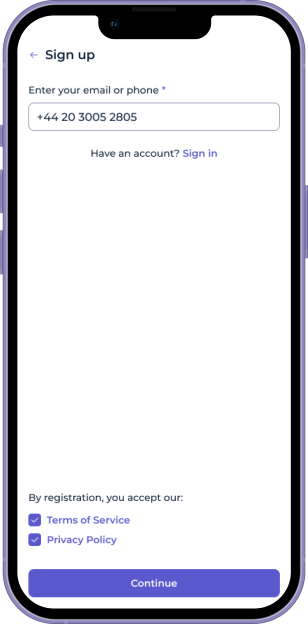

التسجيل الذاتي عبر البريد الإلكتروني أو الهاتف

مسح مرن وتحميل مرن للوثائق (مثل الهوية، وفواتير المرافق، وما إلى ذلك)

اعرف عميلك

آلي (عبر بائعين مدمجين مسبقًا)

يدوي (عبر واجهة المكتب الخلفي)

المصادقة الثنائية (2FA)

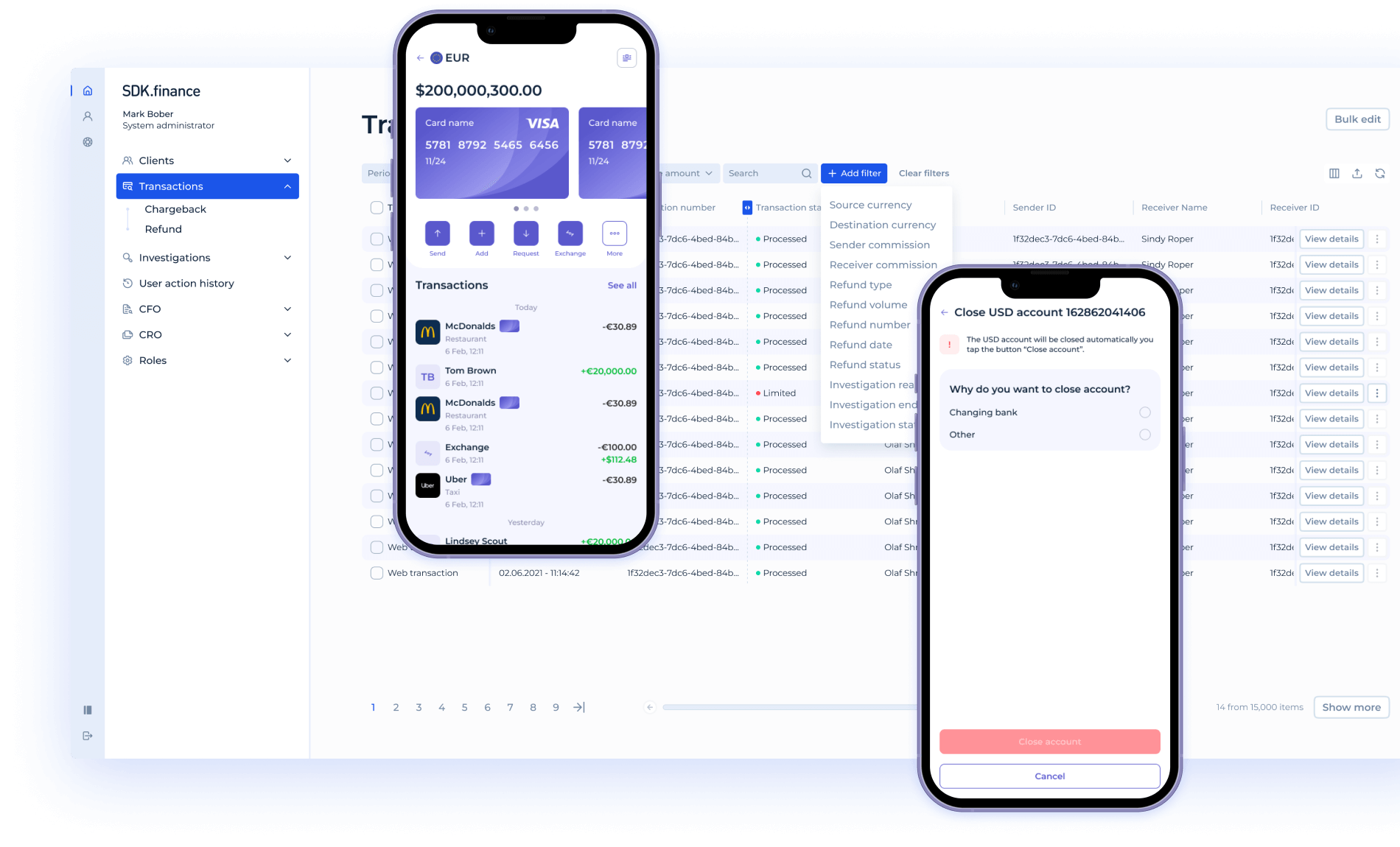

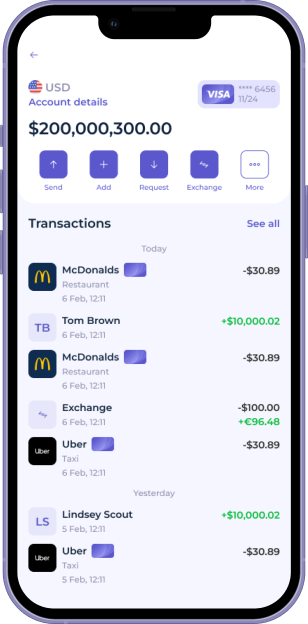

