A clutch survey found that 83% of small businesses maintain or increase their spending on outsourced business services in 2023. The main reason for using outsourcing services is the close link between reducing costs and bringing industry experience to the team, especially in the financial industry, where compliance and security standards are paramount.

In this article, we explore the experiences of top companies using software outsourcing for operational efficiency and walk you through the process of selecting the perfect partner for your fintech business’s development needs.

Understanding FinTech Development Outsourcing

Definition of FinTech Development Outsourcing

FinTech development outsourcing refers to the practice of delegating the creation and maintenance of financial technology solutions to external service providers.

This strategic approach allows FinTech companies to tap into specialized expertise, reduce operational costs, and speed up product development cycles. By outsourcing FinTech development, businesses can concentrate on their core competencies, enhance operational efficiency, and drive innovation in their offerings. This method is particularly beneficial in the fast-paced financial technology sector, where staying ahead of emerging technologies and market trends is crucial.

Additionally, outsourcing enables companies to focus on their core business functions by freeing up internal resources to prioritize essential business processes.

Types of Outsourcing in FinTech

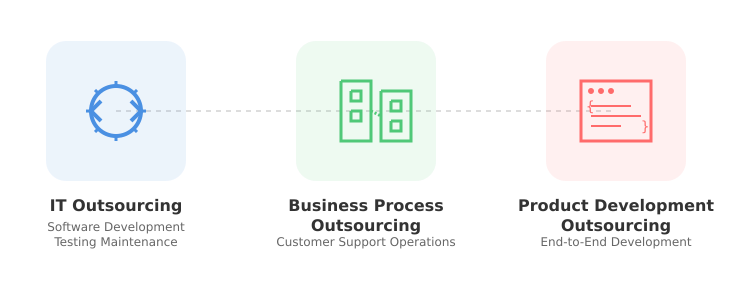

In the FinTech industry, several types of outsourcing models are commonly employed to meet diverse business needs:

- IT Outsourcing (ITO): This model involves outsourcing IT services such as software development, testing, and maintenance to external providers. It allows FinTech companies to leverage technical expertise and advanced technologies without the need for significant in-house resources. Utilizing an outsourcing vendor for fintech app development offers advantages such as access to specialized expertise, cost reductions, and a global talent pool.

- Business Process Outsourcing (BPO): BPO involves delegating business-related tasks like customer support, accounting, and marketing to external providers. This helps FinTech companies streamline operations and focus on strategic initiatives.

- Outsourced Product Development (OPD): OPD entails outsourcing the entire product development process to an external provider. The provider is responsible for designing, developing, and delivering the product, allowing the FinTech company to benefit from specialized skills and faster time-to-market.

Why do businesses choose outsourcing?

Outsourcing is used by large and mid-sized companies in a range of industries, from telecommunications and finance to e-commerce and manufacturing.

Prominent companies such as Microsoft, Google and Apple outsource tasks and processes. In fact, 13.6% of the average IT department’s budget is spent on outsourced tasks.

It can also be observed that outsourcing rates vary by industry. Around 72% of companies outsource app development in the financial or banking sector. Healthcare companies, on the other hand, have reduced their outsourcing work by 31%.

For instance, a company may outsource back-end development to a third-party vendor that has expertise in this area. In this way, software development outsourcing companies can benefit from the provider’s knowledge and experience without having to invest in the labour costs of hiring and training its own staff.

In addition, outsourcing provides the opportunity to increase or decrease flexibility as demand or business requirements change, while helping to reduce the risk associated with certain business functions, such as legal and financial compliance, by having these tasks handled by experts.

For this reason, outsourcing is an important business strategy that can benefit both large and small companies. By using outsourcing services, companies can increase their efficiency and focus on their core business. Selecting the right outsourcing company is crucial for fintech businesses to ensure successful outcomes.

Benefits of FinTech development outsourcing

Outsourcing FinTech development offers a number of benefits that can significantly improve a company’s operations and competitiveness. Here are some of the key benefits:

Cost-efficiency

According to Deloitte data, cost reduction is a primary objective for using FinTech software outsourcing services. Outsourcing allows businesses to access specialized expertise without the overhead costs associated with hiring and training in-house teams.

