The use of paper checks has been on the decline since the early 2000s, but a large portion of the population still relies on these physical check transactions.

Nowadays, consumers want to clear their checks without waiting for hours or days — which is why they prefer digital transactions because they are more convenient and fast-paced.

As a result, financial institutions and banks now use automated banking check-clearing systems to fast-track check payments.

But is automated check clearing foolproof? Can clearing houses handle the rigors of this relatively new technology?

In this article, we discuss automated check-clearing and highlight the benefits of image-based cheque-clearing systems.

What is check-clearing?

Check clearing is the movement of cash (or digital payments) from one bank, followed by the transfer of the physical or digital paper back to the origin.Based on this check clearing definition, Bank A (withdrawal bank) sends the check to Bank B (deposit bank), while Bank B processes the request and sends the money to Bank A.

This is the standard check-clearing cycle used in all financial institutions and digital retail banks.

How does automated check-clearing work?

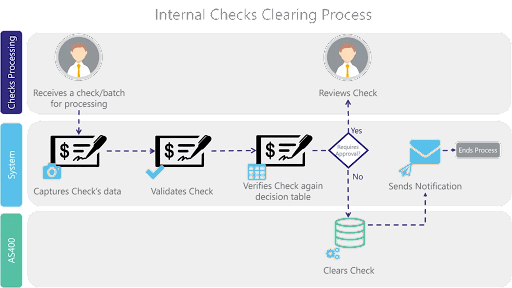

Automated check processing follows the same working principle as physical check clearing. The only difference is that the process is automated.

The withdrawal bank sends a digital copy of the cheque, accompanied by data on the MICR band. Afterward, the check is processed without manual handling from the deposit bank — this new approach is called check truncation.

A brief history of check clearing in the US

Check clearing became popular in the USA during the post-WWII era as people looked for ways to move money fast between locations.

But at the time, most banks struggled to handle the overwhelming demand for check transfers.

Later on, the Bank of America — alongside the Stanford Research Institute — launched the Electronic Recording Machine (ERMA) to read and organize checks.

ERMA came into existence in 1959, announcing the revolutionary magnetic-ink character recognition (MICR) system.

The American Bankers Association adopted MICR-enabled production machines as the industry standard in the 1970s.

However, these early ERMA devices were cumbersome and difficult to use. And after long hours of operation, they needed air conditioners to cool down before resuming operations.

Eventually, the Burroughs Adding Machine Company created the Burroughs machine — a device capable of reading 1500+ checks per minute.

This invention laid the groundwork for the Burroughs Payment Systems and IBM’s Check Processing Control System.

Burroughs later released the B4700 machine in 1977, which could handle 60 000+ checks per hour.

Since then, modern banks now handle automated check processing using technologies like remote deposit capture (RDC), electronic funds transfer (EFT), and automated clearing house (ACH).

Automated banking check-clearing statistics

Check clearing has become easier for bankers since automated checks took over the process.

At the same time, the number of people cashing checks is rapidly declining as new technologies, like cryptocurrencies, come to the fore.

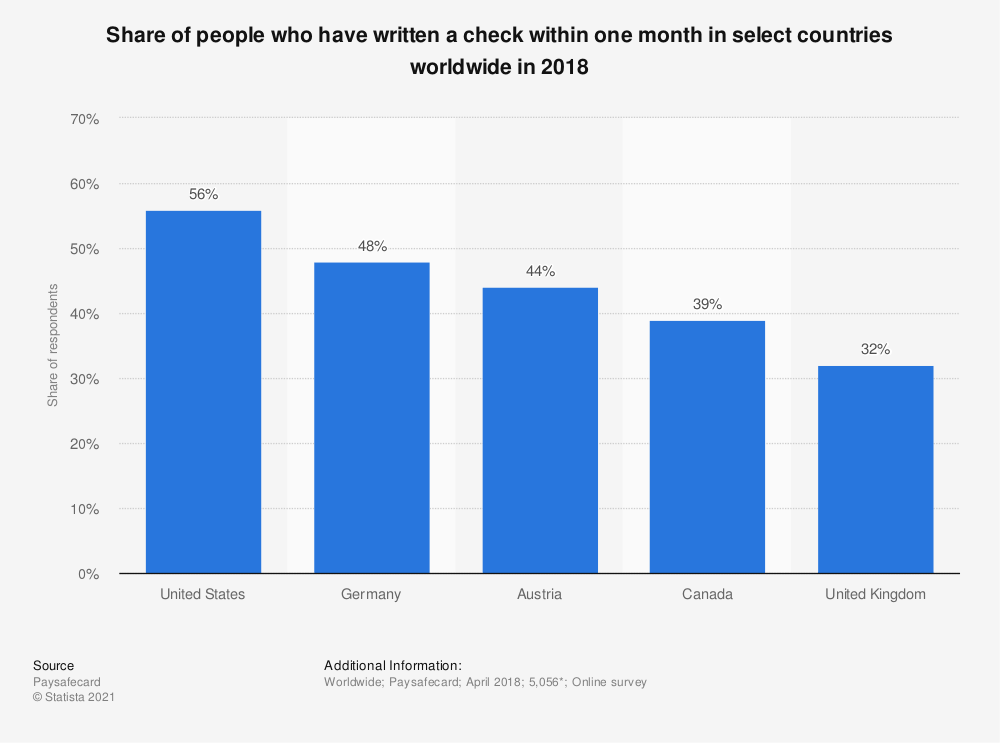

According to Statista, 56% of US consumers are likely to write a check monthly. Also, 30.2% of issued checks went to financial institutions, 7.7% went to the government, and only 5.4% were used in P2P services.