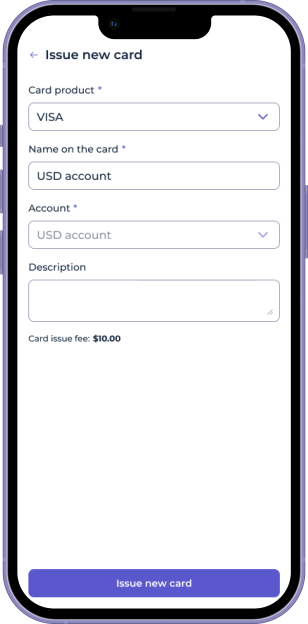

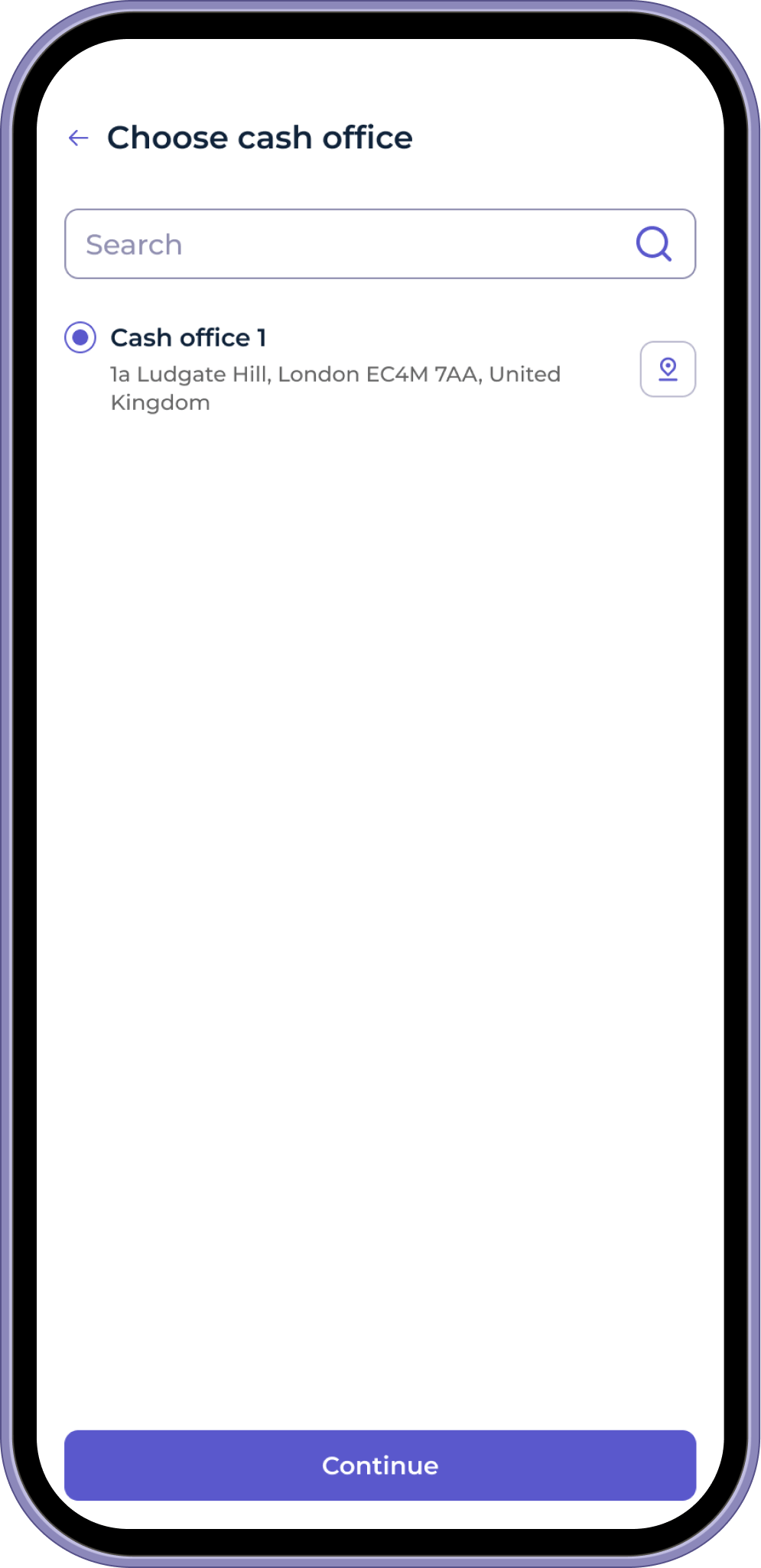

عمليات إعادة التعبئة والسحب

عمليات بوابة الدفع (عبر بائعين مدمجين مسبقًا)