Source: Deloitte Global Outsourcing Survey

The cost-effectiveness can free up resources for other critical business needs. These cost savings can then be redirected to other important areas such as marketing, research and development, customer support, or infrastructure improvements.

In fact, the cost of outsourcing varies greatly depending on the region in which you plan to use your software development services.

For example, in North America and Western Europe, which are known for their high cost of living and developed technology industries, you can expect to pay higher hourly rates, typically ranging from $100 to $250, while in regions like Eastern Europe and Asia, hourly rates typically range from $20 to $90.

Software development outsourcing hourly rate by region

| Region | Hourly rate range |

| North America | $100 – $250 |

| Western Europe | $80 – $150 |

| Eastern Europe | $40 – $90 |

| Asia (India) | $20 – $60 |

| Latin America | $30 – $80 |

Note that the choice of region for outsourcing depends on several factors, including specific project requirements and qualifications.

Faster time-to-market

Aside from saving money, outsourcing FinTech software development can also help businesses save time because it can accelerate product development and deployment. By leveraging the resources and capabilities of an external team, companies can bring their FinTech products to market faster by skipping the hiring process for a technical team.

Multinational e-commerce and technology conglomerate Alibaba, for example, recognized the potential of outsourcing to achieve faster time to market.

It outsourced various aspects of website development, enabling it to quickly set up and improve its online platforms. This flexible approach enabled Alibaba to stay ahead in the highly competitive e-commerce industry and respond quickly to changing market demands.

Access to specialized skills

Companies are no longer looking for typical software outsourcing services, but require a complex approach with a deep understanding of the FinTech industry, technical knowledge and project scope analysis to meet requirements and develop competitive products. Selecting suitable fintech development outsourcing partners is crucial for financial brands to ensure the success of fintech development initiatives.

This ensures that the solutions developed are in line with industry best practices.

For example, the success story of Microsoft, a major player in the technology sector, includes a chapter on outsourcing: the company has regularly delegated certain software development tasks, focusing on leveraging its global knowledge pool.

Focus on product development

As mentioned earlier, outsourcing allows a company to focus on its core business, such as strategic planning, marketing and customer acquisition, while experts take care of the technical details.

Apple is known for its innovative products, but the company also outsources the production of its products to companies like Foxconn. This allows Apple to focus on product design and development while leaving the manufacturing process to the experts.

Innovation and technological advancement

Outsourcing partners are frequently at the forefront of technological advancement. Working with them allows companies to take advantage of the latest innovations and stay competitive in a rapidly evolving industry.

Apple’s virtual assistant, Siri, is a great example of how software outsourcing can drive innovation. Apple acquired the technology behind Siri from a startup company called SRI International. The innovative aspect of Siri was its natural language processing and speech recognition capabilities, which allowed users to interact with their devices in a human-like manner.

By outsourcing the original development of Siri, Apple gained access to cutting-edge expertise and technologies in artificial intelligence and natural language processing. This strategic move contributed significantly to Apple’s position as an industry leader in innovative technologies and user-friendly interfaces.

Expansion and scalability

Although we are not as well known as the companies mentioned above, we are proud of our client, a leading MENA PSP that has successfully ventured into new markets thanks to outsourcing providers.

The leading MENA PSP transforms its central transactional accounting system through SDK.finance on-premise ledger layer software. The goal was to make payments accessible and user-friendly while supporting cashless transactions. The company assembled a team of experts and turned to SDK.finance for a solution that would ensure growth, integration capabilities and scalability.

The result was a transformative accounting system that integrated with an extensive network of POS terminals to deliver efficient accounting, enhanced customer experience, expanded partnerships, increased transaction volumes, improved scalability, and the potential for limitless growth in the rapidly evolving FinTech landscape. Here you can get more information about this case study.

Potential pitfalls in FinTech development outsourcing

Outsourcing FinTech development offers numerous benefits, but it’s not without potential pitfalls. Recognizing and overcoming these challenges with effective project management tools is critical to a successful outsourcing process. Here are common pitfalls and why they can be detrimental:

Lack of clear objectives and product requirements

- Detriment: without clearly defined goals or product requirements, outsourcing teams cannot fully grasp the goals of the project, leading to misalignment and inadequate results.

