Accounting model by operations

Internal operations

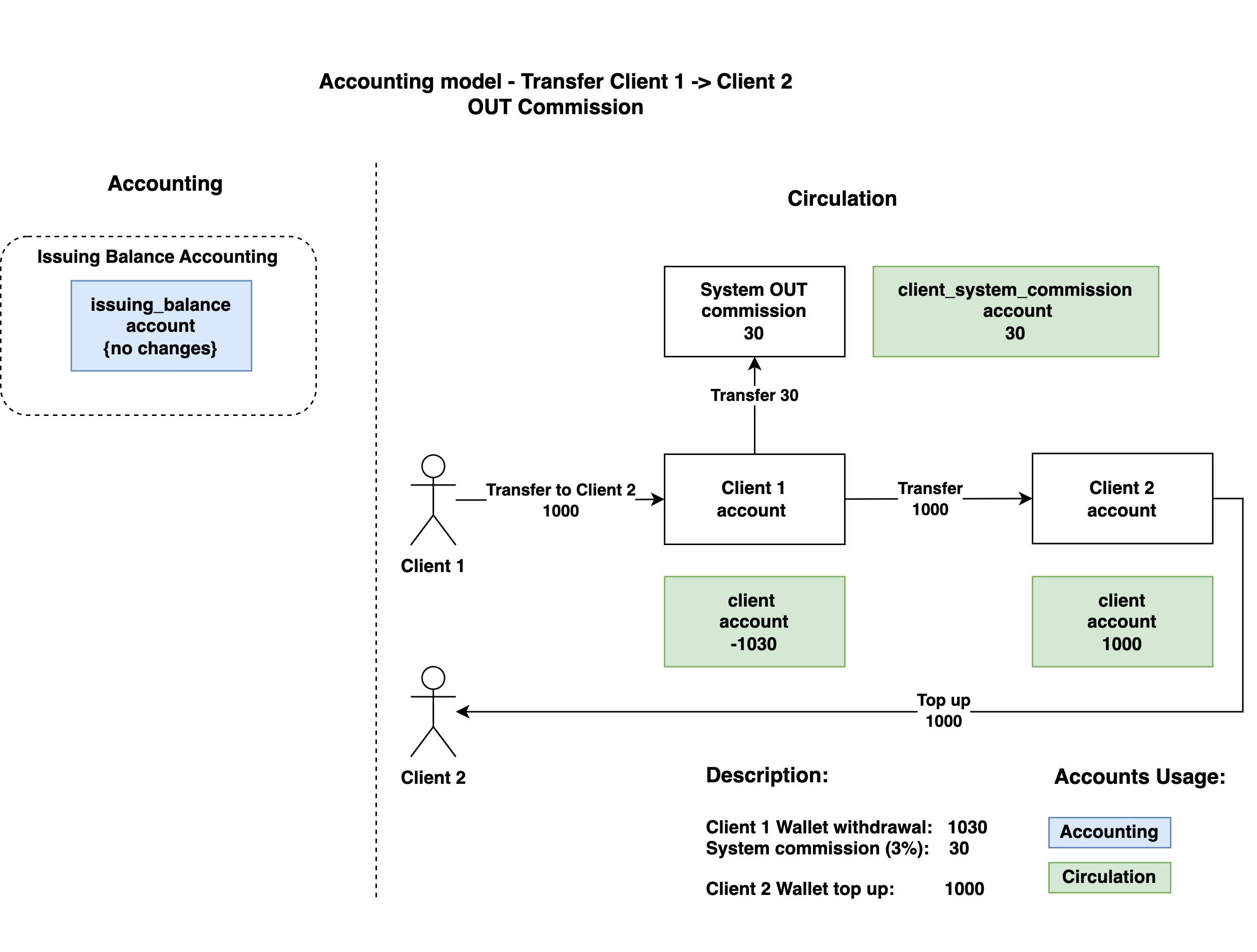

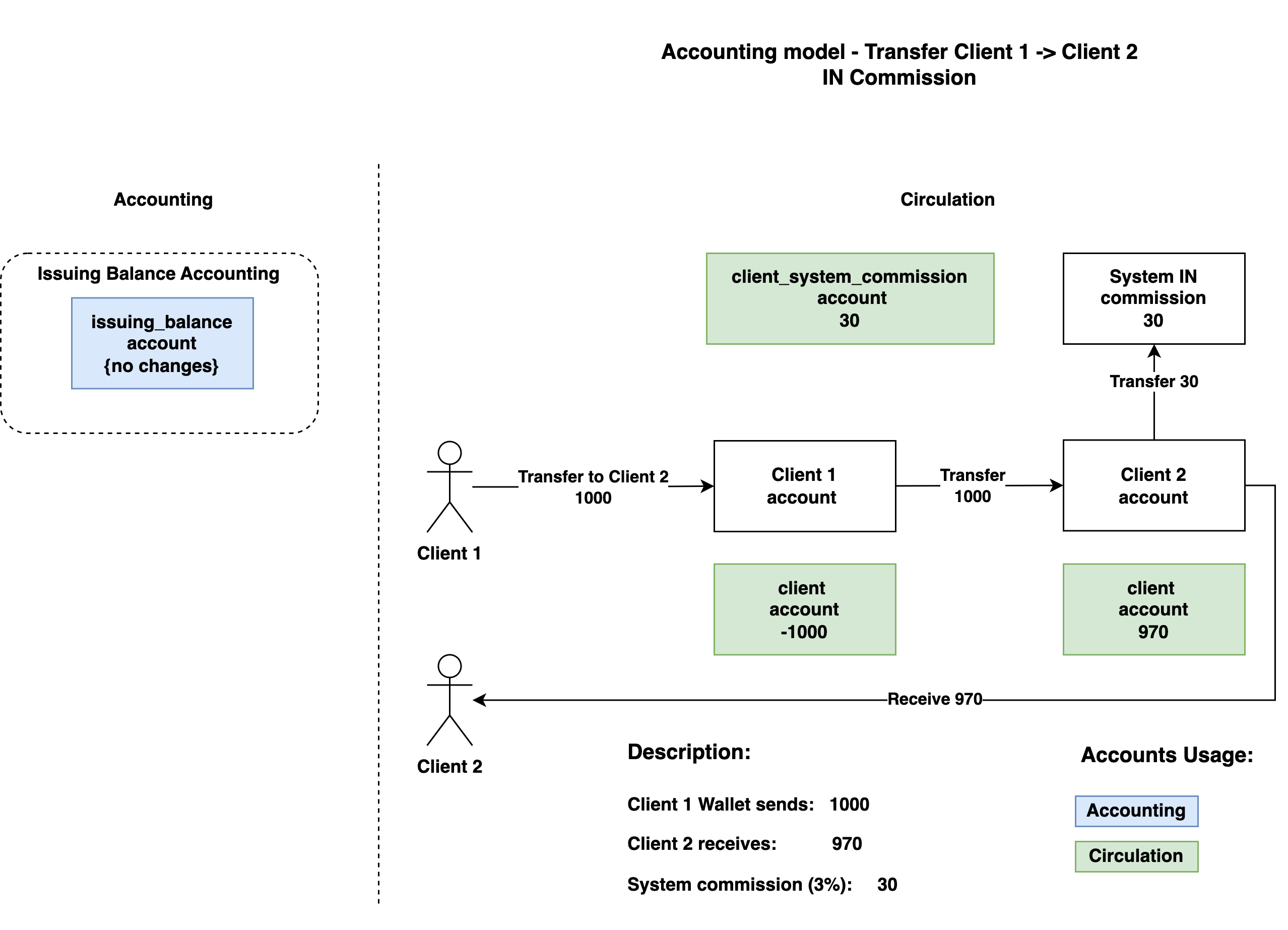

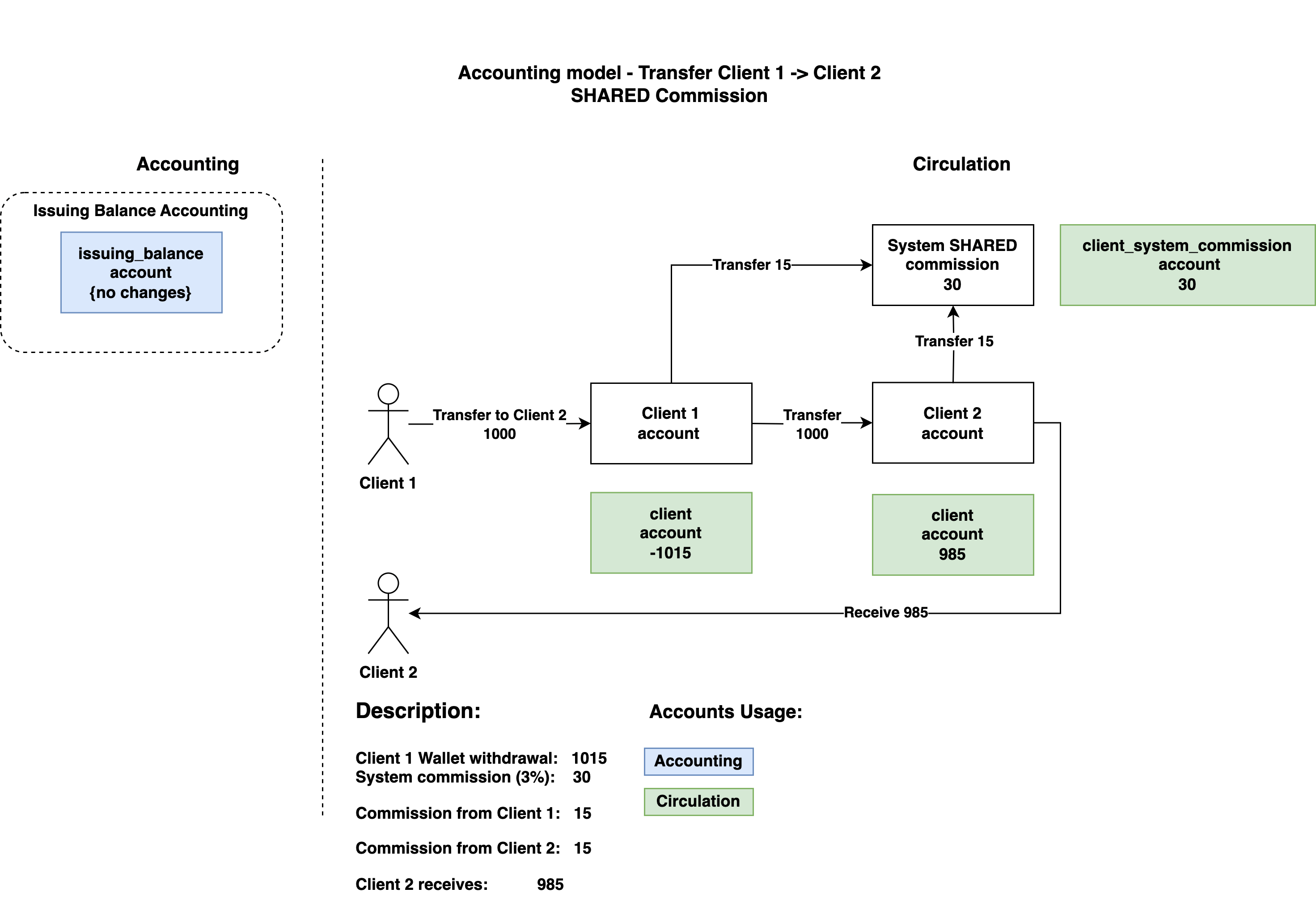

Transfer

The transfer operation occurs inside the circulation and does not change the volume of electronic money issued to the system (it does not influence the balance of the wallet with the type issuing_balance).

The system commission for the transfer operation is also accumulated inside the circulation until it is deducted from the circulation by withdrawal from the commission wallet – as the company’s revenue.

Transfer OUT commission

Transfer IN commission

Transfer SHARED commission

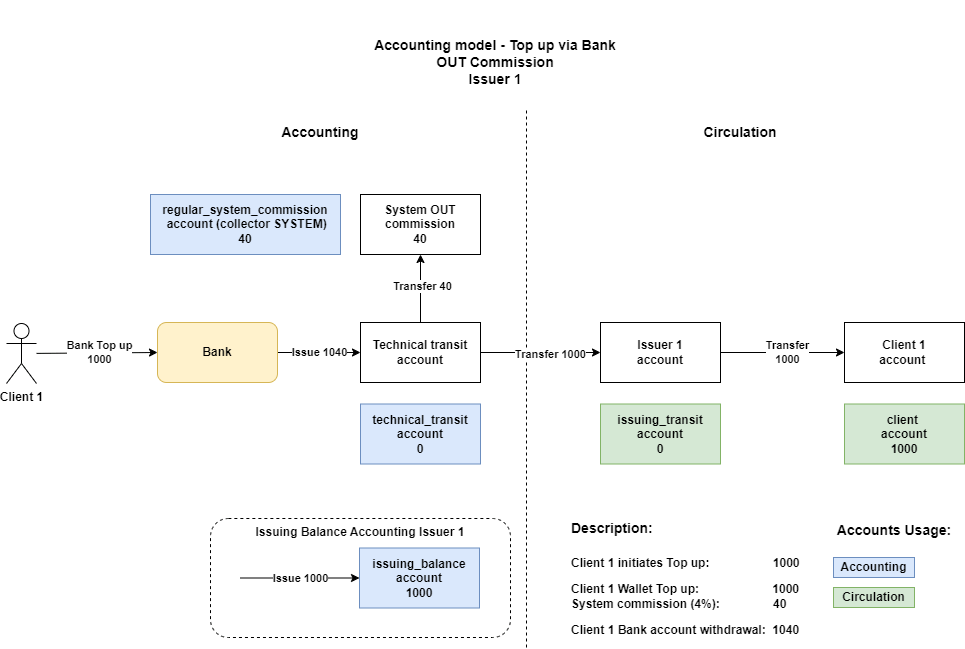

Bank operations

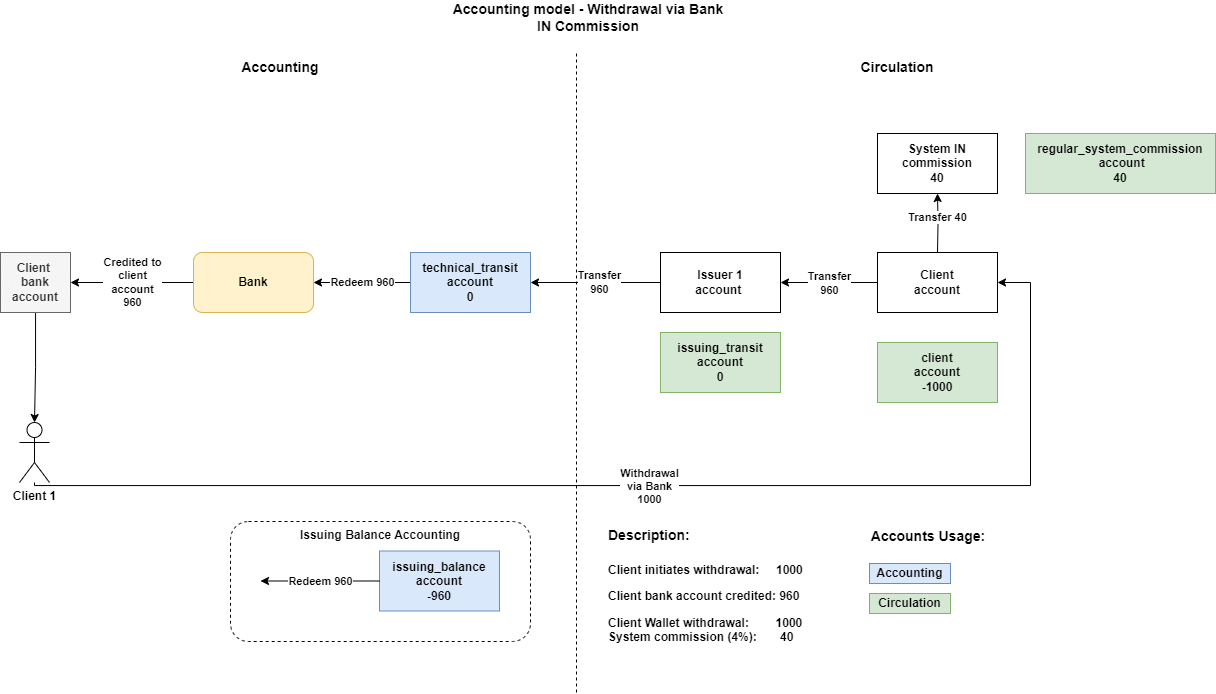

Operations of Top up/Withdrawal of wallet via manual bank transfer have an impact on the volume of e-money circulation (circulation increases with top up and decreases with withdrawal oeprations).

For the operations, which have an impact on the volume of e-money circulation the general approach to calculating and issuing/redeeming system commissions is the following:

-

when inputting funds into circulation (e.g. Top up via bank), the system commission is not included in the amount of e-money issued into circulation, it is only calculated for the accounting needs on a separate commission wallet (usage=accounting).

-

when redeeming funds from circulation (e.g. Withdrawal via bank), the system commission is not included in the amount of e-money removed from circulation, it is accumulated on a separate commission wallet (usage=circulation). Until it is deducted from the circulation by withdrawal from the commission wallet – as the company’s revenue.

