In 2023, Visa and Mastercard, the payment giants, generated more than $57 billion in combined revenue, mainly from the fees they charge businesses to process card transactions. One of these giants’ key offerings is their card-based recurring payment scheme, which has fueled the global rise of the subscription-based economy.

But things are starting to change. Variable Recurring Payments (VRPs) are emerging as a game-changer in banking. Compared to existing payment methods, VRPs offer a more flexible and affordable way to handle payments, allowing businesses to reduce transaction fees and hold on to more of their revenue. As VRPs continue to grow in popularity, they might shake up the status quo and reshape the future of how we handle payments.

Recurring payments – a cornerstone of the modern economy

Recurring payments are the backbone of today’s economy, underpinning a wide range of transactions, from subscription giants like Netflix and Spotify to essential utilities such as electricity, gas, and internet payments.

For SaaS businesses, recurring payments are the engine that keeps revenue flowing and customers connected. Adobe Creative Cloud, for example, gives users ongoing access to tools while ensuring the company maintains a reliable cash flow—benefiting both sides.

Gym memberships, insurance premiums, software licenses, subscription boxes, and loyalty programs are just a few examples of industries that have embraced this payment method.

While traditional recurring payments involve fixed amounts at regular intervals, variable recurring payments offer greater flexibility to accommodate changing circumstances. Conventional methods like direct debit are less flexible compared to VRPs, as they lack control over payment amounts and timing.

This adaptability fosters stronger customer relationships and helps businesses avoid the additional fees associated with traditional payment methods like Visa and Mastercard.

So, what are variable recurring payments in a nutshell?

A variable recurring payment (VRP) is an automatic transfer of money from one account to another, initiated at regular intervals based on specific parameters.

Customers can authorize registered payment service providers to make these payments on their behalf, with the timing and amount allowed to vary within agreed limits.

The Head of VRP at Tink, an open banking company, explains the concept of variable recurring payments in this video:

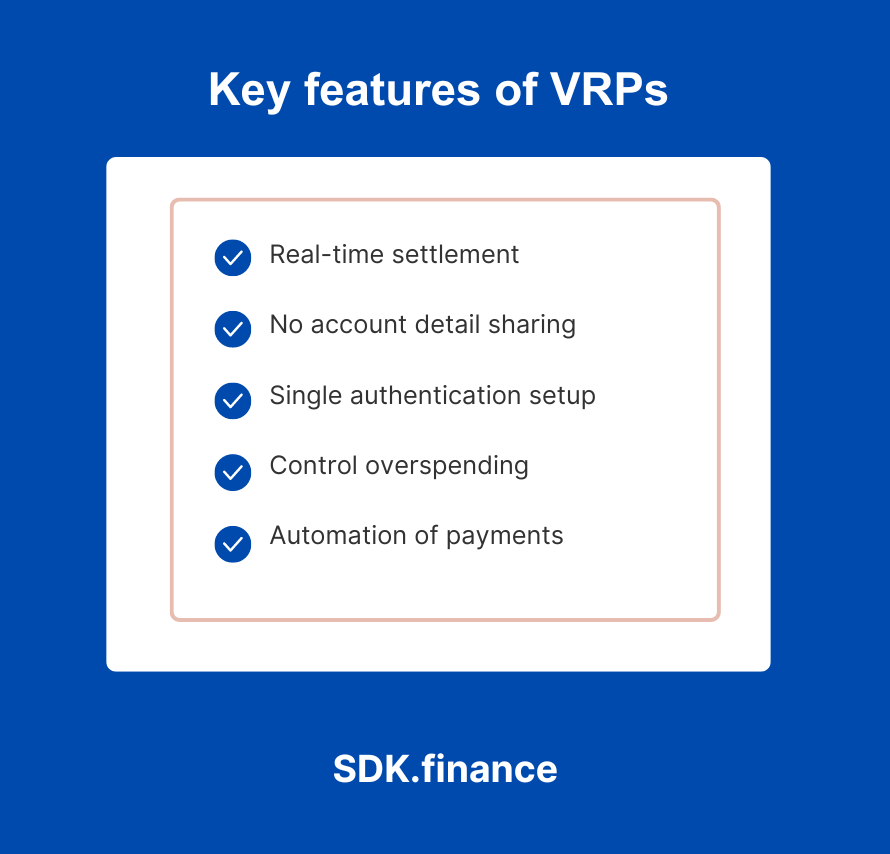

Key features that make VRPs a game-changer

From flexible payment options to seamless integration with open banking, VRPs bring a whole new level of convenience to the payment world. They don’t just improve billing—they’re a flexible and secure payment method shaking up the entire digital payments industry.

These standout features make VRPs the go-to solution for managing recurring payments, offering a smoother, smarter alternative to outdated methods.

Why are VRPs a win for businesses and customers?

In contrast to traditional methods like continuous payment authority, credit cards, or direct debits, VRPs enable automated and flexible payments directly between bank accounts.

