Digital banking is reshaping finance. With skyrocketing growth and millions of users, it’s clear that traditional banking is being disrupted. From seamless transactions to personalized financial management, digital banks are redefining customer experience.

This article explores the essential components, underlying technology stack, and innovative solutions required to construct a next-generation banking system design.

Digital banking industry growth

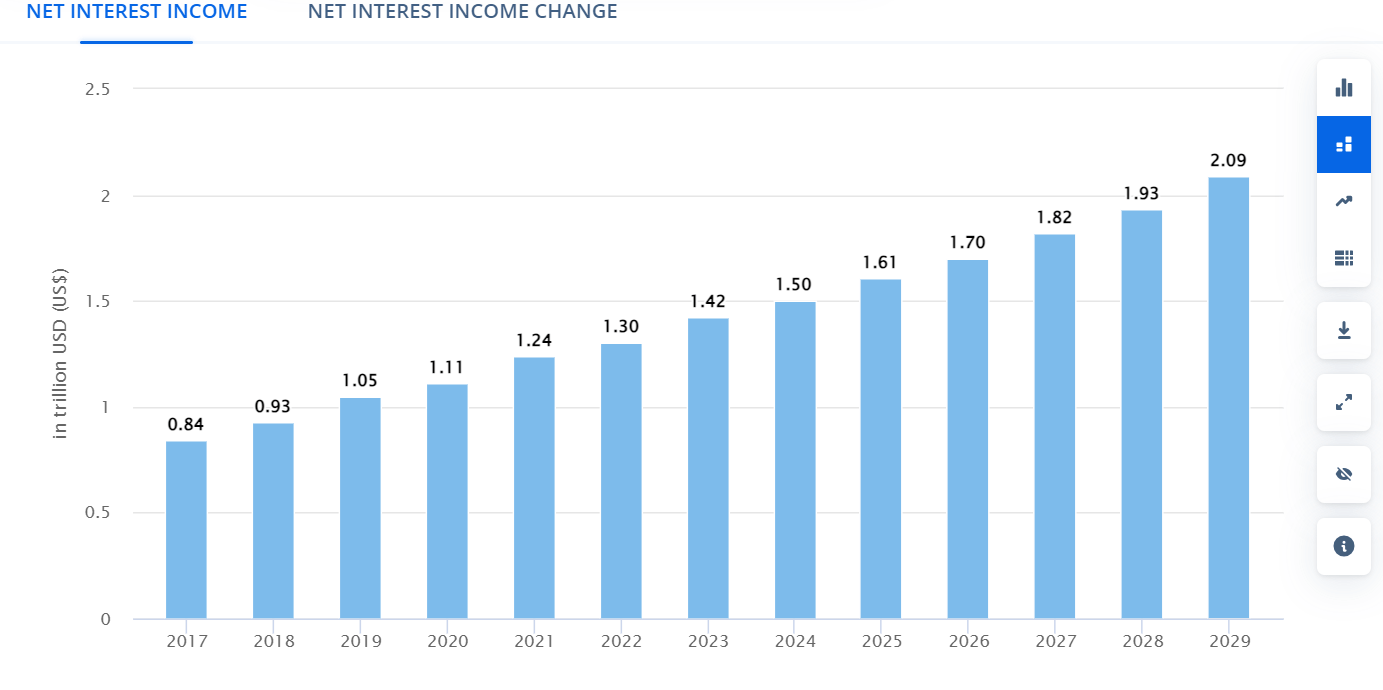

Digital banks are surging in popularity globally, driving significant market growth. According to Statista, the sector’s Net Interest Income is projected to expand at a 6.86% CAGR from 2024 to 2029, reaching a market volume of US$2.09 trillion by 2029.