Top up via bank

Withdraw via bank

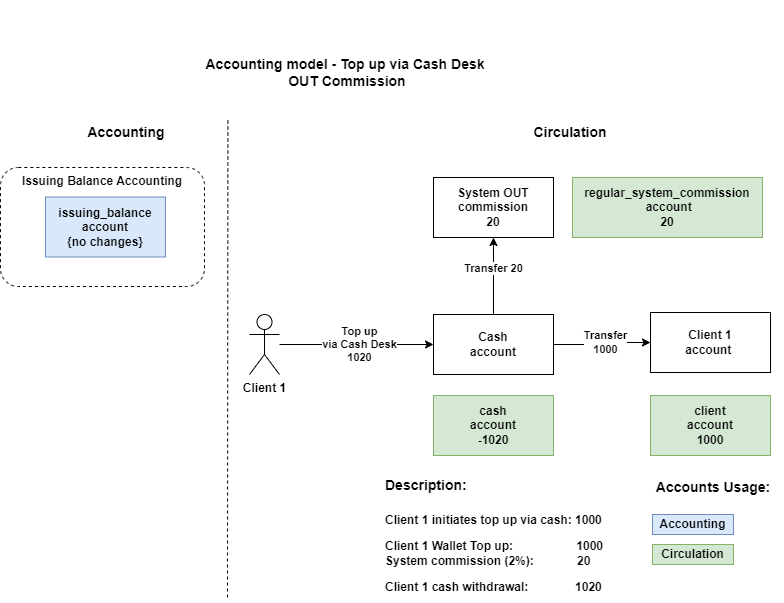

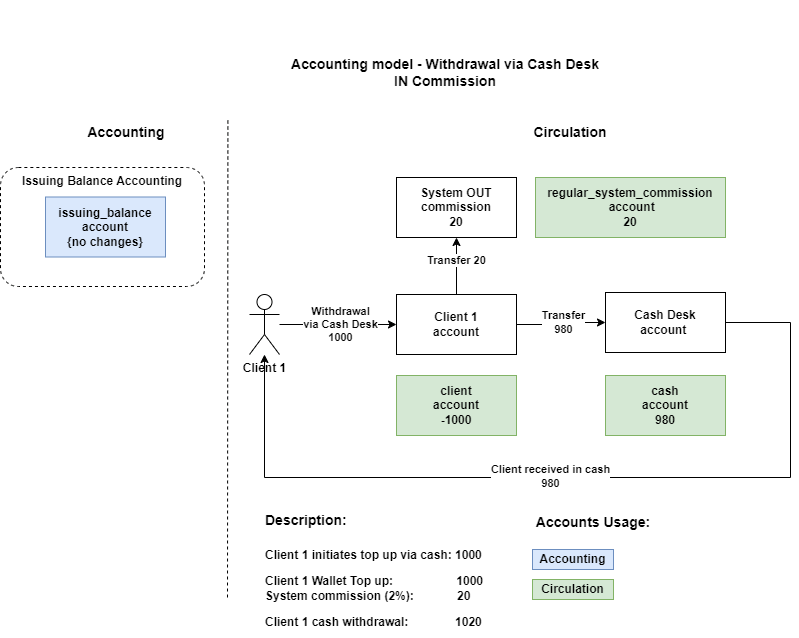

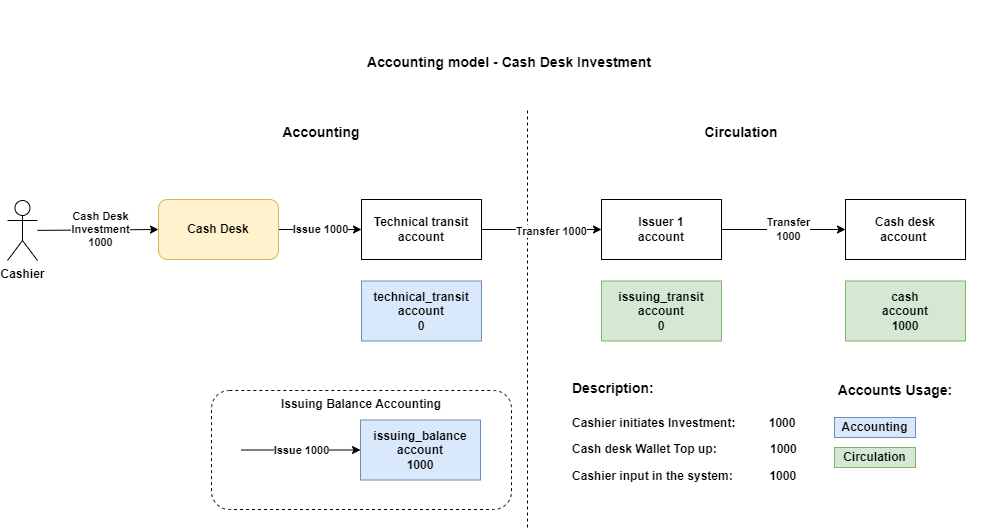

Cash desk operations

The system supports an account model for Top up/Withdraw via cash desk operations in which the e-money balance on the cash desk wallet has been issued into circulation in advance, before the actual transaction (by using Cash desk investment operation). Transfers between clients and cash desk wallets during Top up/Withdraw operations occur inside the circulation and do not change its volume.

The system commission for the Top up/Withdraw via cash desk is also accumulated inside the circulation until it is deducted from the circulation by withdrawal from the commission wallet – as the company’s revenue.

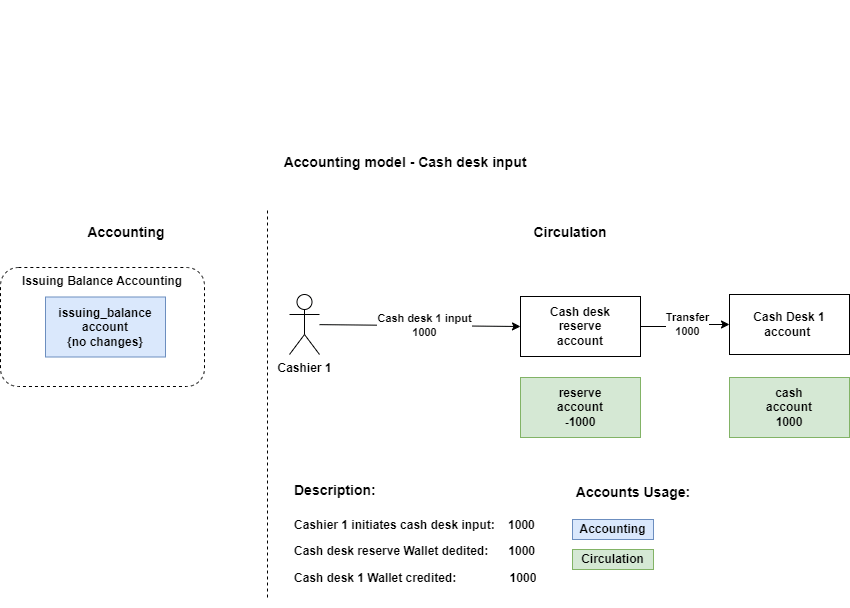

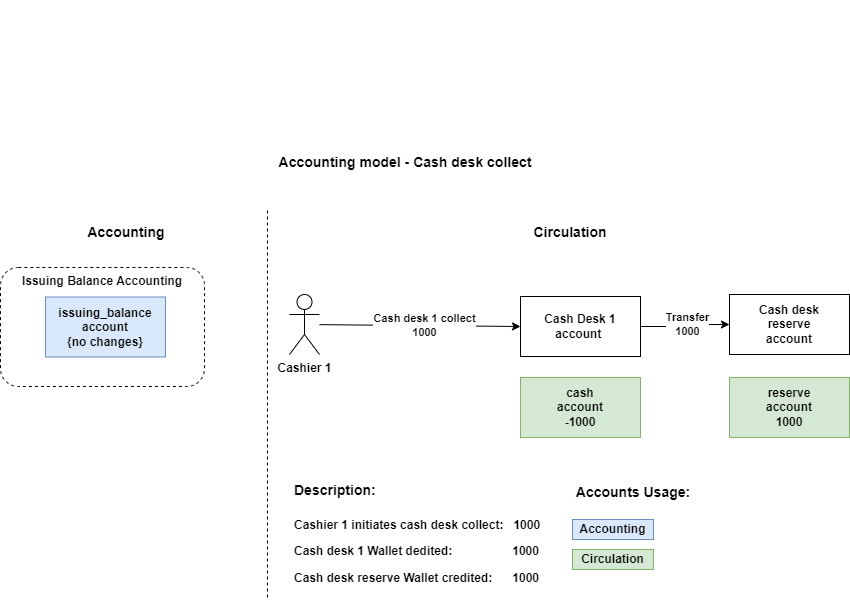

Cash desk input/collect operations also occur inside the circulation and do not change the volume of money circulation (it does not influence the balance of the wallet with the type issuing_balance).