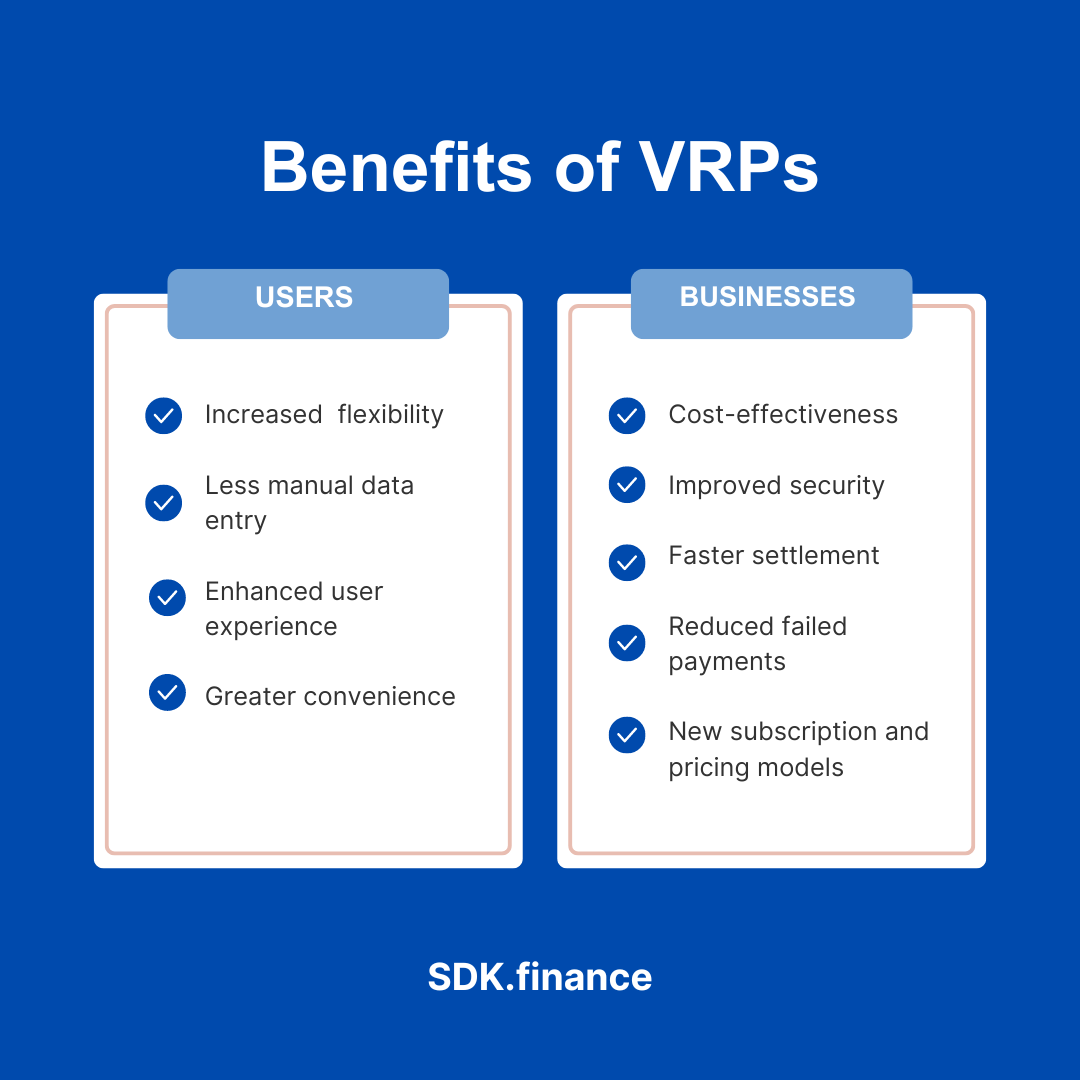

Key benefits to businesses:

Lower fees, higher profits

Variable recurring payments are a cost-effective solution that bypasses the high transaction fees associated with traditional card payments. This means businesses can retain more of their revenue.

For example, businesses with high transaction volumes, such as subscription-based services or utilities, can save significantly on processing costs by switching to VRPs. Additionally, using VRPs can help reduce indemnity claims, thus saving businesses even more money.

Safer and smarter payments

Since VRP transactions are part of a broader range of secure payment services, merchants don’t need to store sensitive card information, greatly reducing the risk of data breaches. Additionally, VRP transactions utilize strong customer authentication (SCA), ensuring enhanced protection for both merchants and consumers.

Get paid in a flash

VRPs operate on a faster payment scheme, allowing for almost instant settlement, unlike traditional card payments that can take 3-5 days to clear.

For instance, e-commerce businesses can benefit from receiving payments instantly, helping them better manage stock, supplier payments, and operational costs. VRPs can also help businesses manage future payments more efficiently by providing a clear overview of recurring payment agreements and their limits.

Keep payments flowing

VRPs offer a more reliable payment solution that can help businesses reduce failed payments and improve customer retention.

A subscription service, for instance, would experience fewer revenue disruptions as customers would not drop off due to outdated card details.

Flex your pricing

VRPs offer merchants flexibility to create innovative subscription models, such as variable pricing based on usage or dynamic billing cycles.

For example, energy providers could implement pay-as-you-go models that automatically adjust based on a consumer’s actual energy consumption, offering more personalized billing options.

Key benefits to consumers:

More control over money

Automating recurring payments gives consumers more control over their customer’s account. They enable seamless transfers between accounts or bill payments without the need for manual intervention, reducing the risk of missed payments or late fees.

For example, VRPs can ensure the timely payment of pension benefits. They can also make the payment of salaries more efficient and ensure that employees receive their wages on time.

Less paperwork, less hassle

One of the biggest advantages of VRPs is that, unlike traditional payment methods, they require less paperwork and fewer forms. Consumers can also easily manage their VRPs through a banking app, simplifying the process of canceling subscriptions.

For instance, if a user needs to update their payment amount or frequency, they can do so easily without filling out lengthy forms.

Smoother and simpler payments

VRPs provide a frictionless payment experience that eliminates the need for manual intervention. Compared to direct debit payments, VRPs offer a smoother experience with faster settlement speeds and improved user convenience. Once you set up a VRP, your payments are processed automatically, saving you time and effort.

This helps users not to miss a payment for the streaming service, gym membership, or software license again. VRPs handle these recurring payments seamlessly.

No more card update drama

VRPs offer greater convenience by eliminating the need to update the payment information. Unlike card-based payments, VRPs use bank account details, ensuring your payments continue uninterrupted even if you lose or replace your card.

Imagine not worrying about updating card details for multiple services when switching to a new debit card—VRPs keep payments flowing smoothly.

