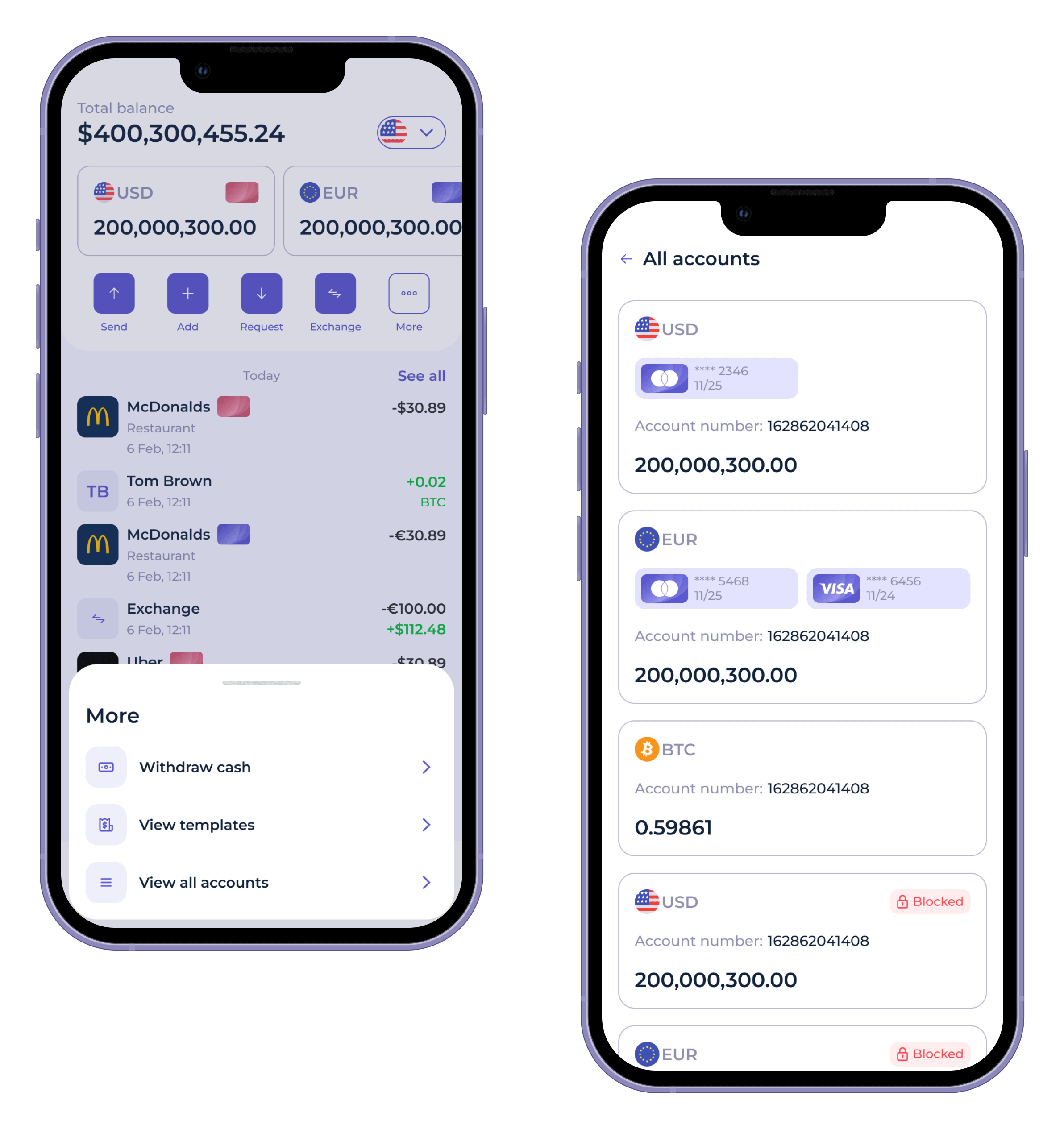

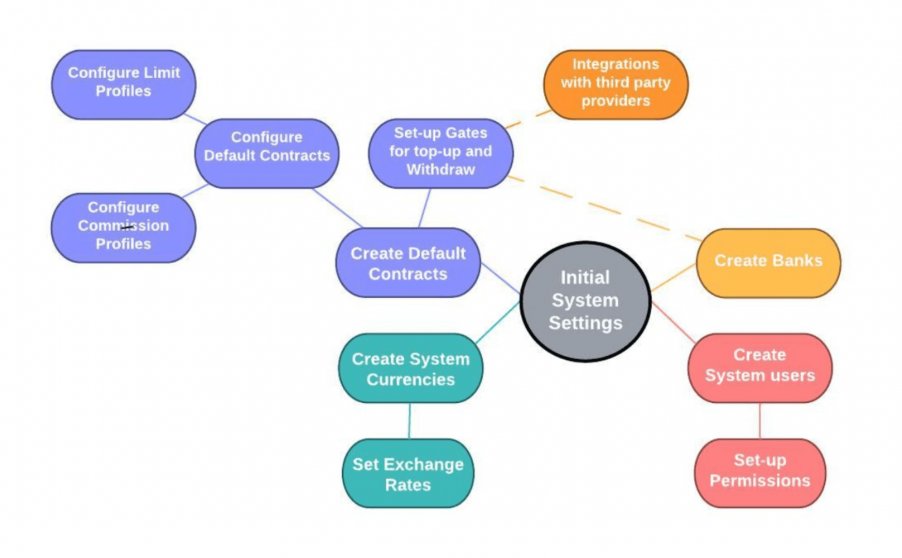

The prospect of starting an online bank from the ground up is scary because we always imagine how much it will cost to get every small facet in the right place. But when working with digital banks, you don’t need to worry about building offices and vaults. All you need is a valid banking license, top-notch funding, proper planning, and timely execution to build a bank that customers will want to use. According to research by Insider Intelligence, 18% of the US population (48 million people) will start banking exclusively with digital banks by 2024. Data from Research and Markets shows that the global neo-banking CAGR will increase by 45% in 2025. Source: Research and Markets In the global neobanking market, enterprise applications account for over 52% of the global revenue, which is about 47.4 billion USD. This signifies a lot of promise for digital banking. Financial institutions are adapting to meet changing customer demographics and marketing needs, particularly focusing on community banks and their role in serving diverse clientele. As the trend continues to sway towards contactless banking, fintech companies will rely more on personalization, data analysis, and deep learning to improve their services and remain competitive. Some banks will have to deliver the banking experience as an ecosystem of value-laden products and digital banking services. Also, banks will collect biometric data from their consumers to provide more secure services. These technologies could replace SIM cards, token drives, and PIN codes. The banking industry is a complex and highly regulated sector that plays a crucial role in the global economy. It is essential to understand the different types of banks, their functions, and the regulations that govern their operations. Banks offer a range of services, including deposit accounts, loans, credit cards, and investment products. By understanding the fundamental role of banks, you can better appreciate the importance of creating a robust and compliant digital banking platform. There are several types of banks, each with its unique functions and services. The main types of banks are: Central banks are the primary regulators of the banking industry. They oversee monetary policies, manage currency movements, and set interest rates. Central banks also act as lenders of last resort during times of financial crisis. The Federal Reserve, for example, is the central bank of the United States, playing a pivotal role in maintaining economic stability and regulating the money supply. Retail banks are the most familiar type of bank to the general public. They offer a range of services, including deposit accounts, savings accounts, credit cards, and loans. Retail banks cater to individual customers and small business owners, providing them with financial products and services to manage their daily transactions and financial needs. These banks are essential for everyday banking activities and are often the first point of contact for most people. Commercial banks cater to large businesses and corporations. They provide services such as real estate loans, payment processing, and international banking. Commercial banks often handle complex financial transactions and provide specialized services to large corporations. Their role is crucial in supporting the financial infrastructure of large-scale enterprises and facilitating significant economic activities. By understanding these different types of banks and their functions, you can better navigate the regulatory landscape and design a digital bank that meets the needs of your target audience. Banking is a tightly regulated sector that maintains a high bar of entry for prospective entrepreneurs. Before you create a digital bank, you need to understand how the industry works and the key considerations to bear in mind. A comprehensive business plan is essential as it defines objectives, identifies resources, and outlines strategies for compliance with regulatory requirements. You need money to start a digital retail bank — a lot of money. And this is the first barrier to entry for anybody