Top up via cash desk

Withdrawal via cash desk

Cash desk investment

Cash desk input

Cash desk collect

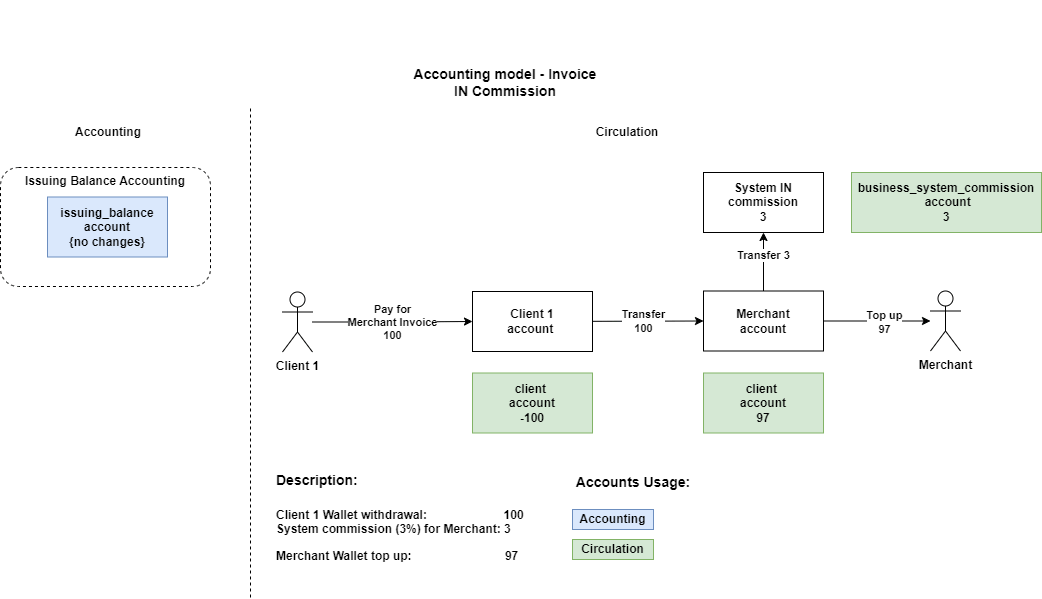

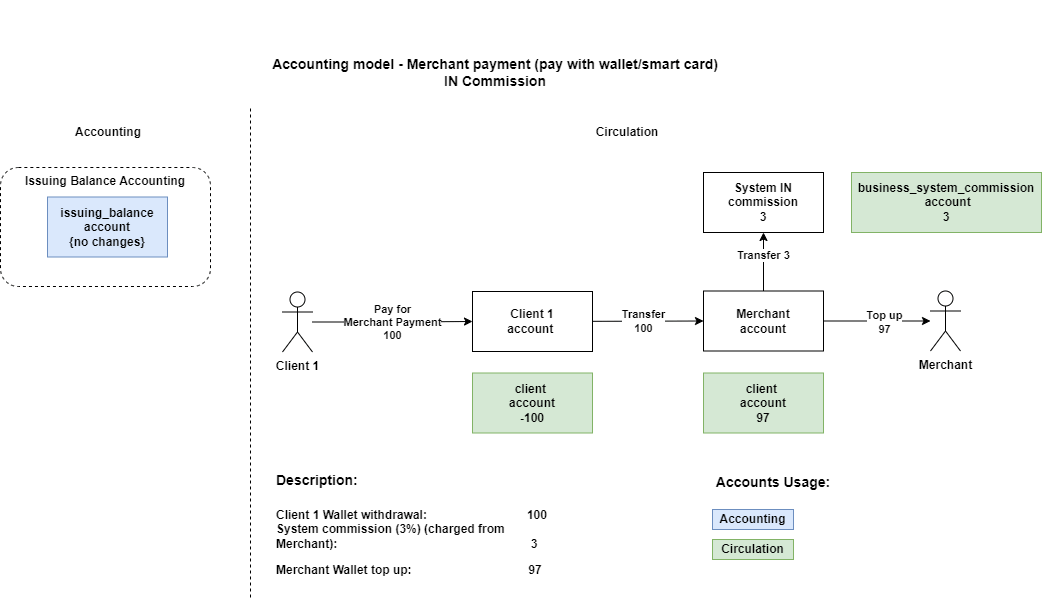

Invoice and Merchant payments

Invoice and Merchant payments occur inside the circulation and do not change the volume of e-money issued to the system (it does not influence the balance of the wallet with the type issuing_balance) – under condition that the client pays for Invoice or makes a Merchant payment with the e-wallet of smart card. With this model, e-money was issued into circulation (to the balance of the e-wallet) earlier, during the wallet top-up operation. And will be redeemed from the circulation when the Merchant makes a Withdrawal from his wallet.

The system commission for the transfer operation is also accumulated inside the circulation until it is deducted from the circulation by withdrawal from the commission wallet – as the company’s revenue.

Invoice

Merchant payment

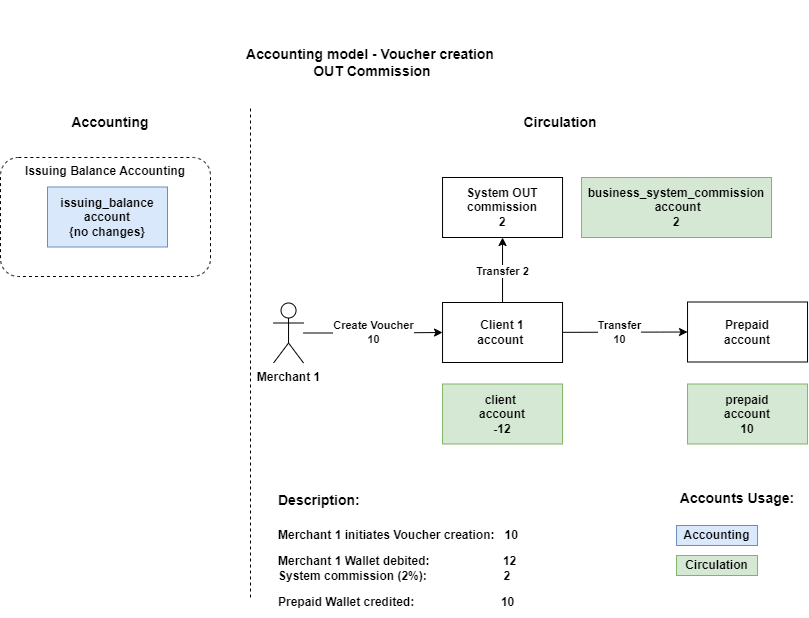

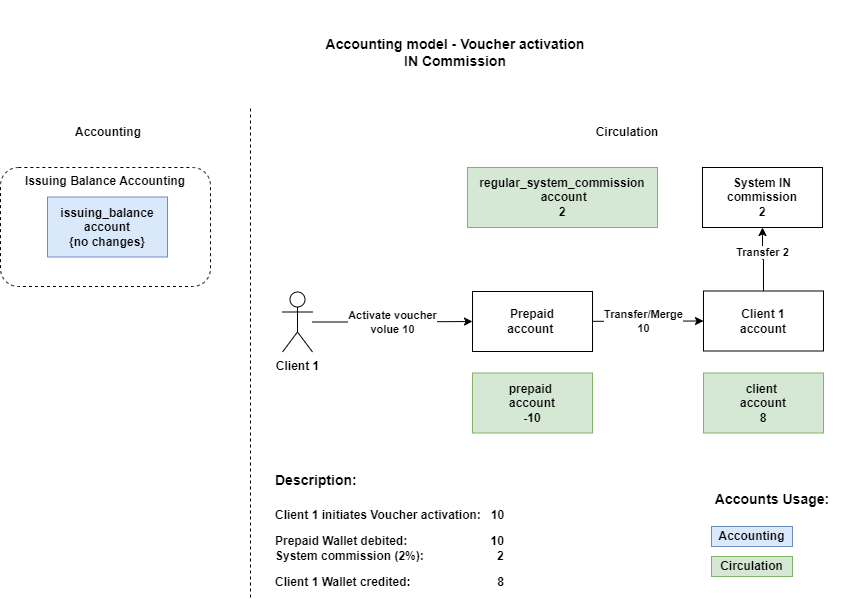

Prepaid voucher

Voucher creation and Voucher activation occur inside the circulation and do not change the volume of e-money issued to the system (it does not influence the balance of the wallet with the type issuing_balance). With this model, e-money was issued into circulation (to the balance of the e-wallet) earlier, during the Merchant wallet top-up operation.

The system commission for the transfer operation is also accumulated inside the circulation until it is deducted from the circulation by withdrawal from the commission wallet – as the company’s revenue.

