Mobile wallet apps have become increasingly popular in recent years, providing a convenient and secure way for users to manage their financial transactions. The adoption of these software programs is caused by their convenience for users and advanced security that makes accepting digital wallet payments safer than traditional payment methods like cash or credit cards. Popular digital wallet providers like Apple Pay and Google Pay are leading examples of this trend.

However, building a mobile wallet app from scratch can be a difficult task. In this article, we will consider how to build a mobile wallet app using a ready-made solution to save your time and resources.

Mobile wallet app industry overview

The mobile wallet app industry has been rapidly growing in recent years, as more consumers adopt digital payments and mobile devices become increasingly ubiquitous. A variety of digital wallet providers, such as PayPal, Apple Pay, and Google Pay, are playing a crucial role in this expanding market. According to a report by Allied Market Research, the global mobile wallet market size was valued at $1.04 trillion in 2020 and is projected to reach $7.58 trillion by 2027, growing at a compound annual growth rate (CAGR) of 28.2%.

Mobile wallet market 2020-2030 (USD, Million)

Source: Grand View Research

The rise of mobile banking apps can be attributed to several factors, including convenience, security, and the increasing prevalence of contactless monile payments. With mobile wallet apps, consumers can quickly and easily make payments from their mobile devices, without having to carry cash or cards. These apps also offer enhanced security features such as biometric authentication and encryption, which can help prevent fraud and theft. Another contributing factor is the adoption of digital payment methods, which offer improved conversion rates, convenience, and security.

In addition to traditional payment services, mobile wallet apps also offer a range of value-added services such as loyalty programs, coupons, and budgeting tools. This has helped make mobile wallet apps more attractive to consumers and has contributed to their growing popularity. As the mobile wallet app industry continues to grow, it is likely that we will see continued innovation and competition in the space, as companies seek to differentiate themselves and capture market share.

What is a mobile wallet app?

A mobile wallet app is a digital application that allows users to store, manage and use their payment information for transactions on their mobile device. This app essentially turns a mobile device into a digital wallet, allowing users to securely store their credit/debit card information, bank account details, and other payment methods.

With a mobile wallet app, users can make payments, transfer money, and manage their financial transactions without having to carry physical cash or cards. Mobile wallet apps also typically provide additional features such as loyalty programs, coupons, and budgeting tools to enhance the user experience.

Why Building a Mobile Wallet App is a Smart Move?

Creating a mobile wallet app can bring numerous benefits to businesses and individuals alike. Here are some of the key advantages:

1. Stronger customer engagement & loyalty

People love convenience, and a mobile wallet app makes payments faster and easier. But beyond that, it can help businesses build stronger relationships with their customers. Features like rewards programs, special discounts, and personalized promotions keep users engaged and coming back for more. When payments and perks are all in one place, customer retention naturally improves.

2. Lower transaction costs

Handling cash or using traditional payment systems can be expensive. Mobile wallet apps cut down on these costs by enabling quick, digital transactions. With fewer fees, reduced processing times, and no need for physical payment infrastructure, businesses can save money while offering a more seamless experience to their customers.

3. Better security & fraud protection

Security is a huge concern when it comes to financial transactions, and mobile wallet apps are designed with this in mind. Features like encryption, biometric authentication, and two-factor verification help protect sensitive information. This not only reduces the risk of fraud but also builds trust with users, ensuring they feel safe when making transactions.

4. Increased revenue through data insights

One of the biggest hidden advantages of mobile wallet apps is the data they generate. Businesses can gain valuable insights into customer spending habits, preferences, and behaviors. This data can then be used to create targeted marketing campaigns, improve services, and ultimately drive more sales. Personalized offers based on actual customer activity can be a game-changer.

5. Staying ahead of the competition

In today’s market, simply offering great products or services isn’t enough—you need to provide a top-notch experience. A mobile wallet app can set a business apart from competitors by adding a layer of convenience and innovation. Companies that invest in mobile payment technology position themselves as industry leaders, making it easier to attract and retain tech-savvy customers.

