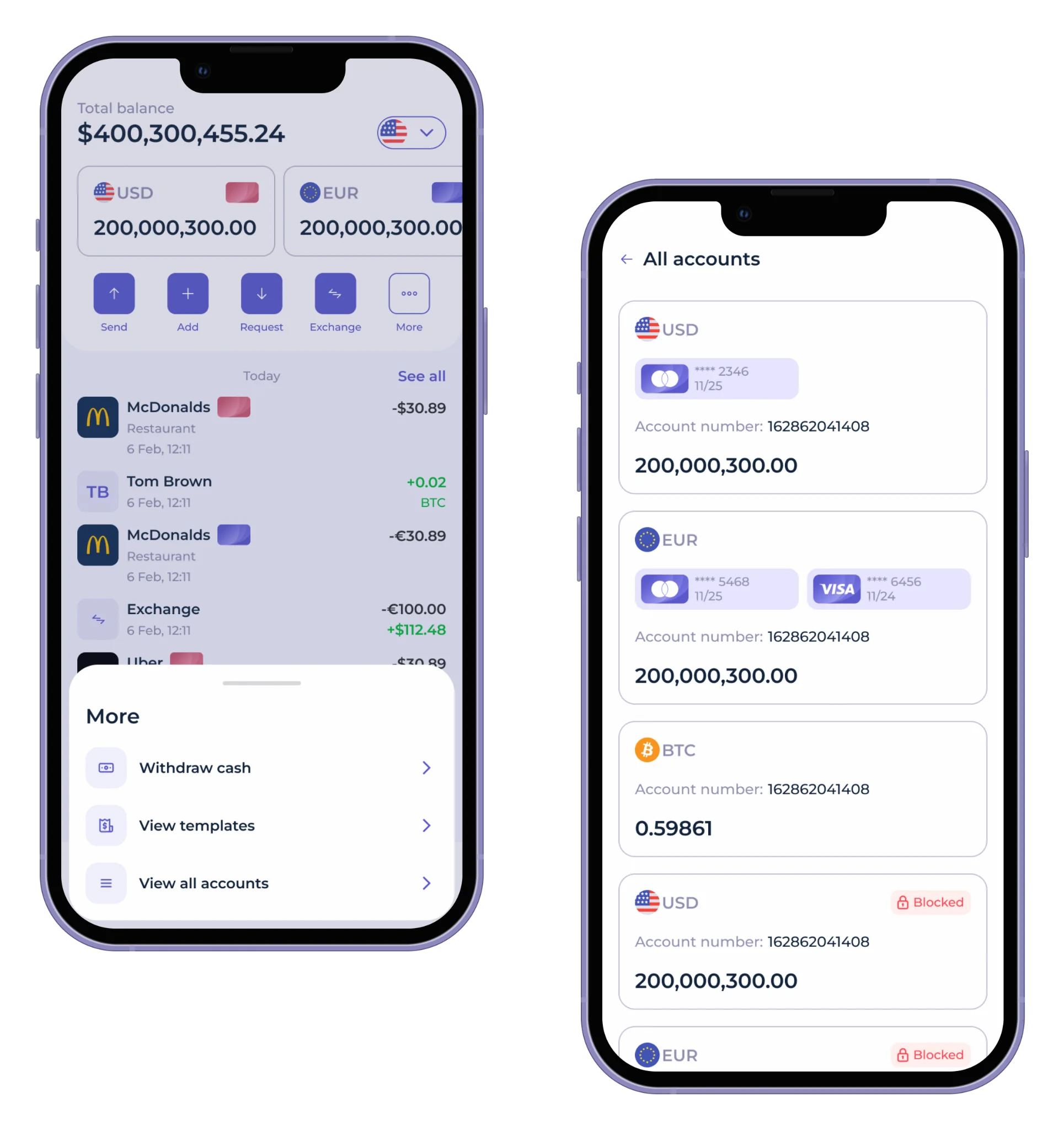

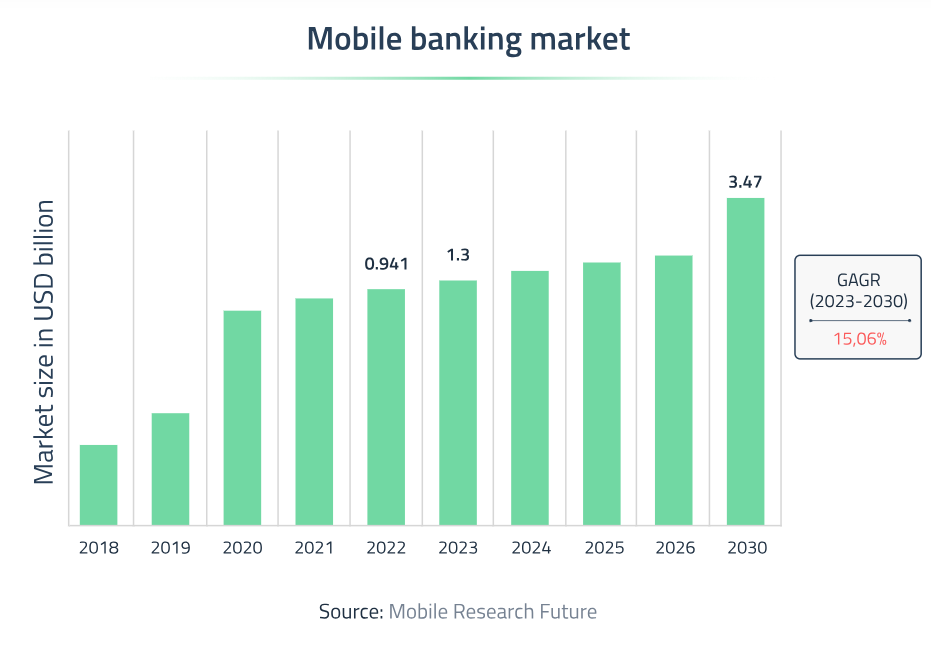

With the advancement of smartphones, banks began creating dedicated mobile apps that expanded the range of activities users could perform, including transferring funds, paying bills, and managing accounts on the go. Today, mobile banking apps provide comprehensive financial management tools, investment services, and seamless payment integrations, making them an essential component of modern banking. Let’s take a closer look at the fundamentals and mobile banking trends. With pre-built backend, and backoffice for system management. Mobile banking technology refers to the suite of digital tools and services that enable users to conduct financial transactions and manage their banking needs via mobile devices, such as smartphones and tablets. From the early days of SMS banking to the development of sophisticated mobile banking applications, the evolution and global usage of these applications have transformed how people interact with their banks. Countries worldwide have seen significant growth in the adoption of mobile banking applications, with many banks integrating these apps into their operations to enhance customer experience. This technology leverages mobile applications and the Internet to provide a wide range of banking services, allowing users to access their accounts, make transactions, and receive financial information without the need to visit a physical bank branch. The mobile banking industry surpassed the $1.3 billion mark last year and is projected to triple by 2030, demonstrating an impressive compound annual growth rate (CAGR) of over 15%. Banking IT consultants at ScienceSoft note that with mobile tech costs democratized over the years, banks can now build custom apps for as little as $150,000, fueling even faster market growth. Mobile banking technology operates through a seamless integration of secure applications, real-time data processing, and advanced security protocols to provide users with convenient access to financial services on their mobile devices. Addressing mobile banking security concerns is crucial to protect against hacking attacks, data leaks, and fraudulent activities by cyber criminals. Here’s a breakdown of how mobile banking technology works behind the scenes: In essence, mobile banking technology ensures that every step of your banking experience, from logging in to completing transactions, is protected by multiple layers of security. This robust framework not only provides convenience but also peace of mind, knowing that your financial information is secure. Mobile banking technologies have revolutionized the banking experience for consumers and financial institutions. These technologies harness the capabilities of smartphones and digital innovations, providing various benefits that improve convenience, security, and efficiency. The table below outlines the key advantages of mobile banking technologies for both end-users and companies: The advantages of mobile banking technologies are significant and wide-ranging. For users, these technologies offer exceptional access and control over their financial activities, making banking more convenient and personalized. For companies, mobile banking simplifies operations, lowers costs, and improves customer satisfaction through innovative and secure solutions. As technology continues to advance, the benefits of mobile banking will only increase, further transforming the financial industry. Mobile banking has become a widespread trend, with 89% of survey respondents using it, and a massive 97% of millennials indicating that they use it, as per Insider Intelligence’s Mobile Banking Competitive Edge Study. The evolution of design and technology in mobile banking apps has significantly contributed to this trend, integrating functionalities such as peer-to-peer lending, international money transfer, voice banking, biometric