Growth forecast for digital banking industry, 2017-2029

Source: Statista

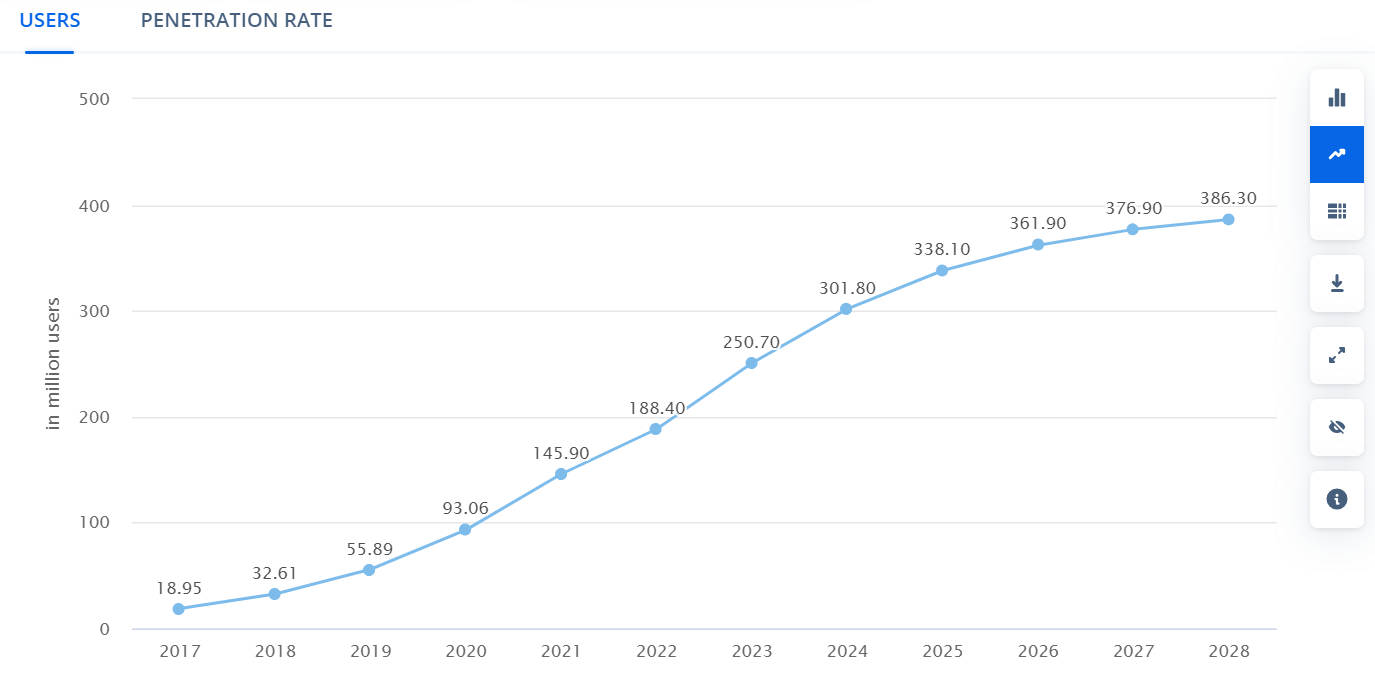

The increasing popularity of digital banking is evident in the rising number of users. There were 301 million users in 2024, and this number is expected to reach 386 million by 2028, representing a substantial 28% growth.

The number of digital banking users

The increase in digital usage reflects a larger shift towards digital banking in the finance industry. Consumers are increasingly choosing digital banking platforms over traditional methods due to their convenience and efficiency.

Source: Statista

There are several reasons for this trend. The widespread use of smartphones and high-speed internet has made banking services more accessible. Additionally, digital banks provide innovative services like real-time transaction alerts, personalized financial advice, and seamless integration with other financial tools, improving the overall user experience.

The growing adoption of digital banking has made it necessary to rethink the design of banking systems. The increasing demand for convenient, accessible, and personalized financial services has pushed banks to seek out innovative solutions. To grasp the complexities of developing a next-generation banking system design, it’s essential to define its core components.

The components of banking system design

What is a banking system?

A banking system is an intricate network of institutions and processes that facilitate financial transactions. It serves as the backbone of an economy, enabling the transfer of funds, lending, borrowing, and other financial services. At its core, a banking system comprises various components that work in tandem to deliver these services to individuals, businesses, and governments.A banking system is a complex ecosystem of connected components that work together to deliver financial services.