A mobile wallet app isn’t just a trend. It’s a powerful tool that can enhance customer relationships, reduce costs, boost security, and drive revenue. As digital payments continue to grow, businesses that embrace this technology will be better equipped to meet customer expectations and stay competitive. If you haven’t considered developing a mobile wallet app yet, now might be the perfect time.

How to create a digital wallet app?

Digital wallet app development is a complex process that requires a range of technical skills and knowledge, including expertise in software development, security, and financial systems. In this guide we consider these steps from idea to launch that will tell you how to make a wallet app.

Discovery stage

Before beginning to design and develop a mobile wallet app, it is important to define the purpose and objectives of the future mobile app. This should include a clear understanding of what problem the app is trying to solve, and what specific benefits it will offer to users. This information will help guide the design and development process, and ensure that the app meets the needs of its target audience.

Compliance with legal requirements and standards

To create a reliable mobile wallet, it’s essential to ensure it is compliant with all the regulations. First of all, the software must comply with financial regulations such as Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. Secondly, as the mobile application accepts, processes, stores, or transmits credit card data it must maintain compliance with Payment Card Industry Data Security. It is also important to ensure that the app adheres to all relevant laws and regulations in the country or region it operates in, including licensing, taxes, and other legal requirements.

Market research

Another important step is market research, as it provides valuable insights into the competitive landscape and user preferences. It is crucial to understand the importance of compliance regulations for digital payment apps, as these applications must adhere to various legal standards set by central banks. This research should include an analysis of similar mobile wallet apps, as well as an understanding of the broader digital payments industry. This step can help you understand what potential users are looking for in a mobile wallet app. This can include features like security, ease of use, and integration with other apps.

Design phase

Choosing a design approach

One of the key decisions to be made in the design phase is whether to use a native or hybrid approach. Native apps are built using the platform-specific programming language (such as Java for Android and Swift for iOS), while hybrid mobile wallet apps are built using web technologies (such as HTML, CSS, and JavaScript) and can run on multiple platforms. The choice of approach will depend on a variety of factors, including the target audience and the app’s specific functionality and requirements.

Creating wireframes and prototypes

Once the design approach has been chosen, the next step is to create wireframes and prototypes of the mobile wallet app’s user interface (UI) and user experience (UX). Wireframes are low-fidelity representations of the app’s interface, while prototypes are more interactive and closer to the final product. These design elements should be tested with real users in order to ensure that the app is intuitive and easy to use.

User experience design

User experience (UX) design is an important aspect of the mobile app’s design phase. This includes the overall look and feel of the wallet app, as well as the flow and functionality of the various app’s features. User testing should be conducted in order to ensure that the app is user-friendly and meets the needs of its target audience.

Development phase

Front-end and back-end development

The digital wallet development phase involves building the app’s front-end and back-end. The development team should work closely with the design team to ensure that the final product is consistent with the wireframes and prototypes.

Technology and Platform Selection

When creating a mobile wallet app, selecting the right technology and platform is crucial to ensure a seamless and secure user experience. Here are some popular technologies and platforms for mobile wallet app development:

- Java and Kotlin for Android App Development: These programming languages are widely used for developing Android apps. They offer robust performance, security, and compatibility with a wide range of devices.

- Swift and Objective-C for iOS App Development: These languages are the standard for iOS app development. They provide high performance, security, and seamless integration with Apple’s ecosystem.

- React Native and Flutter for Cross-Platform App Development: These frameworks allow developers to build mobile wallet apps that run on both Android and iOS platforms using a single codebase. This can save time and resources while ensuring a consistent user experience across devices.

- Blockchain Technology for Secure and Transparent Transactions: Blockchain can enhance the security and transparency of transactions within a mobile wallet app. It provides a decentralized and tamper-proof ledger, making it ideal for financial applications.