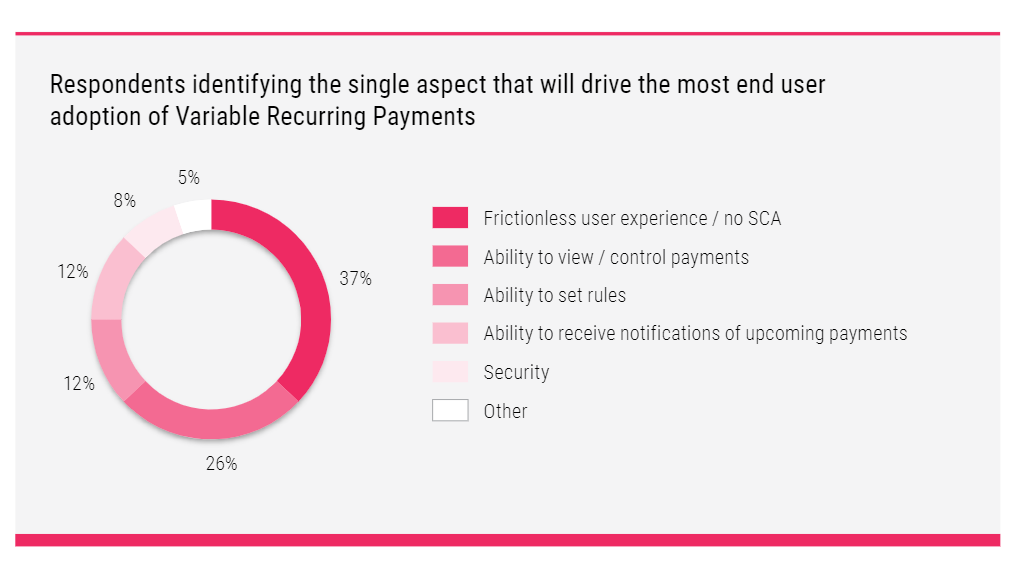

The survey by Token.io confirms that the key benefits of adopting VRPs for end-users are frictionless user experience and the ability to control spending.

How variable recurring payments are used in real life?

VRPs present a modern, efficient solution for recurring payments with the potential to enhance both consumer and business experiences.

Subscription payments

VRPs are ideal for subscription services, offering a more reliable alternative to traditional card-on-file payments. Since bank account details don’t expire and authentication happens only once, payment failures become less frequent.

E-commerce one-click payments

In e-commerce, VRPs help make online shopping faster and more convenient. They eliminate the need to repeatedly enter sensitive payment information. This improves the user experience and reduces cart abandonment.

According to recent ecommerce shopping statistics, simplifying the checkout process through features like VRP can significantly increase conversion rates and customer retention.

For example, a customer buying clothes online can use VRP to approve payments with just one click. This speeds up checkout and provides added security without sharing card details.

Utility bill payments

VRPs are great for paying household bills directly from a current account, offering flexibility to match irregular income schedules or pay based on actual usage.

For instance, energy providers can offer VRPs to allow customers to pay based on actual electricity or gas consumption each month, making budgeting easier.

Delivery payments

VRPs simplify grocery payments by allowing customers to pre-authorize payments within a set limit, making it easy for merchants to adjust charges based on order changes. VRPs can also be used to manage payments from credit accounts, enabling users to direct funds for paying off loans, credit cards, and avoiding costly overdraft situations.

For example, if a customer orders groceries for delivery and the store needs to substitute items, the VRP allows for payment adjustments without needing further customer approval at checkout.

Taxes

VRPs can automate the process of setting aside funds for taxes, such as VAT or income tax, ensuring businesses avoid cash flow issues and make timely payments.

It can be useful for small businesses to automatically allocate funds for tax payments each month, ensuring they never miss a payment and helping with cash flow management. VRPs can also help automate the transfer of surplus funds to a savings account for tax payments.

Taxi & delivery services

VRPs help to enhance the taxi and food delivery services, streamlining the payment process, and offering both riders and customers a smoother experience.

For instance, Uber and Uber Eats VRPs could facilitate automatic fare adjustments based on ride distance or duration, and implement recurring meal deliveries, reducing transaction costs associated with traditional card payments. VRPs can also help manage excess funds by automatically transferring them to appropriate accounts.

