Saudi Arabia’s FinTech sector is undergoing rapid transformation, fueled by Vision 2030’s ambitious digital economy goals, strong regulatory support, and a booming demand for digital financial services. With a target to have 525 FinTech companies by 2030, the Kingdom of Saudi Arabia is positioning itself as a leading hub for financial innovation in the Middle East.

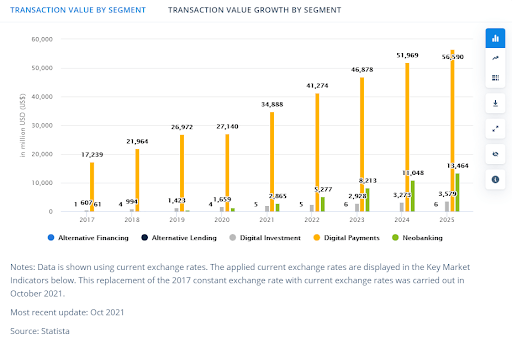

Saudi Arabia’s FinTech sector is projected to reach $1.5 billion by 2025, driven by a combination of regulatory reforms, the financial sector development program, increasing smartphone penetration, and changing consumer behavior. Key trends shaping the market include:

- Digital Payments Dominance: Over 75% of financial transactions in Saudi Arabia are now digital, supported by the government’s push for a cashless economy.

- Surge in BNPL (Buy Now, Pay Later): Companies like Tamara and Tabby are leading the BNPL revolution, attracting significant investment and expanding their services across the region.

- Open Banking Framework: Saudi Arabia’s central bank, SAMA, launched its Open Banking Framework in 2022, paving the way for FinTech firms to develop innovative financial products.

In this article, we explore fintech companies and their operations in the Kingdom of Saudi Arabia. Continue reading to understand the state of fintech in the kingdom.

What are fintech companies?

The consensus fintech meaning refers to the integration of technology into financial services — financial technology. Essentially, this fintech definition positions it as any technology that automates, manages, and delivers financial services between consumers and businesses.In the same vein, fintech companies are institutions that deliver digital financial services to startups, SMEs, and large corporations. Financial organizations can also use fintech tools to digitize investments and payments to foster transparency, convenience, and processing speed.

The current state of the fintech ecosystem in KSA

The country’s dedication to developing the financial sector, particularly Saudi Arabia’s fintech sector, is evident in the ongoing Vision 2030 initiative — a project that hopes to position Saudi Arabia as the premier fintech hub in the Middle East and the rest of the world by 2030.

Saudi Arabia’s fintech sector is experiencing significant growth, driven by a combination of technological adoption, supportive regulatory frameworks, and a young, tech-savvy population. The market size reached approximately USD 39.91 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 13.7% between 2025 and 2034, potentially reaching around USD 125.01 billion by 2034.

Minister of Finance Mohammed Al-Jadaan said the number of fintech companies in Saudi Arabia reached 224 by the end of Q2 2024, surpassing the Financial Sector Development Program’s (FSDP) target of 168 companies for the same period.

Source: Statista

As a testament to the success of this Fintech-oriented initiative, the Saudi government has adopted the UK’s financial service model to form the new Fintech Saudi.

Currently, Fintech Saudi works under the auspices of the Saudi Arabian Monetary Agency (SAMA), supporting innovation in the Fintech world and promoting a favorable environment for startups and entrepreneurs to thrive and compete locally and globally.

Source: FintechSaudi.com

Also, more fintech solutions have entered the Saudi financial sector since SAMA established Saudi Payments (SADAD) and Payment Service Provider Regulations (PSP Regulations). As a result, smartphone transactions have tripled since 2019, reaching a current estimate of 34 million USD.

Unlike China and Bolivia, Saudi Arabia has embraced blockchain technology and cryptocurrencies. In the previous year, SAMA added 50 billion SAR (13 billion USD) into the blockchain fintech sector.

Despite these changes and advancements, entrepreneurs and investors still ask: “is bitcoin legal in Saudi Arabia?”

If you want to trade bitcoin in Saudi Arabia, SAMA regulations allow peer-to-peer and B2B transactions. So, you can run a bitcoin exchange in Saudi Arabia, provided you get a license from the regulatory bodies — and these licenses are difficult to obtain.

Fintech Regulations in Saudi Arabia

The fintech sector in Saudi Arabia operates under a robust regulatory framework managed by two key authorities: the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA). SAMA oversees a wide range of financial services, including banking, finance, insurance, credit bureaus, and payments. On the other hand, the CMA focuses on capital market-related activities such as dealing, arranging, managing, advising, and custody of securities.