- Cloud-Based Platforms for Scalable and Reliable Infrastructure: Cloud platforms like AWS, Google Cloud, and Azure offer scalable and reliable infrastructure for mobile wallet apps. They provide the necessary resources to handle large volumes of transactions and ensure high availability.

Consider key mobile wallet features

Another crucial step in creating an outstanding digital wallet is to implement necessary end-users features. It may be an informative transaction history, valuable rewards or convenient budgeting trackers. For example, with SDK.finance mobile wallet software you can provide users with expense tracking, helping them control their spendings.

Integration of a payment gateway

This step includes the integration of a secure payment gateway, as well as features such as encryption, two-factor authentication, and fraud detection. This may include integration with third-party services or APIs, the development of additional payment methods, or other features that enhance the app’s overall value proposition.

Security standards

To create a wallet app you must use robust security features in order to protect the users’ personal and financial information. The mobile wallet app can use biometric recognition ( fingerprint or face ID), or two-factor authentication that helps to prevent unauthorized access to your account.

The mobile wallet app can use biometric recognition (fingerprint or face ID), or two-factor authentication that helps to prevent unauthorized access to your account.

Encryption and tokenization are two key security features used by mobile wallet apps to protect users’ sensitive payment information. The tokenization of payments is the effort to replace sensitive data, such as credit card numbers and PINs, with a unique identifier that can only be authenticated, decrypted and translated by the token provider.

For example, when the user makes a payment with the mobile wallet application, the tokenization service provider creates a unique token or identifier for the card information, which is stored securely in its database, making transactions more secure.

Quality assurance and testing

Prevention is better than cure, that’s why thoroughly software testing is one of most important steps in mobile wallet creation. Quality assurance and testing are critical aspects of the development phase, because they help to prevent any bugs or technical issues.

In addition, you can use different types of testing to provide the users with a reliable mobile wallet. First of all, functional testing to check if the app works as intended, including the user interface, navigation, and transaction processing. Second step is security testing that includes testing for vulnerabilities such as data breaches, hacking, and fraud prevention. To ensure a smooth development cycle and reduce potential setbacks, teams often implement effective project risk management practices to identify challenges early and maintain control over timelines and deliverables.

It is also essential to conduct the performance testing that helps to verify if the app can handle different levels of traffic and user loads without crashing or slowing down. Moreover, testing provides feedback and insights that can help companies improve the mobile wallet. For instance, the SDK.finance mobile wallet platform is tested with JUnit, Arquillian and checked with OWASP security scanner. Our technical team checks the code quality with SonarQube, UpSource and FindBugs.

Launch the application

Launching a mobile wallet app requires careful preparation and planning. This includes developing a marketing strategy, creating promotional materials, and preparing the app for distribution on app stores. The app should be submitted for review well in advance of the launch date in order to ensure that it meets all app store guidelines and requirements.

