While some hail API and all the trouble it entails, it is commonly agreed that its effectiveness is groundbreaking. An application programming interface (API) in banking technology acts as a facilitator of communication between applications, empowering users by allowing secure data sharing with third-party applications and enhancing the banking experience through tailored financial solutions. To start with, let’s debunk the myths about the big bad wolf stealing users’ private data and spying on innocent ones.

What is a banking API?

In fintech and banking, API (application programming interfaces) is used as a method of communication between third parties and online banking systems. This integration allows banking services to be embedded into various platforms and applications, providing customers with a seamless and convenient experience. For instance, an independent payment or financial service provider can access financial accounts and account data about a certain user through his or her bank account by relying on the already undergone KYC process.However, unlike the critics argue, a banking API can be granted access to customers’ data only after full consent is given.

The growth of bank APIs

Despite APIs having been around for a long time, their usage in the banking industry is now growing at an unprecedented rate. APIs are now being used by 70% of banks to support internal purposes, while 30% of banks use them externally.

What’s more, one in five banking APIs is “public.” This means that they’re open to anyone who wants to use them-not just the bank’s customers.

The global API banking market size was estimated at USD 3.5 billion in 2023 and is expected to reach around USD 17.5 billion by 2032. This growth is further bolstered by the global banking capabilities facilitated by APIs, enabling international reach and partnerships between fintech companies and traditional banks.

Source: Custom market insights

In 2021, there were 795 million successful API calls performed utilizing banking APIs, which increased to more than 1,13 billion in 2023. Statistics indicate a positive tendency toward integrating and utilizing banking APIs.

Banks aren’t content with this level of success, though. They plan to double the number of public APIs by 2025. This growth is being driven by several factors: the need for agility, the desire to reduce IT complexity, and a focus on making life easier for customers.

APIs offer benefits for banks in many different areas. In addition to simplifying processes and making it easier for customers to get what they want, APIs can also help banks become more agile and efficient. By using APIs in creative ways, banks can improve their customer experience while also reducing costs and becoming more competitive in the market.

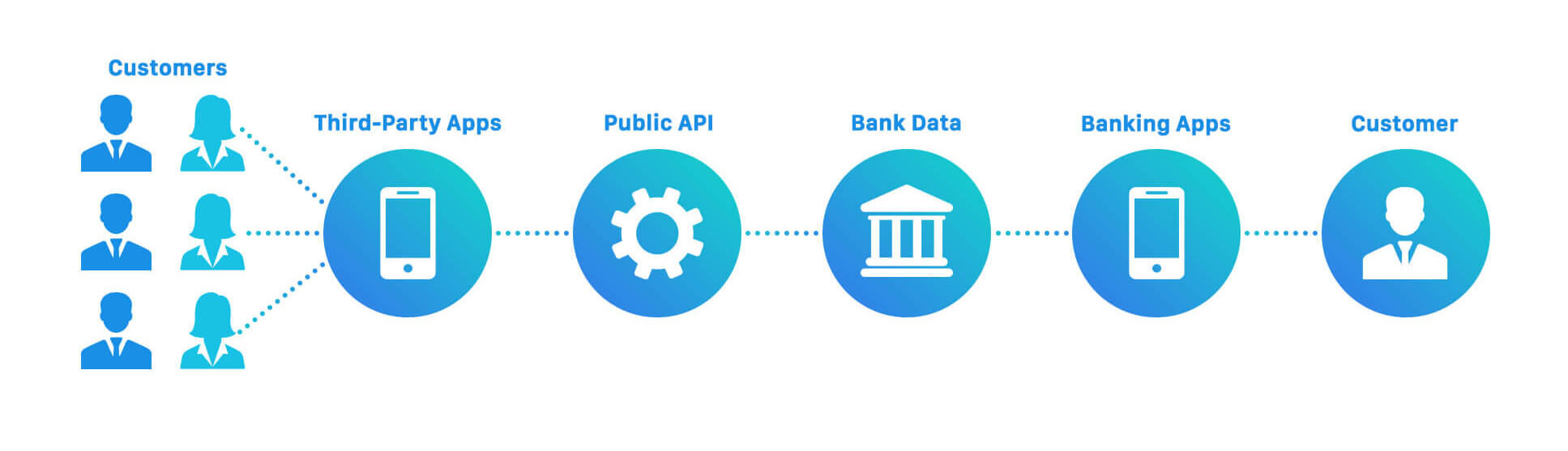

How does the API in banking work?