Voucher creation

Voucher activation

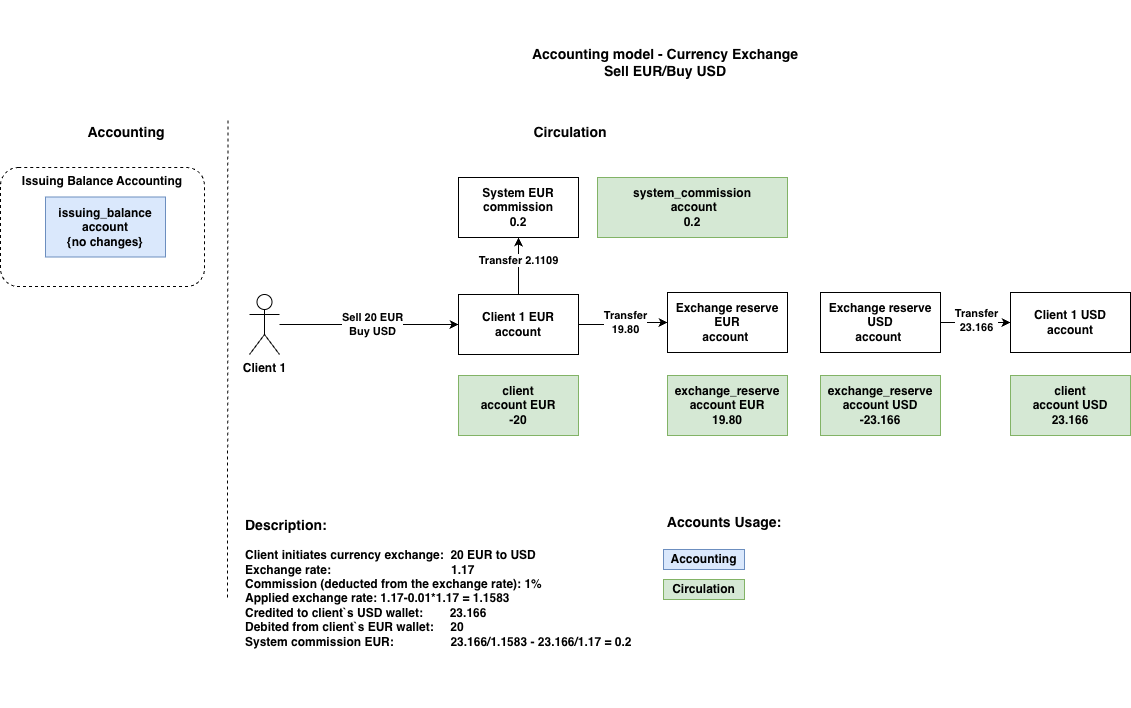

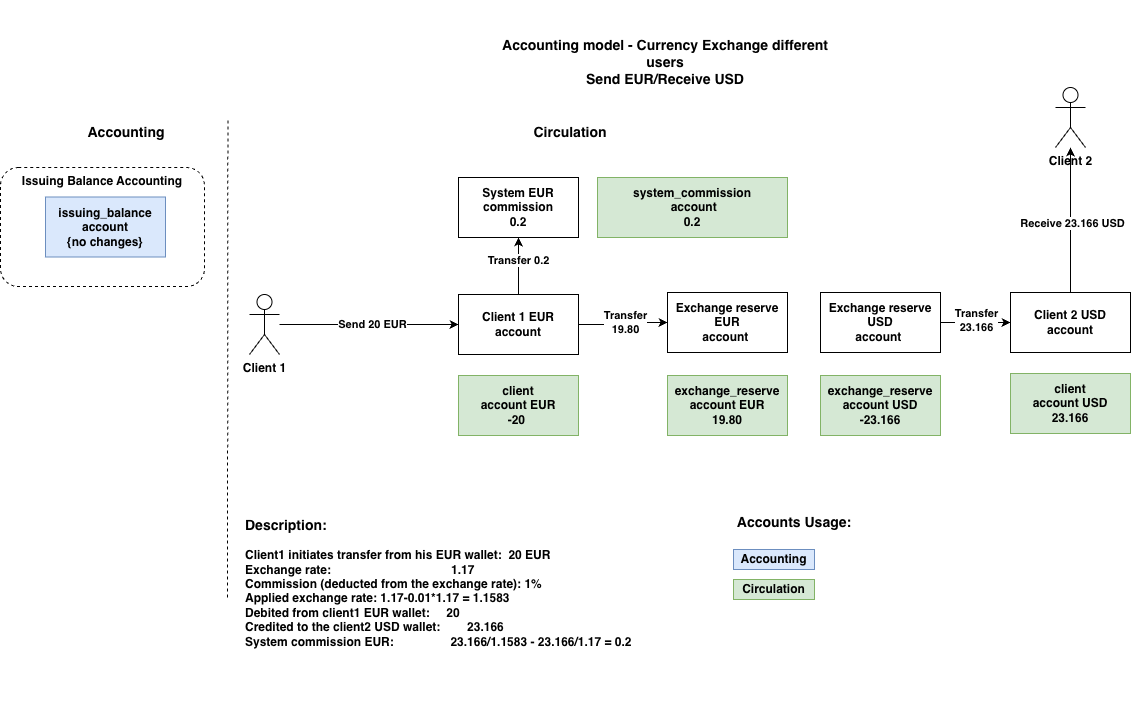

Currency exchange

During Currency exchange operations exchange_reserve wallets in different currencies are involved. Funds to this wallet were issued into circulation before the client performed the currency exchange operation (by using Top up exchange reserve).

To perform Currency Exchange operation Top up exchange reserve wallet is required.

The transfer of bought/sold currency to client wallets during the currency exchange operation occurs from exchange_reserve – that is why the Currency exchange operation itself has no influence on the circulation volume and occurs inside it.

The system commission for the transfer operation is also accumulated inside the circulation until it is deducted from the circulation by withdrawal from the commission wallet – as the company’s revenue.