authentication, and blockchain technology. Several key mobile banking trends fuel this surge. First, Artificial Intelligence (AI) is transforming the way users interact with their finances. AI-powered chatbots can answer questions, troubleshoot problems, and even offer personalized financial advice. For instance, JPMC’s virtual assistant, “Chase Ask,” helps users manage accounts, make payments, and track spending. Consumers increasingly demand instant access to financial services, including real-time payments and transaction processing. Banks are integrating sophisticated real-time analysis and decision engines to meet these expectations, enhancing the overall user experience. For example, Zelle, a digital payments network, allows users to send money directly between bank accounts in real time. Using only their email address or phone number, they can transfer funds and have them available within minutes, which is particularly useful for splitting bills, paying rent, or sending money to friends and family. The rise of digital-only banks highlights a mobile banking trend towards mobile-first strategies. Traditional banks are adapting by streamlining services such as account opening and loan applications for mobile platforms, competing with the convenience and user experience of neobanks. Revolut is a digital-only bank that offers a wide range of financial services through its mobile app. Their mobile-first approach allows users to open an account in minutes, make fee-free international transfers, and manage their finances entirely from their smartphones. This convenience has made it a popular choice among tech-savvy consumers and frequent travelers. The adoption of voice-assisted devices has led to the integration of voice commands in mobile banking. Users can now perform tasks like checking account balances, making payments, and receiving financial updates through voice-activated commands, adding a layer of convenience. For instance, Ally Bank offers voice-activated banking through Amazon Alexa. Users can ask Alexa to check their account balances, review recent transactions, transfer money between accounts, and more. BaaS and open banking APIs are becoming significant mobile banking trends, allowing seamless integration of various financial services within mobile apps. This facilitates a more cohesive and comprehensive banking experience for users. Blockchain is being explored for its potential to enhance security, transparency, and efficiency in mobile banking transactions. It offers a decentralized way to conduct and verify transactions, reducing the risk of fraud and errors. These mobile banking trends highlight the dynamic nature of the mobile banking industry, showcasing its commitment to innovation and adaptability in meeting the evolving needs of consumers in an increasingly digital world. The SDK.finance Platform is designed to help neobanks by providing a wide range of cutting-edge features and capabilities. Some key highlights include: These features make SDK.finance an ideal choice for quickly and efficiently launching a neobank. By utilizing its extensive API capabilities, strong transaction processing, and comprehensive out-of-the-box features, businesses can focus on providing exceptional customer experiences and innovative financial services. This enables them to enter the market faster, saving valuable development resources while ensuring a high level of service and operational efficiency. Additionally, the convenience of accessing bank accounts through mobile banking applications enhances customer satisfaction and engagement. Build a user-friendly experience for your customers with the pre-made mobile banking app compatible with iOS and Android, crafted for digital banking, ewallet, and payment apps. Watch this demo video about white-label mobile app for banking and payments: Have questions? Talk to our experts for answers. What is mobile banking technology?

