We’re proud to announce that the SDK.finance team was awarded 2nd place at the Barclays CBDC Hackathon 2022, preceded by the winner – Lloyds Bank, and followed by Mastercard, who won 3rd place.

The Hackathon, held on September 27-28, 2022, focused on the future of money – CBDC (central bank digital currency), a new digital payment instrument, and its potential to improve the financial systems across the globe. The adoption of CBDCs is being actively researched by the central banks worldwide, becoming a global trend, with dozens of similar hackathons taking place to explore the possibilities of digital currencies and resolve challenges related to the interoperability of the existing and new forms of money.

Everything you need to launch crypto wallets, payments, and custody

Learn moreHosted by Barclays Rise, London’s primary FinTech hub, the event brought together the representatives of both banks and tech providers, including Lloyds Bank, Mastercard, IBM, Barclays and other well-known companies in the FinTech arena.

For all the 9 participating teams which made it through a demanding application process, the Barclays hackathon offered a spectacular opportunity to showcase their solutions for the operations involving CBDC and regulated money, plus leverage industry ecosystems to address the challenges related to the usage of CBDC and its interoperability.

Pavlo Sidelov, founder and CTO at SDK.finance, says:

“I believe, the adoption of CBDC is one of the biggest breakthroughs for the financial industry since the introduction of cards. This is the next generation of operations with money. We view it as a huge opportunity for our product. We are going to work on the SDK.finance platform to support operations with all CBDCs emerging in the world out of the box. More than that – our vision is to supply an ecosystem covering an entire CBDC lifecycle – from digital money issuing to redemption and withdrawal, including transfers, payments and exchanges.”

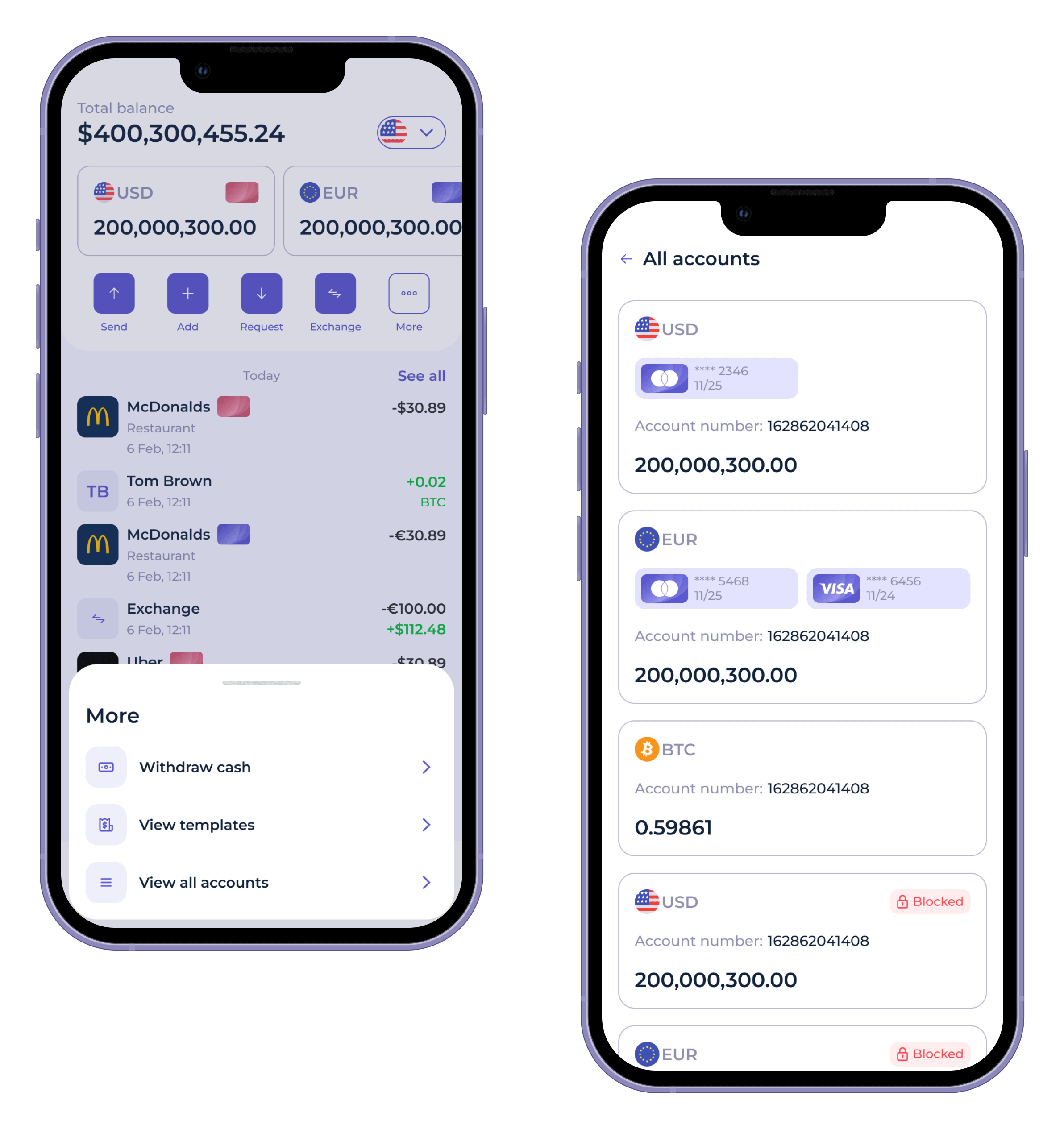

SDK.finance impressed an expert panel of judges by presenting their fully interactive CBDC solution prototype to demonstrate their solutions for the coding challenges. The prototype was based on the SDK.finance core payment platform, which offers a transaction accounting foundation and multi-asset/multi-currency features, along with the fundamental entities, like accounts, banks, customers etc. These capabilities facilitated its integration with the CBDC layer and streamlined the operations with CBDC accounts.

Pavlo Sidelov is receiving the award for the SDK.finance team that he led and represented at the Hackathon

SDK.finance is proud to have competed with the banking and FinTech goliaths and to have come second in the hackathon. We have discussed the possibility of participating in the Barclays and Bank of England testing labs and are going to further explore the future prospects of CBDC and implementation of the digital money operations within the SDK.finance software platform.

SDK.finance presentation at the Hackathon

Background

A Central Bank Digital Currency (CBDC) is a new digital payment instrument that is a direct liability of the central bank. It is now being researched by the central banks around the world in terms of its perspective for the general public and financial institutions.

Barclays CBDC Hackathon participants had the opportunity to explore how industry ecosystems could be leveraged to solve the CBDC challenges across both existing and new forms of money, including both retail UK CBDC and commercial bank deposits and mitigate the CBDC adoption risks.