and adhering to these regulations is essential for success.

- Licensing: Depending on your business model (e.g., payments, lending, investments), securing the appropriate license is crucial.

- AML and KYC: Robust AML/KYC procedures are mandatory to verify user identities and prevent financial crimes.

- Consumer protection: Regulations safeguard consumers by ensuring fair treatment and protecting their rights.

- Data privacy: Data protection laws like GDPR (EU) and CCPA (California) ensure responsible handling of customer information.

Building and maintaining a comprehensive compliance framework can be an arduous task for startups. This is where SDK.finance steps in.

They offer several ways to assist FinTech startups in meeting compliance requirements:

- Robust security measures: SDK.finance prioritizes strong security protocols to safeguard user data and financial transactions.

- Integrated compliance tools: Integrating with their platform provides access to tools that streamline AML/KYC processes and automate regulatory reporting.

- Streamlined onboarding: Their tools can expedite customer onboarding while adhering to KYC/AML regulations.

By leveraging SDK.finance’s solutions, FinTech startups can free up resources and focus on their core business functions, gaining a competitive edge.

Advantages of the PaaS model for FinTech startups

The FinTech industry thrives on innovation, but navigating the technical complexities of building a financial platform can be a significant hurdle for startups. PaaS provides a pre-built foundation, allowing startups to focus on what matters most – creating innovative products and services for their customers.

Here’s key benefits that SDK.finance’s PaaS brings to FinTech startups:

- Reduced initial investment: Forget massive upfront costs for infrastructure and development. SDK.finance’s pay-as-you-go pricing structure minimizes initial investment, allowing startups to launch with minimal financial burden.

- Scalable transaction costs: Pay only for the resources you use. Transaction-based pricing ensures cost efficiency, allowing startups to scale their spending as their user base grows.

- Fast deployment: Ditch the lengthy development cycles of building from scratch. SDK.finance’s platform enables rapid deployment, getting your FinTech solution to market faster.

- Robust and scalable infrastructure: SDK.finance provides access to a secure and scalable infrastructure, eliminating the need for startups to invest heavily in their own data centers and servers.

- Efficient scaling: As your business grows, SDK.finance’s platform scales seamlessly to accommodate increased transaction volumes – no need for costly infrastructure upgrades.

- Focus on product development: With the underlying infrastructure taken care of, startups can devote their energy and resources to developing innovative FinTech products and services.

By leveraging the PaaS model provided by SDK.finance, FinTech startups gain the advantage of a robust, secure platform, reduced costs, and faster time-to-market. The focus can then shift towards refining your core product, fostering innovation, and creating a unique and compelling customer experience that drives long-term success.

Conclusion

Building your fintech product can be approached in different ways—either through in-house development, which offers complete control but requires significant time and resources, or by leveraging ready-made solutions like SDK.finance, which allow for a faster, more cost-effective launch.