Currency exchange

Same user

Different users

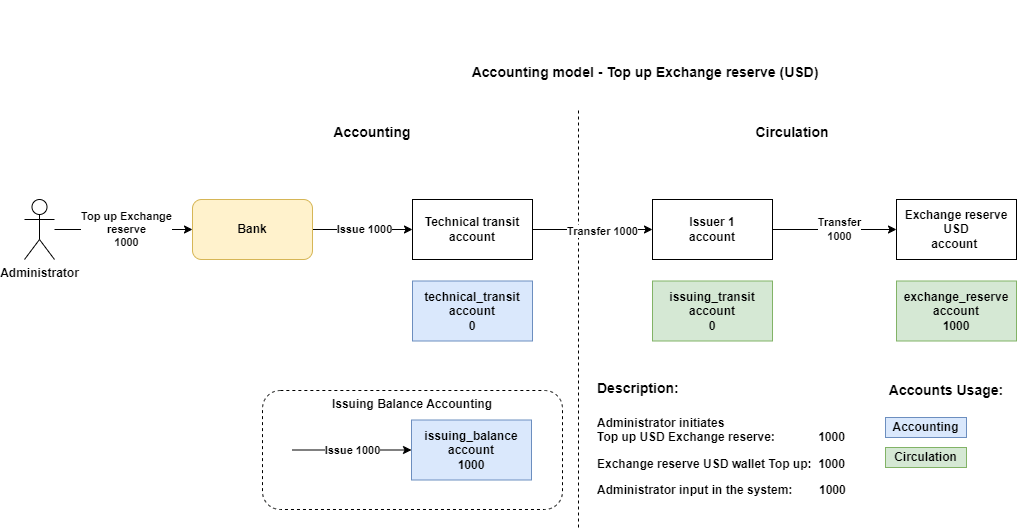

Top up exchange reserve

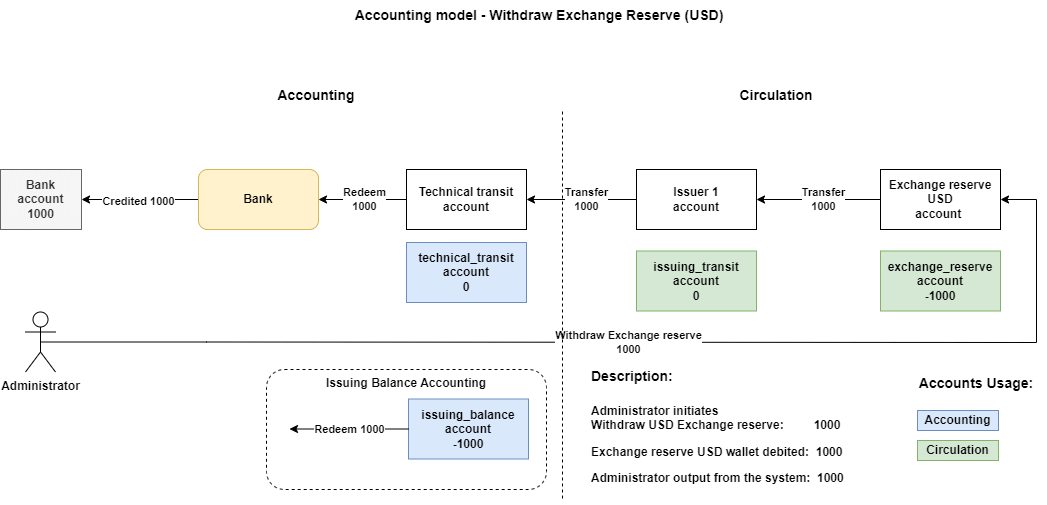

Withdraw exchange reserve

External operations

Top up

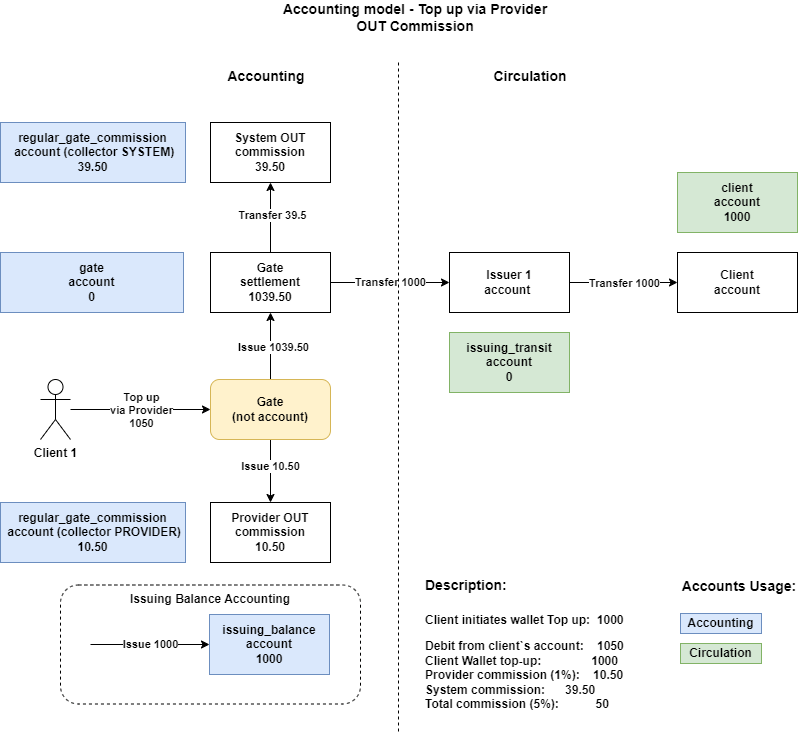

“Top up via provider” operation impacts the volume of e-money circulation (increases it).

For “Top up via provider” operations, the approach to issuing commissions is the following:

-

the system and provider commissions are not included in the amount of e-money issued into circulation, it is only calculated for the accounting needs on separate commission wallets (usage=accounting).

