Over the past few years, the banking sector, like other industries, has started adopting cloud-based computing for daily banking operations.

But despite the current shift towards cloud-based banking, some financial institutions are still hedging to migrate their operations to the cloud exclusively — and for good reason.

But what is a cloud bank, and why should financial institutions not rush to implement it?

In this article, we explore the challenges and benefits of cloud-based digital banking. But first, let’s define relevant terms.

What are cloud banking services?

Cloud banking services refer to deploying (and managing) banking infrastructure in order to control banking cloud services and financial operations without dedicated physical servers.

Before going any further, let’s define what is a cloud bank.

Banking cloud services are any banking infrastructure that exists on the cloud.

The SDK.finance cloud solution on AWS

SDK.finance offers a ready-made FinTech Platform to help you bring your PayTech product to market in the shortest possible time. Our cloud solution can now be accessed through the AWS marketplace. This allows our customers to benefit from the scalability, security, and cost-effectiveness of the AWS cloud infrastructure while ensuring the protection of sensitive data and compliance with data localization regulations.

How does cloud banking work?

Cloud service providers (CSPs) like Microsoft, Google, and Azure handle the complex cloud infrastructure and allow banks to use it for specified fees.

Depending on the company’s size and budget, a CSP can offer private, public, or hybrid clouds.

Some of the standard cloud service models include:

- Business Process-as-a-Service (BPaaS) — provides services that cover everyday operations like billing and human resources.

- Infrastructure-as-a-Service (IaaS) — delivers a fully-fledged core banking infrastructure that handles business operations and software integrations.

- Software-as-a-Service (SaaS) — delivers cloud-based banking software for accounting, invoicing, customer relationship management, etc.

- Platform-as-a-Service (PaaS) — offers a cloud-based core banking platform for app and database development.

White-Label digital banking platform for Banking in the Cloud

A shortcut to building your bank solution

Learn moreAdvantages of cloud-native development for banking

Now that we’ve established a relationship between cloud computing and banking, let’s explore the advantages of migrating your bank to the cloud.

Affordability

When you host your banking infrastructure on the cloud, you won’t have to pay server costs; the cloud service vendor handles maintenance. Instead, your financial institution only needs to pay a subscription fee.

Besides, modern CSPs use a pay-per-use model, which is a cost-efficient option for banks of all sizes.

Compatibility

When your banking services run on the cloud, compatibility won’t be an issue because cloud infrastructure works on all platforms.

Conversely, banking organizations that rely on legacy software might experience compatibility issues when modernizing their infrastructure.

Convenience

Most banks are shifting to cloud-native banking solutions because they are convenient to use. At the same time, CSPs now provide data management services to manage complex processes within the bank.

Popularity

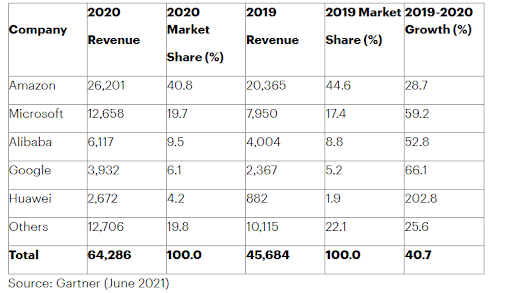

As it stands, Amazon, Microsoft, Google, Alibaba, and Huawei dominate over 80% of cloud banking market shares, which signifies that these giants are backing cloud-based banking.

With that in mind, financial organizations can choose any CSP that meets their requirements and budget.

Fraud detection

Financial institutions cannot tolerate any data breaches; your organization needs airtight data management systems to protect sensitive information from criminals.

With cloud banking services, you can protect your digital retail bank from malicious third-party access. Cloud-based solutions can also help digital banking institutions detect irregularities like identity fraud and money-laundering operations.

Analytics

Since FinTech vendors offer cloud-native development for banking with built-in data management systems, banks can enjoy automated data reporting and analysis.

Environmentally-friendly

Managing banking operations requires significant computing power, which affects the environment negatively. But with cloud computing, you can maintain an eco-friendly infrastructure for your internal and external services.

Scalable Neobank Platform

Develop your own neobank faster with SDK.finance PayTech Platform

More detailsChallenges of cloud-native banking

Despite the eye-catching promises of cloud-based core banking solutions, the challenges to this model are enormous.

Let’s explore the risks of cloud-based banking:

Regulations

Banks and other financial institutions must abide by various local and global regulatory guidelines regarding data sharing and usage. At the same time, cloud vendors offer a different set of compliance rules, which conflict with established financial regulations.

As a result, banks must hire professionals to cross-reference these conflicting regulations in order to avoid fines.