venturing into banking services. Before you kickstart your project, ensure to secure a reliable source of funding. Regulators will have to evaluate your capital potential and the bank’s operations before granting you a license to build a digital bank. Common sources of funding for digital banks include angel investors, venture capital, borrowed funds, deposits, and shareholders’ money. Once you’ve sorted the funding, you still need to figure out the prospective bank customers for your neobank. Conduct extensive research to determine the user demographics from which you can predict the customer’s journey with your potential product and digital banking services. Dedicate enough time to define roles within the team. Start with administrative tasks and work your way down to risk management. Address the following questions: Answering these questions will help you establish a clear-cut hierarchy within your organization. Additionally, ensure you develop a robust risk management infrastructure to demonstrate financial stability and readiness to regulatory authorities, which is essential for obtaining the required licenses and ensuring the bank’s safe operation. You’ll need to factor in technology considerations for online banking in the early stages. Before finalizing your development ideas and assembling a team, confirm that your company has the required technology stack to build a secure digital banking platform. Don’t forget to determine if your team understands compliance regulations within the banking sector. If not, consider outsourcing the development process to certified digital banking platform providers. Since your online banking will not have any physical branches, you must build features to replicate the feeling of a “traditional” bank online. Some key components of a standard digital bank in 2022 include: Watch the SDK.finance Platform’s demo video to explore the system functionality and simplify transaction management via one powerful Platform: You can take advantage of digital banking technology to add more features to your mobile banking platform or pay attention to the features of popular neobanks like Revolut. Regardless of the purpose of creating the core banking system, you owe your investors and board members a duty to make returns on their investment. That said, you must figure out ways to generate income from the core banking systems. The following monetization models can work for your digital banking platform: Note: Some young banks use the zero-commission play to attract users, but this strategy is not sustainable in the long run. When you build a new bank, especially an online one, you need to follow a systematic approach to ensure it meets all industry requirements. Follow these steps to learn how to start an online bank: Before you start a digital bank, conduct in-depth market research to find out who the bank customers will be. Understanding the digital banking platform’s potential users will help you develop user personas from which developers and designers can build a market-relevant product. Also, you must understand that only 25% of the global population (1.9 billion people) uses any form of digital banking. Since many people still distrust branchless banks, you can only convince them to use your platform by creating awareness and showing transparency. Sometimes, owners prefer to obtain the license for their product before they start building it, but this process is never straightforward. Here are three license categories for digital banks: Some regulatory bodies can only license your product if you have a working prototype or proof a business model, while others just give you a license before you start creating anything. To avoid any issues, work with an expert consultant in the banking technology sector for guidance. US agencies involved in the licensing and monitoring process for digital banks include the Federal Reserve Board of Governors and the Federal Deposit Insurance Corporation (FDIC). Developing digital banking software from scratch can be a challenging task, as it can take 1-2 years and significant financial resources. You are also responsible for server infrastructure and security