Despite the increasing adoption of the branchless banking system, some customers are still reluctant to switch completely to the branchless banking model. Of course, the reason for this is not far from the benefits the branched banking industry offers. For instance, we all know how sensitive finance issues are. Most persons would prefer to hand over the maintenance of their funds to financial institutions with physical branches rather than one without identifiable branches. Over the years, this belief system has supported the growth of retail banking across different age grades.

However, the rise in digitalization and the inclination of the younger generation towards accessing convenient, fast, reliable, and over the internet banking services is a concern for most retail banks. As a result, retail banks have stepped up to offer retail financial banking services to their online customers. But then, what is retail banking, and how does it differ from digital retail banking?

Retail banking definition

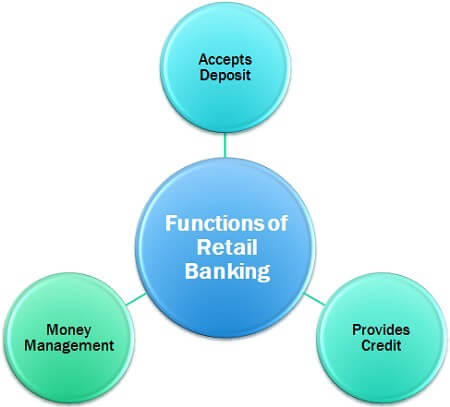

When people talk about going to a bank to open an account, make a deposit, or withdraw, they refer to retail banking. It is a banking model whose operational focus is to provide monetary services necessary for the day-to-day activities of individual consumers within a geographical area. In this banking sector, the need of individual consumers supersedes the needs of corporate entities, and as such, services are tailored toward satisfying individuals in their daily activities. Their goal of helping individual customers better plan and manage their finances earned them the name- consumer banking or personal banking.

Source: Banking Hub

To provide some context to this termin, let’s check out some retail banking products and services.

- Account opening and savings

- Cash remittance

- Personal loan processing

- Safe-deposit services

- Issuance and maintenance of debit cards and credit cards

- Foreign transactions

- Processing of mortgage loans

- Certificate of deposit, etc

Retail banking vs. retail digital banking

As we have discussed earlier, retail banks are simply those banks we see around us and transact with daily. The catch with the customer banking system is this: it is a consumer-centric banking model that offers basic monetary services. Some examples of retail banks include Stand chartered bank, Citi Bank, US Bank, Bank of America, Wells Fargo, etc.

Banking retail services include account opening and checking, personal loan processing, savings, funds transfer, etc. Imagine performing all of these financial activities via branchless internet-based platforms. Now, that is what digital personal banking implies. For clarity, digital retail banking is an online version of consumer banking in that it has to do with offering financial services but with the use of digital-only tools.

Retail banking vs. commercial banking

In retail banking, the bank’s focus is to profer financial and ancillary services that are tailored towards meeting the monetary needs of their individual customers in their daily activities. On the other hand, commercial banking describes the system of banking whose services are tailored toward meeting the needs of corporate entities and governmental organizations. It is not uncommon to find most banks operating both banking industry, and that stems from the benefits these systems offer the bank. The shift towards digital channels and technology-driven solutions continues to reshape retail banking trends.

In running a bank, both commercial and retail banking systems work hand in hand to keep the bank profitable. Let’s consider this in context, shall we? The customer banking industry helps the bank pool a good amount of liquidity from deposits made by individual consumers. At the same time, While the commercial banking system is where the funds are used in the form of loans to business entities and government organizations who in turn pay interest to the bank.

Trends driving the retail banking industry

Retail banking trends have been rapidly evolving in recent years, driven by digital transformation and changing customer expectations. The rise of technology has revolutionized the way people interact with their banks, leading to a significant shift towards digital channels and services.

-

Dependence on the Internet

According to a study, many customers, particularly slow digital adapters, were forced to switch to online during the lockdown. The way individuals shop and use internet banking has permanently changed, particularly for consumers aged 65, which is more than three times the proportion of Generation Zs. The reliance on digital touchpoints along this journey has risen quickly, prompting retail business models to rethink their offerings and conform to new customer expectations by offering their products and services via retail digital banking.

-

Rebalancing

Although most consumer banking and sales continue to take place in physical locations, the distribution of footfalls has shifted. Throughout 2022 and even 2023, online retail choices will outperform high streets, shopping centers, and city center sites. People will remain nervous about the virus, want more services from home, and online retail options offer that convenient click-to-click destination. However, as consumers expect more and more digitally-centric customer journeys that seamlessly integrate digital touchpoints inside a physical environment to increase convenience, the purpose of stores will continue to shift swiftly. As a result, rebalancing became one of the most common retail banking trends.

-

Disruption in the supply chain

The pandemic has highlighted the fragility of complex global supply chains, and we expect to see hunger issues persist throughout 2022. Rising transportation expenses, labor costs, customs, levies, a shortage of haulers, and disruption of country borders will be significant issues. Stock availability will continue to be difficult, which might exacerbate the problem for organizations like retail banks that want to expand their supply chain and reduce reliance on jostling time modules.

-

Net Zero Emissions strategy

This banking industry will face more pressure to provide excellent transparency around core emissions, including ambitious and measurable targets. According to research, just around half of publicly traded UK retail banks have a net-zero emission, and of those that do, the average time to net-zero is about 22 years.