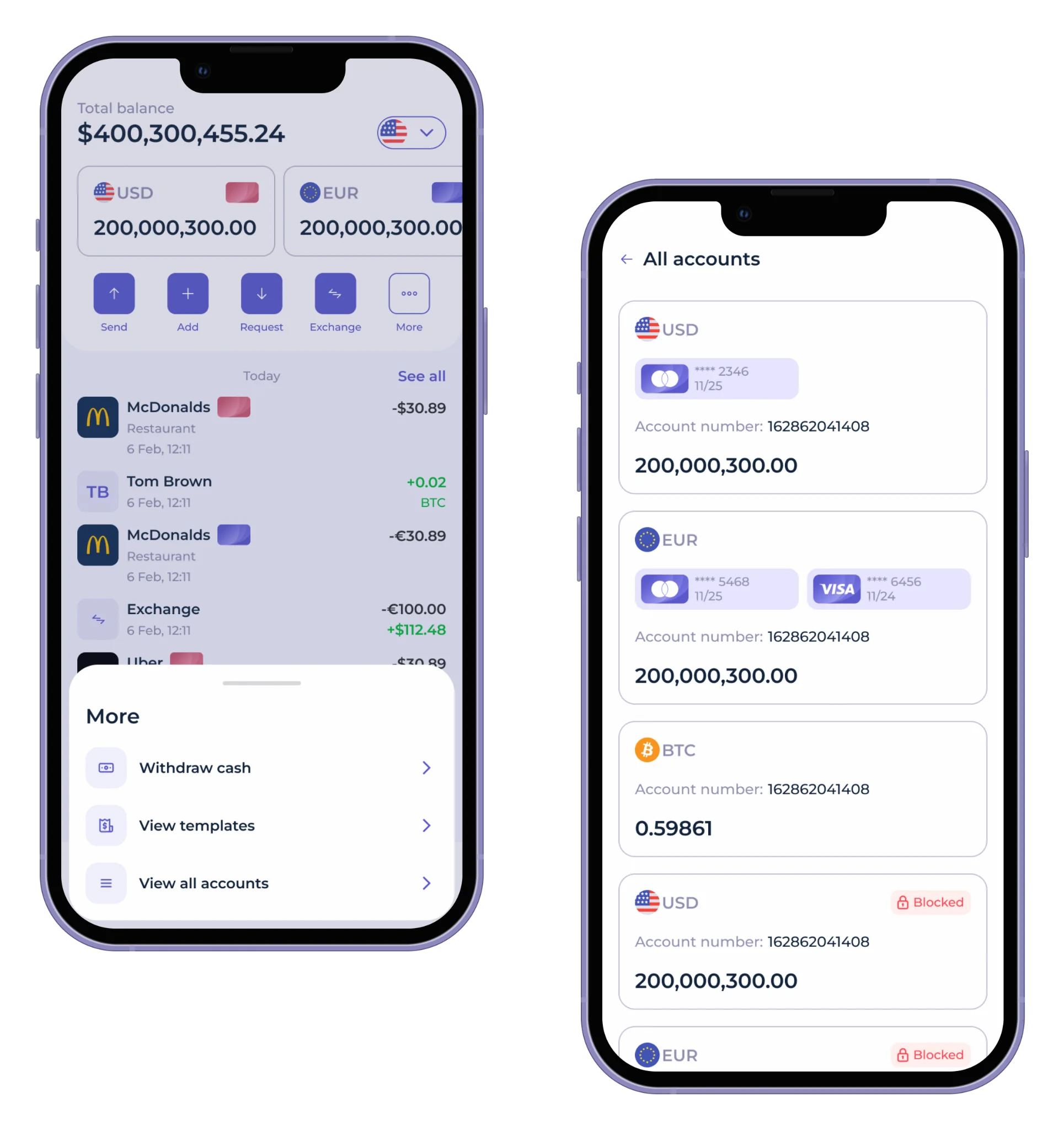

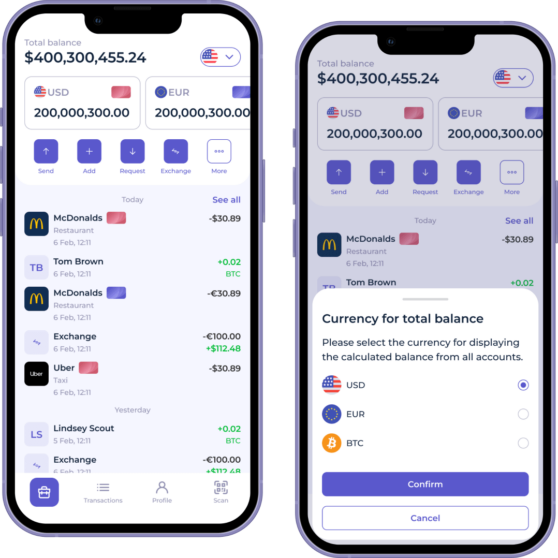

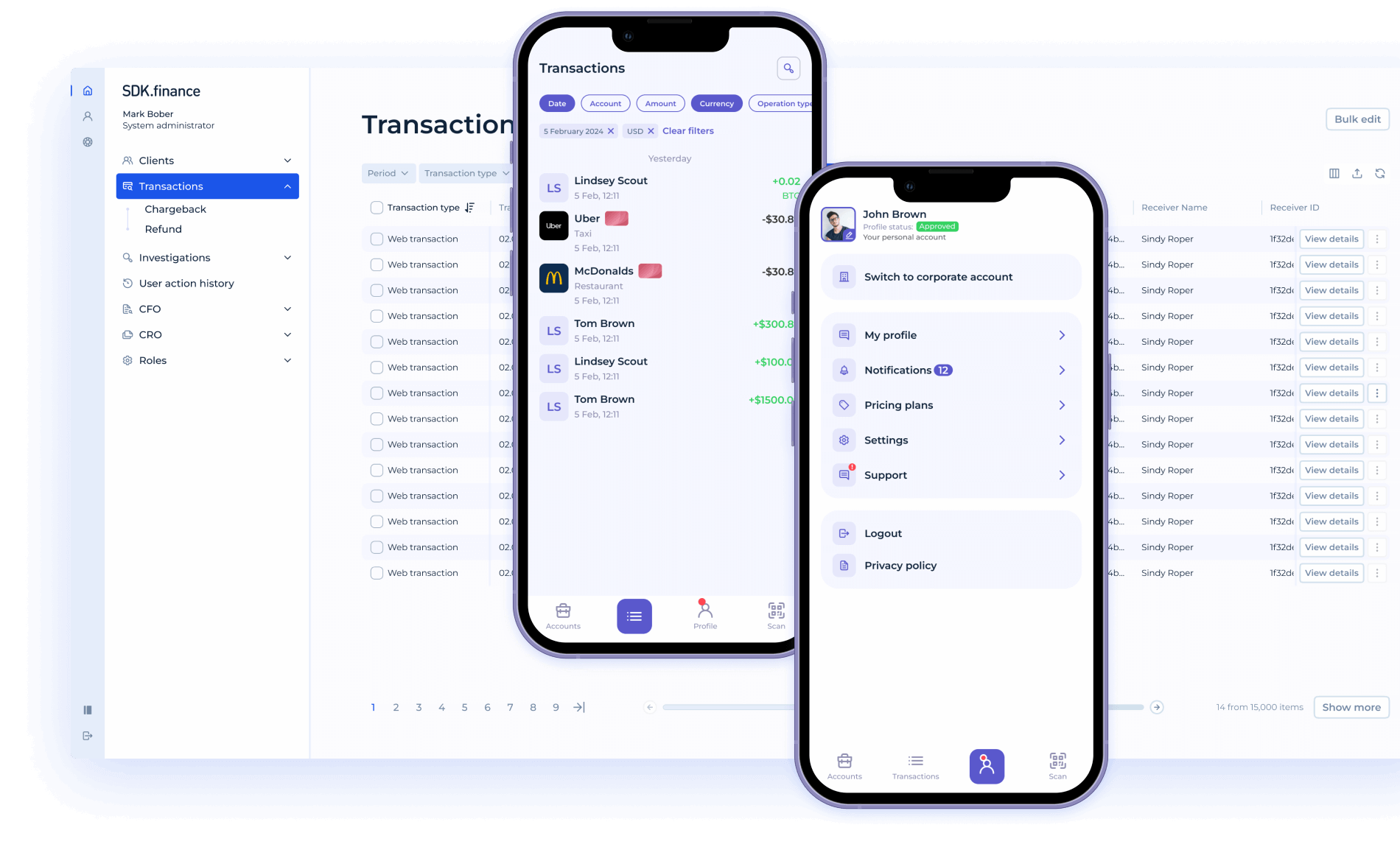

Image source: SDK.finance interfaces

Ongoing development and support

Maintain and update a mobile app

After the mobile wallet app is launched, it is important to continue to maintain and update it in order to keep it running smoothly and provide ongoing value to users. This includes focusing on digital wallet development, which is crucial for integrating key features, partnering with experienced developers, and managing the complexities involved in the development process. Additionally, fixing any bugs or issues that arise, updating the app’s functionality and features, and ensuring that the app remains compatible with new operating systems and devices are essential.