measures, and need to find an experienced development team capable of handling a complex fintech project. The SDK.finance payment platform serves as a powerful foundation for building a digital bank, e-wallet or payment acceptance product. It is a stable and reliable engine for your banking services that can be easily extended via integrations with virtually no limitations. With our pre-developed fintech system, you can launch your payment product and increase your revenue by offering digital banking services faster. To establish a foundation for your digital bank, it’s important to configure the environments, including development, pre-production, and production, in a way that promotes smooth and efficient development. Additionally, you’ll need to set up services that can assist with deployment, monitoring, and maintenance tasks. This step will ensure that your platform is well-prepared to operate effectively. The infrastructure of SDK.finance comprises three servers: a developers instance, which is used for software development and testing; a production instance, which is responsible for live operation with real end-users and transactions; and a pre-production or Sandbox instance, which has the same specifications as the production server and is utilized for debugging third-party component integrations. Requirements of the instance for production and test environments: CPU – 1 RAM – 2 GB SSD – 40 GB OS: Ubuntu 20.04 LTS Software: NGINX 1.14.0 Optimizing the performance and security of a digital bank platform requires undertaking several essential tasks, such as establishing roles, configuring commissions, creating wallets and currencies, setting up contracts, determining exchange rates, and granting permissions. Properly executing these tasks can ensure the smooth and efficient functioning of the digital banks systems. To begin setting up the SDK.finance payment software, you need to authenticate as an administrator via the API. After successful authentication, the API will provide a token along with other user parameters in the response. This token is crucial for accessing other APIs, and you can choose to save additional parameters if needed. System management enables you to establish specific standards and regulations for user behavior and determine the primary services and functions accessible to customers, including individuals and merchants. There are the various use cases within the system management: Contracts management comprises the creation of custom contracts, the inclusion of commission regulations, editing of system settings, and enabling provider commissions for digital banks. Payment gateway management involves configuring exchange rates and managing currency. Reports and analytics provide an opportunity to generate transaction-based reports that can be downloaded for further analysis. Check out our knowledge base to find more information about system management. User management consists of 4 main stages: user profile management, user registration and revision and KYC management. User profile management includes registration, either by email or phone number, and the option to deactivate a profile. The administrator can also update profile and business information and manage security settings within the core banking systems. KYC management enables basic compliance processes, such as document uploads, document and user verification, and requesting user actions to complete the compliance procedure. Watch SDK.finance Platform’s demo video to explore how to manage your users, ensure KYC compliance, and prevent fraud with the robust system back office: For more advanced KYC and AML functionality, we suggest integrating with specialised third-party providers. Explore our knowledge base to get more details about this step in the digital banking platform development process. This step includes funds transfer, bill payment, recurring payments setting up, currency exchange, invoicing, and merchant payment services. Bill payments The system provides the possibility for users to make payments for utility bills, mobile top-ups, and other services with their digital bank account. These functionality can be used through