“Top up via provider”: total commission > provider commission

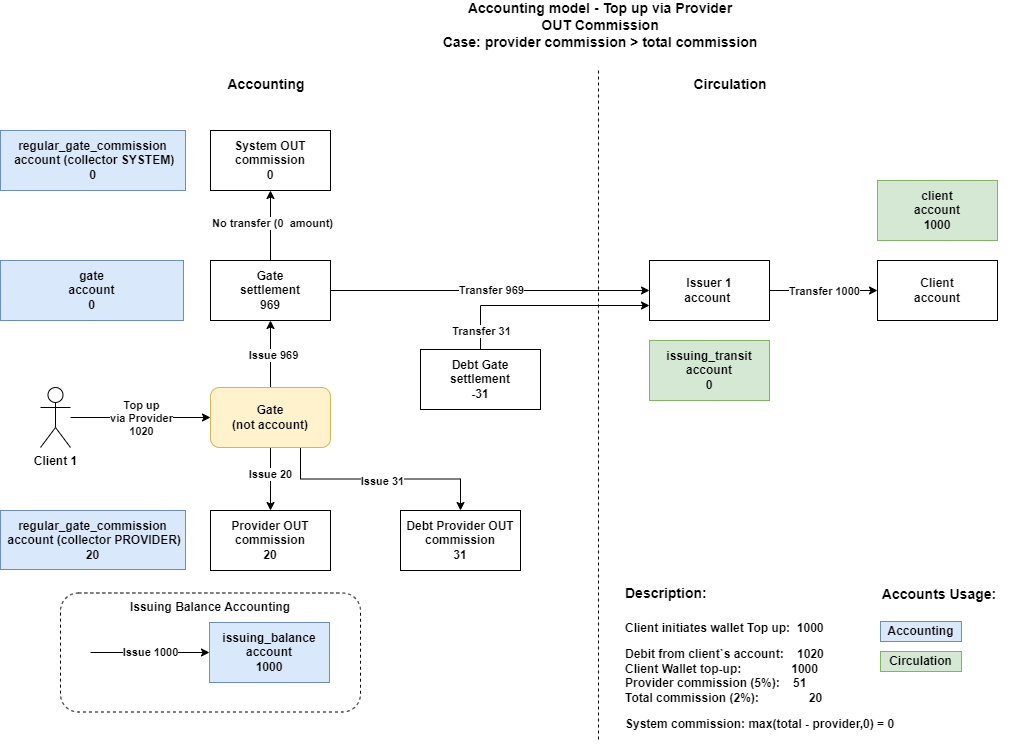

“Top up via provider”: total commission < provider commission

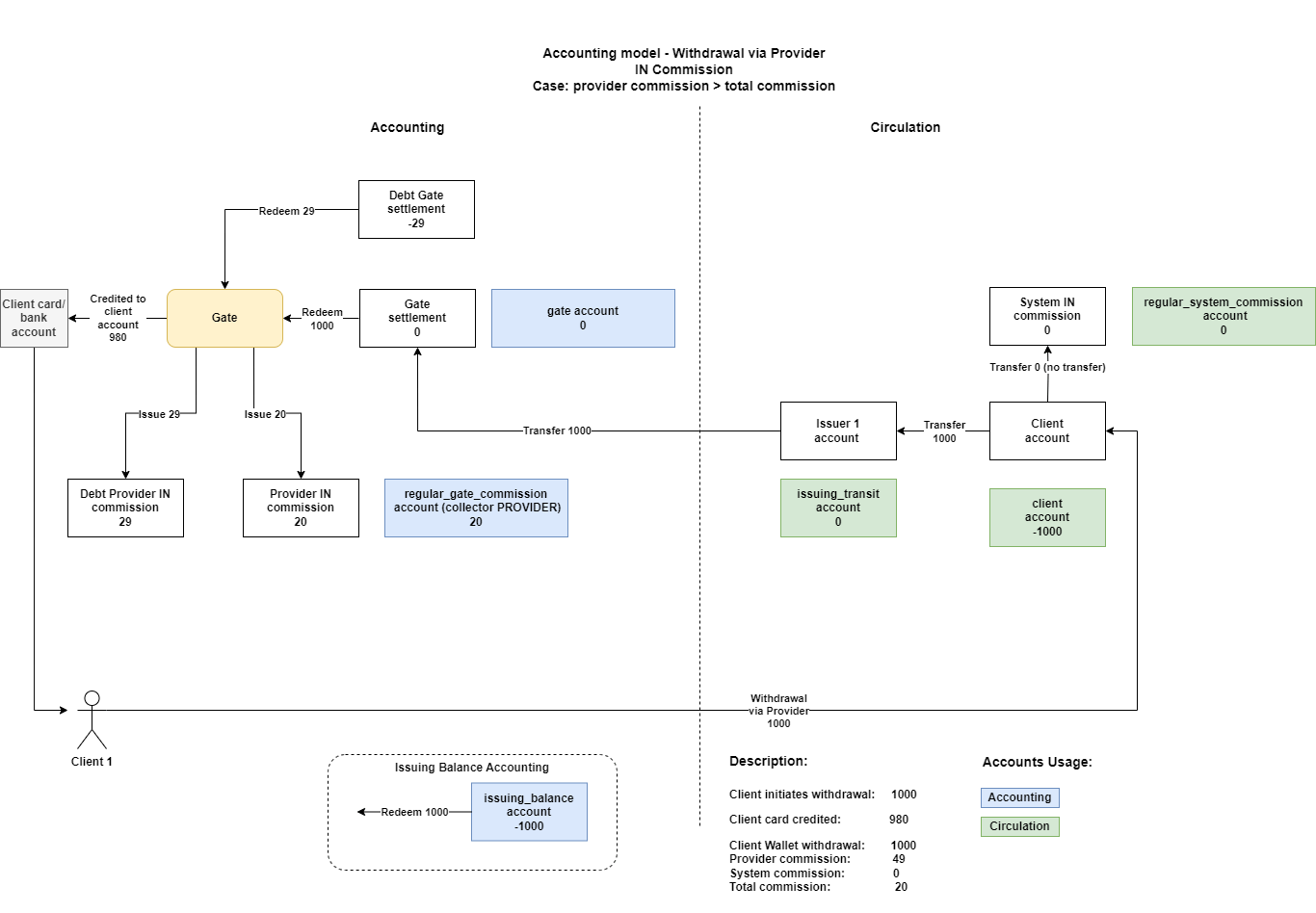

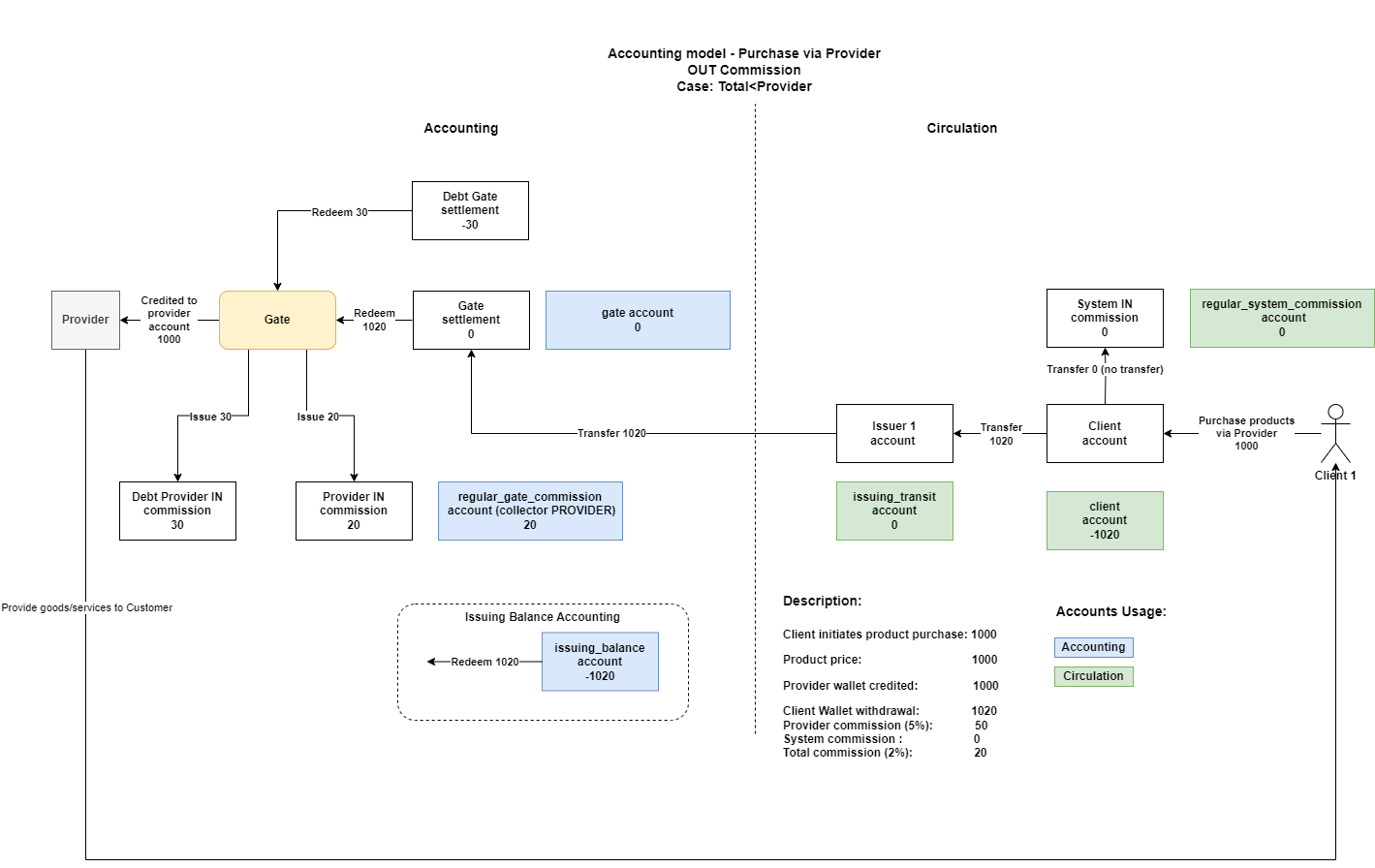

An additional case is when TOTAL commission is less than the PROVIDER commission and it involves the next account types:

-

debt_gate_settlement – to show the amount that the system did not receive from the provider because the provider deducted their commission (allow negative balance)

-

debt_gate_commission – to show gate commission that was not covered by the total commission received from the customer

The Administrator can see both calculated and applied commissions (use POST /transactions/view):

-

Calculated provider commission – is the commission to be paid to the provider (full amount)

-

Applied provider commission – is the commission that will actually be paid to the provider, will be equal to total commission

-

Applied system commission – will be equal 0

-

Applied total commission – is the commissions that was charged from the client, equal to the provider commission

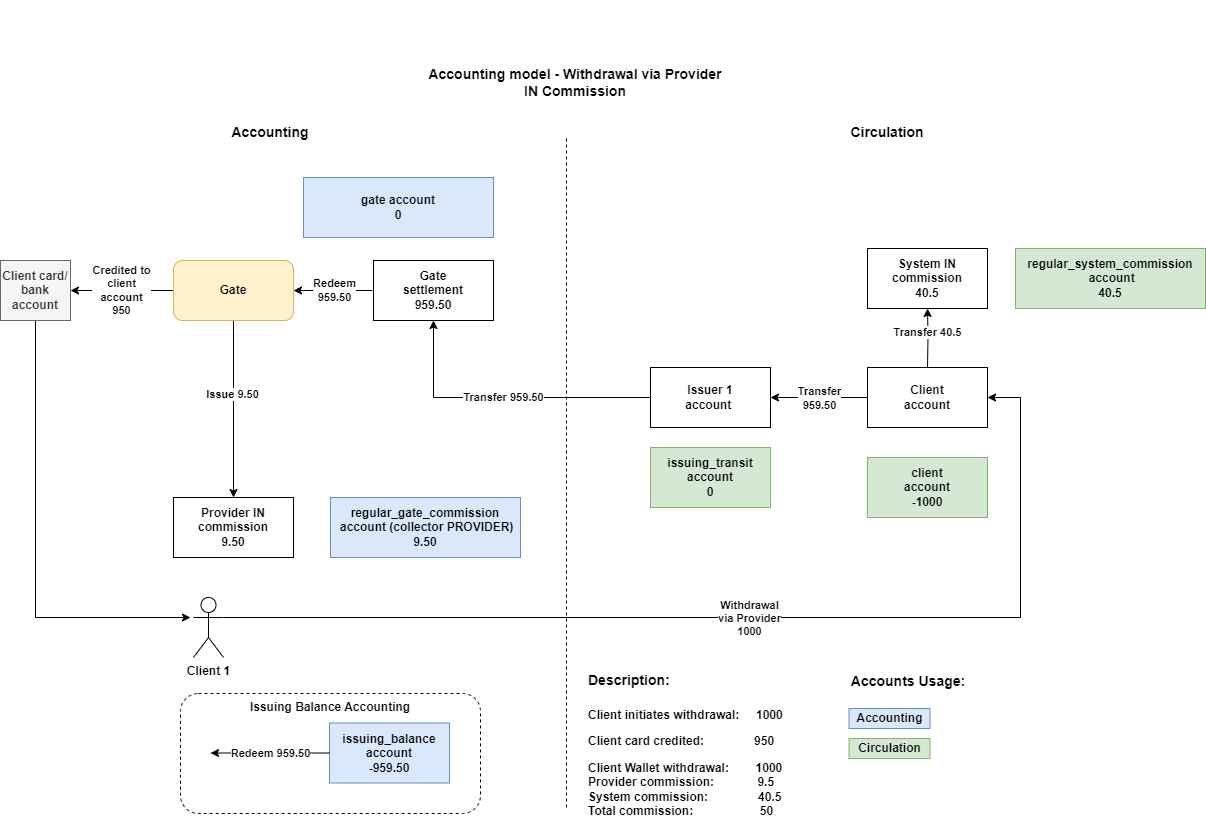

Withdraw

“Withdraw via provider” operation impacts the volume of e-money circulation (decreases it).

For “Withdraw via provider” operations, the approach to issuing commissions is the following:

-

the system commission is not included in the amount of e-money removed from circulation, it is accumulated on a separate commission wallet (usage=circulation). Until it is deducted from the circulation by withdrawal from the commission wallet – as the company’s revenue.

