The global technology market has grown rapidly from $1,6 billion in 2015 to $14 billion in 2022, according to Merchant Machine. It is driven by the adoption of online payment methods for banking and financial services. Mordor Intelligence forecasts that mobile payments will grow 24.5% between 2021 and 2026. The demand for an online mobile payment system increases the need for digital solutions. As a result, fintech companies are trying to provide a frictionless payments experience for their customers, and are pushing back against a product-centric approach. One such solution is a mobile wallet application that keeps credit cards and provides transactions.

However, developing FinTech software is a time-consuming and costly process. The cost of developing an e-wallet app varies from $45,000 to $250,000 and depends on the level of complexity and functionality of your wallet. Nevertheless, there is a solution that can speed up the process and reduce development costs.

In this article, we discover what an e-wallet is, how it works, and what you need to know before developing such an app.

What is a digital wallet?

Digital wallets are computer software that can conduct transactions online or over the Internet. It stores customers' payment details for different payment methods on different websites. Digital wallets are also referred to as e-wallets. Although digital wallets are often stored on smartphones, there is another form, such as on a desktop.Digital wallets can enable more than just transactions. They also hold loyalty cards, tickets, gift cards, and are used for user authentication. For example, mobile wallet apps can verify a person's age when purchasing alcohol.

Why do you need to invest in mobile wallet app development?

According to Statista, the market for mobile wallet transactions will grow significantly over the next few years. It is expected that the total number of digital wallet users worldwide is expected to exceed 5.2 billion in 2026, up from 3.4 billion in 2022, representing strong growth of over 53%, due to a new study from Juniper Research.

Market size of mobile wallet transactions worldwide with forecasts from 2021 to 2025.

Source: Statista

As a result, the banking and financial sector is being forced to shift its key service and product offerings to digital formats. In response, financial institutions have started to offer various digital solutions tailored to specific needs. Thus, the introduction of digital payment options helps to increase customer loyalty, boost demand, and improve the convenience of modern users.

Key mobile payments statistics

- Mobile payment app revenue is expected to grow from $550 trillion in 2015 to $1,639.50 trillion by the end of 2022, according to Forbes.

- The number of people using digital wallets is expected to reach 4.4 billion by 2025, according to Juniper Research.

Here you can find more information about leading e-wallet companies.

The basic technologies behind a digital wallet

Wallet apps can be used quite easily. The customer launches the app with PIN codes or fingerprints to select the card to use. Many digital wallet apps use NFC technology when transferring cards and can even be used to make purchases.

NFC (or near-field communication) is a contactless technology that provides secure transactions between a wallet and a POS terminal. It functions as a communication protocol and enables contactless payments via mobile devices.

MST (or Magnetic Secure Transmission) is a similar technology to NFC that uses magnetic card readers to scan your card when you swipe it through a slot on POS.

iBeacon enables secure data exchange that provides security authentication and the ability to send personalized offers and discounts to customers.

QR code payments contribute to a seamless payment experience. The transaction takes only a few seconds, making payment via QR codes extremely fast and convenient. Users just need to open the QR code scanner, scan the QR code and confirm to make the payment.

Biometric authentication enhances the security of digital payments and provides fingerprint, facial and voice recognition. It also prevents fraud and extortion.

Artificial intelligence and machine learning. Digital wallets must-have AI and ML capabilities that help integrate admin panels and detect fraudulent activity.

Top 5 must-have e-wallet features

When it comes to designing digital wallets, it is important to always focus on the future user. There are key features of a digital wallet app that you need to incorporate to meet the needs of the user. Understanding these features will help you hire the right team and develop the wallet according to the needs of your business and the needs of your customers.

- Instant money transfer. It’s important that you enable your customers to transfer money.

- Bank integration. Working with a banking network can help you meet your customers’ financial needs. It can also help you reach new clientele and increase your sales. Offer bank payments via IBAN or SWIFT (you might need to integrate with the corresponding providers). Read this article to find out information about the potential of offering payment cards for digital wallets.

- Multi-asset (multi-currency) accounts. You need to give your customers the ability to hold their funds in multiple currencies in the account.

- Expense tracking. It makes sense to give your clients the ability to track their spending.

- Currency exchange. Allow users to exchange currencies within their wallets.

These features are essential for the development of digital wallets, as they are the basis for the functioning of a modern mobile wallet app. You can also extend them and add different features as needed.

SDK.finance digital wallet solution

SDK.finance is a fintech platform that serves as the foundation for building a payment product. By using its ledger layer, you can save at least 1 year of active development time for creating your digital wallet product.