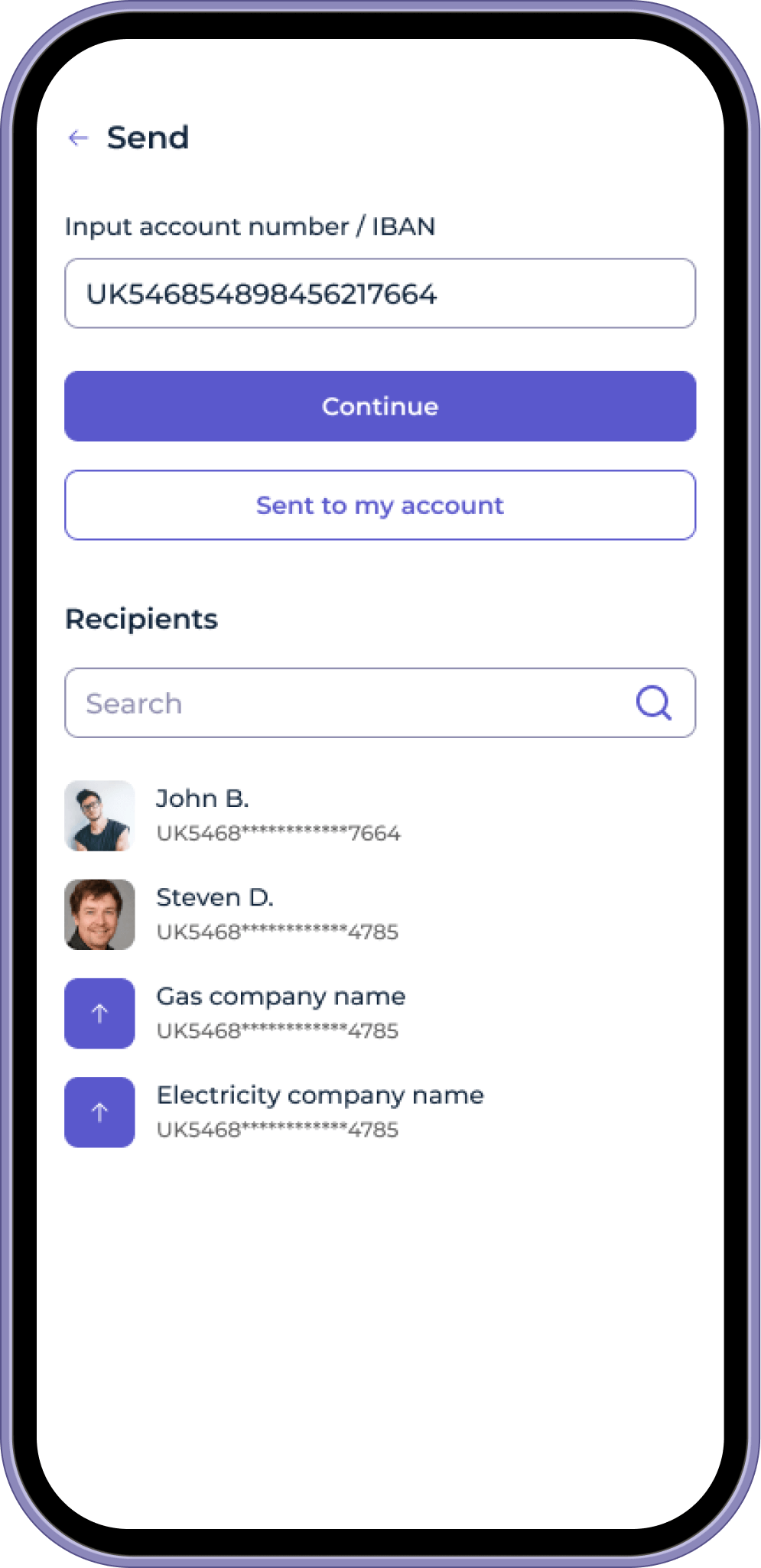

التحويلات أو المدفوعات داخل النظام

صرف العملات داخل النظام

صرف العملات الخارجية (عبر بائعين مدمجين مسبقًا)

