The remittance market refers to the global market of money transfers between individuals or businesses across borders. It is a significant and growing market, with an estimated 200 million migrants sending money back to their home countries, according to the World Bank.

According to Juniper Research, digital cross border remittances will grow from $295 billion in 2021 to $428 billion in 2025. With the increase in demand for remittances, there are opportunities for the development of money transfer companies to meet the needs of users. In this article, we consider the basics of remittance business, its benefits for payment companies and present the fintech solution to speed up the money transfer app development process.

What is a remittance?

Remittance refers to the transfer of money or funds from one place to another, usually across international borders. This transfer of money is typically made by a person who is working in a foreign country and sending money back to their home country or to their family and friends. Remittance is often used as a way for migrant workers to support their families and loved ones who may be living in a less economically developed country.

Remittances can be sent through various channels such as banks, money transfer companies, and online platforms, and they can be received in various forms such as cash, bank deposits, or mobile wallet balances. The process of sending remittances typically involves a fee or commission that is charged by the service provider, which can vary depending on the amount of money being sent, the destination country, and the method of transfer. Remittances are an important source of income for many families in developing countries, and they can contribute significantly to a country’s economy.

How does remittance work?

The process of sending a remittance usually begins with the sender depositing money into a financial institution, such as a bank or a money transfer service. The recipient then receives the money in their home country, either through a bank account, cash pickup location, or mobile money account. The exchange rate used to convert the funds from one currency to another can have a significant impact on the amount of money received by the recipient.

What is the difference between remittance and money transfer?

The term remittance refers to the money that is sent or transferred by an individual (usually an immigrant) living in one country to another individual (usually a family member) living in a different country. Remittances are often sent to support the financial needs of family members back home, such as paying for education, healthcare, and daily expenses.

Money transfer, on the other hand, refers to the process of moving money from one account to another. This can be done through various means, such as wire transfers, online transfers, or mobile transfers. Money transfer services can be used for a variety of purposes, including paying bills, making purchases, or sending money to friends and family within the same country.

So, while remittance involves sending money across borders to support family members, money transfer can be used for a wider range of purposes and may or may not involve cross-border transactions.

Things to know before starting a remittance or money transfer business

Starting a remittance or money transfer business can be a lucrative venture, but it’s important to do your due diligence and prepare thoroughly before launching your business. Here are some things to consider before starting this type of business:

Regulations and compliance

Research and understand the regulations and compliance requirements for money transfer businesses in your country and any countries you plan to operate in. This includes regulations related to anti-money laundering (AML) and Know Your Customer (KYC) requirements.

For example, to start a remittance business in the US and offer your solution to all US residents, you will be required to obtain a money transfer license in all 50 US states. Once you have obtained your license, the next step is to secure a bank account for depositing funds. Additionally, you will need to partner with a payment processing provider that enables end users to fund their accounts using ACH or cards.

Technology and infrastructure

You will need to invest in the right technology and infrastructure to ensure smooth and secure transactions. This includes developing a user-friendly app or website, integrating payment gateways and security measures, and building partnerships with banks and financial institutions.

Fees and pricing

Determine your pricing model and fees carefully, taking into account your costs and the fees charged by competitors. Offering competitive rates and transparent pricing can help you attract and retain customers.

Customer service

Provide customer service and support to build trust and loyalty with your customers. This includes offering multiple channels for customer support and being responsive to customer inquiries and issues.

Ensure a quick response time for customer queries or complaints. This can help mitigate customer frustration and improve overall customer experience. As a result, 24/7 customer support to address urgent queries or issues. This can be achieved through automated chatbots or by outsourcing support to a third-party service provider.

How does the payment business benefit from remittance?

Remittance services are important for payment businesses for several reasons:

Diversification of revenue streams

By offering remittance services, payment businesses can diversify their revenue streams and reduce their reliance on traditional payment processing services. This can help to increase their overall profitability and reduce their exposure to market fluctuations.

Increased customer base

Remittance services attract a diverse range of customers, including migrant workers, expatriates, and individuals who need to send money to family members or friends in other countries. By offering remittance services, payment businesses can tap into a new customer base and expand their reach into new markets.

Cross-border payments

Remittance services allow payment businesses to offer cross-border payment solutions to their customers. This can help to facilitate global trade and commerce, which is becoming increasingly important in today’s globalized economy.

High transaction volumes

Remittance services typically involve high transaction volumes, which can generate significant revenue for payment businesses. This can help to offset the costs of offering these services and provide a stable source of income over time.

Customer loyalty

By offering remittance services, payment businesses can build customer loyalty and trust. This can lead to repeat business and positive word-of-mouth referrals, which can help to grow their customer base over time.

In summary, remittance services are important for payment businesses because they offer a new source of revenue, a diverse customer base, cross-border payment solutions, and high transaction volumes.

SDK.finance white-label money transfer software

You can use the SDK.finance money transfer software to respond to the rising market demand for fast and cost-effective financial services.

With our white-label money transfer software you can create a future-proof P2P payment or remittance app, without starting from scratch. We offer an API-driven approach that helps to integrate your instance of the software with virtually any third-party provider or service, quickly and cost-effectively.

Use our fintech ledger platform as a powerful and reliable basis to build the remittance system. Our system can be implemented on-premises or in the cloud to enhance its accessibility.

The SDK.finance money transfer software offers the following features for your payment business:

- Fully digital onboarding

Offer a user-friendly way to remotely register and authorize, along with the option to upload required documents for KYC compliance, if deemed necessary.