- Solution: Establish clear product requirements and objectives. Document detailed product requirements, features, and expected outcomes.

Communication challenges

- Detriment: poor communication between the internal team and outsourced developers can lead to misunderstandings, missed deadlines, and increased project risks. This can lead to inefficiencies, errors, and even project failure.

- Solution: create effective communication channels from the start. Hold regular meetings, both synchronous and asynchronous, to keep everyone informed and involved.

Security concerns

- Detriment: security breaches or data vulnerabilities in financial software can have serious consequences. Failure to adequately address security concerns can result in data breaches, regulatory violations, financial losses, and damage to a company’s reputation.

- Solution: ensure robust security measures are in place. Regular security audits and penetration testing should be part of the process.

Quality control issues

- Detriment: inconsistent or inadequate quality control may result in a final product with defects, errors, or performance problems.

- Solution: implement effective quality control procedures, including testing, code reviews, and quality assurance protocols. Continuous monitoring and feedback loops are essential to maintaining product quality.

Lack of FinTech expertise

- Detriment: outsourcing to a team without sufficient FinTech expertise may result in solutions that do not meet regulatory standards or industry best practices.

- Solution: gain FinTech expertise by partnering with SDK.finance‘s team of experts. With a decade of experience in FinTech software development, our team has deep expertise in this specialized area.

By avoiding these potential pitfalls, companies can realize the full potential of outsourcing FinTech development, turning challenges into opportunities and leveraging the expertise of dedicated partners to create innovative and secure financial solutions.

Intellectual Property (IP) Protection

Protecting intellectual property (IP) is a critical concern in FinTech development outsourcing. FinTech companies must ensure their IP rights are safeguarded when collaborating with external providers. Key measures to protect IP include:

- Non-Disclosure Agreements (NDAs): Signing NDAs with outsourcing partners to prevent the unauthorized disclosure of sensitive information.

- IP Agreements: Establishing clear IP agreements that define ownership and rights to the developed software, ensuring that the FinTech company retains control over its innovations.

- Secure Development Environments: Ensuring that outsourcing partners use secure development environments to protect sensitive data and intellectual property throughout the development process.

Common Challenges in FinTech Development Outsourcing

FinTech development outsourcing can be a complex process, and companies may face several challenges when outsourcing their FinTech software development. Some of the common challenges include:

Finding a Reliable IT Vendor

Finding the right outsourcing partner for FinTech development can feel like searching for a needle in a haystack. There are so many options out there, and not all of them will be a good fit for your specific needs. The challenge isn’t just about picking a company with technical know-how—it’s about finding a team that understands the complexities of financial technology, has a solid track record, and aligns with your goals.

So, how do you narrow down your choices? Start with thorough research. Look into their past projects, check client reviews, and don’t hesitate to ask for case studies. A vendor might have all the right certifications, but if they haven’t successfully delivered projects similar to yours, that’s a red flag. Referrals from industry peers can also be incredibly helpful. If someone you trust has worked with a particular company and had a great experience, that’s a strong endorsement.

At the end of the day, the key is due diligence. Take the time to vet potential partners properly, and you’ll save yourself a lot of headaches down the road.

Communication Barriers

Communication barriers can pose significant challenges in FinTech development outsourcing, especially when working with vendors from different cultural backgrounds or time zones. Misunderstandings and misaligned expectations can lead to project delays and subpar outcomes. To overcome these barriers, it’s crucial to establish clear communication channels from the outset.

Define project goals and expectations explicitly, and ensure that all stakeholders are aligned and informed throughout the project. Regular meetings, both synchronous and asynchronous, can help maintain effective communication and collaboration. Choosing a FinTech development outsourcer that provides clear documentation, agile processes, and direct access to technical experts can also reduce friction and speed up delivery.