With SDK.finance cloud-based ewallet software, you do not need to develop the software from scratch and can use a ready fintech platform to create your wallet product. Our modern tech stack offers you high scalability so you can expand your ecosystem without worrying about system overload. The API-first approach helps to add new features and integrations and ensures a faster development process.

It is possible to use an affordable cloud-based version by subscription or purchase a source code license from us to get full access to the backend for ultimate independence and no more recurring payments.

SDK.finance digital wallet offers the following features:

| Multi-currency | Add different fiat or non-fiat currencies to the system, without any limit. |

| Bank payments | Integrate with a bank network to offer payments that satisfy your customers’ financial needs. |

| Cross-border transfers | Offer internal P2P transfers, regardless of location. Enable payments between cards, wallets, and cell phones via integration with the corresponding service or payment providers. |

| Popular payments | Create a payment template and help your users save time Integrate with local providers to enable payments for electricity and broadband bills, airtime top-ups, and payments for other popular services. |

| Spendings visualization | Help your customers track their spending and control their transactions using visualized charts |

| Currency exchange | Enable seamless currency exchange between your customers’ wallets within the system. |

How to build a digital wallet on top of SDK.finance payment software?

Developing a digital wallet can be a challenging process that requires the necessary knowledge, expertise and preparation. With SDK.finance creation of a payment product on top of our software involves several steps:

Setting up the infrastructure and services

This step involves configuring environments, such as development, pre-production, and production, to ensure a smooth and efficient development process. It also involves setting up services that will aid in the deployment, monitoring, and maintenance of your e-wallet platform. By taking the time to configure these components correctly, you’ll create a strong foundation for the success of your e-wallet platform.

Configuring development, pre-production and production environments

SDK.finance infrastructure consists of 3 servers: developers instance (for development and testing of the software); production instance (live operation server with end-users and real operations); pre-production or Sandbox (infrastructure with the same specs as the production instance used for debugs of integrations with third-party components).

Requirements of the instance for production and test environments:

CPU – 1

RAM – 2 GB

SSD – 40 GB

OS: Ubuntu 20.04 LTS

Software: NGINX 1.14.0

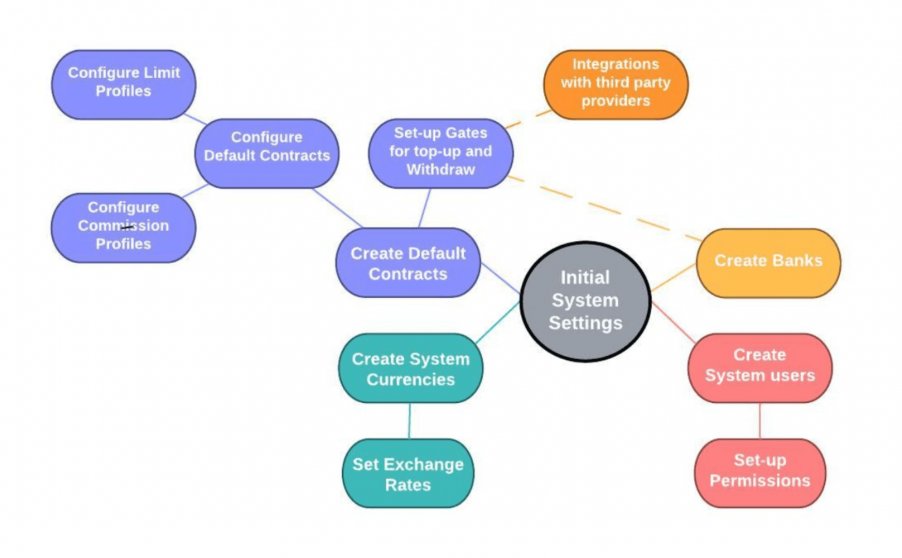

System configuration

Creating roles, setting up commissions, creating wallets, currencies, contracts, setting up exchanging rates and permissions.

To start configuring SDK.finance digital wallet software you need to authorize as an administrator via API. In the response, you will receive a token along with the other user’s parameters. The received token should be used to access other APIs. You can also save any other parameters if needed.

Currency creation

Then you can create any system currencies( real or any objects which you are going to count in your e-wallet platform like points, coins, bonuses, etc.) First, you have to create an issuer and the system will generate an id which will be used in the use cases where it is required to specify the currency.

Establishing currency exchange rates

To enable currency conversion within the digital wallet, it is essential to establish exchange rates. This can be achieved by either manually managing the exchange rates or integrating a reliable third-party service.