- Multicurrency accounts

Enable your customers to transact with any currency (whether fiat or not) that you have set up within the system, without any restrictions on the type of currency they can use.

- Borderless remittance services

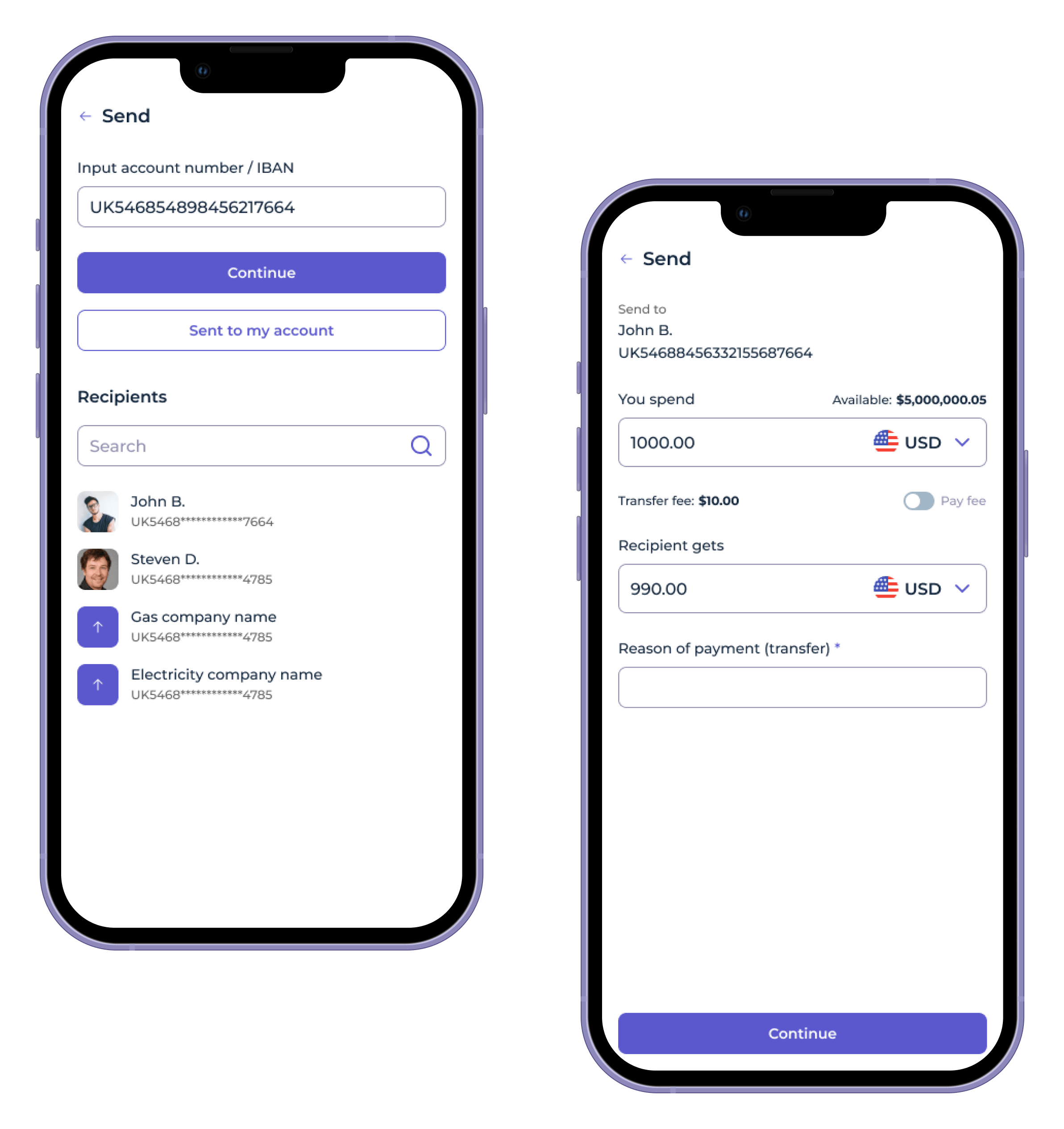

Provide built-in peer-to-peer (P2P) transfer functionality for app users, and integrate with payment or service providers to facilitate transfers between cards, wallets, and mobile devices.

- Bank and card payments

Incorporate connectivity with a banking network to offer bank payments such as IBAN, SWIFT, or collaborate with card providers to enable card payment capabilities.

- Bill payments

Cooperate with regional service providers to provide users with the ability to make payments for utility bills, mobile top-ups, and other popular transactions that are beneficial to them.

- Expense tracking

Boost user satisfaction by providing a transaction map that pinpoints where each transaction took place based on its location.

- Currency exchange

Enable customers to open accounts in various currencies and facilitate currency exchange between their accounts.

Experience the future of payment processing firsthand with a video demo of the SDK.finance Platform, showcasing its payment features and capabilities. Simplify transaction management and ensure financial compliance with our powerful FinTech Platform:

Wrapping up

The remittance market is significant and growing, with digital cross-border remittances expected to increase over the next few years. Before starting a remittance or money transfer business, it’s essential to understand the regulations and compliance requirements, choose the right technology and infrastructure, determine pricing models and fees, and provide excellent customer service. SDK.finance money transfer software can help you speed up the development of the remittance application.