Banking API is the process of exposing banking functions as a web service so that they can be accessed by third-party companies. This makes business processes more efficient, as it allows different parts of the organization to work together in a coordinated manner. Additionally, direct integration allows for seamless payment processing within applications, enabling third-party companies to build products around banking services. This means that customers can use the APIs to get real-time updates on their bank accounts and perform transactions without having to go through a bank representative.

API banking. How it works?

Source: Dzone

What are bank API types and their benefits for financial institutions?

Different types of APIs come with different target solutions and usages, but as outlined by Fintech Ranking, these are divided in:

- Core banking (for deposits, lending, and SME cross-border);

- Plug & Play (trading, accounting routine, oAuth)

- Cards, wallets and transfers (SDK stock, MultiCurrency, fraud monitoring, and others);

- Acquiring (mobile and alternative phone payments, NFC solution, online card acquiring, and others).

These APIs enable the integration of various financial tools, enhancing user experiences by offering financial functionalities directly through their platforms.

REST is an architectural style where messages are sent in a single direction while SOAP is a messaging language that allows for two-way communication. REST and SOAP provide different benefits to businesses, such as scalability, security, and data transmission efficiency. However, integrating a banking app or website with an API is easy and quick–making it simple for businesses to take advantage of all the benefits these platforms have to offer!

Types of Banking APIs

According to another banking API classification, below is a list of different types of banking APIs that are used to facilitate communication between software components:

-

Open or Public APIs (External APIs)

Open APIs are widely used to integrate third-party services and allow applications to interact with each other.

-

Internal APIs (Private APIs)

These APIs are focused on internal functionality, security, and the optimization of organizational processes. They play a vital role in streamlining workflows, automating internal procedures, and improving communication between various departments within an organization.

-

Composite APIs

These APIs are optimized for performance and speed, minimizing the number of calls and reducing server load, which is crucial in complex financial infrastructure.

-

Partner APIs

These APIs enable collaboration between financial services companies and third party developers, and are frequently used in B2B models for complex financial services such as payment processing, data sharing, identity verification, and supply chain management.

The APIs also have full support for international transactions, making them ideal for global businesses. Finally, scaling is easy because the platform supports unlimited payouts from one account number. This makes it possible for businesses to process payments in bulk quickly and easily-saving time and money.

How API banking simplifies the maintenance of financial services

API banking provides a flexible and scalable approach to financial services. Here’s how it makes maintenance easier:

- Component-Based Updates:

API banking leverages modular architectures, enabling developers to update or replace individual components of the system. This means that improvements or fixes can be implemented without touching the entire platform, minimizing disruption.

- Enhanced Stability:

By isolating changes to specific modules, API banking reduces the risk of widespread issues. If a problem occurs, it’s confined to a single component, making it easier to diagnose and resolve quickly.

- Seamless Integration:

Third-party services, such as Plaid and Yodlee, can be integrated with ease. Developers can incorporate new functionalities or data sources without overhauling existing systems, ensuring that services remain up-to-date without extensive downtime.

- Incremental Improvements:

Updates can be rolled out in small, manageable stages. This incremental approach allows for continuous enhancement of services, with significantly reduced risk of errors or service interruptions.

- Better Testing Practices:

API banking facilitates more robust testing by isolating individual components. This modularity allows for thorough testing of each piece before it goes live, ensuring a smoother overall user experience.

In summary, API banking provides a structured yet flexible framework that allows for quicker, safer, and more efficient maintenance of financial services.

What are the advantages of using APIs in banking?