For instance, SDK.finance leverages the powerful Currency Cloud service for obtaining accurate and up-to-date currency exchange rates. Check our knowledge base to find out more information about currency exchange commission calculation.

Configuring top-up and withdrawal

SDK.finance offers implemented basic top-up and withdrawal flows that can be extended and customized based on our client’s business needs. You can configure top-up via:

- bank transfer

- cash deposit

- third-party providers

There’s also a pre-developed flow for top-up by cards, which is available on the UI, but will be fully functional after integration with a certain third-party provider which will cover this functionality.

Users can conveniently withdraw funds from their wallets through the methods activated for their types of contracts:

• via external provider (to the card, to third-party provider, directly to bank account, etc.)

• to bank account via bank transfer

• via cash desk

Check our knowledge base to get more details about top-up and funds withdrawal.

Setting up contracts and commissions

By accessing the SDK.finance software, you can modify or expand upon the default contract types.

There are four types of contracts available out of the box:

- Base

- Standard

- Gold

- VIP

Each of them has a ready-made setting or you can also create a custom contract.

Different commission types are available:

- Fixed

- Percent

- Zero

To configure the commissions:

- Choose the start and end date for the commission to be applied.

- Configure the way the commission will be deducted (added or shared between the users).

- Then choose the commission status: active or inactive.

Customizing the UI

SDK.finance provides a ready-made interface for administrators and a basic UI for end-users, and both are available for customization.

You can access our open-source UI packages and have developers customize both the admin area and the end-customer front-end of the digital wallet to suit your business needs and reflect the brand’s unique requirements.

Third-party integrations

The type of integration depends on business needs and the necessary operations of the e-wallet.

There are different types of third-party providers:

| Functionality | System integration necessary |

| Payment processing | PayPal, Stripe, and Square offer integrations with various utilities and bill payment systems. |

| Third-party payment providers |

Bill.com and PaySimple offer payment processing services and integrations with various utility and bill payment systems |

| Accounting software providers | QuickBooks and Xero offer integrations with utility and bill payment systems to help businesses manage their bills and payments |

| KYC/eKYC process automation | KYC providers (Regtech companies specialize in providing technology solutions for regulatory compliance). |

| Identity verification companies | Jumio, Onfido, and Veriff offer identity verification solutions that can be integrated with KYC procedures |

| Data providers |

Refinitiv and Dun & Bradstreet offer access to global data sets that can be used to verify customer identities and conduct background checks |

| Customer onboarding platforms |

Signicat and HooYu offer end-to-end solutions for customer identity verification and KYC compliance |

| International remittance and cross-border payments | Payment gateways, money transfer companies, and foreign exchange providers. Banks can also be integrated into e-wallet software to enable cross-border payments. |

| AI chat assistant for support & ticketing system for customer tickets | Chatbot providers |

| Compliance management | AML-CTF compliance management software, audit, and reporting software |

| Cash top-ups and withdrawals | ATM networks, payment kiosk providers, mobile network operators, banks |

| Currency exchange operations | Third-party exchange services. In our case, we use Currency Cloud as a third-party solution for getting currency exchange rates (available out-of-the-box) |

| Onboarding process and regular checking | AML and CTF checks |

| Card issuers | Visa and Mastercard can offer APIs to allow e-wallet providers to issue virtual or physical cards that can be used for online or offline transactions). |

| Payment processors | PayPal, Stripe, and Adyen that allow e-wallet providers to accept card payments |

| Card processing companies | Fiserv and Global Payments offer solutions for card processing and payment acceptance |

You also can configure fees and limits for each provider and allow or prohibit certain operations for a particular group of users. To find more information about third-party integrations, check our knowledge base.

Watch the SDK.finance mobile app UI of our platform, designed to help you create secure and feature-rich financial experiences in record time. Supercharge your mobile payment, finance, or digital wallet app launch with SDK.finance:

Wrapping up

Nowadays a lot of customers are looking for practical fintech solutions to manage their financial activities. Therefore, we need to develop a new payment method to ensure optimal customer satisfaction.

A digital wallet is a modern solution that offers value to both customers and businesses. Mobile wallet apps enable merchants to make faster sales and save customers time. This benefits all parties and makes the payment process faster and easier.

SDK.finance provides you with the foundation you need to make your digital wallet product successful and make it your customers’ favorite when it comes to meeting their financial needs. Contact us to discuss how our fintech development expertise can help you develop your own digital wallet solution or add one to an existing product.