-

the provider commission is included in the amount of e-money redeemed from the circulation

“Withdrawal via provider”: total commission > provider commission

“Withdrawal via provider”: total commission < provider commission

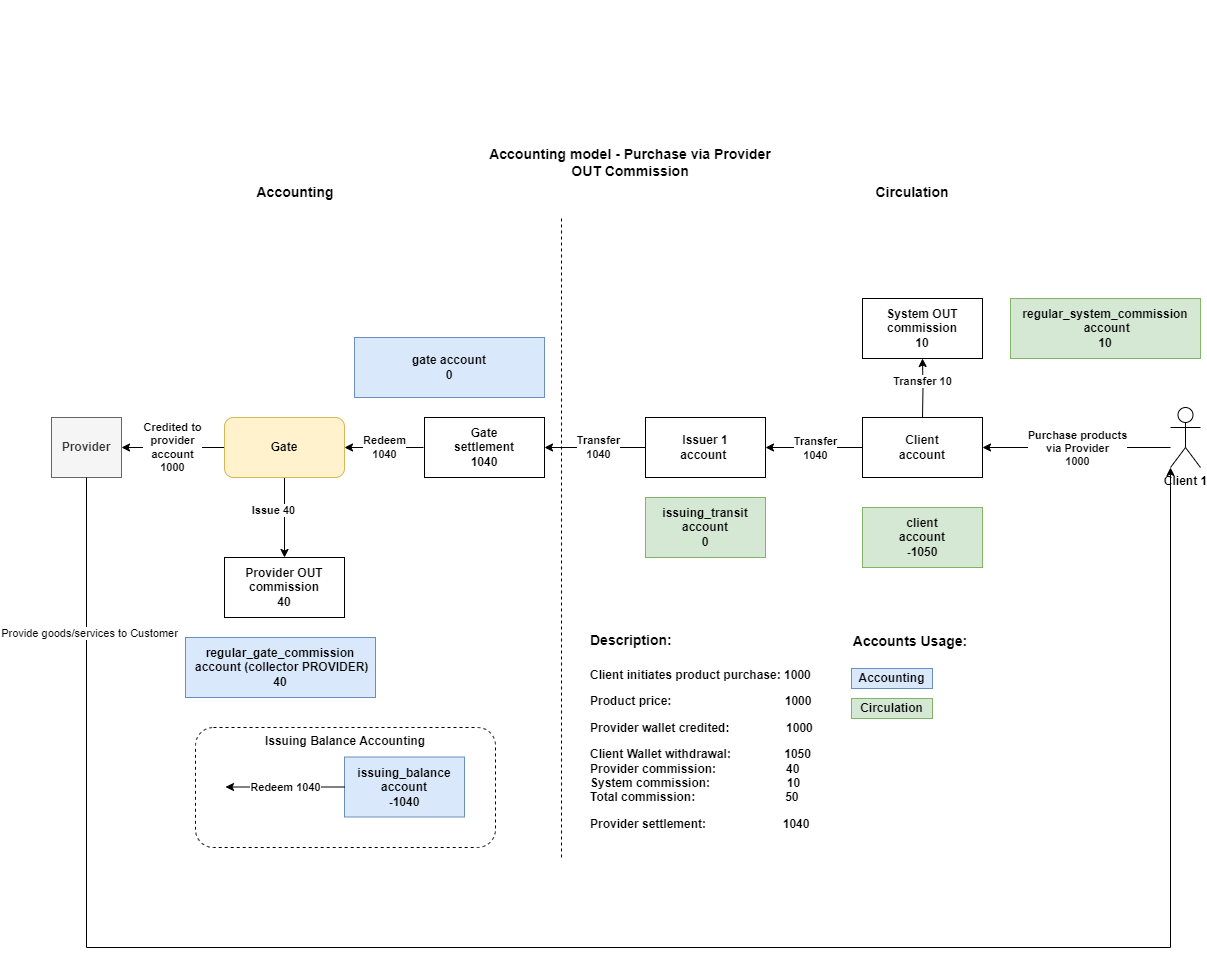

Purchase via provider

“Purchase via provider” operation impacts the volume of e-money circulation (decreases it).

For “Purchase via provider” operations, the approach to issuing commissions is the following:

-

the system commission is not included in the amount of e-money removed from circulation, it is accumulated on a separate commission wallet (usage=circulation). Until it is deducted from the circulation by withdrawal from the commission wallet – as the company’s revenue.

-

the provider commission is included in the amount of e-money redeemed from the circulation

In this case, an amount to send to the provider settlement includes the price of the product plus the provider’s commission.

“Purchase via provider”: total commission > provider commission

“Purchase via provider”: total commission < provider commission

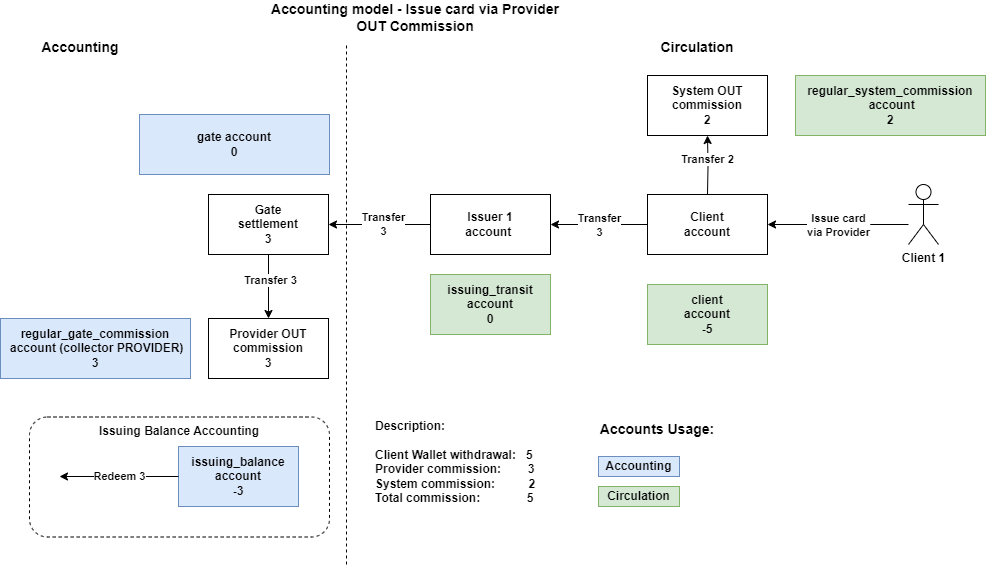

Issue card

“Issue card via provider” operation impacts the volume of e-money circulation (decreases it) only for amount of provider commission.

For “Issue card via provider” operations, the approach to issuing commissions is the following:

-

the system commission is not included in the amount of e-money removed from circulation, it is accumulated on a separate commission wallet (usage=circulation). Until it is deducted from the circulation by withdrawal from the commission wallet – as the company’s revenue

-

the provider commission is included in the amount of e-money redeemed from the circulation (in this case, an amount to send to the provider settlement is only the amount of provider’s commission)

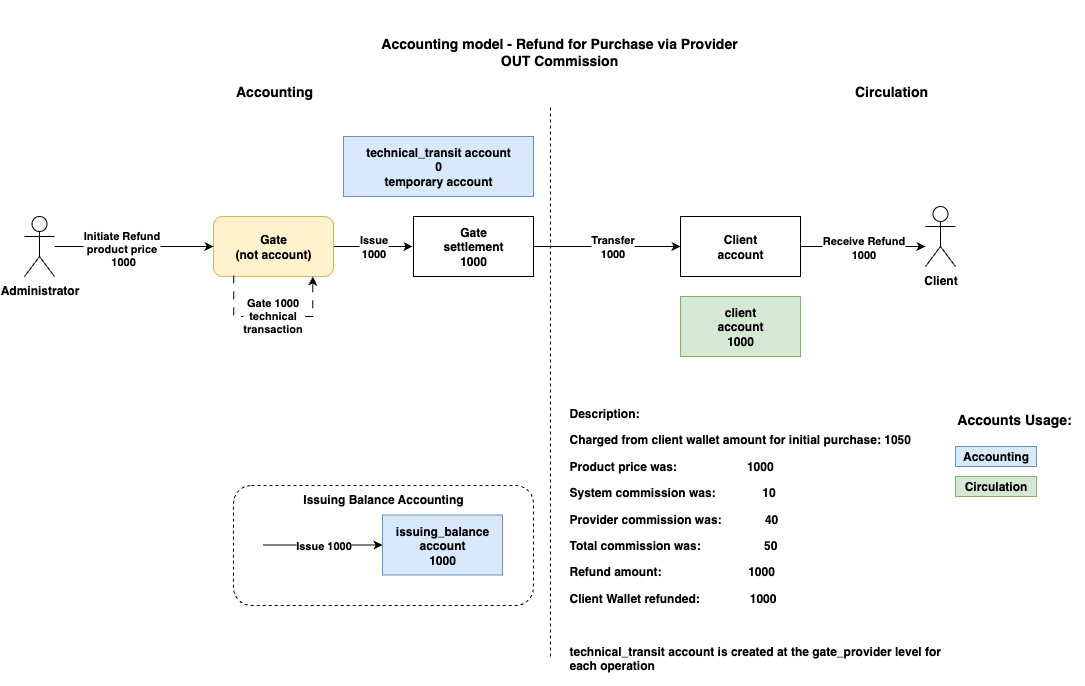

Refund for purchase via provider