the integration with any relevant payment provider. Using SDK APIs, accounting can be decoupled by customers’ virtual accounts.To allow certain payments the operation should be added to the contract. Recurring payments Recurring in-system payments can be implemented utilizing the subscriptions features for banking software. Subscriptions enable individuals or businesses to make regular payments for a service or product. SDK.finance provides pre-implemented functionality to cover the subscriptions flow, which has different settings, such as the payment period, number of payments, and subscription end date for digital banks. Subscriptions can have various statuses: The expiration type of a subscription determines how it will end, either by a certain date, a certain number of payments, or with no limitations on its duration. Read our knowledge base to find out more about payments and transactions. Payment systems built on top of SDK.finance allow users to create, send, and manage invoices electronically, making the process more streamlined and efficient. Merchants can effortlessly create and monitor invoices, streamline payment reminders, and handle customer payments. This simplifies financial operations, minimizes errors and administrative tasks, and enhances customer contentment by offering a smooth and seamless payment process for a digital banking platform. Our current set of use cases for banking software related to invoicing includes: Check out our knowledge base to dive into invoice issuing flow. The integration type required is dependent upon the specific operational needs of the digital bank and the payment business model. Various categories of third-party service providers exist, including: You can also customize charges and restrictions for each provider and authorize or forbid specific functions for a particular user group. For additional details regarding third-party integrations, read our knowledge base. The cost of building an online banking system varies according to your chosen route. If you want to buy a ready-made solution for a vendor, you will not pay as much as someone building the entire architecture from scratch. If you have a large team of experts available to you, then you can build your core banking solution from scratch. In this case, you’ll have to spend around 500 000 USD to 1 million USD to buy APIs, pay your staff, apply for licenses, and pay server fees. But if you buy an off-the-shelf banking solution, you won’t have to pay all these administrative wages and service fees. Instead, you can ask for custom adjustments to get a bespoke solution that meets your initial requirements. This ready-made solution will cost you around 250 000 USD to 500 000 USD to purchase and integrate into your banking ecosystem. With SDK.finance white label digital banking software you can save time and money, without starting from scratch. Our system is available both as a cloud-hosted version and an on-premise one. You can start with affordable cloud-based software by subscription or get a full control, using a source code license. We believe that this is an ultimate approach to save quite a load of time and resources for software development. You get a fully functional piece of core bank software that can be extended and customized according to your business requirements by your own in-house team. Being built by our team of seasoned experts in fintech software development with 15+ years of experience (and quite a lot of mistakes along the way that we learned from), the resulting product is reliable, secure and future-proof (and continuously improved). Building a digital bank requires proper planning, execution, and attention to the minutest details. But first, you need to develop a concept, find the right audience, obtain the required licences, and get funding. You also need to choose the technology stack and monetization models to make the app profitable. And above all, you need to create a product development plan for your internal or external team of developers. Now that you know what it will cost to build a digital bank, start working on a budget and funding source right away.A quick overview of digital banking