For fintech startups in Saudi Arabia, understanding whether their services fall under the purview of SAMA or CMA is crucial. Both regulators provide comprehensive lists of regulated activities on their respective websites, helping fintech companies navigate the compliance landscape. Interestingly, there are currently eight standalone fintech activities that do not require regulatory approval, offering a unique opportunity for innovation in areas like business tools and customer experience enhancement.

This regulatory clarity not only ensures a secure and transparent fintech ecosystem but also encourages innovation and growth within the sector. By adhering to these regulations, fintech companies can confidently operate and contribute to the dynamic financial landscape of Saudi Arabia.

Digital Payments and Remittances in Saudi Arabia

Digital payments and remittances are at the heart of Saudi Arabia’s fintech sector, reflecting the nation’s commitment to digital transformation. The country has made remarkable progress in promoting digital payments, achieving a 70% non-cash transaction rate two years ahead of the 2025 target. This rapid advancement underscores the effectiveness of initiatives like FinTech Saudi in driving economic growth.

With 97% of the population using smartphones, Saudi Arabia has established itself as a mobile-first society. This high smartphone penetration, coupled with a youthful demographic—nearly 35% of the population is under the age of 35—creates a solid foundation for digital adoption. The number of fintech companies in the Kingdom has doubled between 2022 and 2023, further accelerating the digital transformation.

As the nation continues to embrace digital payments, the fintech sector is poised to play a pivotal role in shaping the future of financial services in Saudi Arabia. This ongoing digital revolution not only enhances convenience for consumers but also positions Saudi Arabia as a leader in the global fintech landscape.

Types of fintech startups in Saudi Arabia

Like traditional financial institutions, fintech companies vary based on the services they offer. In Saudi Arabia, most fintech companies digitize B2B operations, facilitate P2P financial services, and connect consumers with banking services.

However Saudi fintech companies do not focus solely on businesses and consumers. Here is an extensive spectrum of fintech companies in the kingdom and the specific areas they cover.

- RegTech (or Regulatory Technology) focuses on international and local compliance standards, most of which focus on anti-money laundering legislation and customer satisfaction.

- Insurtech (or Insurance Tech) digitizes the insurance industry and simplifies the application process for consumers.

- Payments — Companies like Venmo, CashApp, and PayTab handle payment portals and digital wallet services from which you can conduct online purchases.

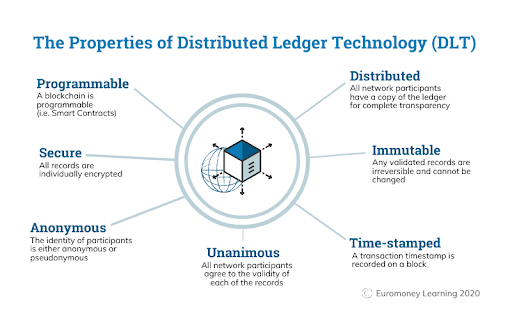

- Blockchain — financial houses are shifting to blockchain technology because it uses a distributed ledger to maintain records of digital payments.

Source: Euromoney

Source: Euromoney - Cryptocurrency and NFTs — As the world continues to embrace the crypto era, fintech companies like Binance and Moyasar provide solutions to help users save, trade, and convert their crypto assets online. Also, these companies enable consumers to acquire non-fungible tokens (NFTs).

- Neobanking — as financial institutions move their operations online, neobanks are becoming popular globally. Fintech companies can help you set up and navigate the heavily-regulated neobanking sector.

- Digital banking — traditional banks can also digitize their operations by adopting digital banking software that runs on cloud-hosted databases.

- Money transfers (P2P and B2B lending) — fintech companies like Wise and Lendo handle instant money transfers between financial entities. Individuals can also use these services to lend money and obtain digital collateral from their peers.

- Stock trading and investment — with apps like Robinhood and WetHaq, consumers can trade stocks and invest in other financial assets.

- Crowdfunding — platforms like GoFundMe and Buthoor allow users to apply for and obtain funding for specific initiatives.

Top fintech companies in Saudi Arabia in 2026

The fintech Saudi Arabia ecosystem is booming alongside the country’s economy. Although most Saudi fintech companies are yet to match their Western competitors, they have shown tremendous promise over the last few years.

International fintech companies play a crucial role in enhancing the local fintech ecosystem through collaboration and innovation, driving diverse fintech activities and supporting sustainable growth.

Saudi Arabia’s FinTech landscape is growing rapidly, with startups and technology providers shaping the future of digital finance. Key players include:

- STC Pay: The first FinTech unicorn in Saudi Arabia, offering a wide range of mobile wallet and remittance services.