Get insights and optimize

Analytics and user feedback are valuable tools for measuring the app’s performance and identifying areas for improvement. Wallet app analytics can provide insights into user behavior, engagement, and retention, while user feedback can help identify areas where the app can be improved or expanded.

How to build a mobile wallet on top of SDK.finance payment software?

Image source: SDK.finance interfaces

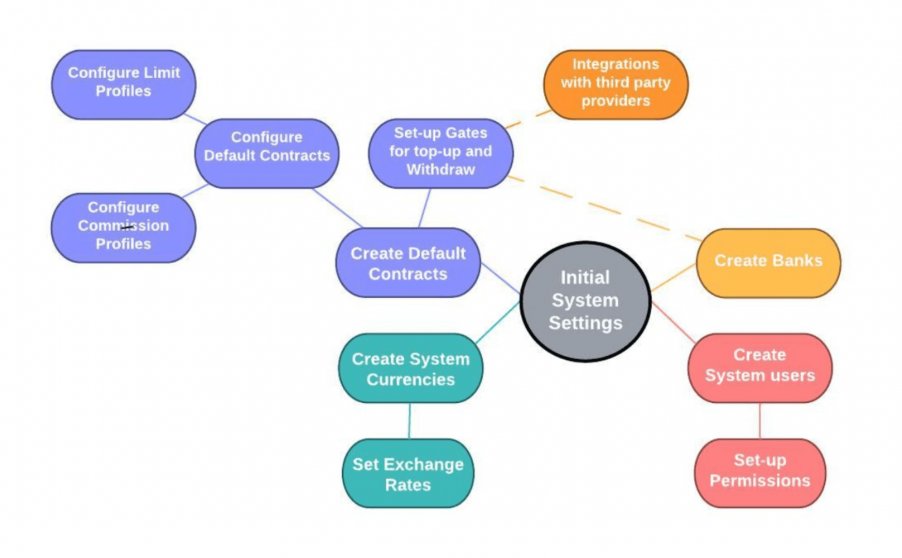

Building a mobile wallet can be a difficult task that requires huge technical knowledge, expertise and preparation. With SDK.finance developing a payment product on top of our software involves the following steps:

Configuring the infrastructure and services

This process consists of development, pre-production, and production environment configuration to provide a seamless and efficient development process. This also involves the establishment of various services that will facilitate the deployment, monitoring, and maintenance of your mobile wallet platform.

Setting up development, pre-production and production environments

The SDK.finance infrastructure comprises of three servers: a developers’ instance, which is used for software development and testing; a production instance, which serves as the live operation server for end-users and real operations; and a pre-production or Sandbox, which is a replica of the production instance with similar specifications, utilized for debugging integrations with third-party components.

Requirements of the instance for production and test environments:

CPU – 1

RAM – 2 GB

SSD – 40 GB

OS: Ubuntu 20.04 LTS

Software: NGINX 1.14.0

System configuration

To ensure the smooth and efficient functioning of the mobile wallet platform, it is necessary to undertake several crucial tasks. These include establishing roles, configuring commissions, creating wallets and currencies, setting up contracts, determining exchange rates, and granting permissions. By properly executing these tasks, you can optimize the performance and security of the payment system.

To initiate the setup process for the SDK.finance mobile wallet software, it is necessary to authorize as an administrator through the API. Once authorized, a token will be provided in the response along with other user parameters. This token is essential for accessing other APIs, and you may also choose to save additional parameters, if required.