Here is a quote from a London bank CEO as reported by Cloudera’s managing director, Dr. Richard Harmon:

“Banking in the cloud consists of the largest, and most significantly regulated industry in the world, running on an entirely unregulated infrastructure.”

This quote encapsulates the sentiment of conflicting regulatory standards in handling cloud-based core banking solutions.

Security

Despite the promises of airtight security and privacy, the cloud is not a haven for sensitive user and company data.

Companies like Google are infamous for selling user data, which goes against GDPR compliance standards. Although the company claims to protect banking data, no guarantees exist that they keep to their word.

Data migration

Moving the entire architecture is a momentous task that most companies struggle to handle. In fact, Bloor Research carried out a study that showed that 38% of all data migration efforts end in utter disaster.

If your organization is migrating from obsolete legacy software, finding qualified cloud computing experts becomes a menacing headache.

Besides, migrating cloud-based banking services can take several months, depending on the bank’s size and underlying infrastructure. And in the hands of incompetent migration technicians, the process can disrupt banking operations significantly.

Read the article on Banking Legacy Systems Migration to explore how to modernize the payment system.

Outsourcing risks

If a bank doesn’t have a properly-trained IT department to implement the cloud-based banking core, it would have to outsource the migrations, which presents additional security risks.

Outsourcing means that the bank hands over the reins of the entire banking architecture to a third party. By doing so, the bank or financial institutions endanger their users’ data.

Human error

Although most modern cloud banks rely on automated algorithms, humans still write the code and assemble the core infrastructure.

Sky News reports that “sloppy coding” introduces over 1 million weaknesses in the software infrastructure that hackers can exploit.

Besides, a buggy code fragment can crumble the entire cloud infrastructure when creating a neobank platform.

So, you can never legislate for human incompetence and how it will affect your bank’s operations.

Unforeseen circumstances

Apart from human error, unforeseen circumstances can crush your cloud-based banking solutions.

Server downtimes and cyberattacks can render the application unusable. And since you don’t have any control over the vendor’s infrastructure, your organization will remain in limbo until they fix the issue.

Cloud-based core banking vs. on-premise software

Financial entities are still at odds about migrating to cloud banks or adopting on-premise software. However, the truth remains that both options have several accompanying challenges and risks.

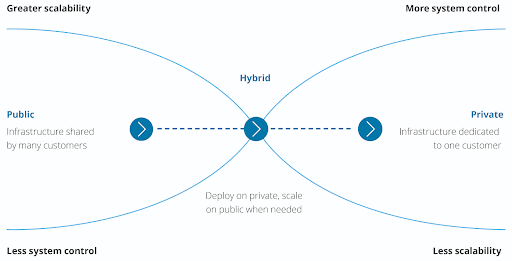

Source: Deloitte

On the one hand, cloud-based banking services are scalable because they are public, giving your organization less control over the system. On the other hand, your organization can adopt a private banking infrastructure to maintain control.

Essentially, the best option lies in the middle — a hybrid, on-premise cloud-based banking solution that internal teams can deploy and adjust.

And why is this the better option?

- Your IT department can handle internal operating models to suit your bank’s needs.

- Your financial organization can migrate to the cloud at a favorable pace.

- You can scale financial operations at your convenience.

- On-premise cloud infrastructure allows you to adjust the system to compliance standards and regulations.

- With on-premise solutions, you can add extra encryption and security protocols to protect sensitive user and company data.

- You can customize data analysis and handling based on specific use cases.

- Business teams and risk managers can make informed decisions to curb unnecessary billing expenses on cloud-based services.

Conclusion

The future of banking is in cloud-based systems, and the involvement of tech giants like Google, Microsoft, and Amazon consolidates this fact. But before adopting cloud-based banking solutions, explore the challenges, benefits, and billing costs.

Alternatively, invest in on-site digital banking solutions tailored to your banking requirements. That way, you end up with a banking infrastructure that meets all industry regulations and compliance standards. Besides, you gain absolute control over banking data analysis, risk assessment, and daily operations.

If you need help implementing on-premise or cloud-based digital banking solutions for your financial institution, reach out to us right away. Our software will help you build a banking or payment product within a short timeframe.

Digital wallet as a service Platform

Build your payment product or provide finance services within your existing one.

More infoReferences

- Banks now rely on a few cloud computing giants. That’s creating some unexpected new risks

- Cloud computing transformation in banking risk

- Clouds Bring New Risks To Financial Services

- Banks take steps to reduce potential cloud computing risks, Google survey

- How much risk do banks face with cloud computing?

- BOE Warns on Risks of Banking’s Reliance on Cloud Computing

- Cloud Computing in Banking

- Cloud Banking: Financial Services and Banking of the Future

- Why do so many data migration projects end in disaster?

- Banks Under Attack: Tactics and Techniques Used to Target Financial Organizations – Security News