روابط الدفع

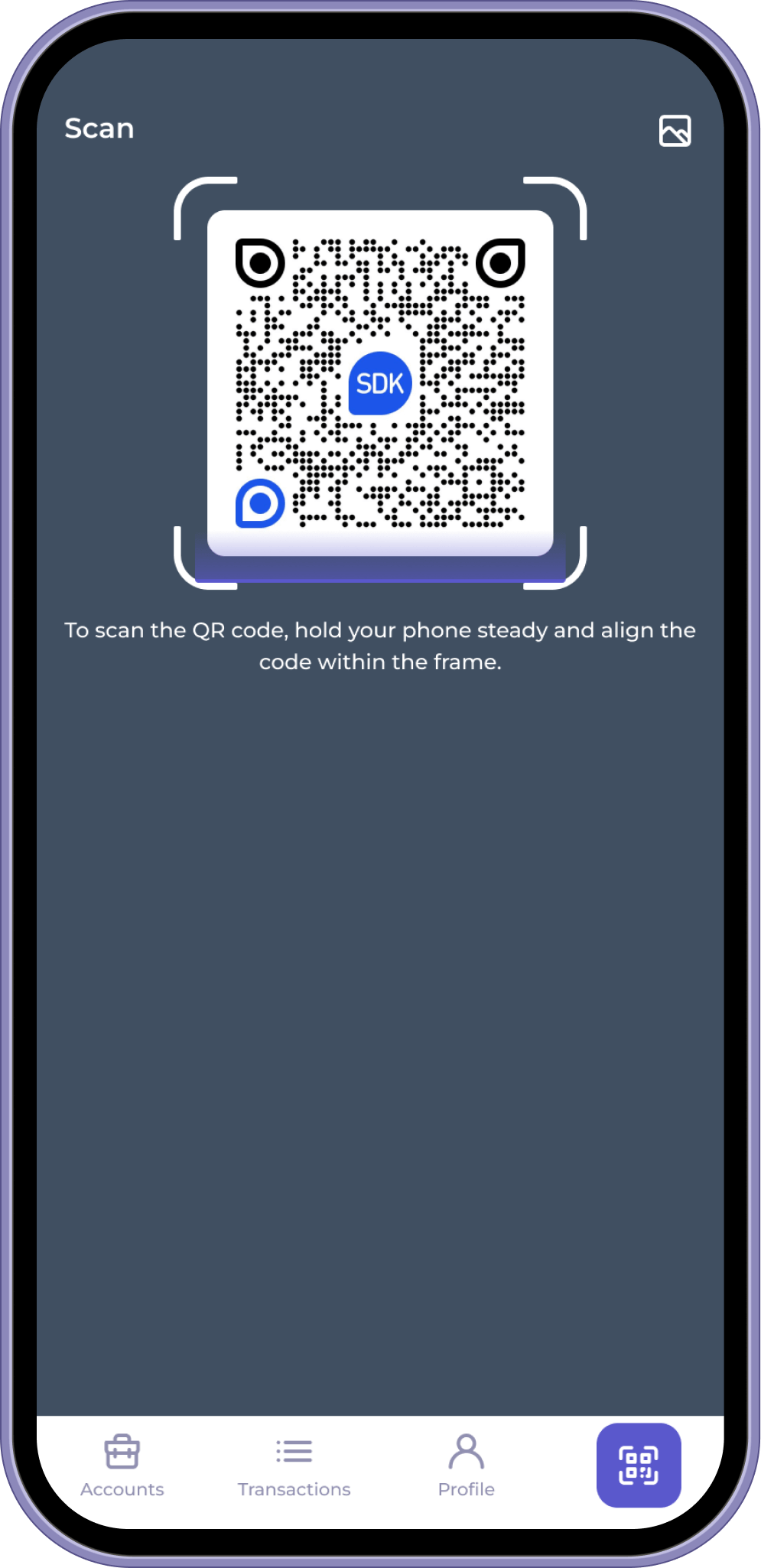

مدفوعات QR (coming soon)

الاسترداد ورد المبالغ المدفوعة (قريبًا) (coming soon)