How does mobile banking technology work?

Benefits of mobile banking technologies for businesses and consumers

Category

Benefits for end-users

Benefits for companies

Convenience

Access banking services anytime, anywhere

Operate without the need for physical branches

Time-saving

Quick transactions, instant access to information

Efficient handling of customer transactions

Security

Biometric authentication, real-time alerts

Advanced security measures reduce fraud risks

Financial management

Budgeting tools, spending trackers

Data analytics for better decision-making

Ease of payments

Instant fund transfers, mobile payment integration

Streamlined payment processes

Cost-effective

Reduced need for paper statements, lower fees

Lower operational costs, reduced need for staff

Personalization

Customized offers, AI-driven financial advice

Targeted marketing, personalized services

Increased customer engagement

Enhanced interaction through mobile apps

Improved customer engagement and satisfaction

Mobile banking trends

Artificial intelligence

Real-time payments and services

Digital-only services and neobanks

Voice-activated banking

Banking as a service and API integration

Blockchain technology

Build a neobank with a ready-made SDK.finance platform

The Future of Mobile Banking Technology: Key Trends and Innovations

FAQ

What is mobile banking technology?

Mobile banking technology refers to the suite of digital tools and services that enable users to conduct financial transactions and manage their banking needs via mobile devices, such as smartphones and tablets.

How is AI used in mobile banking?

AI is used to provide personalized banking experiences through chatbots and virtual assistants, fraud detection, predictive analytics for financial planning, and improved customer service through automated responses.

How is blockchain technology influencing mobile banking?

Blockchain technology offers enhanced security, transparency, and efficiency in transactions. It enables faster cross-border payments, reduces the need for intermediaries, and ensures a tamper-proof ledger of transactions.

What innovations can we expect in mobile banking in the next few years?

Innovations may include more advanced AI capabilities, expanded use of blockchain, enhanced mobile payment options, increased integration with financial planning tools, and broader adoption of open banking APIs for seamless integration with other financial services

What are the benefits of mobile banking for consumers?

Mobile banking offers convenience, real-time access to account information, quick and easy transactions, improved financial management, and enhanced security features.

Navigate through article