Watch the SDK.finance mobile app UI of our Platform, designed to empower you to create secure and feature-rich financial experiences in record time. Supercharge your mobile wallet app launch with SDK.finance:

Currency creation

After authorization, you have the ability to create any system currencies -real or any objects which you are going to count in your mobile wallet platform like points, coins, bonuses etc. To begin, you must first create an issuer, which will result in the generation of an ID utilized in scenarios where currency specification is necessary.

Establishing currency exchange rates

To facilitate currency conversion within the digital wallet, it is important to establish exchange rates. This can be accomplished through manual management of the rates or by integrating a dependable third-party service. For instance, SDK.finance utilizes the robust Currency Cloud service to acquire precise and current currency exchange rates. Check our knowledge base to find out more information about currency exchange commission calculation.

Configuring top-up and withdrawal

SDK.finance provides a pre-built, fundamental top-up and withdrawal process that can be tailored and expanded according to the specific requirements of our clients’ businesses. The top-up process can be configured through the following methods:

- bank transfer

- cash deposit

- third-party providers

There’s also a pre-developed flow for top-up by cards, which is available on the UI, but will be fully functional after integration with a certain third-party provider which will cover this functionality.

For users, withdrawing funds from their wallets is made easy through the activation of methods that align with their specific contract types. These methods may include:

- via external provider (to the card, to third-party provider, directly to bank account etc.)

• to bank account via bank transfer

• via cash desk

Check our knowledge base to get more details about top-up and funds withdrawal.

Setting up contracts and commissions

Through access to the SDK.finance software, you have the ability to customize or broaden the pre-existing contract types.

There are four types of contracts available out of the box:

- Base

- Standard

- Gold

- VIP

Each of them has a ready-made setting or you can also create a custom contract.

Different commission types are available:

- Fixed

- Percent

- Zero

To configure the commissions, you must take the following steps:

- Determine the start and end dates for the commission to be applied.

- Establish the method in which the commission will be deducted – whether through addition or shared distribution amongst users.

- Select the desired commission status – either active or inactive.

Customizing the UI

SDK.finance offers an out-of-the-box interface for administrators and a basic user interface for end-users, both of which can be customized. Access to our open-source UI packages enables developers to tailor both the admin area and the customer front-end of the mobile wallet to align with specific business needs and brand identity.

Third-party integrations

The integration type required is dependent upon the specific operational needs of the mobile wallet and the business.

There are different types of third party providers:

| Functionality | System integration necessary |

| Utility and payments | Payment processing services like PayPal, Stripe, and Square which offer integrations with various utilities and bill payment systems.

Third-party payment providers (Bill.com and PaySimple offer payment processing services and integrations with various utility and bill payment systems). Accounting software providers (QuickBooks and Xero offer integrations with utility and bill payment systems to help businesses manage their bills and payments). |

| KYC/eKYC process automation | KYC providers (Regtech companies specialize in providing technology solutions for regulatory compliance).

Identity verification companies (Jumio, Onfido, and Veriff offer identity verification solutions that can be integrated with KYC procedures). Data providers (Refinitiv and Dun & Bradstreet offer access to global data sets that can be used to verify customer identities and conduct background checks). Customer onboarding platforms (Signicat and HooYu offer end-to-end solutions for customer identity verification and KYC compliance). |

| International remittance and cross-border payments | Payment gateways, money transfer companies and foreign exchange providers. Banks can also be integrated into mobile wallet software to enable cross-border payments. |

| AI chat assistant for support & ticketing system for customer tickets | Chatbot providers |

| Compliance management | AML-CTF compliance management software, audit and reporting software |

| Cash top-up and withdrawals | ATM networks, payment kiosk providers, mobile network operators, banks |

| Currency exchange operations | Third-party exchange services. In our case, we use Currency Cloud as a third-party solution for getting currency exchange rates (available out-of-the -box) |

| Onboarding process and regular checking | AML and CTF checks |

| Card payments | Card issuers (Visa, Mastercard can offer APIs to allow digital wallet providers to issue virtual or physical cards that can be used for online or offline transactions).