The technology behind VRPs

Here are the primary technologies involved: VRPs utilize open banking APIs to facilitate transfers between current accounts, enabling automatic fund transfers. This technology allows for sweeping, which helps manage finances more effectively by avoiding overdrafts and optimizing savings through the redirection of excess funds into higher interest accounts.

Open banking APIs

VRPs are powered by open banking APIs that enable third-party providers to access customer bank accounts for payment initiation.

For example, SDK.finance integrates with Salt Edge to use these APIs to securely fetch account information and initiate payments. Salt Edge uses SCA – Strong Customer Authentication to ensure security and regulatory compliance, which requires multi-factor authentication before accessing sensitive account data or initiating payments.

OAuth 2.0 authentication

OAuth 2.0 enables secure authorization for accessing customer data and initiating payments. Once consent is given, access tokens are issued for securely initiating subsequent payments without requiring the user to re-authenticate each time, ensuring a seamless recurring payment flow.

For instance, with SDK.finance’s SaltEdge integration, users are redirected to a secure widget to provide consent for recurring payments.

REST APIs

VRPs rely on REST APIs for real-time data exchange between financial institutions, third-party providers, and payment processors. VRP sessions are created and managed via REST API interactions, ensuring that payments can be automatically triggered based on pre-set schedules or conditions.

Encryption and secure data transmission

Data transmission between platforms and the end-user is encrypted using transport layer security (TLS), ensuring that sensitive account and payment data is securely transmitted.

By the way, the companies must ensure compliance with PSD2 by using eIDAS certificates for strong customer authentication (SCA), which verifies the identity of payment service users and guarantees the security of transactions.

Regulatory landscape for variable recurring payments

The regulatory environment for Variable Recurring Payments (VRPs) is in flux, with different regions moving at varying paces. Here’s an overview of the current state of VRP regulation in key markets:

United Kingdom

The UK is leading the charge in VRP implementation, thanks largely to the Competition and Markets Authority (CMA). Since July 2022, the nine largest UK banks, collectively known as the CMA9, have been required to offer VRP services for “sweeping” — automatically transferring funds between a customer’s accounts to optimize interest or avoid overdraft fees. However, this initial focus on sweeping has delayed the introduction of commercial VRPs, which would allow direct payments from customer accounts to merchants. As a result, commercial VRPs are still largely unavailable.

The Payment Systems Regulator (PSR) is working to change that by expanding VRP use beyond sweeping. Consultations are underway to explore low-risk applications for VRPs, such as payments to regulated firms, utility companies, and government bodies. E-commerce is also seen as a promising but complex opportunity due to its size and potential benefits.

A significant advantage of VRPs, particularly for those with variable incomes, like gig economy workers, is the increased control over recurring payments. By reducing penalties for failed Direct Debits, VRPs could provide more financial flexibility for many consumers.

European Union

In the EU, open banking initiatives are gaining momentum, but regulatory support for VRPs hasn’t reached the same level as in the UK. Many member states are still in the early phases of creating the necessary frameworks for VRP adoption. This slow, fragmented approach has resulted in a lag in implementing both open banking and VRP solutions across the EU.

United States

In the US, the regulatory landscape is notably fragmented, hindering the adoption of both open banking and VRPs. With a patchwork of state-level regulations and a lack of federal guidance, the progress toward a unified approach to VRPs has been slower.

Global developments

In other regions around the world, the development of regulatory frameworks for VRPs is ongoing. Efforts to establish global standards and guidelines are underway, and updates will be provided as more information becomes available.