Understanding the Banking Industry

What is a Bank?

A bank is a financial institution that facilitates the flow of money between individuals, businesses, and governments. It acts as an intermediary between savers and borrowers, providing a safe and secure way to manage financial transactions.

Common Types of Banks

Central Banks

Retail Banks

Commercial Banks

What you should know when starting a digital bank

Funding

Customers

Internal administration and risk management infrastructure

Technology stack

Essential features

Monetization

How to start an online bank?

Identify the target audience

Apply for banking license

Build a digital bank on top of SDK.finance solution

Set up the infrastructure and services

Set up production environments

System configuration

System management

User management

Payments and transactions

Invoicing

Third-party integrations

Functionality

System integration necessary

Payment processing

PayPal, Stripe, and Square offer integrations with various utilities and bill payment systems.

Third-party payment providers

Bill.com and PaySimple offer payment processing services and integrations with various utility and bill payment systems

Accounting software providers

QuickBooks and Xero offer integrations with utility and bill payment systems to help businesses manage their bills and payments

KYC/eKYC process automation

KYC providers (Regtech companies specialize in providing technology solutions for regulatory compliance).

Identity verification companies

Jumio, Onfido, and Veriff offer identity verification solutions that can be integrated with KYC procedures

Data providers

Refinitiv and Dun & Bradstreet offer access to global data sets that can be used to verify customer identities and conduct background checks

Customer onboarding platforms

Signicat and HooYu offer end-to-end solutions for customer identity verification and KYC compliance

International remittance and cross-border payments

Payment gateways, money transfer companies, and foreign exchange providers. Banks can also be integrated into e-wallet software to enable cross-border payments.

AI chat assistant for support & ticketing system for customer tickets

Chatbot providers

Compliance management

AML-CTF compliance management software, audit, and reporting software

Cash top-ups and withdrawals

ATM networks, payment kiosk providers, mobile network operators, banks

Currency exchange operations

Third-party exchange services. In our case, we use Currency Cloud as a third-party solution for getting currency exchange rates (available out-of-the-box)

Onboarding process and regular checking

AML and CTF checks

Card issuers

Visa and Mastercard can offer APIs to allow e-wallet providers to issue virtual or physical cards that can be used for online or offline transactions).

Payment processors

PayPal, Stripe, and Adyen that allow e-wallet providers to accept card payments

Card processing companies

Fiserv and Global Payments offer solutions for card processing and payment acceptance

How much does it cost to start a digital bank?

Conclusion

How to Start a Bank: Guide to Starting an Online Bank from Scratch

FAQ

What should I know when starting a digital bank?

Before you create a digital bank, you need to understand how the industry works and the key considerations to bear in mind:

Before you kickstart your project, ensure to secure a reliable source of funding. Regulators will have to evaluate your capital potential before granting you a license to build a bank.

Conduct extensive research to determine the user demographics from which you can predict the customer’s journey with your potential product.

Dedicate enough time to define roles within the team.

Before finalizing your development ideas and assembling a team, confirm that your company has the required technology stack to build a secure banking infrastructure.

Figure out ways to generate income from the core banking software. The following monetization models can work for your digital banking platform.

How much does it cost to start a digital bank?

The cost of building an online banking system varies according to your chosen route. If you want to buy a ready-made solution for a vendor, you will not pay as much as someone building the entire architecture from scratch.

You’ll have to spend around 500,000 USD to 1 million USD to buy APIs, pay your staff, apply for licenses, and pay server fees.

A ready-made solution will cost you around 250,000 USD to 500,000 USD.

Navigate through article