The system is typically structured into three primary layers: backend, middleware, and frontend. A crucial part of this architecture is the core banking system, which plays a vital role in optimizing user interface and experience, ensuring seamless personal experiences, and maintaining operational performance in the competitive financial industry.

Back end

The back end serves as the foundation of a banking system, handling core functionalities and data management. Key components include:

- API (Application Programming Interface): A set of defined protocols for building and integrating application software. In banking, APIs enable secure communication between internal systems (e.g., core banking, fraud detection) and external partners (e.g., payment gateways, fintechs).

- Data and analytics: This component encompasses data warehousing, data mining, and business intelligence. It involves collecting, storing, processing, and analyzing vast amounts of financial data (transactions, customer behavior, market trends) to extract valuable insights for risk assessment, fraud prevention, customer segmentation, and product development.

- Digital banking platform: The core system that powers online and mobile banking services. It includes modules for account management, payments, transfers, bill payments, investments, and customer support. The platform often leverages cloud technology for scalability and flexibility.

Effective software development is crucial for building and maintaining these backend functionalities, which are essential parts of a modern banking system design.

Middleware

Acting as a bridge between the backend and frontend, the middleware layer ensures smooth communication and integration. Essential components include:

- Security: This encompasses a suite of measures to protect sensitive financial data, including encryption, authentication, authorization, and fraud prevention mechanisms. It involves implementing firewalls, intrusion detection systems, and data loss prevention policies.

- Integration: This component focuses on connecting disparate systems and data sources within the bank (e.g., core banking, CRM, payment systems) and with external partners (e.g., payment processors, credit bureaus). It involves using integration platforms, data mapping, and API management to ensure seamless data flow.

- Orchestration: This involves managing and coordinating the flow of data and processes across different system components. It includes workflow automation, business process management, and service-oriented architecture to optimize operations and improve efficiency.

Front end

The front end is the customer-facing interface that enables users to interact with the banking system. It encompasses various channels such as:

- Web banking: Online access to banking services through a web browser, providing features like account overview, fund transfers, bill payments, investment management, and customer support.

- Mobile banking: Banking functionalities accessible through mobile devices, offering features similar to web banking but optimized for smaller screens and touch interfaces.

- ATMs: Self-service terminals for cash withdrawals, deposits, balance inquiries, and other transactions, often equipped with additional functionalities like bill payments and account transfers.

- Branch banking: Traditional brick-and-mortar branches for in-person customer service, offering comprehensive banking services including account opening, loans, financial advice, and complex transactions.

Online banking systems enhance customer experience through user-friendly interfaces, tailored recommendations, and attentive customer support, all key considerations in banking system design.

Tech stack for building an online banking system design

The tech stack you choose for your payment system is crucial to its success. It will determine the system’s scalability, security, performance, and overall user experience. Let’s delve into the key components and considerations.

Front-End development

- HTML, CSS, JavaScript: The foundation for building interactive user interfaces.

- Frontend frameworks: React, Angular, or Vue for creating dynamic and responsive payment pages.

Back-End development

- Programming languages: Python, Java, Ruby, Node.js, or Go for backend logic and processing.

For instance, PayPal heavily relies on Java for its high-performance transaction processing capabilities. Additionally, incorporating C++ allows for low-level resource management and fast execution times, crucial for handling massive volumes of data. Introducing a robust system to manage transaction history is essential for storing and processing transaction data efficiently.

- Frameworks: Django, Spring, Ruby on Rails, Express.js, or Gin to accelerate development.

- Databases: PostgreSQL, MySQL, MongoDB, or Cassandra for storing transaction data, user information, and payment preferences.

Stripe leverages Python’s readability and maintainability for efficient development, while the mix of databases (PostgreSQL for structured user data and transactions, Cassandra for handling high-volume, unstructured data like user behavior) provides scalability and flexibility.