The government, consumers, investors, and even also internal financial institutions employees would put more pressure on corporations to do the right thing. Large retailers will put increasing pressure on their suppliers, to be honest about core emissions, and performance and ambition will become a much more critical aspect in retailers’ selection of suppliers.

-

Protecting profitability

Before the pandemic, retail banking profitability was under severe strain, and pretax earnings for the most prominent retailers have nearly halved in the last decade, falling to 9.2% in 2012 and 5.1% in 2021. Margins have been squeezed by growing expenses, fierce competition, and a shift towards online activities. In particular, the shift towards IT banking has left many retailers with more physical outlets than they could commercially justify, which often ties them to structures that inhibit their ability to implement business models as quickly as they require.

Simultaneously, significant expenditure will be necessary to improve the efficiency of online operations. Automated dispatch systems, hiring data scientists, or introducing more complex marketing campaigns are all possibilities. This digital transformation will present new hurdles across the whole value chain, resulting in increased costs, changing the retail banking trends.

With these retail banking trends, the industry is undergoing a transformative shift, adapting to the demands of a digital-first and customer-centric landscape.

How retail banking works and earns profit

As it is with all product and service entities, the primary driving force is to generate revenue. The same revenue logic drives the banking sector. For retail banks, revenue is generated from the charges and interest they make off the services they render to the public. For instance, when an account is opened in a retail bank, you are allowed to make a deposit. The money you deposit doesn’t lie idle in your account. Rather, it isthey are used for the operation of credit facilities. Other bank users borrow from these funds, and the bank generates revenue in the form of interest on borrowed funds.

Also, services of retail banking institutions generate revenue from the discrepancies in interest rates. For instance, a retail bank promises you an interest that ranges from 4%-5% if you leave your money untouched for a while. But the bank will issue you a loan to get a house or a car at a rate ranging from 10% to 15%. Making consumer loans is a crucial strategy through which retail banks generate revenue.

In addition, retail banks charge a small service fee for some ancillary services. A few examples are monthly, credit card, and overdraft costs. These are the strategies retail banks employ to stay profitable.

Note: the profit generation strategies also apply to retail digital banking.

Kinds of retail banking

There are two major categories of the banking institutions, and they include:

- Mass retail banking: Here, the focus of the bank is to provide essential monetary services to a large number of people. The aim of this kind of bank is to generate a large pool of clients who, through their deposits, ensure constant funds are available for the bank to carry out their businesses. It is subdivided into the following:

- Community banks: This kind of bank provides essential monetary services to low-average income earners within a defined community.

- Postal saving system: This type of banking retail system serves individual consumers who do not have access to a proper bank, a safe and secured avenue to deposit their money.

- Class retail banking: It provides monetary services to a very limited but unique segment of clients. Clients in this segment are defined by the wealthy they command, and they are usually the elites in the society who perform businesses that are heavily beneficial to the bank. The most popular in this category are Julius Baer, Goldman Sachs, BNP Paribas, Citigroup, JPMorgan Chase, and Credit Suisse.

Advantages of retail banking

If you are looking at the personal banking system from the resource and asset perspective, the benefits of retail finance to the bank and the economy are indisputable. Let’s look at a few of these advantages.

Brand building

This banking system serves many people who prefer running transactions with a branch financial institutions. Of course, bringing in large individual consumers ensures there is enough liquidity to provide loans for other consumer clients. But on the flip side, it is building awareness for the bank. The more people walk into the bank to transact, the higher the chances of retaining a mental picture of the bank, which is good for brand creation.

Constant liquidity with non-negotiable interest

Retail client deposits are stable and create core deposits. Such deposits come with non-negotiable interest. Hence, there is less room for extra interest negotiating. Since they serve many people, they also have access to large funds.

Improve client relationship

Consumer banking has a better client management score and that in turn helps in building a dedicated and loyal client base

Increased diversification

With personal banking in place, banks can now look into more side businesses like pension schemes, mortgage processing, mutual funds, etc. Through increasing output, retail banks contribute to the country’s economic progress and rebirth.

Consumer banking provides quick and easy soft loans to consumer clients, thus improving the standard of living of low and average-income earners.

Disadvantages of retail banking

Increased rate of long-term loans becoming non-performing assets. There is a high chance of consumers defaulting on long-term loans in retail banks, which could become non-performing long if not properly supervised.

Retail banks incur heavy expenses on human resources to keep tabs on many disbursed loans.

The future of retail banking

With the closure of many bank branches, particularly in the United States, the retail banking industry has undergone significant changes in recent years. Although it is impossible to pinpoint the exact cause of these closures, given the current state of internet consumer banking, there is no doubt that online and mobile banking is playing a role in all of these difficulties. Experts believe these retail banking trends will continue in the personal banking segment, as it had done for the past 25 to 30 years when the government deregulated banks. It should, however, be noted that not all retail banks are closing branches; some are forming credit unions.

Digital banking platform vendor

The adoption of digitalization has given birth to many modern banking models that offer branchless banking services. These banks employ improved fintech solutions to offer people fast, secured, and seamless basic banking services. Since branchless banking is getting more and more popular, and the demand for digital banks is growing, building new digital banks is easier if you’re using a ready solution like that of SDK.finance digital retail banking platform.

With the SDK.finance white-label banking platform, a new banking product can be launched a few times faster compared to building it from scratch. Basing your neobank on the reliable transactional core build by an expert team with 15+ years banking and payment software development, you will be able to focus on attracting the huge customer base and improve the service for customers.