In Britain, only 32% of consumers are ready to write checks. According to Pay.UK — the premier independent payment system in the United Kingdom — the use of checks spiked briefly to over 250 million in 2019. Financial experts credit this spike to the proliferation of automated payment and check processing systems nationwide.

In Canada, over 383 million transactions were made through the Automated Clearing Settlement System (ACSS). These figures represent a 20% decrease from the previous years, which is a downward trend in terms of automated check processing.

Now, let’s explore SDK.finance’s FinTech Platform, as we dive into a demo showcasing how it revolutionizes reconciliation processes, offering seamless financial management solutions for modern banking institutions:

Common automated banking check-clearing issues

Every human-made technology has its limitations, and automated check processing is not exempt.

Here are the issues associated with essential components of automated check clearing.

The Automated Clearing House (ACH)

The automated clearing house refers to a computer-based network that handles the transfer of electronic funds. NACHA (National Automated Clearing House Association) uses ACH to provide several payment services in the United States.

The ACH is similar to a financial entity that moves money between bank accounts for interested customers.

Source: Investopedia

However, transactions within the ACH network are not instant. Although this delayed transaction model suits B2B payments, individuals prefer instant payment processing — which ACH does not offer.

Besides, ACH only supports debit payments of bills, utilities, and loans. The ACH network can also limit the number of transactions users can initiate.

The Clearing House Interbank Payments System (CHIPS)

The Clearing House Interbank Payments System (CHIPS) is a privately owned US-based clearing house for massive transactions. Financial institutions around the globe use CHIPS to conduct international and domestic check transactions.

However, CHIPS only collaborates with 47 banks worldwide, which also serve as the regulatory body. And like ACH, CHIPS is a netting engine that doesn’t allow RTPs (real-time payments).

The UK equivalent for CHIPS is CHAPS (Clearing House Automated Payment System) — a sterling same-day system that handles time-critical and lower-value payments.

Automated cheque processing (ACP) issues

Automated Cheque Processing (ACP) is a component of the ACH that enables same-day cheque clearing.

Here are the main issues associated with ACP, ACH, and CHIPS:

-

Availability of funds

Not every bank can handle the constant influx of check-clearing requests without prior notice. Small financial institutions like loan unions may lack sufficient funds to process your digital checks.

In these situations, your automated check could stay in digital limbo for a few hours or days. So, always notify the bank, loan house, or credit union beforehand when you want to cash a massive check.

-

Technical issues

Digital check processing systems rely on the Internet to work. Besides, technical issues like server malfunction and internet downtime can block automated checks from clearing.

-

Human error

Misspellings and incorrect user information are common automated banking check-clearing issues. Also, missing MICR data can force the system to bounce your check. Since the AI-powered system can only process validated digital checks, your transaction might take longer than usual to complete.

-

Financial regulations

Financial laws vary in different countries, which is an issue when transferring money between two international banks. For example, banks can withhold a check from a foreign bank or hostile nation under security regulations. Also, banks often flag massive transactions from suspicious individuals.

-

Possibility of scams

In line with local and international financial regulations, banks could struggle to facilitate automated check processing fast. If a bank spots any suspicious activity — stale checks, hold payment requests, or missing MICR data — they can discontinue the transaction and alert the authorities.

What is image-based check processing?

Since we’ve discussed the issues with standard check-clearing systems, let’s discuss the alternative — image-based check processing.

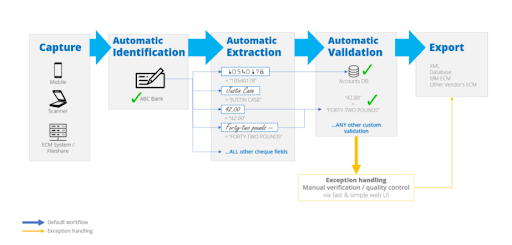

How does this image-based system work?

- The user captures the image on their mobile device or scanner.

- The system uses OCR and ICR engines to identify the fields on the check.

- These engines extract information from the required fields and forward it to the straight-through-processing (STP) database.

- If STP validation fails, the user can perform microtasks on the simplified interface to complete the process.

- The system exports the result to the back-end system/ (XML, dB, or LOB).

Why use an image-based check-clearing system?

The image-based system excels over other check-clearing methods because it relies on the Future Cheque Clearing Model (FCM). So, let’s check out the main advantages of using this FCM model:

- Speed

The overall check processing time using image-based solutions is low compared to CHIPS and ACH. The system can process the uploaded images of your check and deliver the verdict instantly.

- Easy integration

Image-based check processing solutions are heterogeneous, meaning that they can be integrated with databases and core banking systems without significant compatibility issues.

- Privacy

Cybersecurity is paramount in the financial world. Banks need image-based check verification and process to protect their systems and customers. These AI-powered document verification systems also help combat financial fraud and loan scams.

- Cost-effectiveness

Clearing checks with automated tools saves operating costs by eliminating the humans and third parties involved in the process. Besides, you get a solution that scans checks, processes payments, and aggregates data, all in one package.

- Compliance

Since financial regulations are constantly changing, you need a solution that can update industry standards to help you avoid sanctions and fines. Modern image-based solutions have a flexible architecture that allows you to adjust the core banking system to international and local financial standards.

- Advanced reporting

Data is the glue to the success of every financial institution. Advanced check-clearing systems now collect, report, and share data instantly.

Final words

Automated banking check clearing is a relatively new technology. But despite being young, automated check processing has improved the way we make financial payments.

Nonetheless, you need to remain mindful of financial regulations, security, overcharging, technical issues, and human error when buying a new check-clearing solution.

Use AI-powered image-based clearing systems to process check payments for your business or financial institution. If you need assistance building or implementing these automated check-clearing solutions, reach out to our experts right away.