The main benefit of API, in the age where time is money, is the elimination of redundant procedures, meaning that third parties don’t have to verify new customers but solely rely on the KYC procedure already completed by the bank.

In other words, it ensures speed and ease of use for third-party financial service providers. The only element needed is a successful online banking login. An example is credit scoring, which can be submitted in seconds because of the data imported from a client’s bank account by the API finance.

Because of their benefits (and ensured security), APIs are being used in a number of solutions, and fintech is pioneering their implementation.

- For starters, they allow for different ways of developing apps, which can be a key advantage in banking.

- In addition, the four dimensions of a hybrid integration platform help banks modernize efficiently and streamline operations. Microservices are an effective way to develop apps because they’re flexible and adaptable to nearly any computing context, making them perfect for the fast-paced world of banking.

- Additionally, businesses can manage their entire financial operations using our dashboard or API.

What are the disadvantages of using APIs in banking?

Nothing’s perfect, so along with numerous pros, banking APIs do have a few disadvantages:

- they can be expensive

- there is always the risk of fraud when dealing with sensitive information

- APIs can be difficult to use and may require specialized knowledge.

Still, these disadvantages are outweighed by the many benefits that come with using APIs in banking.

How can APIs be used to drive innovation in embedded finance?

- By using APIs, banks can offer new products and services without having to develop them themselves. This process is fast and easy, thanks to the power of APIs. Embedded finance is a crucial aspect of this, as it allows the integration of financial services into non-financial applications, enhancing user experiences through API banking.

- In addition, APIs can be used by banks to integrate new products and services with the bank’s existing systems. This allows for a quick and seamless integration that can be done in a matter of minutes. If a bank wishes to create a new product or service, APIs make that process much easier than it would be otherwise.

- Seamless integration of new technology is not limited to vendors who are part of a third-party provider marketplace. Banks can also use APIs internally to improve efficiencies across all areas of their business. For example, APIs might interface with automation tools to further reduce the risk of human error. Using APIs in this way can help banks innovate at a rapid pace and keep up with the competition.

API Architecture

API banking architecture typically consists of a layered structure, with each layer serving a distinct function to ensure efficient and secure operations. The layers include:

- Presentation Layer: This layer handles the user interface and user experience, ensuring that customers have an intuitive and engaging interaction with the banking services.

- Application Layer: This layer manages the business logic and API calls, processing requests and ensuring that the correct operations are performed.

- Data Layer: Responsible for storing and retrieving data from various sources, this layer ensures that all necessary information is available for processing and decision-making.

- Integration Layer: This layer enables communication between different systems and services, ensuring that all components of the API architecture work together seamlessly.

By organizing the architecture in this way, financial institutions can provide robust and scalable banking services that meet the needs of their customers.

How do banks use a layered architecture in API banking?

Banks employ a layered architecture in API banking to streamline operations and enhance functionalities via structured interactions.

Core Services and API Abstraction

Each core banking function—such as account management, payments, and data analytics—is abstracted into distinct modules. These modules each have their own APIs, adhering to standard protocols and data formats like JSON or XML. This abstraction simplifies third-party interactions with the bank’s services. For instance, fintech startups can integrate specific banking functions, like payment processing, without delving into other modules.

Modular Design for Flexibility

The modular design permits faster innovation and targeted enhancements within financial services. Developers can focus on specific APIs for different functionalities, facilitating quicker integration and updates. This means a business can update one part of the system independently, reducing maintenance burdens and increasing flexibility.

API Gateway and Security

A crucial component is the API gateway, which acts as a secure entry point for all incoming API requests. It authenticates these requests, performs necessary security checks like token validation or OAuth authentication, and then routes them to the appropriate service module. This protective layer ensures that only authorized requests can access core banking systems, safeguarding sensitive financial data.

Monitoring and Analytics

On top of these APIs, banks often implement monitoring and analytics layers. These layers track API usage, measure performance metrics like latency, and identify potential bottlenecks. This data allows banks to maintain optimal performance, anticipate issues, and improve their services continually.