Keeping Quality in Check

Quality control in FinTech development outsourcing isn’t just important – it’s absolutely essential. If it’s not handled properly, you could end up with a product riddled with bugs, security vulnerabilities, or performance issues. And in the world of financial technology, even the smallest glitch can lead to serious consequences, from user frustration to compliance violations.

So, how do you make sure things stay on track? It all comes down to setting up strong quality control measures from the very beginning. This means establishing clear checkpoints throughout development, conducting regular code reviews, and implementing thorough user testing. Bug tracking should be a continuous process, not just something that happens at the last minute. The goal is to catch and fix issues early before they snowball into bigger problems.

Another key factor? Feedback loops. Keeping an open line of communication with your outsourcing partner ensures that any quality concerns are addressed in real time. It’s not just about setting high standards—it’s about enforcing them every step of the way.

At the end of the day, a FinTech product is only as good as the quality control behind it. Put the right safeguards in place, and you’ll significantly increase your chances of success.

Factors to consider when selecting a FinTech development outsourcing partner

Selecting the right FinTech development outsourcing provider requires a systematic and well-informed approach. Consider the following factors to ensure a successful partnership:

Technical background

Review the partner’s technical skills and expertise in FinTech development. Look for experience with relevant technologies such as blockchain, artificial intelligence, machine learning, or mobile app development. Assess knowledge of programming languages, frameworks, and databases commonly used in the FinTech industry.

Industry experience

Evaluate the partner’s industry experience and understanding of the FinTech landscape. Look for partners who have worked with financial organizations similar to yours or have a deep understanding of the specific challenges and regulatory requirements in your industry. This industry knowledge will enhance their ability to deliver solutions tailored to your organization’s needs.

Certifications and partnerships

Consider any relevant certifications or partnerships that the outsourcing partner holds. Certifications such as ISO 27001 for information security management or SOC 2 for data protection demonstrate the partner’s commitment to security and compliance. Partnerships with industry-leading FinTech software providers or technology vendors can also indicate their expertise and access to cutting-edge tools and resources.

Innovation and adaptability

Assess the partner’s ability to innovate and adapt to new technologies and industry trends. Look for evidence of its involvement in research and development activities, participation in industry conferences or events, or contributions to open-source FinTech projects. A partner who stays ahead of the curve and is committed to innovation will bring fresh ideas and perspectives to your project.

Past projects and case studies

One of the best ways to assess an outsourcing partner’s capabilities and reliability is to review their past projects and client recommendations. Request case studies or references from customers who have worked with the partner in the past. This will give you valuable insight into the partner’s project management skills, the quality of the delivered products and overall customer satisfaction.

Evaluating ROI from Outsourcing

Evaluating the return on investment (ROI) from outsourcing is essential for FinTech companies to ensure they are gaining value from their partnerships. Key factors to consider when assessing ROI include:

- Cost Savings: Comparing the cost of outsourcing development to the expenses of in-house development, including labor, infrastructure, and training costs.

- Time-to-Market: Measuring the time saved by outsourcing development, which can lead to faster product launches and a competitive edge in the market.

- Quality of Work: Assessing the quality of work delivered by outsourcing partners, which impacts the overall performance and reliability of the product.

- Innovation: Evaluating the level of innovation and expertise brought by outsourcing partners, which can enhance the product’s features and drive business growth.

Legal Considerations and Compliance

When outsourcing FinTech development, companies must navigate various legal and compliance requirements to ensure smooth and lawful operations. Key considerations include:

- Data Protection: Ensuring that outsourcing partners comply with data protection regulations such as GDPR and PCI DSS to safeguard customer information and maintain trust.

- Financial Regulations: Verifying that outsourcing partners adhere to financial regulations like PSD2 and AML, which are critical for maintaining compliance in the financial sector.

- Contractual Obligations: Drafting comprehensive outsourcing contracts that clearly define the roles, responsibilities, and obligations of both parties, ensuring compliance with relevant laws and regulations.

By carefully considering these factors, FinTech companies can mitigate risks and maximize the benefits of outsourcing, leading to successful and secure financial technology solutions.