Payment processors (PayPal, Stripe, and Adyen that allow providers to accept card payments). Digital wallet providers (Apple Pay, Google Pay, and Samsung Pay allow users to add their credit or debit cards to their digital wallets and use them for online or offline transactions). Card processing companies (Fiserv and Global Payments offer solutions for card processing and payment acceptance). |

To further customize your mobile wallet platform, you can configure fees and limits for each provider and set permissions for specific user groups to allow or prohibit certain operations. To find more information about third-party integrations, check our knowledge base.

Launch your mobile wallet app faster with SDK.finance software

SDK.finance offers a white-label digital mobile wallet solution to help you cut down on the time and costs of your digital wallet app development. Developing a successful digital wallet app with SDK.finance software ensures a structured process that includes product discovery, design, development, and maintenance.

The mobile wallet app software empowers you to build an advanced application to meet your customers’ financial needs, thanks to its flexibility and modern technology stack. With SDK.finance mobile wallet solution, you can provide the following features for your users:

| Feature | SDK.finance mobile wallet software |

| Bank payments | By integrating with a banking network, you can offer bank payment options such as IBAN and SWIFT to fulfill your users’ financial and payment requirements. This can help you cater to different customer segments and increase your revenue. |

| Money transfers | Provide your customers with a convenient and seamless way to send and receive money instantly, ranging from internal peer-to-peer transfers to cross-border remittance. You can extend the range of your transfer services by integrating with payment and service providers. Contactless payments like NFC and QR code payments are available. |

| Expense tracking | You can help your customers with managing their finances, enabling them to control their spending. It is possible through visual aids such as charts and graphs or by displaying the information on a map, providing users with better financial management opportunities. |

| Currency exchange | Customers can effortlessly exchange one currency to another within their digital wallets instantly during transactions, as well as buy and sell currencies. |

| Bill payments | Your mobile wallet app can enable users to save time by facilitating bill payments for a wide range of services such as utilities, mobile top-up, and broadband. Additionally, you can add support for any vendor through API integration to offer more options to your users. |

Check a demo video of the mobile Android/IOS application developed by our partner software development company, KindGeek, using the SDK.finance platform.

As a business owner you get the following features of using SDK.finance mobile wallet software:

-

Transaction fees and limits management

You can set commission types: flat fee, %-based, and different commissions for operations amounts within a specific range. It is also possible to control commission ranges: different commissions for operations amounts within a specific range.

Watch SDK.finance Platform demo video to explore how to manage transaction fees and limits to maximize your revenue with our FinTech solution:

-

Currencies management

Control currency exchange rates input – manual or automated (from external feed) and manage the process of currency and issuer creation .

-

CRM & customer support

Verify customer profile information and provide KYC-management. You get a default log of customer activity in the system and have customer accounts status management.

-

Transaction history

Check all customer’s transactions in all statuses.

-

Contracts management

Group fees and limits in a “contract” and create a set of tariffs for customers to choose from.

SDK.finance ewallet software is a powerful and scalable platform for mobile wallet development that provides connecting with third-party services through 400+ digital wallet API endpoints. The system processes thousands of transactions per second and withstand high loads without a hiccup that can improve user experience and boost turnover.

Our mobile wallet software serves as a reliable foundation for building a mobile wallet or a digital payment platform. Save at least 1 year of active development and lots of team resources with our core fintech system.

Conclusion

Mobile app development requires a significant investment of time, resources, and expertise, but it can be a valuable tool for businesses and consumers alike. By following the steps outlined in this guide, businesses can successfully speed up the app development process and launch a high-quality mobile wallet app that meets the needs of their target audience.

You can also use the SDK.finance ready-made payment solution and launch your mobile application in a short time.