Benefits of Layered Architecture

- Enhanced Security: The API gateway acts as a shield, ensuring only authorized access.

- Scalability and Flexibility: Individual modules can be updated without impacting the entire system.

- Targeted Innovation: Developers can build specialized services using specific APIs.

- Operational Efficiency: Standardized APIs facilitate easier integration and maintenance.

In summary, banks leverage a layered architecture in API banking to promote modularity, security, and innovation, making it easier for third-party developers to integrate and build upon their services.

How do real-time analytics and monitoring benefit businesses using API banking?

Real-time analytics and monitoring provide substantial advantages for businesses utilizing API banking.

Firstly, these features enable companies to keep a close eye on their transaction activities. By tracking transactions as they happen, businesses can promptly identify any discrepancies or unusual patterns. This immediate visibility helps in quickly addressing potential issues, ensuring smoother financial operations.

Additionally, monitoring usage patterns offers valuable insights into customer behavior. For instance, businesses can observe peak usage times and adjust their operations accordingly to ensure optimal performance and customer satisfaction. They can also detect emerging trends, allowing them to adapt their services to better meet market demand.

Analyzing system performance is another crucial benefit. Real-time monitoring helps in identifying bottlenecks or inefficiencies within the system. By pinpointing areas that require improvement, businesses can take proactive steps to enhance overall system performance, thus reducing downtime and preventing potential revenue losses.

Furthermore, the actionable insights derived from these analytics can significantly inform business strategy. Understanding detailed metrics enables companies to make data-driven decisions that improve their competitive edge. For instance, they could refine their product offerings, develop targeted marketing strategies, or streamline operational processes based on the insights gained.

In conclusion, real-time analytics and monitoring are vital for businesses using API banking. These tools not only help in maintaining robust operational oversight but also drive strategic improvements, ensuring long-term growth and customer satisfaction.

How will APIs in banking impact the future of banking?

There is no doubt that APIs will play a major role in the future of banking. They help banks generate new customer insights and revenue streams, improve customer experience and make their systems & data available to third parties.

But what does this mean for consumers?

APIs can help third-party companies build products around banking services. This means that customers can use the APIs to get real-time updates on their accounts and perform transactions without having to go through a bank representative.

Moreover, API banking facilitates smoother and more convenient interactions for the customer. Whether it’s faster payment processing or more intuitive financial management tools, these benefits elevate the overall customer experience. By enabling third-party companies to integrate advanced features, customers enjoy a more seamless and efficient banking experience.

Key Benefits:

- Real-Time Updates: Customers can instantly see changes in their accounts, enhancing their ability to manage finances proactively.

- Direct Transactions: Perform transactions swiftly without the need for intermediary steps, saving time and effort.

- Faster Payment Processing: Experience quicker transactions, reducing wait times and improving satisfaction.

- Intuitive Tools: Access user-friendly financial management tools that simplify complex tasks.

In essence, API banking not only empowers third-party developers but also significantly enhances the overall banking experience for customers.

How can financial institutions generate revenue through API banking?

- By using APIs, banks can offer new products and services without having to develop them themselves. This process is fast and easy, thanks to the power of APIs.

- In addition, APIs can be used by banks to integrate new products and services with the bank’s existing systems. This allows for a quick and seamless integration that can be done in a matter of minutes. If a bank wishes to create a new product or service, APIs make that process much easier than it would be otherwise.

- Seamless integration of new technology is not limited to vendors who are part of a third-party provider marketplace. Banks can also use APIs internally to improve efficiencies across all areas of their business. For example, APIs might interface with automation tools to further reduce the risk of human error. Using APIs in this way can help banks innovate at a rapid pace and keep up with the competition.

- Monetization Opportunities: Financial institutions can also monetize their APIs, opening up new revenue streams. By enabling third-party developers to access and utilize these APIs, banks can facilitate the creation of value-added services that attract more customers.