- Tamara & Tabby: Leading BNPL providers, enabling interest-free instalment payments for consumers.

- HyperPay: One of the region’s top payment gateways, facilitating secure online transactions for businesses.

- SDK.finance: A payment solution provider that enables businesses to launch financial products quickly with a robust white-label platform. By offering pre-built wallet, payment processing, and transaction management capabilities, SDK.finance helps companies reduce development time and focus on scaling their FinTech solutions in the Saudi market.

- Riyad Bank FinTech Accelerator: Supporting early-stage FinTech startups with funding and mentorship.

- Geidea: offers digital banking technology, POS terminals, and business management solutions for both financial institutions and small businesses in retail and digital commerce.

Talent and Investment in Fintech Saudi

Talent development and investment are critical components driving the growth of the fintech industry in Saudi Arabia. Historically, talent was a significant challenge for the sector, but various initiatives are now addressing this gap. One notable effort is the partnership between the Financial Academy, Fintech Saudi, and AstroLabs, which launched a comprehensive fintech bootcamp. This program successfully trained 30 young professionals, supporting the development of fintech prototypes and fostering a new generation of fintech talent.

Investment in fintech startups has also seen a substantial increase. In the MENAP region, investments surged from $200 million in 2020 to approximately $704 million in 2023. This influx of capital is expected to drive MENAP fintech revenue to $3.5–$4.5 billion by 2025. Saudi Arabia, in particular, aims to boost foreign direct investment (FDI) levels by 20%, targeting $3.2 billion by 2030.

These efforts in talent development and investment are not only enhancing the capabilities of the fintech sector but also positioning Saudi Arabia as a burgeoning hub for fintech innovation and growth.

Challenges and Opportunities in Fintech Adoption

Challenges:

- Regulatory Complexity: While SAMA has introduced progressive regulations, navigating licensing and compliance remains a hurdle for new entrants.

- Competition with Established Banks: Traditional banks are rapidly digitizing, making it harder for FinTech startups to differentiate themselves.

- Cybersecurity & Fraud Risks: As digital transactions grow, fraud prevention and cybersecurity measures must evolve to maintain consumer trust.

Opportunities:

- Payment Solutions for a Digital-First Economy: With Saudi Arabia’s rapid shift towards digital transactions, scalable payment infrastructure is essential. SDK.finance provides a modular payment solution that enables FinTech startups and enterprises to streamline payment processing, automate transactions, and integrate with banking APIs—helping them comply with local regulations and accelerate go-to-market time.

- Open Banking & API Integration: Saudi Arabia’s Open Banking Framework allows FinTech firms to develop personalized financial services through seamless bank integrations.

- Growth of Islamic FinTech: Sharia-compliant digital banking and investment platforms represent a huge untapped market in the Kingdom.

- Cross-Border Expansion: Saudi FinTech startups can scale regionally, leveraging the GCC market’s demand for digital financial services.

Future Outlook for Fintech in Saudi Arabia

The future of fintech in Saudi Arabia looks exceptionally promising. The Kingdom’s unwavering commitment to digital transformation and financial inclusion is expected to propel significant growth in the fintech sector. By 2030, the number of fintech companies in Saudi Arabia is projected to reach 525, contributing approximately 13 billion riyals to the GDP and creating 18,000 direct jobs.

The Saudi government’s support for the fintech sector, including the establishment of the Saudi Arabian Monetary Authority (SAMA)’s Regulatory Sandbox Framework and the Fintech Saudi program, is set to continue driving innovation and growth. These initiatives provide a conducive environment for fintech startups to thrive and experiment with new technologies.

With a tech-savvy population, high broadband connectivity, and a favorable regulatory framework, Saudi Arabia is well-positioned for continued expansion in digital finance. The Kingdom’s strategic vision and proactive measures are paving the way for a sustainable and prosperous future, positioning Saudi Arabia as a global fintech hub.

Final words

Saudi Arabia is rapidly emerging as a FinTech powerhouse, offering vast opportunities for startups, financial institutions, and technology providers. With strong government support, increasing digital adoption, and a fast-growing startup ecosystem, now is the ideal time for businesses to tap into Saudi Arabia’s financial innovation wave.

Looking to launch a FinTech product or payment processing solution in Saudi Arabia?

SDK.finance provides a white-label payment solution that enables businesses to launch financial services without building from scratch. With features such as wallet management, transaction processing, and seamless API integrations, SDK.finance helps companies bring their payment products to market faster and more efficiently.