VRPs and the future of banking infrastructure

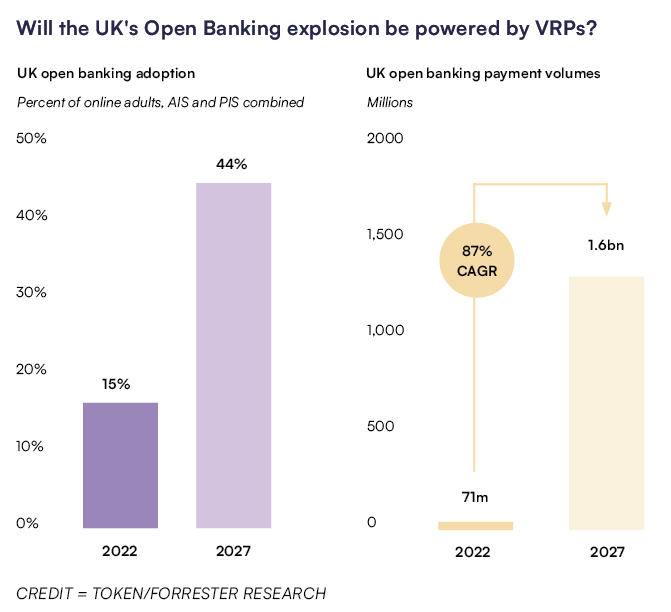

According to the forecasts made in the “Banking in 2035” report by SAS institute, traditional card payments will see a sharp decline in the next 10 years, with open banking innovations like VRPs very likely to be a standard feature in banking. VRPs can facilitate the automatic transfer of funds to savings accounts, optimizing financial management.

Banks that successfully adapt to this shift will have transformed their infrastructure into flexible, real-time platforms, capable of supporting a wide array of financial services.

Source: Payment Cards and Mobile

The growth of open banking payments is a key driver behind the rise of VRPs. As open banking continues to expand, the volume of direct, account-to-account payments is expected to surge, reducing reliance on card networks.

Charles Damen, Chief Product Officer at open banking payments platform Token, draws an insightful parallel with the transformation of the music industry:

“If you look at the music business, 20 years ago it derived 100% of its revenue from physical performance and physical music formats,” he says. “Last year, 67% of its revenues come from digital streaming – and revenues across the music business are at record levels.”

This analogy highlights that change doesn’t necessarily equate to threat—rather, it represents a significant opportunity. For the banking industry, embracing VRPs and open banking payments can lead to new levels of growth and profitability.

But how to integrate advanced variable recurring payments into established banking infrastructure?

Below, we present three forward-thinking strategies for banks to adapt to these technologies and smoothly transform their digital banking services:

Agile payment solutions

Banks need to integrate agile payment solutions that can support VRP services. This includes investing in API-driven architectures and cloud-based platforms to offer seamless, real-time payment experiences.

Cooperation with FinTechs

By partnering with fintechs, banks can accelerate their VRP capabilities and bring innovative payment products to market faster. Collaborations can also provide access to specialized technologies, such as fraud prevention and customer verification tools.

Customer-centric innovations

Banks must focus on providing personalized, value-added services that differentiate them from competitors. This could include offering budgeting tools, spending insights, and flexible payment scheduling options.

The opportunity of VRP implementation for FinTech businesses

FinTech businesses can use VRPs to enhance their service offerings and cater to evolving customer demands – streamline payment processes, offer more flexible financial solutions, and capitalize on the growing demand for automated, account-to-account (A2A) transactions.

One example of successful integration is SDK.finance, which partnered with Salt Edge, an open banking provider.

Through this partnership, SDK.finance integrated open banking capabilities into the Platform, allowing its clients to provide flexible payments and connect with 5,000+ banks in 47 countries via a single API. Here you can explore more details about SDK.finance integration with Salt Edge.

Conclusion

The era of variable recurring payments marks a transformative shift in banking. With real-time settlements, enhanced control, and increased flexibility, VRPs are set to transform everything from subscription payments to utility billing.

Platforms like SDK.finance can help businesses capitalize on this change. With a ready-made FinTech Platform companies can build and launch payment products in record time.

By integrating VRP functionality and leveraging its modular architecture, SDK.finance enables businesses to offer flexible, scalable payment solutions, positioning them at the forefront of the financial industry’s next big transformation.