- Revenue Models: There are multiple ways to generate income through APIs. Banks can implement a pay-per-use model, where developers and businesses pay each time they use the API. Another option is a subscription model, offering continuous access to the API for a recurring fee. Both methods provide substantial revenue opportunities while fostering an ecosystem of innovation around the bank’s services.

By leveraging APIs for both operational efficiency and revenue generation, financial institutions can stay competitive and meet the evolving needs of their customers.

SDK.finance: a reliable banking API vendor

As banking APIs continue to influence how financial services are built and delivered, many organisations eventually arrive at the same question: which provider can supply a stable, secure, and adaptable API layer for their product? Once the role of APIs is clear, the next logical step is choosing a vendor that can support long-term growth rather than limit it.

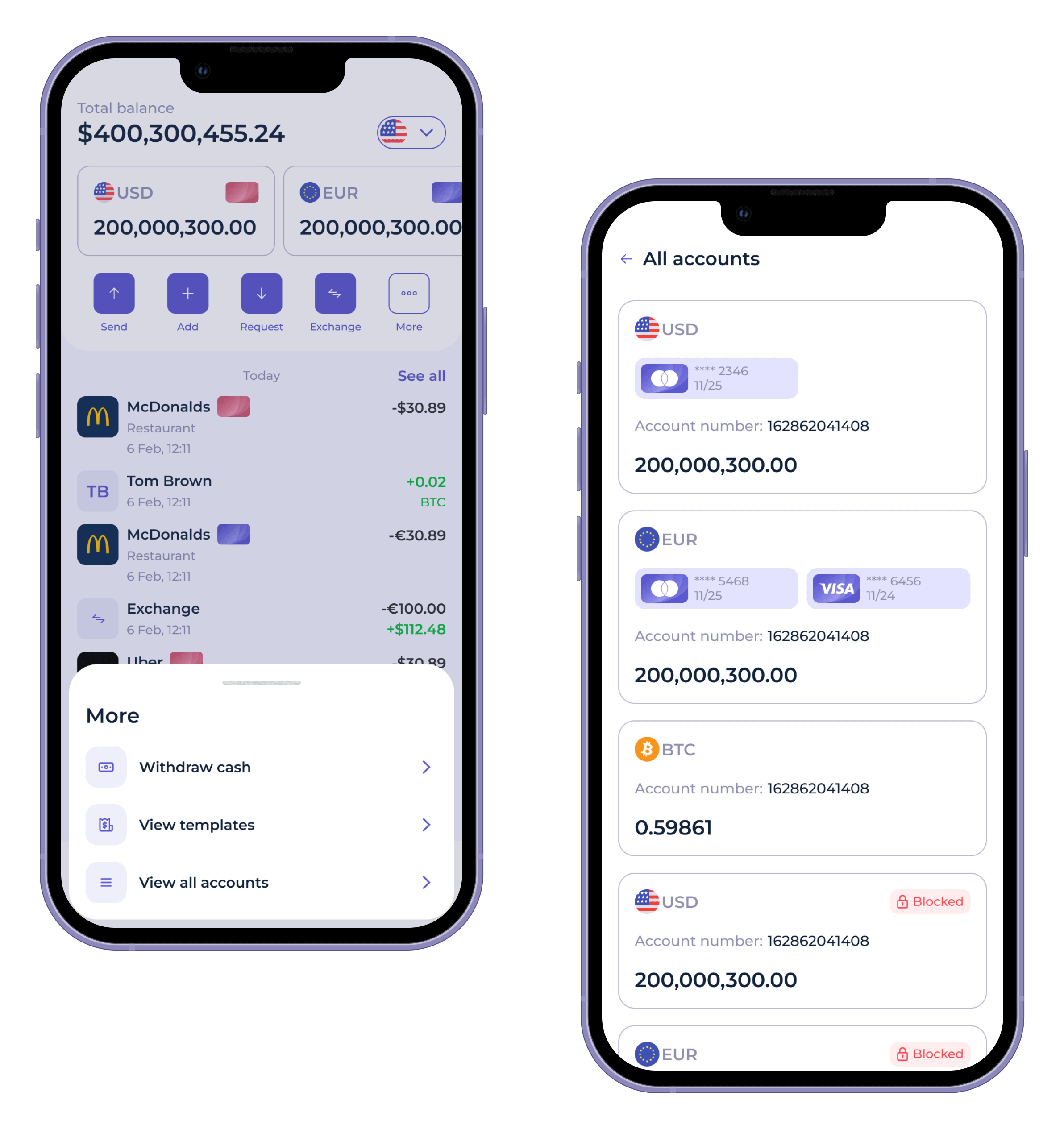

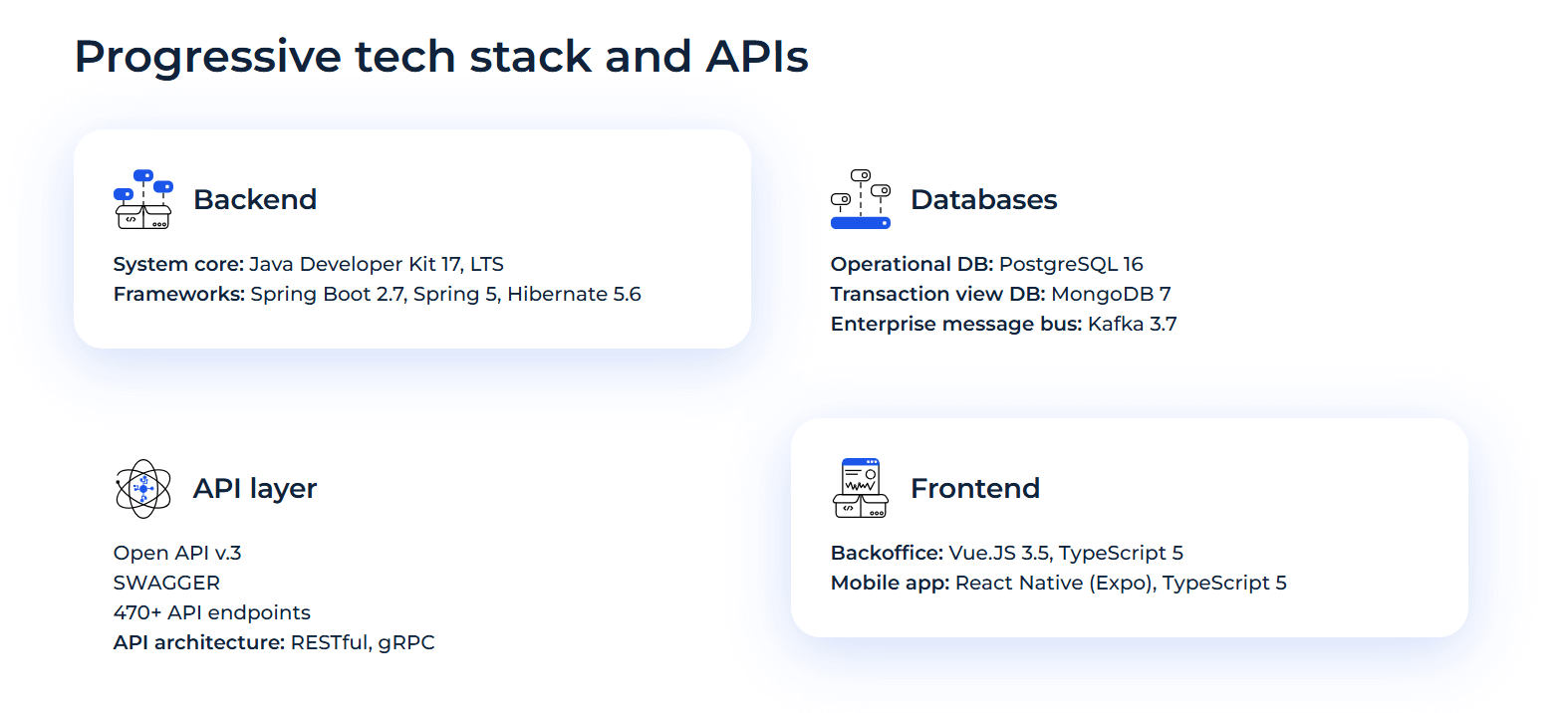

SDK.finance is one of the vendors that takes an API-first approach seriously. The Platform includes more than 470 RESTful endpoints covering accounts, multi-currency wallets, onboarding and KYC/AML flows, card integrations, money movement, fees, limits, and the full transaction ledger. The API structure follows a consistent design, which makes it easier for engineering teams to expand functionality without dealing with fragmented logic.

Image: SDK.finance technologies

Broad functional coverage

The APIs support the essential components for banking and embedded finance: multi-currency accounts, deposits, virtual accounts, internal and external transfers, card issuing connections, advanced fee logic, limits, and a ledger designed for high volumes.