- Message queues: RabbitMQ, Kafka, or Redis for handling high-volume, asynchronous transactions.

- Cloud platforms: AWS, GCP, or Azure for scalable infrastructure and managed services.

Middleware and integration

- API gateways: Apache APISIX, Kong, or Amazon API Gateway to manage API traffic and security.

Payment gateways: Stripe, PayPal, or Authorize.Net to process payments from various sources.

Looking towards the future, blockchain technology might revolutionize payment systems by enabling secure and transparent peer-to-peer transactions. Additionally, a well-defined API using technologies like REST is crucial for seamless integration with other systems and future expansion.

By focusing on technologies that facilitate frictionless data flow and a user-friendly experience (e.g., responsive front-end frameworks like React), your payment or banking system will be well-positioned for success.

Additionally, the tech stack should prioritize robust security measures like encryption, tokenization, and compliance with relevant regulations (PCI DSS) to ensure user data protection. Integrating fraud prevention tools into the system would further bolster security and user confidence.

How to build the banking system architecture?

Crafting a banking system architecture is a critical decision that lays the groundwork for your financial institution’s success. Here’s a breakdown of two main approaches to banking system design:

Building from scratch

- Define key functionality: Identify core services like account management, loans, payments, and investments.

- Design the architecture: Choose an architecture style (layered or microservices) to manage data flow and system interaction.

- Develop core components: Build the central banking engine, financial CRM, loan processing system, and payment processing modules.

- Implement robust security: Integrate robust data encryption, user authentication, and fraud detection strategies.

- Integrate with external systems: Connect to payment gateways, credit bureaus, and other critical external services.

- Build user interfaces: Develop a user-friendly online banking platform, mobile app, and integrate with any physical branches.

While building from scratch offers complete control and customization, it’s a resource-intensive process. It requires substantial time, effort, money, and a team of highly skilled developers.

Using ready-made solutions

Ready-made FinTech platforms like SDK.finance offer a pre-built foundation with essential features and built-in integrations. This approach provides several advantages:

- Faster time to market: Leverages pre-developed components, significantly reducing development time.

- Reduced costs: Saves on development resources compared to building everything from scratch.

- Improved efficiency: Integrates with various financial services and reduces development complexity.

- Scalability: Provides a foundation that can grow alongside your business needs.

For financial institutions seeking a quicker and more cost-effective approach, SDK.finance provides a ready-made FinTech Platform, allowing you to focus on building innovative banking products and services rather than reinventing the wheel.

SDK.finance FinTech Platform for banking system development

SDK.finance Platform is a ready-made solution to make your PayTech product go live in the shortest possible time. With its comprehensive suite of features and robust technological infrastructure, SDK.finance provides a solid foundation for creating and managing mobile banking app architecture.

- Extensive API framework

The Platform offers over 400 API endpoints, facilitating seamless integration and communication between various internal and external systems.

- High-performance transaction processing

One of the key strengths of the SDK.finance platform is its ability to process massive transaction volumes, handling up to 2,700 transactions per second (TPS) and beyond.

- Advanced security measures

The platform’s security features include robust data encryption, multi-factor authentication, and comprehensive fraud detection mechanisms. Additionally, the isolated cloud infrastructure ensures data privacy and protection.

- Flexible development and deployment

The SDK.finance offers over 60 modules, providing customizable options to extend its capabilities and tailor it to specific business requirements.

- Rapid time-to-market

As a ready-made solution, SDK.finance significantly reduces the time required to bring PayTech products to market. By leveraging pre-built components and features, financial institutions can quickly launch their services, gaining a competitive edge in the fast-paced digital banking landscape.

Wrapping up

With the rise of digital banks, there is a growing need for secure, scalable, and flexible IT architectures. Platforms like the SDK.finance FinTech Platform offer pre-built solutions that allow financial institutions to quickly launch innovative banking products and services.

By using extensive API frameworks, high-performance transaction processing, advanced security features, and flexible development options, financial institutions can stay competitive in the digital banking landscape and meet their customers’ increasing demands.