Outsource FinTech Software Development Effectively

Outsourcing FinTech software development can be an effective way to access specialized expertise, reduce costs, and improve efficiency. To outsource FinTech software development effectively, companies should:

- Define Clear Project Goals and Expectations: Clearly outline the project’s objectives, deliverables, and timelines to ensure all parties are aligned.

- Establish Clear Communication Channels: Set up regular communication routines and use collaboration tools to keep everyone informed and engaged.

- Evaluate Potential Vendors: Assess vendors based on their technical expertise, industry experience, and past projects. Look for partners with a proven track record in FinTech development.

- Ensure Industry Standards and Best Practices: Verify that the vendor adheres to industry standards and best practices to ensure high-quality outcomes.

- Implement Quality Control Measures: Establish clear quality checkpoints, conduct code reviews, user testing, and bug tracking to maintain high standards.

- Monitor Progress and Budget: Regularly review the project’s progress to ensure it stays on track and within budget. Address any issues promptly to avoid delays.

By following these best practices, companies can ensure successful FinTech software development outsourcing and achieve their business goals. This strategic approach allows businesses to leverage the expertise of outsourcing partners while maintaining control over the project’s direction and quality.

Team augmentation vs. outsourcing: key differences

From time to time, companies need additional talent to fill gaps in their organization or to execute a large project. Team augmentation and outsourcing are the common models that provide additional technical teams to support software development, but they differ in key ways.

What is the team augmentation?

Team augmentation involves adding external experts to your internal development team who work closely with your existing staff. These experts become an integrated part of your organization, working on-site or remotely. Leveraging enterprise project management systems can streamline collaboration and ensure the extended team aligns seamlessly with your internal workflows.

With team augmentation, you retain a high degree of control over project management, task prioritization, and workflow processes. You can directly manage and oversee the work of the extended team.

What is outsourcing?

In outsourcing, an external service provider or team is contracted to perform certain parts of a project or the entire project. The outsourced team works independently of your internal staff and is often located outside the company.

Outsourcing provides a lower level of control over project management and execution. Typically, the outsourcing service provider manages the outsourced team while you provide high-level oversight.

Key difference between team augmentation and outsourcing

| Aspect | Team Augmentation | Outsourcing |

| Integration with team | Augmented team works with in-house staff | External team operates independently |

| Collaboration | Augmented members blend with internal team | Outsourced team often works separately |

| Control | Higher degree of control over project | Reduced direct control over execution |

| Flexibility | Highly flexible for scaling up or down | Project-specific and typically concludes |

When it comes to team augmentation, SDK.finance stands out as a pioneer in offering a complex solution of not only expert professionals but also a cutting-edge Platform tailored to accelerate the development of FinTech products.

Why Choose SDK.finance for FinTech Development Outsourcing?

Pre-Built FinTech Platform for Faster Time-to-Market

Developing a FinTech product from scratch is a time-consuming and costly process. With SDK.finance, you can leverage our pre-built, ready-to-go FinTech platform to dramatically accelerate development. Our platform provides the core infrastructure needed for digital banking, payment processing, and financial services, allowing you to focus on customization and market differentiation instead of building from the ground up.

With 400+ API endpoints and a modular architecture, our platform enables:

- Rapid product deployment – Reduce time-to-market from years to months.

- Seamless integration – API-driven design for easy connection with third-party services.

- Scalability & flexibility – Launch with essential features and expand as needed.

A Dedicated Team for FinTech Success

SDK.finance offers a dedicated team approach, providing access to FinTech-specialized engineers who ensure your product is built efficiently and securely. Instead of managing an in-house team, you gain expert developers who understand the intricacies of digital payments, banking APIs, and regulatory compliance.

Our dedicated development teams offer:

- Deep FinTech expertise – Professionals with hands-on experience in financial technology.

- Faster development cycles – A pre-built platform combined with expert implementation.

- Predictable costs – Transparent pricing with no recruitment overhead.

- End-to-end support – From concept validation to full-scale deployment.

By combining our pre-built FinTech platform with a dedicated development team, SDK.finance enables businesses to launch financial products significantly faster while maintaining full control over customization and innovation.

Get in touch to explore how SDK.finance can accelerate your FinTech development journey.