A practical developer experience

OpenAPI v3 specs, Swagger documentation, OAuth 2.0, a sandbox environment, webhooks, and clear resource naming make the integration process predictable. Teams can plug in new services or build full financial products without unnecessary friction.

Flexible launch models

SDK.finance offers two deployment paths: a SaaS setup for teams that want to move quickly, and a sourse code license for organisations that need full control and operate on their own infrastructure. The modular architecture allows businesses to adjust individual components without touching the whole system.

Built for scale

The core processes more than 2,700 transactions per second on baseline hardware, backed by PostgreSQL for operational data and MongoDB for analytical views. This structure helps maintain performance even under heavy API workloads.

Security and compliance

The Platform is PCI DSS Level 1 certified and follows strong security practices, including encryption, strict access controls, and a clear separation between operational and reporting databases.

Fits regulated environments

SDK.finance doesn’t provide licensing or banking partnerships, but its architecture is built for seamless integration with BaaS providers, partner banks, and compliance vendors. This lets institutions incorporate regulated components while keeping control over their product logic.

Long-term independence

For teams that require complete autonomy, the source code licence allows full ownership of the codebase. This eliminates vendor lock-in and gives organisations the freedom to adapt APIs and business logic to their exact needs.

Key features available via SDK.finance APIs

SDK.finance exposes a wide set of financial and operational capabilities through its API layer, commonly required for building banking-grade products:

Accounts and asset management

-

Multi-currency and multi-asset accounts

-

Virtual accounts

-

Account statements and histories

-

Account hierarchies and sub-accounts

-

Balance checks and hold/reservation management

Payments and transfers

-

Bank payments (local and cross-border)

-

Internal transfers between users or accounts

-

Scheduled payments and recurring transfers

-

Real-time P2P payments

-

Bulk payouts

-

Bill payments and utility top-ups

Currency management

-

Currency exchange

-

Real-time FX rate updates

-

Configurable markup, spread, and fee rules

Cards and issuing

-

Virtual and physical card support via connectors

-

Card activation, PIN management, card controls

-

Card-to-account and account-to-card operations

Onboarding and compliance

-

KYC and KYB workflows (via integrated providers)

-

Document upload and verification flows

-

AML monitoring rules

-

Sanctions screening (through vendor integrations)

Fees, commissions, and limits

-

Dynamic fee configuration

-

Tiered pricing and rule-based fees

-

Daily, weekly, monthly limits

-

Velocity and volume limits for different operation types

Transaction processing and ledger

-

Double-entry ledger

-

Reconciliation and settlement tools

-

Webhooks for transaction events

-

Dispute and chargeback flows (via connectors)

Merchant services

-

Merchant onboarding

-

Payment acceptance

-

Settlement accounts

-

Commission sharing and partner revenue models

Operational and reporting APIs

-

Audit logs (operations, actors, transactions)

-

Role-based access control

-

Transaction search and filtering

-

Financial reporting endpoints

-

Export to CSV, JSON, PDF

If you’re exploring a reliable foundation for your next financial product, learn how SDK.finance Platform can support your project.