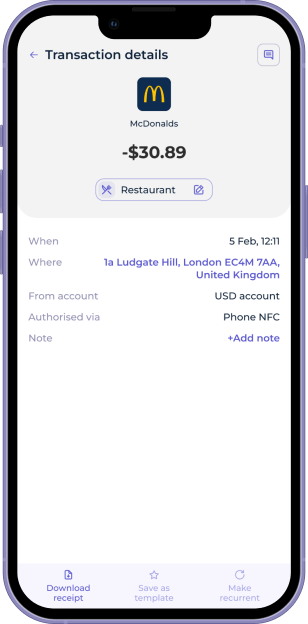

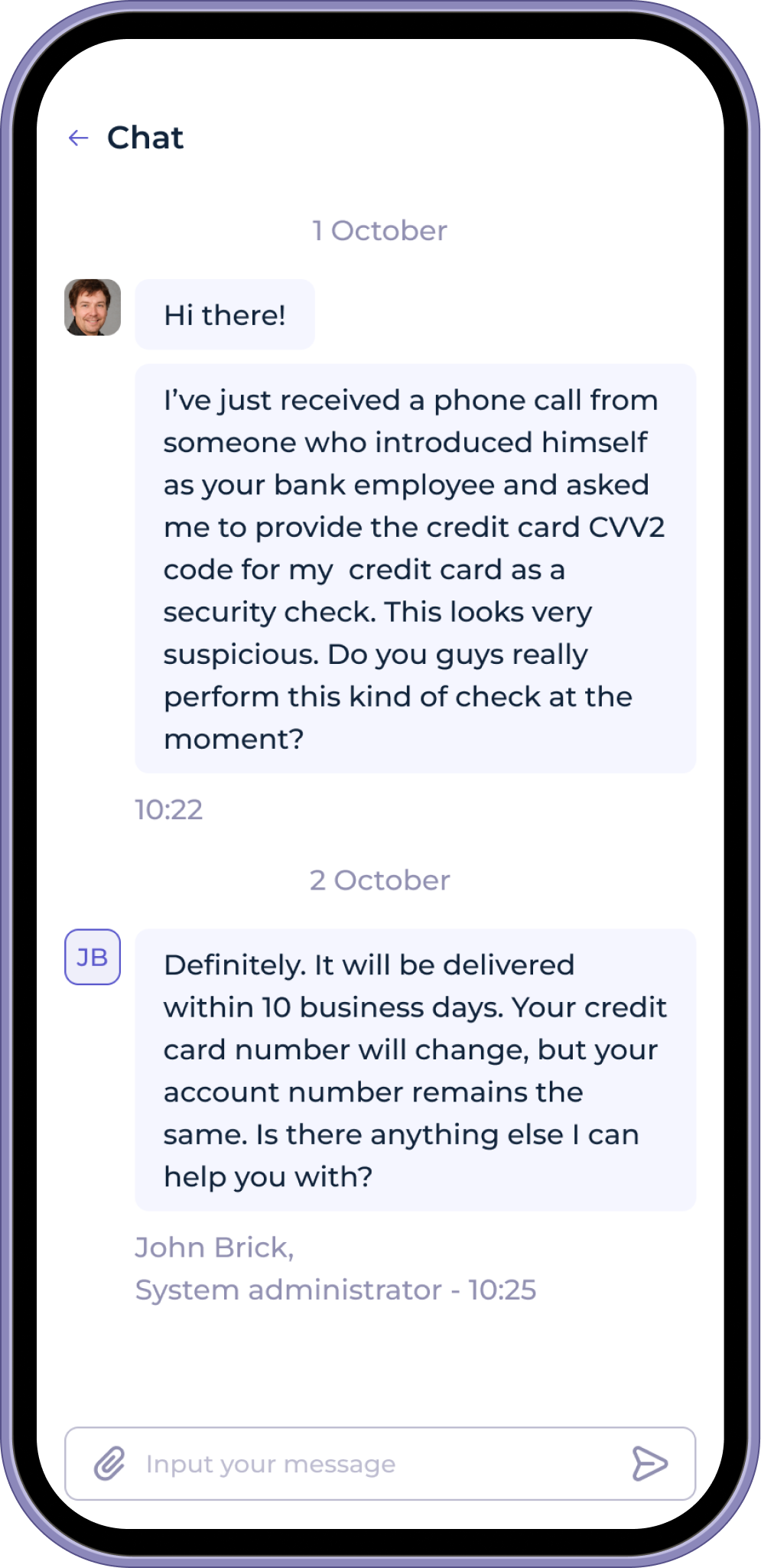

تحديد المعاملات المشبوهة على الفور

الحصول على تأكيد العميل لاستبعاد الاحتيال

الحصول على إثبات دخل من العميل ليكون متوافقًا مع مكافحة غسل الأموال

تجميد/إلغاء تجميد حسابات العميل إذا لزم الأمر

إغلاق الحالة

جميع تفاصيل العميل وأنشطته في مكان واحد

التواصل مع العملاء وإنشاء الملاحظات

الدردشات مع العملاء عبر خدمة المراسلة داخل النظام

ملاحظات حول العميل للمستقبل

سجل أنشطة النظام من قبل العملاء وأعضاء الفريق

التفاصيل الكاملة: عمليات تسجيل الدخول والجلسات والإجراءات المنفذة

قيّمة لأغراض التحقيق